Key Points:

- Reviewing rental history helps clarify how an applicant acted in the past to help you better predict potential behavior on your property.

- Incomplete or inconsistent rental information could be a warning sign.

- Landlord reference checks can help reveal a tenant’s payment history and lease violations.

- Millions of tenants are evicted every year. It’s essential to check for previous evictions, criminal history, and financial background before signing a lease

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Sleuthing together the pieces of a potential tenant’s rental history can sometimes make you feel more like a detective than a landlord. But, considering what’s at risk if you don’t do your due diligence, it’s absolutely worth it to pull out your magnifying glass.

After all, the last thing you want as a busy, independent landlord is to let lax screening practices lead to potential ill-fitting tenants and rent nonpayment, extensive property damage, or expensive eviction costs.

Further, resorting to eviction may be more common than you think. The U.S. Office of Government Accountability states that, while difficult to collect and decentralized, their data suggests that, nationwide, millions of tenants are evicted every year.

However, while this number may seem shockingly high, it’s important to remember that it includes all kinds of eviction charges brought to tenants. It could include people who eventually paid their rent and didn’t go to court, people who had a hard time once and then never again, or people who have a habit of not paying rent and bouncing between unsuspecting landlords.

Every case is different. It’s important to ask potential tenants about their rental histories, but also back up their story through data. This includes collecting reports like a previous eviction check through a reputable tenant screening service like SmartMove®.

This article covers things you need to know about checking into a rental applicant’s past housing outcomes, including how to check rental history, what to prepare, how to look for past evictions, and other recommendations to help better protect yourself when choosing new residents.

What is a Rental History Report?

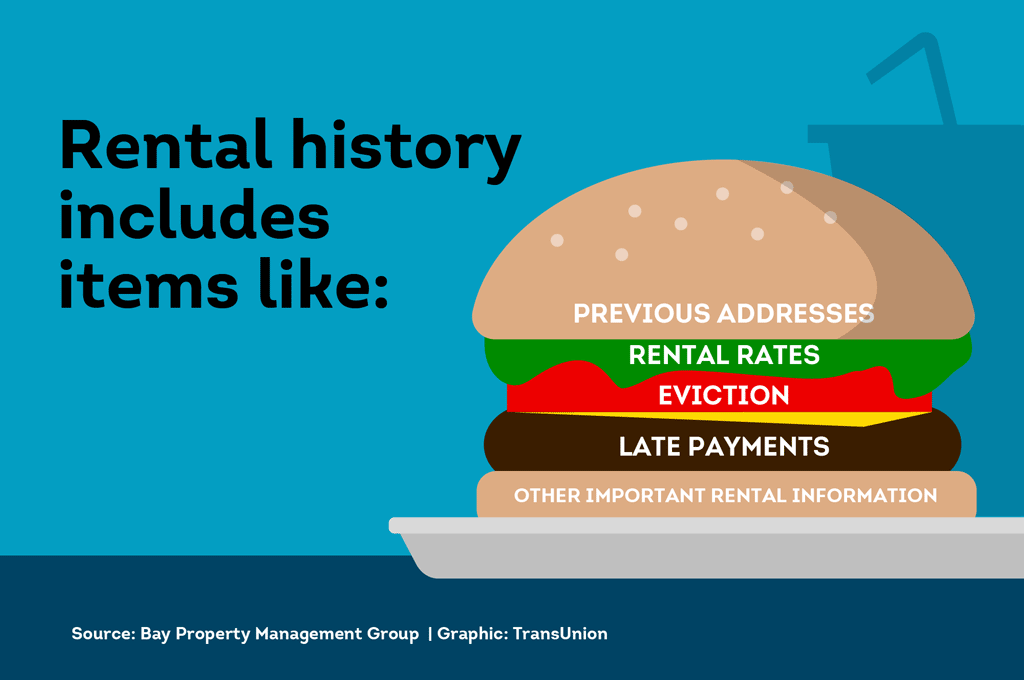

According to Bay Property Management Group, a “rental history report” refers to a comprehensive summary of a person’s previous rental records. It can include things like:

- Previous addresses

- Rental rates

- Evictions

- Late payments

It may also include contact information of the landlord or property manager at the time. Rental history is typically put together through a variety of different sources, including:

- Information supplied by the applicant directly, such as a list of previous rental addresses and landlord information.

