Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Finding a good tenant is a bit like dating. You work your way through interested applicants until you come across someone with compatible qualities that you can trust. Only, instead of pina coladas and long walks on the beach, you’re searching for someone who likes walk-in closets and a spacious backyard, someone who isn’t going to break your heart or your sink.

Beyond the headache of repairing damage, choosing the wrong renter for your rental property can lead to big expenses. Especially if there is sudden tenant turnover, which costs an average of $1,750 per month. In extreme situations, a tenant who refuses to pay rent or engages in criminal behavior may need to be evicted. This behavior not only threatens the safety of you, your neighbors, and your investment but this also means a serious hit to your financial and mental well-being. Our review of certain TransUnion SmartMove® data found that total eviction-related expenses for property managers averages from $3,500 up to $10,000 and can take as long as 3-4 weeks for the eviction process to run its course.

No one wants to sacrifice their hard-earned money on an attorney or filing fees, waste time on regular court appearances, or lose income due to tenant turnover and vacancy. So, how do you find great tenants that aren’t going to cause you headaches?

Consider these aspects when screening prospective tenants:

1. No Relevant Criminal Convictions

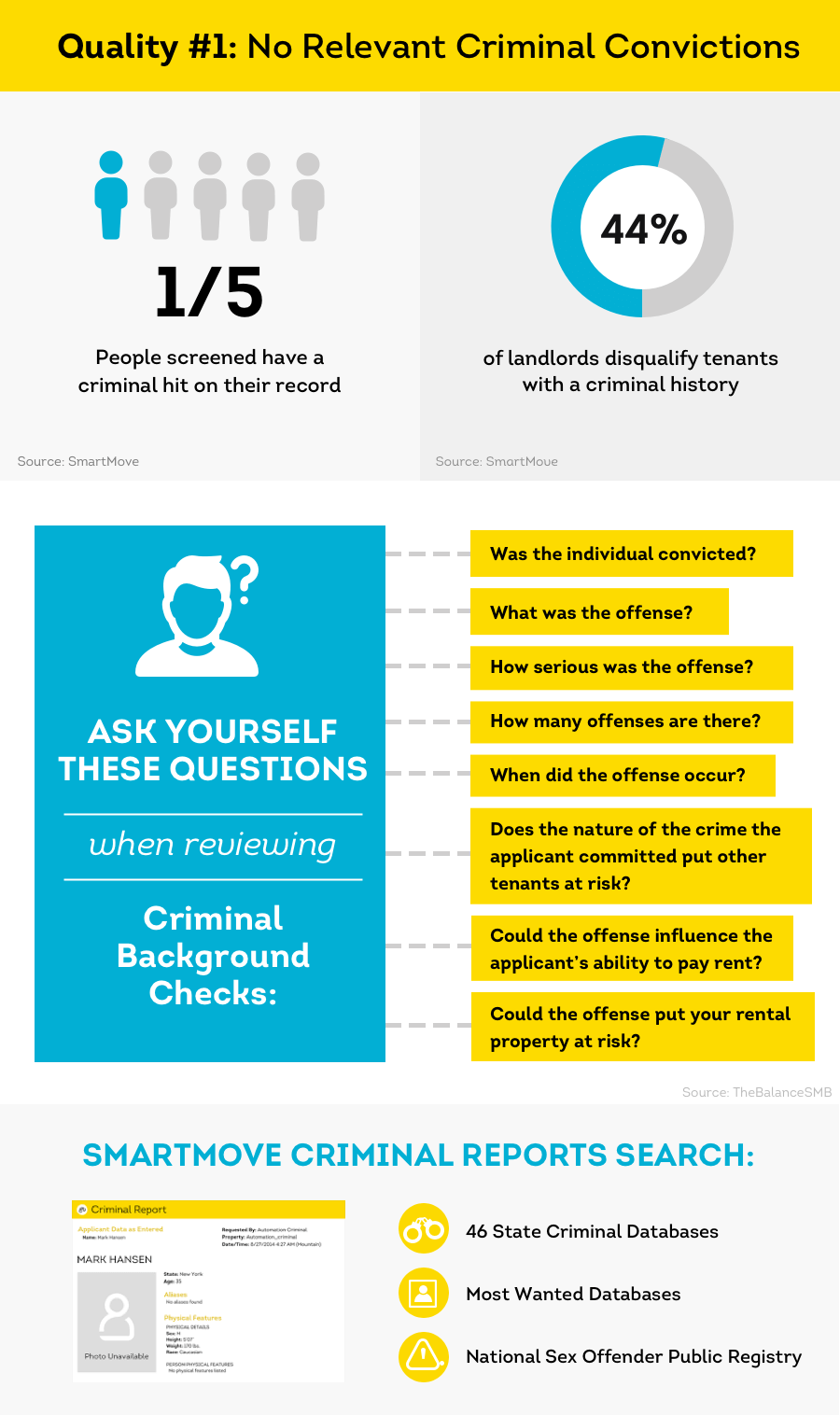

As a landlord, you likely feel that you have a responsibility to keep yourself, your property, and your neighborhood safe. Landlords may believe that they can rely on their gut instincts when it comes to choosing the right rental applicant. However, SmartMove data shows that nearly one in five rental applicants screened had at least one hit on their criminal record. That means approximately 20% of prospective applicants in that data sample possess a criminal record, which reflects that criminal records could be crucial information for your leasing decision.

