Online Credit Checks for Property Owners

What’s in the tenant credit check?

Credit reports for tenant screening are delivered direct from TransUnion®, a trusted credit reporting agency that handles millions of credit files domestically. As applicable, the following may appear in a credit report:

- ResidentScore®

- SSN verification

- Previous employment (where available)

- Credit history

- Accounts in poor standing

- Level of debt

- Recent applications for credit

Our credit checks do not impact a potential tenant's credit score.

A tenant credit report from TransUnion SmartMove® results in a soft inquiry on the applicant’s credit history, which does not affect their credit score. While still giving you the full picture to make an informed decision.

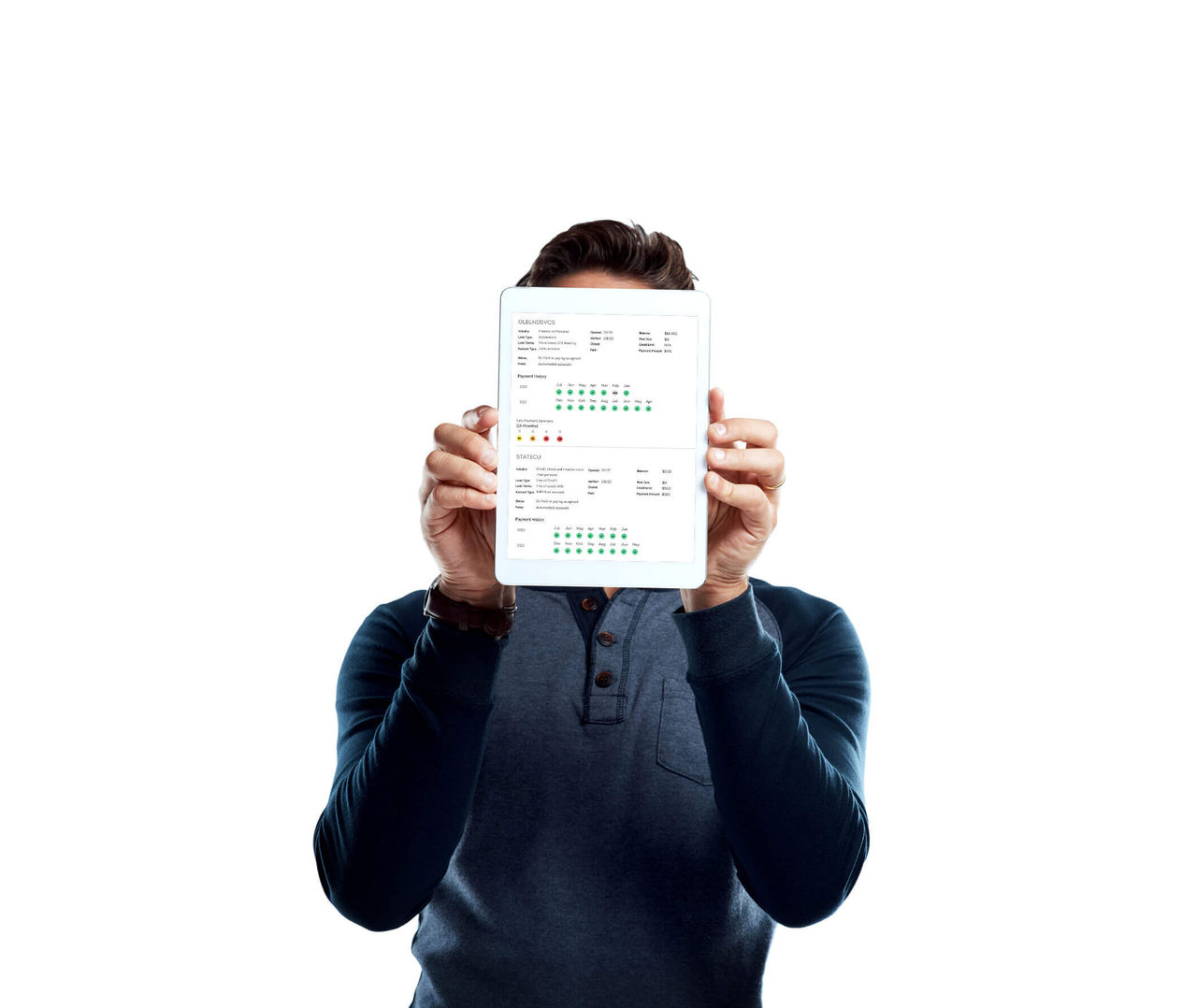

Easy to read tenant credit reports.