- Information received from previous landlords through a reference check, such as if there were any late payments, damages, or if the security deposit was returned.

- Information requested through a background check company, such as past eviction reports, or credit checks.

As a landlord, you may need to buckle down and go through all of these channels to get a better understanding of your potential tenant. If you don’t, it could come back to bite you in the future––and hard.

Why Do Landlords Check Rental History?

There are many reasons to get the details about a potential tenant’s rental past. According to an article from 302 Property , landlord reference checks help you learn more about a tenant’s previous behavior and trustworthiness.

For example, looking at a potential tenant’s credit history gives you an overall view of their financial habits to help answer questions like:

- Do they pay their debts on time?

- Do they make enough to pay the rent?

- Are they responsible with money?

All of these could impact your rental decisions.

Similarly, looking into someone’s rental history may help you understand how they tend to act in rented spaces. If they’ve completely destroyed the last ten apartments they’ve lived in, you may think twice before handing over the keys to your own unit.

The 302 Property article also explains that taking the time to validate an applicant’s rental history can also help you learn:

- How they maintained the unit

- About their payment record

- If they ever broke the lease terms

- If they neglected or damaged your property

Not only does an applicant’s rental history help to give you the bigger picture of who they are, but it may also help to guide your overall tenant decision.

Pro Tip:

If you allow pets and have a pet yourself, consider how your furry-friend reacts to other animals in its space. If your pet has a tendency to be territorial, then you should probably refrain from inviting another pet into your home. If you do allow pets, consider a pet deposit or pet rent.

Potential Benefits of Renting Out a Room

Now is a great time to rent out your extra bedroom. As you can see below, the research shows a combination of more adults living together and a larger supply of available extra rooms.

According to research from Bowling Green State University, shared living has become more common in recent years, both among younger generations and in older adults.”. A shared household is defined as a household with at least one “extra adult” who is:

- 18-29

- Not living with a parent, grandparent, spouse, or cohabitating partner

If you’re looking to take on a tenant to help cover your mortgage payments or earn additional income, then there could be plenty of people searching for a space to lease.

On top of that, Americans have more extra bedrooms than ever before. According to research from Realtor.com, there were 31.9 million extra bedrooms in the U.S. in 2023––a record high that represents 8.8% of homes.

If you’re in the sizeable chunk of Americans with an extra bedroom, you may be able to rent it for some extra cash.

Challenges of Renting Out a Room

However, just because an opportunity to make some extra cash exists, doesn’t mean it’s risk free. Of course, renting out a room in your house comes with its own set of challenges, like:

- Preparing the space

- Ensuring privacy and security

- Making sure everything is done properly

- Finding tenants who will pay rent on time

The point of renting out a room is making money for your own mortgage. Given that, it makes sense why rental nonpayment is a major fear of landlords––even if it’s just a room.

If you do decide to rent out your room, avoiding eviction should be a top priority. Evicting a tenant can be a time-consuming and costly process. This is because an eviction. may cost you between $1,000 and more than $5,000 depending on a number of factors, according to SmartAsset.

When you take on a room tenant (or roommate), you also take on a significant amount of responsibility. Even if you’re not renting out an entire property, you are still considered a landlord.

This means you are subject to laws and regulations applicable to landlords. Additionally, you’re choosing to share your living space, which could become frustrating the longer you live together.

So, there’s plenty to keep in mind when considering renting out a room. However, that doesn’t mean it’s a non-starter. Below, you’ll find some tips to help mitigate some of the challenges of renting out an extra room to help set yourself up for success.

Tips on How to Rent Out a Room in Your House

1. Make Sure the Room is Tenant-Ready

When you rent out even a room, you are a landlord. As a landlord, you generally have a responsibility to create a habitable living space before taking on a tenant, according to FindLaw .

In general terms, habitable means that the premises must suitable for human living throughout the tenancy. According to FindLaw, the states have varying standards on what it takes for a dwelling unit to be considered fit for human habitation.

