Summary:

Offering a month-to-month lease can be an attractive and potentially lucrative approach to renting out property. While a short-term rental can bring more income, it can also take more work, add additional costs for turnover, and bring vacancy uncertainty. If you’re considering offering month-to-month leases, it’s important to weigh the advantages and disadvantages.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Like with many small businesses, optimizing your landlord profits often means wrestling with hard decisions. One question that enters the ring frequently is: should you favor a stable, predictable income stream over a potentially more lucrative––but riskier––strategy?

For independent landlords, the question is paramount. After all, the wrong move could drop a flying piledriver straight into your rental profits.

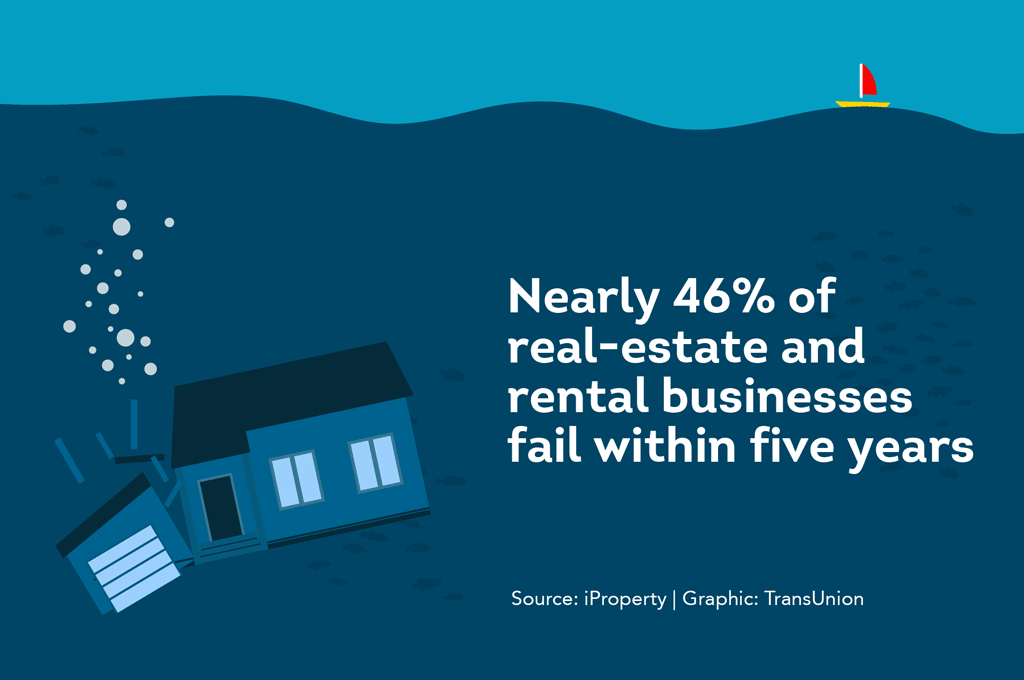

In fact, according to management site iProperty, nearly 46% of all real-estate and rental businesses fail within the first five years. If you’re not careful, your property business dream could be among the wreckage.

One arena this classic showdown of max stability vs. max profit plays out is deciding whether or not to allow tenants to rent from you on a month-to-month basis. On one hand, a month-to-month option could boost your returns. However, on the other, it could be more work than you bargained for––and even pave the way for expensive vacancies.

Like with most business decisions, it’s important to investigate ahead of time. Before signing a lease, landlords run thorough tenant screening through an established service like SmartMove®. Similarly, it’s important to look at the data behind your own property business and your local rental market to help determine if shorter-term rentals make sense for you.

This article provides background information about month-to-month leases, including definitions, benefits, watchouts, and potential pitfalls.

What is a Month-to-Month Rental Agreement and How Does it Work?

A lease is just a lease, right? For the most part, yes. However, for some professionals, there is a difference between a lease and a rental agreement.

The two terms technically refer to different types of contracts. However, for some professionals, there is a difference between a lease and a rental agreement. According to Bay Property Management Group, while both govern rentals, they typically refer to different contract lengths:

Lease: a long-term rental contract of a standard length, typically 6 or 12-months.

