Summary:

Vacancy rate is the percentage of unoccupied units in a given building, area, or portfolio. Understanding your area’s vacancy can help you determine the health of your market and if your rent is priced right. Factors like high rent, maintenance delays, or uncompetitive amenities can contribute to high vacancy rates. Timely responses to tenant requests, offering desirable amenities, and selecting quality tenants from the start are strategies to decrease vacancy rates.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Any game is hard to win if you don’t know the rules. Being a landlord is no different. Oftentimes, juggling tenant needs, paying insurance premiums and mortgages on time, and squaring up at tax season can feel like a chess game where the pieces keep changing.

While the objective is a successful rental business, that’s not always possible. Given that 36% of rental businesses fail in the first five years, according to AdvisorSmith, it’s crucial to do everything you can to help maximize profits and come out triumphant.

One way to keep more of what you earn is to minimize expenses. Most landlords already understand the cost-saving importance of knowing how to set the right rental rate and helping reduce the risk of evictions with thorough renter background checks through a quality service like SmartMove®.

However, fewer landlords are aware of the range of tax breaks available to property owners and managers—opportunities that could help you save big. With many renters and landlords recovering after a financially tumultuous few years, it's more important than ever to help protect your investment.

Below, you’ll find 15 potential deductions that could help you during tax season. While some of these tax breaks apply to all homeowners, many are unique to rental properties . Make sure to check with your tax professional or CPA to determine whether any specific tax deduction applies to you and make the most out of your return.

What is Vacancy Rate?

In general, “vacancy rate” means “what percentage of units are occupied.” Hotels and apartment complex owners usually use vacancy rate to measure the percentage of available units in a multi-unit property. However, landlords that rent out single-family homes and units should use vacancy rate a bit differently.

As FitSmallBusiness indicates, by viewing rental rates on a broader scale, landlords can analyze their vacancy rates to determine rental market conditions in a particular area, like a city or neighborhood. When used in this context, vacancy rate can help answer the following question:

How many properties are available for rent compared to the total number of properties in the area?

If your market has high vacancy rates (e.g. lots of empty apartments), it may indicate that the area isn’t appealing to renters. On the other hand, low vacancy rates usually mean lots of renters want to live there.

Local amenities can make or break vacancy rates in a given area. For example, if your rental property is located near grocery and retail stores, a university, or large transportation center, you may find that there are more renters looking to live in the area due to the abundance of conveniences. If your rental property is located outside of town and lacks easy access to these luxuries, you may find it’s harder to get your rental property off the market

Pro Tip:

While location and amenities are important, there are lots of other important ways to attract great tenants you should know about, too.

Why am I dealing with high vacancy rates

There are lots of reasons you might have high vacancy rates (e.g. lots of empty units), including:

- You’re charging too much for rent: If your rental rates are too high, it might be hard to fill vacant units, especially if there are similar units in the area with cheaper rent. Additionally, overpriced rent could push out good tenants and may lead to costly turnover. Keep tabs on what comparable properties charge with sites like com, or check out forums like BiggerPockets to see what other landlords in your area charge.

- You aren’t keeping up with maintenance requests: Landlords that fail to quickly and appropriately respond to tenant requests may deal with costly turnover more frequently. Whether a tenant is calling to report a leak or needs new batteries in the smoke detector, it’s important to address property maintenance and repair issues as they arise. By doing this you may help to keep your high-quality tenants happy and encourage them to renew their lease when the time comes.

Pro Tip:

Renewing a lease could be as simple as a new signature. However, it’s also a time for new opportunities. Learn how to properly negotiate a lease renewal to benefit both you and your tenant.

- Your property doesn’t compete with comparable properties in your area: If you charge the same rates as other landlords in your area, but your property doesn’t offer the same amenities, you’ll likely deal with more vacancy issues. To determine the average rent price in your area, you’ll want to find out the rent for at least three properties that are comparable to yours. The number of bedrooms and square footage should be the same, and if possible, you should try to find units with similar features, such as a garage, in-unit washer and dryer, and patio or balcony space.

If your vacancy rate is high, consider how your property (and your rental rates) are stacking up against the competition.

- Does your property fail to provide amenities that nearby complexes offer

- Are you charging more money for a 2-bedroom apartment than other landlords or property managers in your area

If this is the case, you may need to reduce your rental rates or update your amenities to remain relevant in the rental market and keep high-quality (and high-paying) tenants from leaving.

When should landlords be concerned about vacancy rates

Ultimately, a property owner could use vacancy rate as a metric for rental business performance. While vacancy rates may traditionally be thought of as a method for assessing individual property performance, such as a nightly hotel vacancy rate, it can also be used as an economic indicator of overall market health in the real estate industry.