With a credit report from TransUnion SmartMove®, you can get the insights that you need to make an informed leasing decision. Also included is SmartMove’s resident scoring system, which will help you to make confident leasing decisions.

Most tenant screening reports delivered same day.

Our tenant screening process is completely online & accessible whenever it's most convenient for you. With SmartMove you can gain access to your potential tenant’s credit, background, and eviction history to help give you with the confidence that you are making the right choice.

Straightforward Pricing

Choose who pays (where permitted) and no hidden fees.

SmartCheck Plus

When you want a little more information on your potential tenant.

${SmartCheck Plus:40}

SmartCheck Basic

Our basic screening includes our proprietary score and criminal background check.

${SmartCheck Basic:25}

Background Check Basic

Our basic screening includes our proprietary score and criminal background check.

${SmartCheck:25}

**The Criminal Report and Eviction Related Proceedings Report are subject to federal, state, and local laws that may limit or restrict SmartMove's ability to return some records. Certain jurisdictions may limit what records are eligible for return, click here for more information.

✝ Based on a 2016 TransUnion Survey:

Credit checks you can rely on, designed specifically for tenant screening.

Frequently Asked Questions:

A credit report can provide a landlord with important information that can be used to make a confident leasing decision. There are also several warning signs on credit reports that you can identify to help avoid renting to the wrong tenant. With that said, there are several reasons why credit reports for landlords can be useful, such as:

Assess financial responsibility: Credit reports provide information such as payment history and outstanding debts. When you run a credit report for a tenant, you may be able to assess whether they’re financially responsible or if they can afford to make monthly rent payments on time.

Avoid non-payment of rent: One of the primary reasons credit reporting for landlords is important is to help avoid non-payment of rent. Credit reports can help landlords gauge whether a rental applicant will likely make rental payments in full and on time to help avoid financial losses and prevent the need for a potential eviction.

Credit reports help paint a clear picture of their financial history and responsibility. To make this possible, tenant screening assesses a wide range of information that can help landlords make more informed leasing decisions.

Some information you can find on a prospective tenant’s credit report includes:

- Personal information

- Names and nicknames used

- Date of birth

- Current and former addresses

- Social Security number verification

- Phone number

- Credit Accounts

- Current and former credit accounts

- Account balances

- Creditor names

- Payment history

- Credit limits

- Account open and close date

- Inquiries

- Collections

- Foreclosures, liens, and bankruptcies

The pricing of a tenant screening report can vary depending on various factors, such as the screening service you choose and the credit check process. At SmartMove, we have several tenant screening bundles to choose from that can match your budget, so you can screen potential renters without digging into your bottom line. When it comes to checking a prospective tenant’s credit, we offer affordable solutions so you can get a better understanding of an applicant’s credit history at an affordable cost.

There are many benefits of online tenant screening, and tenant screening can help landlords make confident rental decisions in a variety of ways. By reviewing a prospective tenant’s credit report, landlords can assess their financial risk to determine if they can make monthly rental payments. Along with helping landlords avoid non-payment of rent, tenant screening can also help landlords make confident leasing decisions which may lead to finding responsible tenants who can keep their properties safe.

Tenant screening with SmartMove not only provides an in-depth credit report and ResidentScore, but you can also view criminal history, income insights, employment history (where available), and more, depending on the package you choose.

If you’re a landlord or property owner, one of the last things you want is a vacant property that is losing you money. With SmartMove credit reports for landlords, you can get most results same day.

Here is how you can start screening prospective tenants in 3 easy steps.

- Register and create a free SmartMove account.

- From there, you can send a screening request to a rental applicant.

- After the applicant verifies their identity, the applicant completes our simple application.

After that, our software will take care of processing the screening request. We will comb through thousands of resident records and provide most results same day. This way, you can make an informed leasing decision on the spot and fill vacancies fast.