Rental agreement: a short-term rental contract, such as a month-to-month rental

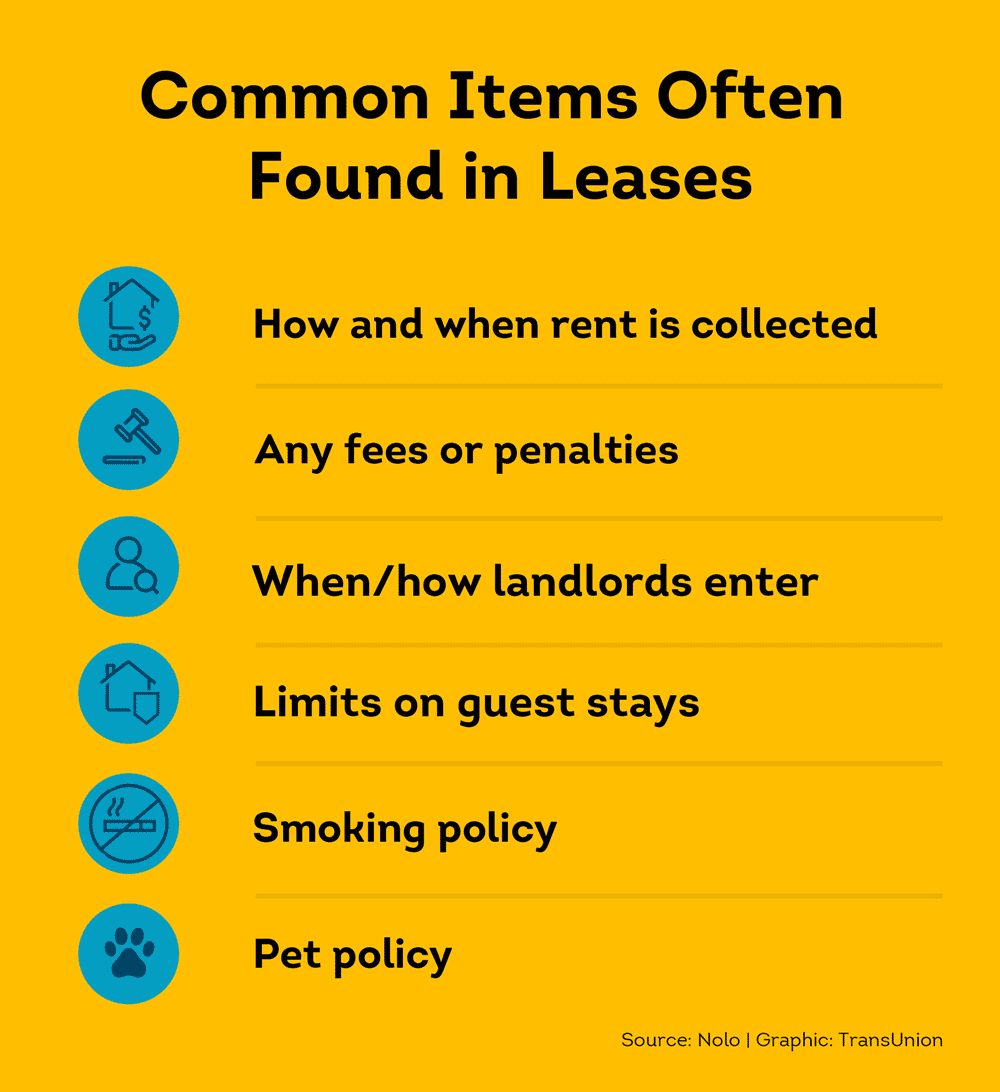

According to legal site NOLO, some of the most common lease terms include things like:

- How and when rent is collected

- Any fees or penalties

- Smoking policy

- Pet policy

- Limits on guest stays

- When and how landlords can enter the property

A month-to-month rental agreement typically lasts, as the name implies, for 30 days. According to legal site Rocket Lawyer, unlike a long-term lease, it typically renews automatically unless the tenant or landlord provides notice of nonrenewal.

Month-to-month rental agreements may require a 30-day notice by either the landlord or tenant, although this may vary based on applicable law.

Pro Tip:

Even in short-term rentals, it’s important for tenants to know what’s expected of them when leaving.

When Should You Consider Using a Month-to-Month Rental Agreement?

A month-to-month rental agreement could be a flexible option for both you and your tenants in several scenarios. One of the most common scenarios where you might encounter month-to-month leases could beafter a long-term lease ends.