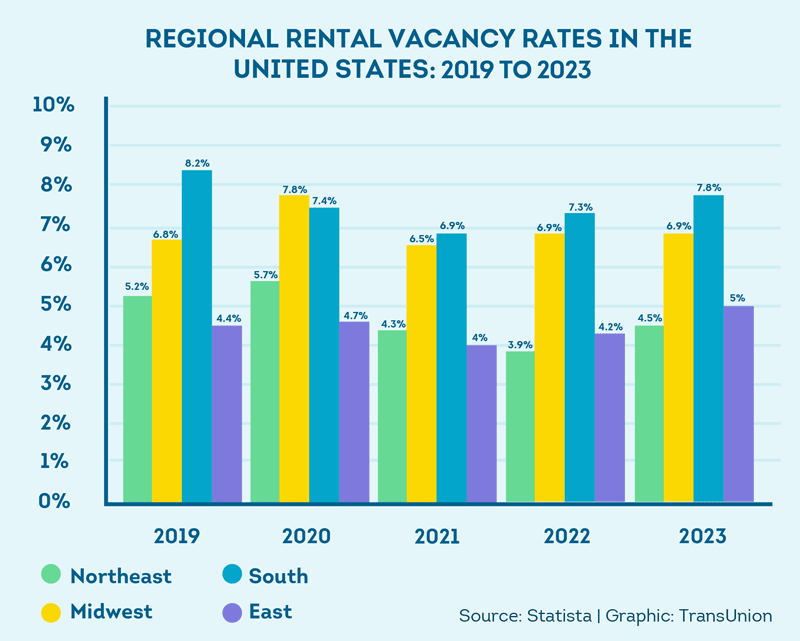

What is the average vacancy rate

Vacancy rates vary among types of properties and different parts of the country. The below chart shows regional vacancy rates across the United States from 2019 to 2023.

Vacancy rates can vary significantly between different areas of a single city. According to the FitSmallBusiness article referenced earlier, a good vacancy rate measures somewhere around 24% in a metropolitan area. However, vacancy rates tend to be higher in rural areas.

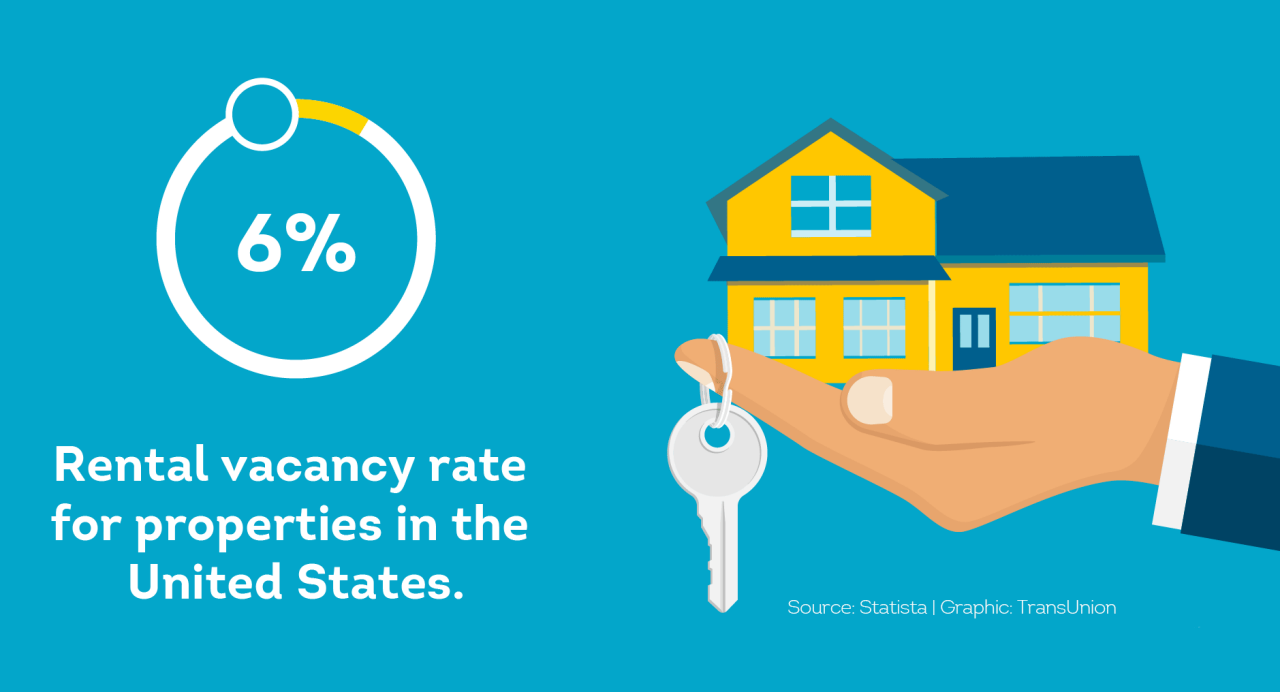

According to data site Statista, the average vacancy rate for all regions of the U.S. in 2023 was 6%, and varied regionally from 5 to 7.8%.