You should run an online background check to avoid placing potentially destructive tenants into your space. That said, it can also be essential to reference or follow HUD guidelines (as/where applicable -- you should review to determine whether they apply and/or consult your legal counsel) when considering screening candidates out based on criminal history. According to these guidelines, you must, in part, treat criminal records on a case-by-case basis and follow a screening policy that considers the criminal conduct in terms of:

- Nature

- Severity

- Recency

- Rehabilitative efforts

Although not all criminal offenses are necessarily deal-breakers, a 2016 SmartMove survey showed that almost half of landlords are not keen on overlooking relevant criminal history—no matter the circumstances.

To make the right leasing decision for your rental property, consider the following questions while screening tenants based on criminal records:

- Was the individual convicted?

- What was the offense?

- How serious was the offense?

- How many offenses are there?

- When did the offense occur?

- Does the nature of the crime the applicant committed put other tenants at risk?

- Could the offense influence the applicant’s ability to pay rent?

- Could the offense put your rental property at risk?

Ultimately, it’s your duty to understand state-specific and federal laws governing screening tenants based on previous criminal records. If you use a compliant, FCRA-approved tenant screening service like SmartMove, then you have peace of mind that your tenant criminal history reports have scanned:

- State criminal databases

- Most Wanted databases

- National Sex Offender Public Registry

With SmartMove background checks, landlords benefit from a search that encompasses nearly 300 million criminal records from both state and national databases, allowing you to make a more informed decision.