Some long-term leases include a month-to-month option after the original lease ends. This may happen when a tenant doesn’t sign a new lease but doesn’t leave right away––for example if they’re waiting for a home purchase to conclude. The existing lease typically spells out how the month-to-month arrangement will work, such as whether the tenant will be required to pay a premium above the rent amount in the original lease. Please be aware that applicable laws may impact the terms of a month-to-month lease.

In addition, other common uses of month-to-month rentals include:

- Wanting to use property as a vacation rental

- Accommodating college students in a university town

- Trying to capture higher rental potential or rising fair market rent in an up-and-coming area

These are just some of the ways in which landlords may use month-to-month leases. Check out the next section for benefits and challenges to consider when deciding if short-term leases might work for your rental business.

Pro Tip:

Running your property business well may require special attention at the end of a lease term. Learn how to negotiate lease renewals to reach better outcomes for both you and your tenants.

Possible Advantages and Disadvantages of Month-to-Month Rental Agreements

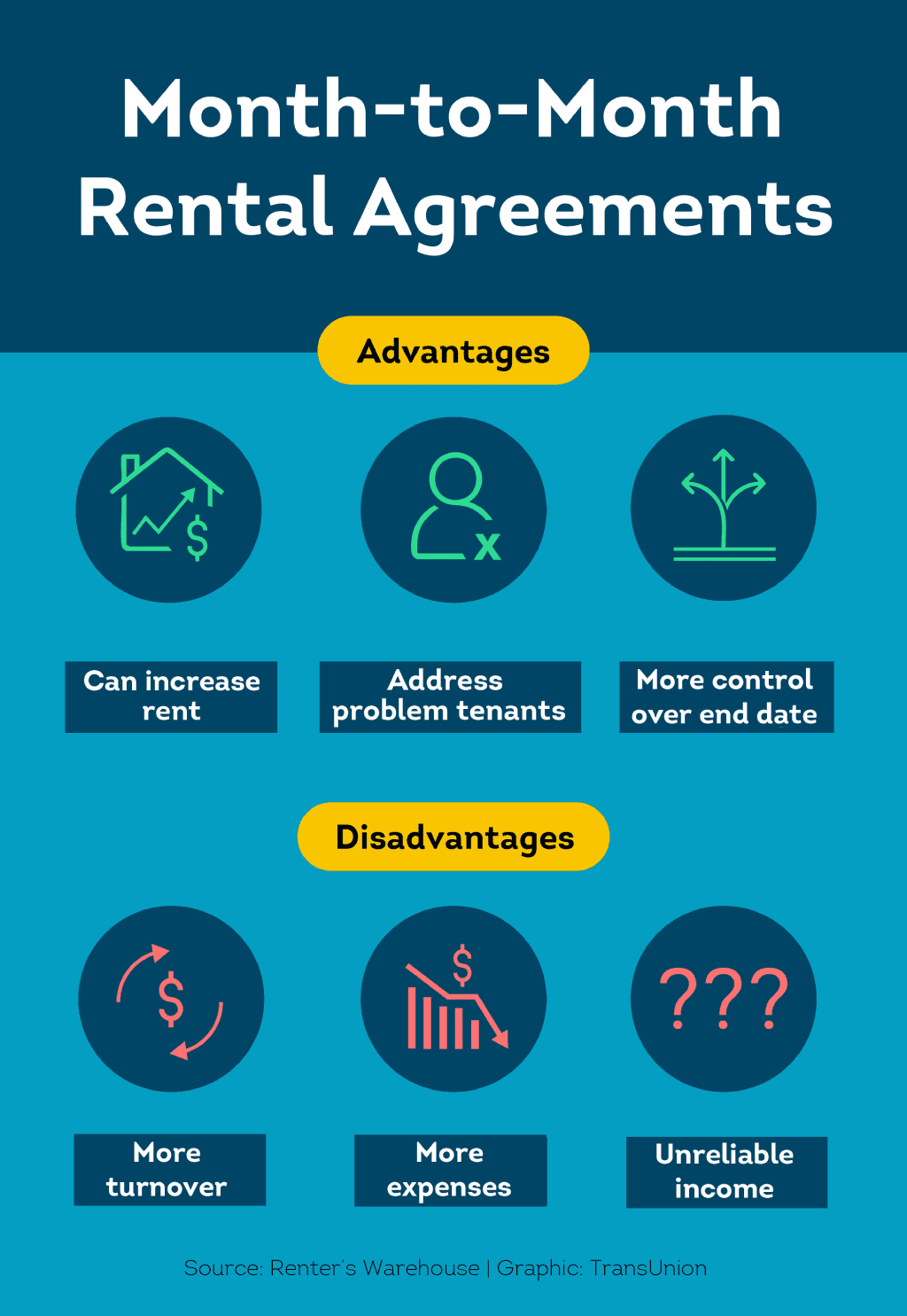

While deciding what approach works best for you, it may be important to consider the advantages and disadvantages of month-to-month rental contracts.

According to leasing site Renter’s Warehouse,there are many benefits that offering month-to-month leases can bring to landlords, including the potential for more money, more control and flexibility, and the ability to deal with problem tenants sooner:

1. More Money

One of the biggest potential advantages to choosing month-to-month rental agreements is additional earning potential. Month-to-month leases can usually enable you to charge more for rent each month, according to Rocket Lawyer.

This increase fee exists because shorter term leases may require more work and can potentially carry more risk for landlords, as tenants can move out any time with proper notice.

How Much Extra to Charge for a Month-to-Month Rental

The exact amount of the surcharge can vary, depending on who you ask. Here are a few opinions:

- $30-200 extra to reflectthe convenience and flexibility of month-to-month rentals, according to the Rocket Lawyer article linked above.

- According to property management site Greystar, month-to-month leases often cost 5-20% more than fixed term leases.

- According to management company OKC Home Realty Services, landlords can charge more than 20% more with month-to-month rentals and sometimes more than 50% more than a fixed term lease.

As you can see, what people charge can have a massive range. In general, the cost for month-to-month rentals should follow the same tips to figure out what to charge for rent: check out your own local market.

2. Flexibility

Another potential advantage of month-to-month leases can be flexibility. By not being locked into a long-term lease, landlords may have more options in terms of what they can do with the property and for changing the terms of the rental, usually by providing proper notice.