How to Determine Vacancy Rate

There’s no single way to determine vacancy rate when viewing it through the lens of rental market conditions. That said, BiggerPockets outlines three different resources landlords can use to determine vacancy rate in their area.

1.Property Managers

Talk to local property managers and landlords. Ask them about vacancy rates and learn what they’re currently experiencing. These individuals may be able to give you more specific information about vacancy rates in particular neighborhoods.

2.Real Estate Agents

Consider hiring a real estate agent to discover more details about vacancy rate in your area. Some real estate agents will conduct a comparative market analysis on local rental property statistics, which will indicate how long properties currently available on the MLS have sat vacant, along with other key pieces of information, including:

- How long properties were vacant before being rented

- Original listing prices compared to final renting prices

3.Census Data

The U.S. Census Bureau reports vacancy rates in various parts of the United States, including the largest 75 markets in the country. However, Census data doesn’t track the vacancy rate of specific neighborhoods, so it may not provide a precise number for your specific rental market area.

Tips on How to Decrease Your Vacancy Rate

Generally, a low vacancy rate is indicative of a well-performing property. If you want to decrease vacancy rate in your property, keep these helpful tips in mind:

1.Respond to tenant requests

Happy tenants are the key to maintaining a low vacancy rate. Keep loyal tenants by responding quickly to requests and making repairs in a timely fashion.

2.Offer more desirable amenities

Consider updating your rental property to offer the amenities that tenants want. From in-unit laundry to high-speed internet and smart home technology, there are plenty of features that could help convince tenants to stay—or to rent from you in the first place. Again, the more up-to-date and in-demand amenities you have to offer, the more aggressive you may be able to get with your rental price.

3.Provide incentives for lease renewal or longer duration

To encourage longer leases, you might consider offering a discount or perk in exchange for a longer lease term. For example, if you charge $1,000 per month for a 12-month lease, then you could consider dropping the rent to $950 for a 24-month lease. If your tenants gives notice that they are leaving and you want to retain them, then provide an incentive for them to stay. For example, you might offer a reduction in one month’s rent if a tenant renews their lease. Alternatively, you could offer certain property upgrades requested by the tenant upon renewal.

4.Find the right tenants from the start

To help decrease tenant turnover and rental property vacancy down the road, it’s crucial to find high-quality tenants from the start. Using tenant screening services like SmartMove may help you weed out unqualified applicants and place the right person in your property.

Tenant screening reports help you gain insight into a prospective tenant’s credit, criminal, and eviction history. SmartMove also delivers a ResidentScore, which predicts the risk of eviction 15% better than a general credit score. ResidentScore is designed specifically for the tenant screening industry and is exclusive to SmartMove.

While vacancy rates may primarily be influenced by market conditions and fair market rent prices, it’s important to acknowledge that eviction could also leave a landlord dealing with an unwanted vacant property as well. In a TransUnion survey, 84% of landlords said that payment problems were one of their top concerns. This makes sense, considering eviction due to the nonpayment of rent is $3,500 on average and can take 3-4 weeks to completeI.

With SmartMove, landlords can learn more about a tenant’s ability to handle rent payments with Income Insights, a model that analyzes the applicant’s self-reported income by using data from their credit report. If Income Insights estimates your applicant’s income may be lower than what they reported, you may want to do additional income verification.

With comprehensive online screening, you can gain insight into a prospective tenant’s credit, criminal, and eviction history. Take advantage of ResidentScore to help predict the risk of renting to a particular applicant, and learn more about a tenant’s ability to handle rent payments with Income Insights.

Help Reduce Vacancy Rates with Fast Tenant Screening Through SmartMove

High vacancy rates may indicate your rental garden isn’t growing as well as it could be. For landlords, finding the right tenants from the start is one major key to a flourishing property business. Help boost tenant retention and rental income with ultra-fast tenant screening through SmartMove.

On-demand criminal record reports scour millions of state and federal-level misdemeanor and felony records, searching for a potential match to your rental applicant. Similarly, a past-eviction check may help match your potential tenants to potential past-eviction records.

Help verify that your rental applicant has a strong history of paying debts on time with FCRA-compliant tenant credit checks. Included in every SmartMove package, a ResidentScore is an exclusive, tenant-specific score that helps predict evictions 15% better than a traditional credit score. Meanwhile, IncomeInsights helps you determine if your applicant actually makes what they say they do, or if additional financial verification is needed.

Super-fast, FCRA-compliant reports are delivered to your inbox as soon as your rental applicant consents to the screening process. Designed specifically for independent landlords with only occasional screening needs, SmartMove provides quick, reliable reports that are backed by TransUnion, a major credit agency with four decades of data expertise.

Don’t let your big plans get choked out by high vacancy rates. Help weed out potential renter issues with fast, affordable screening through SmartMove.

SmartMove,

Great Reports. Great Convenience. Great Tenants

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.