2. Clean Eviction Record

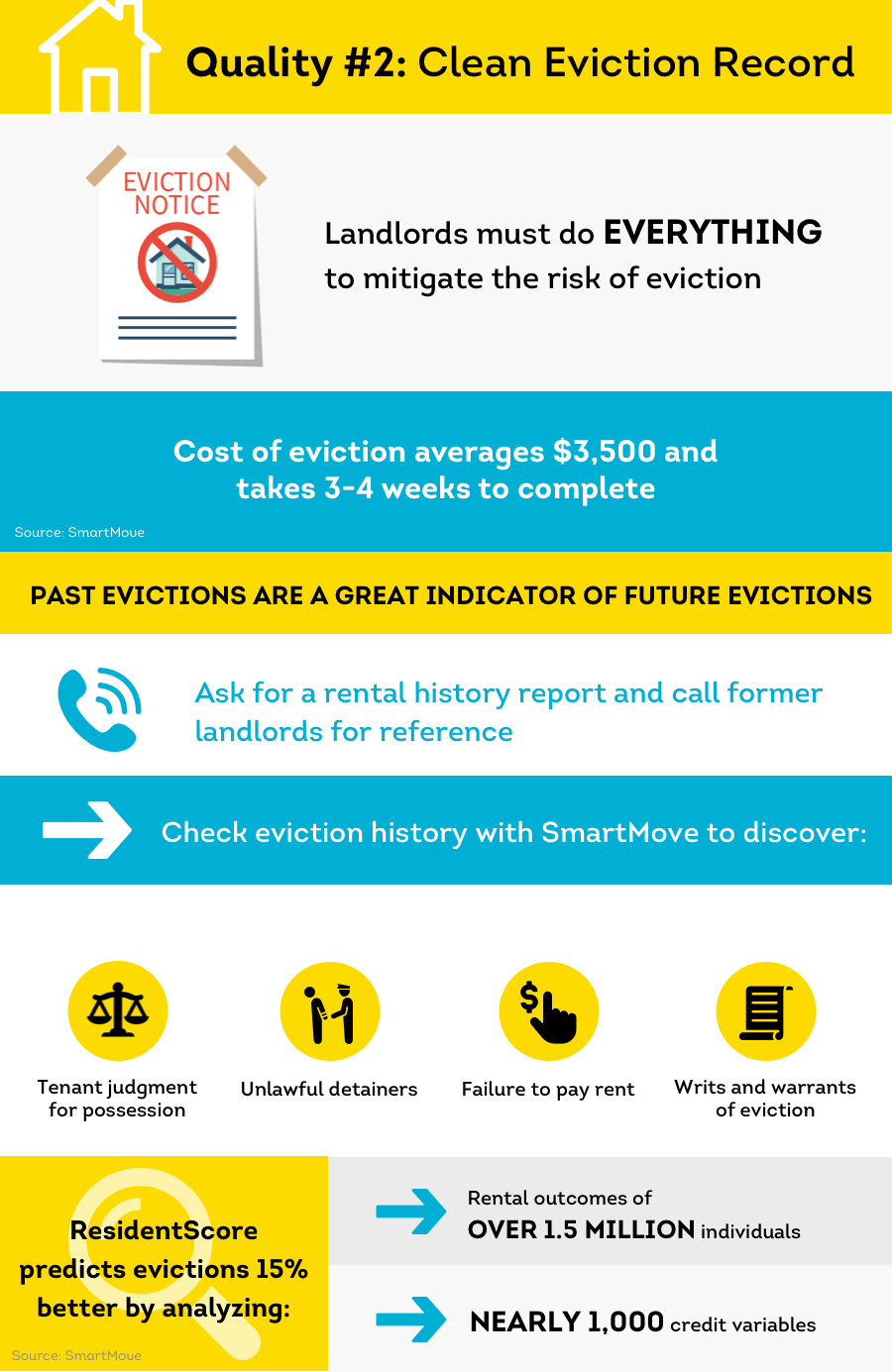

The key to running a successful rental business is to have quality tenants. If you have a tenant who fails to pay rent on time, then this means that you're losing money and you'll need to consider what to do to protect your rental income. With a continued default, this frequently means an eviction will be sought.

It's essential that landlords do everything in their power to mitigate the risk of eviction. Just one eviction can cost landlords an average of $3,500 and take three to four weeks to run its course. Most independent landlords don't have the money or time to deal with such a burden.

Fortunately, past evictions are great predictors of future risk. That's why it's smart for landlords to gain insight into an applicant's rental history with a rental history report. Ask your prospective tenant to supply a list of previous residences and the contact information for their respective landlords.

From here, you can call previous landlords and ask about the applicant's past rental behavior (check laws applicable to you and/or reach out to your legal counsel to confirm what you can ask). Some questions you may want to ask a tenant's previous landlords include:

- Did the applicant pay rent on time?

- Did they keep the property in good condition?

- Did they cause any trouble with the neighbors?

- Can you expect good communication with this renter?

After acquiring your tenant's rental history and contacting their references, you should also run an eviction check. SmartMove eviction checks provide court records on every file, including:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for small claims

Eviction history and past payment problems can also be great predictors of future eviction. In addition to speaking with previous property managers, you can use ResidentScore®, a screening tool proprietary to TransUnion SmartMove that is designed specifically for landlords to help predict tenant behavior, which:

- Is based on the rental outcomes of over 1.5 million individuals across the nation

- Takes into account nearly 1,000 credit variables that are most indicative of rental outcomes

- Predicts eviction risk 15% better than a general credit score

Unlike a typical credit score, ResidentScore was built specifically to identify the likelihood of a potential tenant being evicted. This information not only helps to save you the headache of a timely and costly eviction but can also help ensure you find a tenant that will make on-time rental payments.

3. Good Credit History

Between the increased cost of living, mounting student loan debt amongst Millennials and Gen Z renters, and rising rental rates, it's becoming much more challenging to afford rent while keeping up with additional financial obligations.

It is no wonder that payment problems are the top concern among landlords: nonpayment of rent can result in difficulty keeping up with your own mortgage payments, business expenses, and bills. Plus, tracking down late payments from tenants requires time and energy. Independent landlords just don't have time for that.

Checking an applicant's credit history may help you avoid non-payment, as you'll have upfront insight into whether or not they've been responsible with their money in the past. Here's what independent landlords should look for in an applicant's financial history during tenant screening:

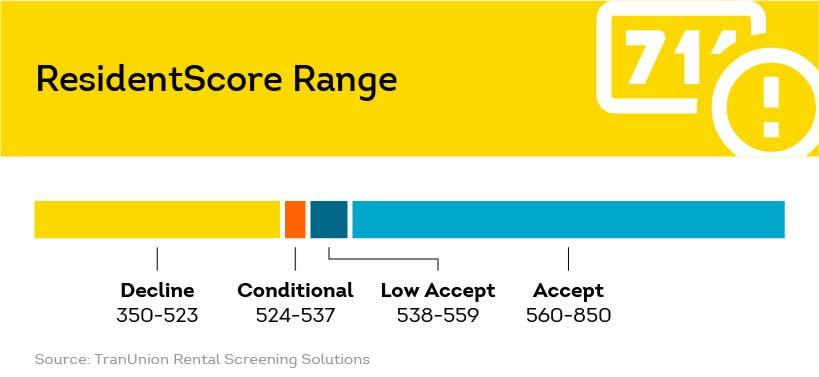

Credit Score

An applicant's overall credit history can help you predict if they're going to pay rent on time. There is no exact number that determines a good credit score versus a bad credit score when it comes to renting. A better predictor is a ResidentScore, which is tailored to landlords and was built to specifically identify the risk of eviction. The tool predicts evictions 15% better than generic credit scores and is an invaluable leasing tool.