Rocket Lawyer notes that in hot markets where rents are rapidly increasing and tenants are plentiful, a shorter lease agreement allows landlords to keep rents comparable to others in the neighborhood or area.

For landlords renting a primary residence, a month-to-month lease allows them to move back into their home much easier over a long-term lease. Some landlords may want the flexibility of having an empty unit available in a few weeks, or the ability to lease it as a vacation home or executive rental, usually fully furnished.

3. Address Problem Tenants

No matter if you’re renting long-term or short-term, you should conduct tenant screening to help get a fuller picture of who you’re leasing your property. However, even with proper vetting, you might occasionally get ill-fitting tenants.

They might have habits like:

- Consistently late on rent payments or stop paying rent altogether

- Smoking in your apartment, even though it’s against the rules

- Concealing an unauthorized pet

- Causing problems with other residents

In long-term rentals, there can be restrictions on when a landlord can break a lease. However, according to theRenter’s Warehouse articlementioned earlier, with a month-to-month rental, if the term ends at the end of the month it may be easier to send the tenant on his way.

Also, a month-to-month rental agreement may be a good way to test whether a tenant will be a good long-term fit for a property. If the renter has the qualities of a good tenant, it’s possible to sign a longer-term lease later.

Whatever your approach, make sure to help mitigate potential risk in your business and property with tenant screening, including:

- Employment & Financial Screening: Learn how to help verify a potential tenant’s employment. Help verify they have the income they claim to have to pay the rent with Income Insights. Then, check their financial history with a credit report. Finally, check out their ResidentScore®, a proprietary calculation that helps predict eviction risks 15% better than a traditional credit score alone.

- Criminal History and Identity Check: A criminal background check zooms through millions of federal and state-level crime records searching for a potential match for your rental applicant. Meanwhile, an identity check helps confirm they really are who they say they are.

- Housing History and Previous Evictions: Run a previous eviction check to help determine if they have past housing-related judgements. Then, help get a fuller picture with previous landlord reference checks.

Remember, even if someone is just in your property for four weeks, they can still cause thousands of dollars worth of damage.

Pro Tip:

Getting a credit report is really helpful––but only if you know what you’re looking at. Learn what to consider when running a tenant credit check and spot potential red flags

Potential Disadvantages of a Month-to-Month Rental Agreement

Like many opportunities to make money, renting month-to-month does come with a few potential pitfalls and watchouts.