Before taking on a live-in tenant, you may need to determine whether you have the means to fix up the space, both now and through continued upkeep. It may be important to consider your financial situation along with your own repair capabilities.

For example, if your tenant’s toilet leaks, are you able to roll up your sleeves and fix the issue? Or, if you need outside help, can you afford it? You need to make sure you have the budget for repairs and ongoing maintenance.

Before committing to becoming a landlord in your own home, be sure you understand the level of responsibility and financial burden it can entail.

2. Consider the Criteria of Your Ideal Tenant

If you rent out a room in your home, then you’ll become both landlord and roommate. Are you comfortable sharing your personal space with someone else? First, figure out what you want from a roommate and a tenant, before the moving boxes start showing up.

Deciding on tenant criteria early on provides several benefits:

- It makes it easier to write a good rental and advertise your property

- It can help identify potentially ill-fitting candidates if they don’t meet your criteria

- It can help you tailor your screening questions when you start accepting applications

- It can help provide clarity into what you’re looking for

For example, when setting criteria, you’ll likely want to confirm potential tenants have sufficient income, no worrying or relevant patterns in a criminal record check or past eviction report, and will comply with your non-smoking and pet policies.

Depending on your own situation, these might be different. For example, if you are a smoker, perhaps you won’t mind a fellow smoker moving in.

Pro Tip:

Sometimes, when renting to students or others, you may have non-traditional start or end dates for your rental agreement. Learn how to help calculate prorated rent and recommendations about the process.

How to Check Rental History?

While the exact tenant screening process may vary from landlord to landlord, reference checks often follow a general pattern, which may include the following recommendations:

Set Your Tenant Criteria and Expectations

Before you list your rental property on the most popular rental listing websites and begin to receive rental applications, be sure you understand what your ideal tenant’s background might look like.

For example:

- How will you handle someone with a relevant criminal history?

- Will you accept a tenant who has paid late rent in the past?

- What about someone who broke their previous lease?

- Will you accept a tenant who doesn’t have any rental history?

Questions like the ones above can help you to create a template of who your ideal tenant would be. They can also guide you when you’re reviewing applications.

That said, it’s important to stay realistic. If your screening criteria is too strict you may have trouble finding qualified tenants. If it’s too light, you may be overwhelmed with potentially ill-fitting applicants. Either way, make sure to always abide by any applicable laws.

Let the Applicant Know You Need Their Rental History

To learn more about your prospective tenant’s rental history, you should gather the applicant’s information. You can ask about these details directly on your rental application.

Common information to request on rental applications includes:

- Addresses of previous rental locations

- Length of time they stayed

- Previous landlord or management company contact information

You may also want to ask how much rent they paid at previous apartments. For example, if you have a rental application that managed to pay a rate higher than your rate for three years without missing a month, it may be a good sign they can afford your rate, too.

Pro Tip:

Careful review of rental applications is the first line of defense when weeding out potentially ill-fitting tenants.

Have Applicant Sign a Rental History Release Agreement

Apartments.com recommends obtaining consent from your rental applicant before contacting their previous landlords. This not only shows you respect your tenant’s personal data, but also increases fairness. What's more, you can show that you received permission in case issues or questions ever arise.

Past rental application information might include:

- Length of residency with previous properties

- Rental amounts paid in the past

- Rental payment history

Also consider including the requirement for rental history review when writing your rental ad. That way, you may start to weed out any applicants who aren’t keen to share their past rental information. In the end, those who can and do provide this information upfront may be more desirable for your rental property.

As always, make sure you follow any applicable laws and contact qualified legal counsel if you have any questions.

Review the Rental Application and Rental History

- Start the rental verification process by reviewing the prospective tenant’s history section in the initial application. According to landlord software site RentSafe, you can check for information and ask for clarification on things like:

- Housing gaps: if there is a significant gap in rental information or frequent house hopping, it could be a warning sign. Perhapsthey moved back in with their parents to save money––or maybe it could be some other explanation.

- Incomplete address: Has the applicant left out rental payment history or street numbers from their previous addresses? Did they not include contact information for previous landlords? Could it be an honest mistake or maybe something more?

- Missing contact information: Did they fail to list their previous landlord’s email and phone number? Perhaps they just didn’t have it on hand, or perhaps they don’t want you to know.