Late Payments

If your applicant has a pattern of late payments, then this could be a predictor that they won't pay rent on time or at all. As you analyze an applicant's late payments, ask yourself the following:

- What payments were they late on?

- Was it a car payment, credit card bill, student loan, or rent?

- How often did they make late payments?

- Could a pattern like this damage my business or lead to eviction?

Total Amount of Debt

If your tenant has a great deal of debt, will they be able to cover the cost of rent while paying off their accrued balance? It's also important to consider what kinds of debt they have. Some debts are responsible, such as student loan debts, while other debts are usually considered irresponsible, such as outstanding credit card bills. In general, a tenant that faces an abundance of debt may be less inclined to pay rent.

Derogatory Credit Marks

As you examine a candidate's derogatory credit marks, ask yourself the following:

- Does the applicant have a history of collections?

- Have they ever filed for bankruptcy?

- Which negative credit marks appear on their file?

By understanding primary credit score factors and reviewing any unflattering marks present in their history, you can better evaluate an applicant's financial accountability. This helps predict if your tenant can handle your monthly rental payments or if they will end up harming your rental business.

When you get credit reports, make sure you use a legitimate and trusted credit reporting agency. Your tenant's credit report should include the following features:

- In-depth payment history information

- Easy-to-read formatting

- Data security for renters

4. Stable Income and Employment

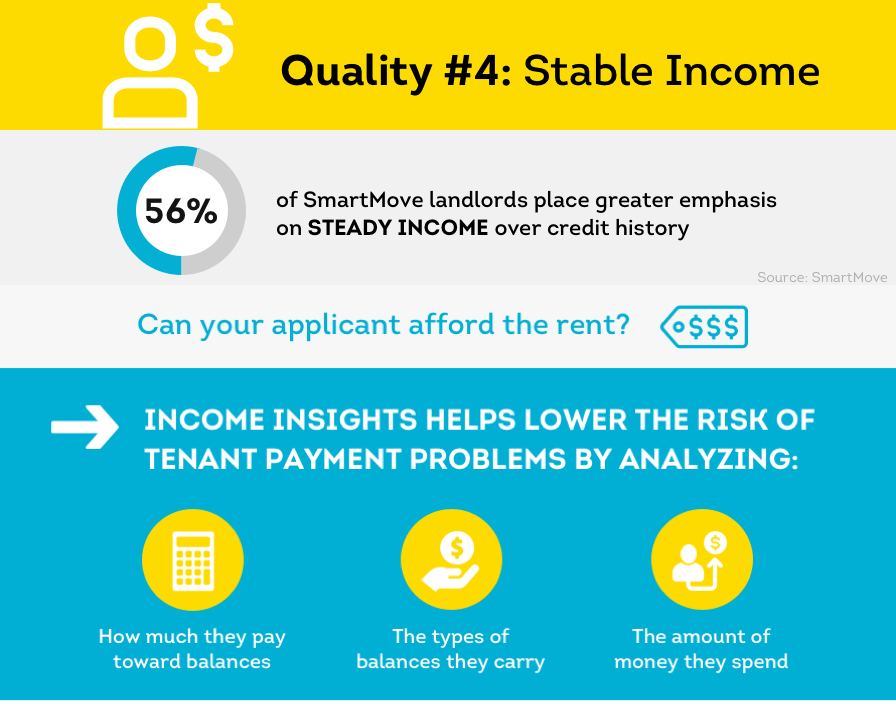

Landlords need proof of stable income and employment to feel confident in their tenant’s ability to pay rent in full and on time every month.

The industry standard rent-to-income ratio suggests that a tenant should make three times the cost of rent in monthly income, but this could vary by state. For example, rent is typically much cheaper in the state of Montana than in the city of Las Vegas so the “3x rule” might apply differently based on fair market rent in your area.

You should always ask for an income estimate within your rental applications (check the laws applicable to you or reach out to your legal counsel to know what you can ask), but don’t always assume the information provided is accurate. In addition to running manual income verification checks on all applicants, you can also use helpful tools like Income Insights, which analyzes:

- How much your tenant pays towards balances

- The types of balances they carry

- The amount of money they spend

Within minutes, Income Insights will indicate if an applicant’s estimated income matches up with their reported income so that you know whether you need to further verify their information before approving their application. This lowers your risk of renter payment problems and also saves you time.