1. Cost of Turnover & Increased Workload

It’s no secret that month-to-month rentals require more hands-on work. When you have potentially new renters every few weeks to months, the time and money it takes to prepare the place can really add up.

According to insurance site Belong Home, replacing a tenant can cost anywhere from $1,000 to $5,000. When you turn the unit over, you may have to pay for things like:

- Cleaning

- Maintenance due to normal wear and tear, such as a fresh coat of paint

- Significant repairs, depending on how the prior tenants left the property

- Marketing costs for advertising your property

- Inspections

- Walk-throughs, whether with in-person or virtual tours

- Communicating with interested parties

- Screening tenants

- Creating and signing rental contracts

- Travel

- The cost of documents and record keeping

According to management site iProperty, 80% of independent landlord businesses are owner managed, meaning most take care of everything themselves instead of hiring an outside management company. If you’re like the majority of independent landlords, you should decide if you have the extra time to commit to shorter-term rentals.

2. Loss of Income

An empty unit means there’s no money coming in––but you’re still on the hook for the mortgage and other costs. As this Rocket Lawyer article notes:

“In a rental market with lower occupancy rates, the potentially high turnover associated with shorter lease agreements may prove problematic, as new tenants may not be at the ready. An apartment without a lease equals loss of rental income.” – Rocket Lawyer

According to Rocket Lawyer it is really important to know your specific rental market. Check on comparable properties, visit listing sites to see available units around town, and get a sense of the general demand in your location.

If rental sites show a ton of available month-to-month rentals that always seem to be posted with no takers, maybe the market is already saturated.

Additionally, rental demand can change by the season. If you try month-to-month rentals in a beachy tourist destination, it might work well for the summer. But, what about the winter? Does your market have the demand to sustain month-to-month rentals throughout the year?

3. Uncertainty––Potential Vacancy, More People in Your Space

A year-long lease is stable. If you’ve secured good, responsible tenants, you can feel more secure that they will pay the rent on time, in full and every month. Plus, they’ll tell you if anything goes sideways on the property. For the most part, you can relax and not think much about the unit for a year.

However, with a month-to-month rental agreement, you may always be30 days away from having an empty unit––and expensive vacancy. You constantly need to focus on the business; finding new tenants, turnover, communicating. This may hinder your ability to plan for the long term, both professionally and personally.

Additionally, by the nature of month-to-month rentals, you have more people coming into your property. Even if you screen all of them, more people may mean more chances something might go terribly wrong.

The bottom line: Month-to-month rental agreements offer great flexibility for both landlords and tenants, but there’s a lot to consider before signing on the dotted line. Landlords may want to weigh the potential for higher income against possible vacancy and increased workload.

Helping Tackle the Challenges of Month-to-Month Rentals with SmartMove Tenant Screening

While a month-to-month lease may bring additional income, it will also bring additional people onto your property. This means you should be to be extra vigilant that the tenants you place in your short-term rentals are screened and likely to pay the rent. Fortunately, you can conduct fast affordable online tenant screening through SmartMove.

Even a short-term resident may be destructive. Before signing a lease, check to see if they have any relevant patterns that could mean disaster for your property business. A criminal background check searches hundreds of millions of federal and state-level crime records looking for a potential match to your applicant. Meanwhile, an identity check helps confirm they really are who they say they are.

Does your potential tenant make enough to pay the rent––even if it’s just for two months? A credit report helps you review their financial history to help determine how they manage their financial obligations. Income Insights helps verify they actually make the money they claim. Then, included in every screening package, a ResidentScore helps predict eviction risk 15% better than a traditional credit score alone.

Even with constant turnover in month-to-month rentals, you can easily keep up with screening demands. Trusted by over 600,000 landlords and over 4.4 million tenants, SmartMove reports are typically delivered just moments same day after your rental applicant verifies their identity. Reports are backed by TransUnion, a major credit agency with over forty years of data expertise.

Designed specifically for independent landlords, there are no sign-up costs, subscriptions, minimums or hidden fees. Simply sign up and start screening immediately.

Don’t let insufficiently-screened monthly renters pin your property business to the mat. Help emerge victorious with fast, affordable tenant screening through SmartMove.

SmartMove

Great Reports. Great Convenience. Great Tenants.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.