As you review, keep an eye out for incomplete information or less obvious warning signs. Key omissions could indicate that your applicant doesn’t want to share their tenancy history, or that they don’t want you to be in contact with previous landlords.

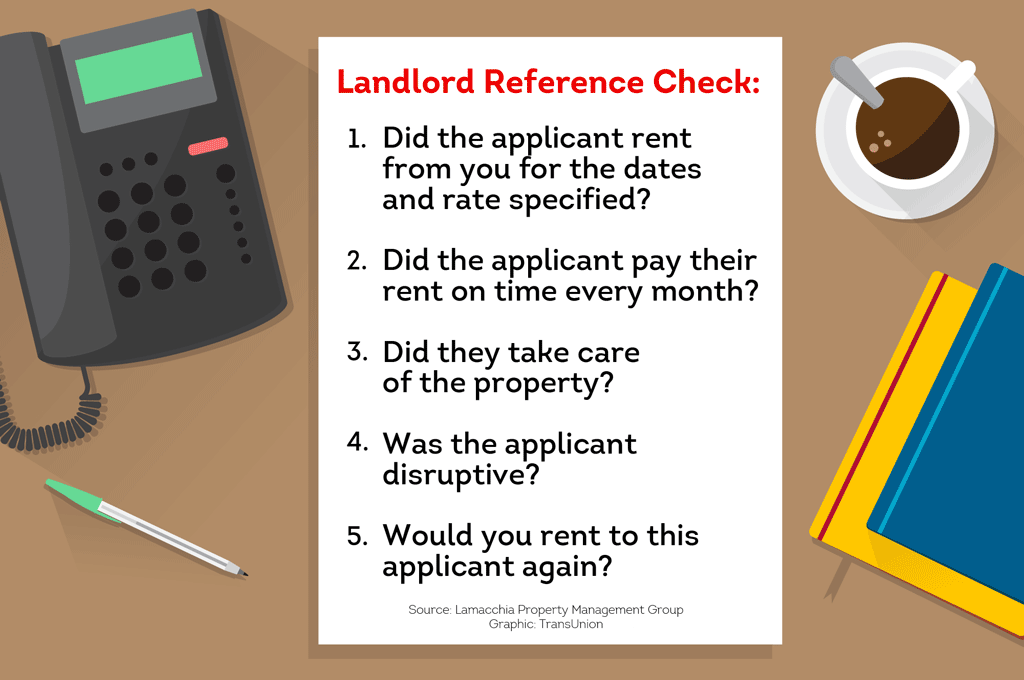

Conduct a Landlord Reference Check

Taking time to ensure your tenant is reliable and responsible may save you the hassle of eviction and costly repairs down the road. Evictions can be expensive and can take a long time to run their course.

Thankfully, getting quality tenant screening data and checking with previous landlords may help you get the information you need to make confident leasing decisions.

Once you’ve reviewed the prospective tenant’s application, you should call their current and previous landlords. A landlord reference check can help you answer important questions, such as:

- Will they keep my rental property in good condition?

- Are they likely to pay rent on time?

- Will they cause trouble with the neighbors?

- What can I expect when communicating with this applicant?

A simple 15-minute phone conversation with an applicant’s current and previous landlord may help provide insight about whether or not your prospective tenant is a good fit.

According to Lamacchia Property Management Group, some potential questions to ask previous landlords during a reference check include:

- Can you confirm the applicant rented from you for the dates and rate specified?

- Did the applicant pay their rent on time every month?

- Did they take reasonable care of the property?

- Were there any major issues beyond normal wear and tear?

- Was the applicant disruptive to neighbors or others?

Would you rent to this applicant again?

Of course, this list contains only a few possible questions to ask, but is by no means exhaustive. You can use these questions as a starting point and add your own. Come up with queries that will provide the information you need to help make a confident leasing decision for your property.

Once you’ve received applications and gathered the information you need, you can begin to validate a prospective tenant’s rental history in a few additional steps.

Check for Past Evictions

Thoroughly examining rental applications and conducting landlord reference checks may be essential steps when investigating a prospective tenant’s rental history. However, it’s crucial that you also validate the information they’ve self-reported.