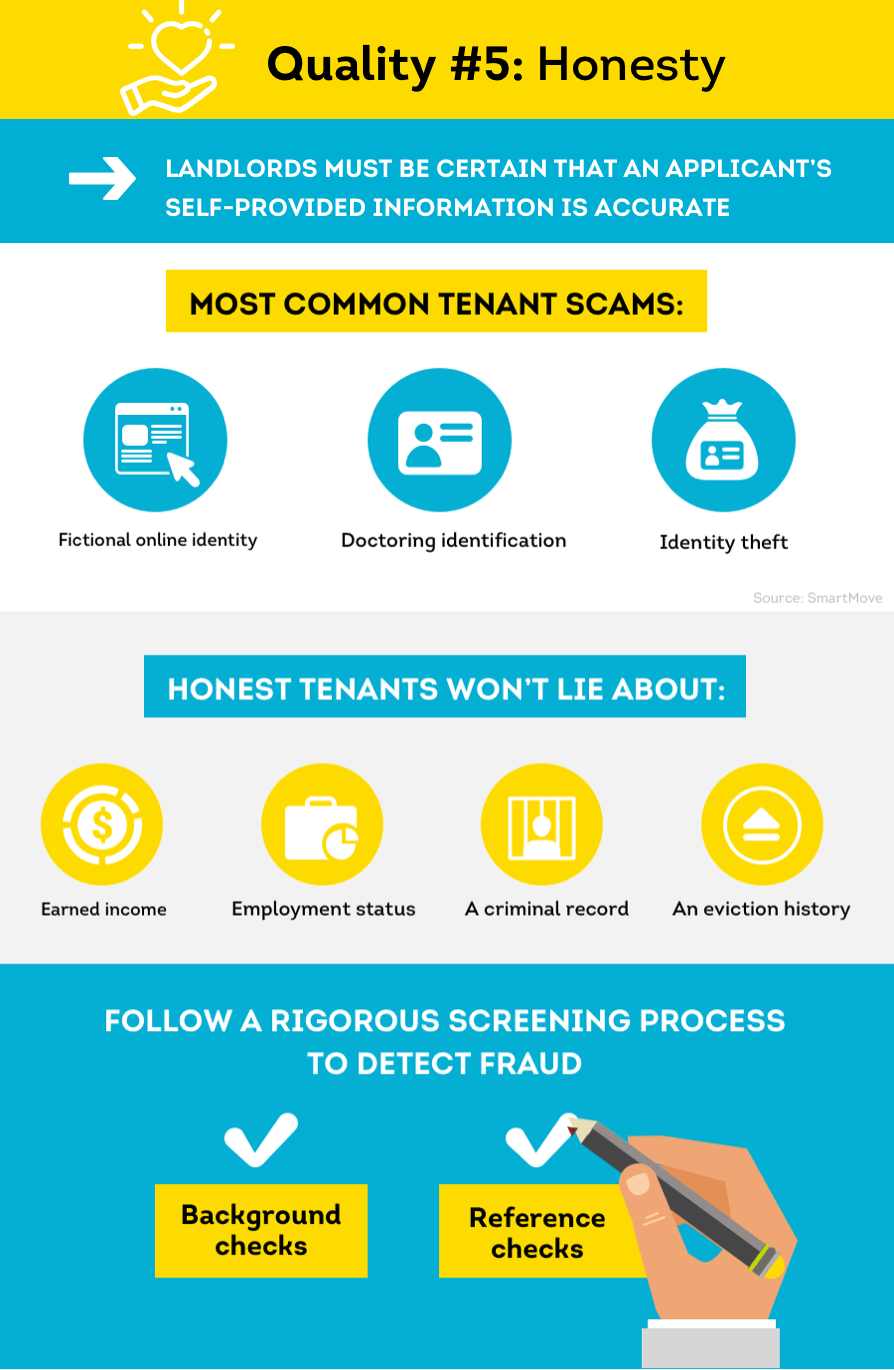

5. Ability to be Honest

It’s important to follow a thorough screening process that can help you spot applicants that might present fraudulent information to get approved for your rental property. SmartMove data shows that the most common tenant scams include:

- Fictional online identities

- Doctoring identification

- Identity theft

A reliable tenant won’t sugar-coat information about:

- Their income

- Their employment status

- Their criminal record

- Their eviction history

Always use pre-screening questions (check the laws applicable to you and/or reach out to your legal counsel to know what you can ask) to help narrow down your pool of prospective renters and be sure to collect rental applications and a rental history report on each and every applicant. Verify your tenant’s reported information by:

- Running a background check

- Conducting reference checks

Unfortunately, a background check won’t provide tenant behavior insights, which is why a reference check is a good idea. Employers and past landlord references are the best sources for useful information about your applicant’s professional and rental behavior. Knowing more about an applicant’s past and intentions can help you determine whether they demonstrate the best tenant qualities. Do of course check the laws applicable to you and/or reach out to your legal counsel to know what you can request from a prospective tenant.

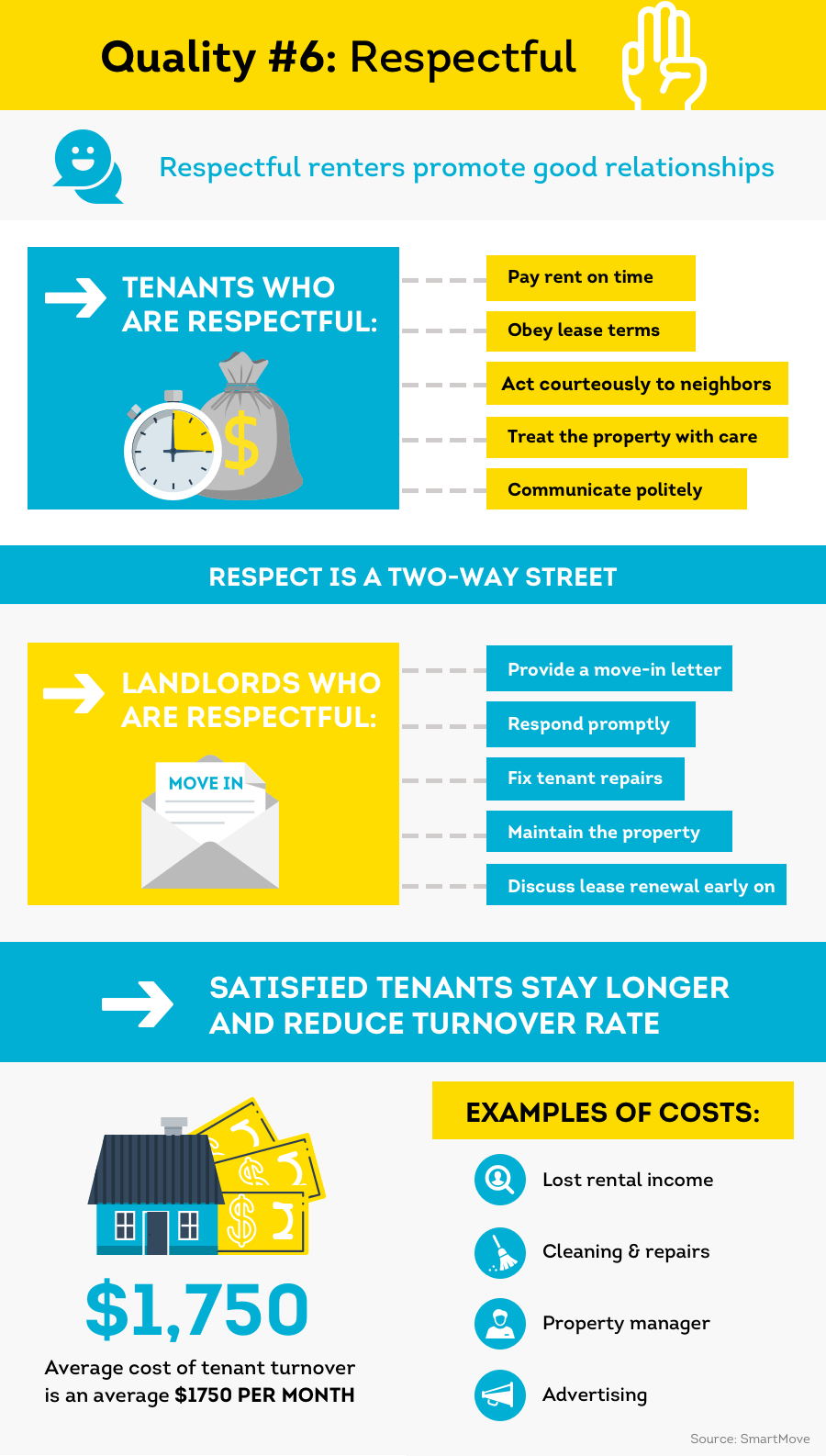

6. Respectful Behavior

Finding tenants who act respectfully to both landlord and neighbors is crucial. A respectful tenant will inform you of maintenance issues, and take care to handle their own responsibilities while living in your rental property.

Respectful tenants are more likely to:

- Pay rent on time

- Follow lease terms

- Refrain from causing problems with other tenants or neighbors

- Keep from damaging your property beyond normal wear and tear

- Communicate politely and in a timely matter

Here are some tips to help determine if you could have a smooth landlord-tenant relationship with your applicant:

- Are they respectful and courteous in their interactions?

-

- Do they arrive at property tours on time?

- Do they provide appropriate documentation? Is it filled out completely?