One way to help do that is through running a previous eviction check. SmartMove eviction checks, include eviction records that have a final judgment, which may include:

- Tenant judgement for possession and money

- Unlawful detainers

- Tenant judgements for small claims

Armed with this knowledge, you may better understand if the history on your potential tenant’s application was correct, or if you need to ask some follow up questions.

Additionally, with SmartMove, you get a ResidentScore® included in every screening package. Unlike traditional scores that were made for money lending, ResidentScore is a proprietary calculation that was specifically designed for landlord/tenant scenarios.

Here are the benefits of a ResidentScore over a traditional credit score:

- Helps predict future eviction risk15% better than a general credit score alone.

- This important score can further help you validate your potential tenant’s information. After all, knowing what’s happened in an applicant’s past could help inform future leasing decisions.

Conduct Tenant Screening

On top of eviction records, getting additional background check reports can help validate the claims on a rental application. Here’s a few ways this can work:

- Credit reports: credit reports often contain previous addresses, which you can check against the history listed on the rental application. Additionally, it may help you determine if they have a habit of paying bills on time or letting them pile up.

- Income Insights: here, you can verify your potential tenant makes the income they claim. This may help you determine if the rental rate they said they’ve paid in the past makes sense with their income.

- Tenant Criminal background check:this report scours hundreds of millions ofcriminal records searching for a potential match for your applicant. It may help you determine if they have any related criminal history that could be a threat on your property.

- Identity check: one of the most important verifications, this report may help confirm your applicant is actually who they say they are. After all, an excellent rental history is meaningless if it doesn’t apply to the person standing in front of you.

In the end, picking a great tenant all comes down to deciding if the applicant is the right fit for your rental property. With the right information, this part of the process can be easier.

Ideally, a landlord wants a tenant who:

- Pays rent on time

- Has an acceptable criminal and eviction history

- Will treat the property as if it’s their own

With a thorough rental history review and tenant screening reports from a well-established company like SmartMove, you might just find what you’re looking for.

Help Get Rental History Insights with SmartMove Tenant Screening

Sometimes, your potential tenant’s past is a mystery that can be difficult to unravel. But, before you don your trench coat and deerstalker hat, know that there are more than just indecipherable paper records and past landlord leads that go nowhere. Bring your search into the modern age with fast, flexible online tenant screening through SmartMove.

Your rental applicant’s past conduct in a rental property may be a helpful predictor of their future.

Dig into their history with rental credit report, eviction report, a criminal report, Income Insights report, and a ResidentScore to help you make a informed leasing decision.

Designed specifically for independent landlords with only occasional screening needs, you can get most reports are delivered same day after the applicant verifies their identity. . Plus, you get only the reports you need and only when you need them. There are no subscriptions, monthly minimums, or hidden fees. Simply create a free account and start screening today.

All reports are backed by TransUnion, a major credit agency with forty years of data expertise. This means you can feel more confident in the data you use to help verify your tenant-supplied information.

Don’t let ill-fitting tenants lead you off the trail. Help verify rental history information for your potential rental applicant with fast, online tenant screening through SmartMove.

Rental History FAQ's

To learn more about your potential tenant’s history, you can ask their previous landlord questions about payment history, lease compliance, and how they took care of the place. This forum on money site Bigger Pockets suggests asking about their rent amount, if they stayed for the entire lease term, if they had any roommates, if they paid punctually and in full, if they had pets, whether or not they gave proper notice and cleaned before leaving, if they maintained the property well, if the landlord would rent to them again, and more.

Often, yes. SmartMove previous eviction checks return eviction records that have a final judgment, which may include:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for small claims

Knowing more about a tenant’s housing history can help you make more confident leasing decisions.

According to legal site FindLaw, an unlawful detainer is a court procedure through which a landlord gets permission to remove a tenant from a property. Landlords generally file an unlawful detainer complaint if they have already served a tenant an eviction notice, but the tenant has not left.

It depends. According to management site RentSafe, frequent moves or housing gaps are not necessarily automatic rejections. However, without a good explanation, inconsistent housing history could indicate a potential problem.

SmartMove

Great Reports. Great Convenience. Great Insights.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.