- Were they respectful in previous rentals? Consider the answers previous landlords provided for the following questions:

-

- Did they cause damage?

- Were there complaints from neighbors?

- Did they pay rent on time each month?

However, it’s important to keep in mind that respect is a two-way street. Show your tenants similar respect by providing a move-in letter, responding promptly to tenant requests, fixing tenant repairs, maintaining the property, and discussing lease renewal early on.

Why does your landlord-tenant relationship matter so much? Satisfied tenants stay longer and reduce turnover rates. TransUnion SmartMove data found that total eviction-related expenses for property managers average $3,500 and can take as long as 3-4 weeks for the eviction process to run its course.**

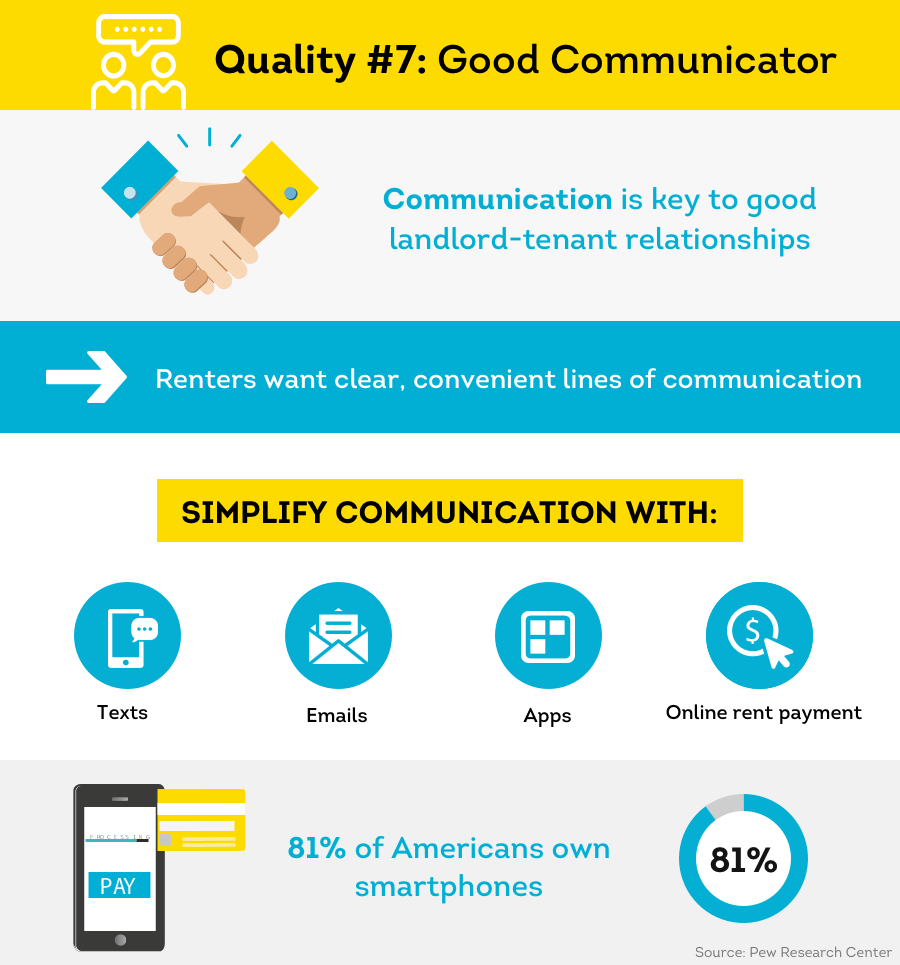

7. Good Communicator

Communication is the key to an effective landlord-tenant relationship. From the moment an applicant reaches out to express interest, consider their communication style by asking yourself these questions:

- Are they attentive?

- Quick to respond to questions or messages?

- Pay attention to details and read postings in full before asking questions?

- Do they follow through on requests for documentation after applying?

- Do they answer your questions fully or avoid tough questions?

As a landlord, you need to hold yourself to the same standard. Communicate with your applicants respectfully and openly to help start your landlord-tenant relationship off on the right foot. To facilitate smooth communication, simplify the process with:

- Text: If tenants can quickly contact you by way of text, then issues may be resolved sooner.

- Email: Similarly, email can be an effective, quick way to resolve tenant problems or manage maintenance requests.

- Apps: There are plenty of landlord and renter apps that can streamline communication and help you manage to-do lists

- Online rent payment: Accepting rent online may help ensure you get your payments on time.

Connecting by way of technology can add convenience for both you and your renter and help improve your communication.

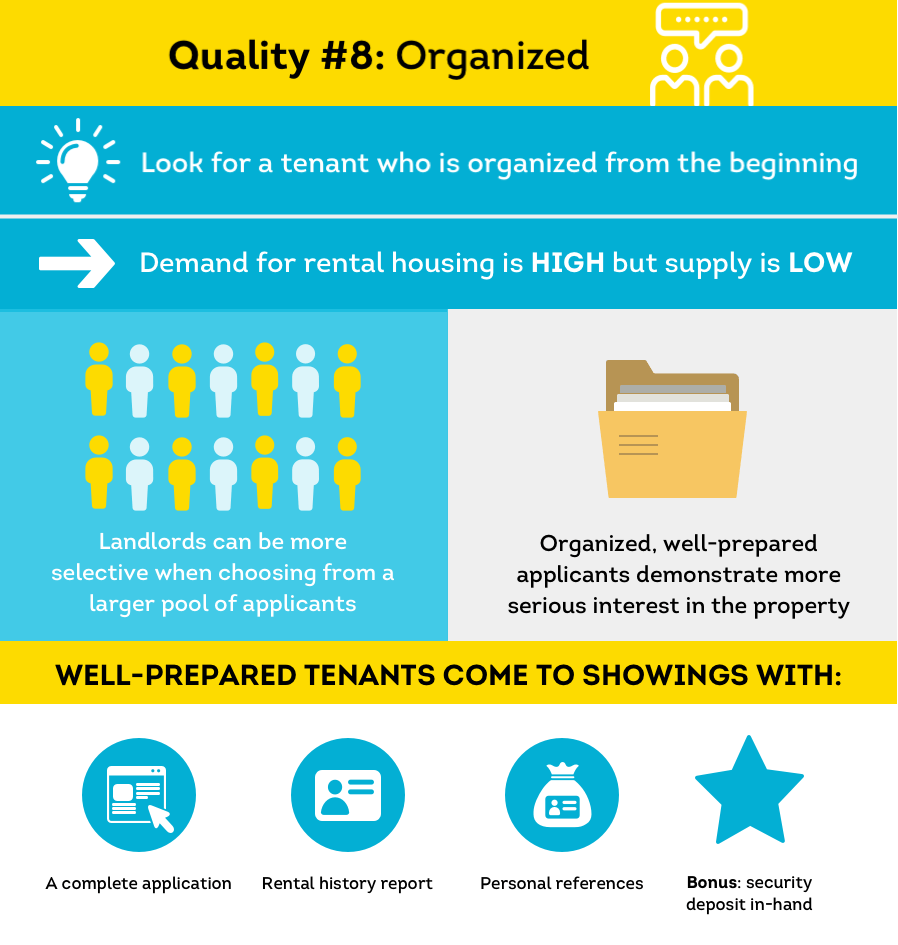

8. Present Organizational Skills

An organized tenant is a great tenant. Weed out uninterested, unqualified tenants early on by focusing on organized applicants.

Organized tenants will come prepared, which helps speed up the leasing process. They have documents and checks ready to go and respond quickly. Good organization shows that they’re serious about signing the lease and are willing to comply with your rental requirements.

In your listing, ask interested individuals to bring the required documentation to the property showing, including:

- A fully filled out rental application

- Rental history report

- Personal references

Do of course check the laws applicable to you and/or reach out to your legal counsel to know what you can request from a prospective tenant. Tenants who come with a security deposit in hand should earn bonus points, as you can more quickly fill a vacancy.

Apply All Renter Criteria Equally

Landlords should take the time to consider the best tenant qualities, but still must ensure the rental application criteria is applied equally to all applicants. Additionally, the criteria must generally abide by the Fair Housing Act, which states – in part – that you cannot reject an applicant based on:

- Race

- Color

- National Origin

- Religion

- Sex

- Familial Status

- Disability

Denying a protected class based on these criteria could result in violating anti-discrimination laws, which can lead to lawsuits and expensive settlements. Keep this in mind when examining the tenant qualities you'd like an applicant to possess.

Confirm Your Tenant Has the Best Qualities with Comprehensive Screening

Finding the right renters with the best tenant qualities is the key to long-term landlord success. With rental housing at a premium, it is a landlord's market out there. Make sure you find the most compatible match for your rental property with comprehensive tenant screening.

Verifying information provided by a tenant is just the beginning of the process. Run credit and Income Insights reports from TransUnion SmartMove. This can confirm if your applicant has stable income and good financial history, which are some of the best qualities you can find in a renter.

A background check, including checking on any eviction history, gives you peace of mind that your potential tenant is responsible and honest. Accepting a tenant with these great qualities means a better chance that you won't have to deal with expensive problems down the road.

Remember that a rental applicant, like a potential date, may look great on paper. But, once you spend more time getting to know them, you'll discover if they possess the best tenant qualities or if they fall flat. While it can't help you find the love of your life, SmartMove can help you find a rental match made in heaven. Don't settle for an "OK" move, make a SmartMove.

Know your applicant.

Additional Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.