Summary:

In general, a guarantor on a lease is a person or business who agrees to pay someone’s rent only if the tenant defaults (stops paying rent). On the other hand, a cosigner is someone who is equally financially and legally responsible for the lease from the start. You may want to consider requiring a guarantor if your rental applicant has a poor financial history, thin rental history, or an unstable employment situation.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

A guarantor on a lease is a bit like a spare tire on a car. Most of the time you’re trucking down the road without giving it a second thought. However, if you do find yourself in a sticky situation, it’s there and ready to help.

Guarantors are people who act as a financial safety net on behalf of others––usually in a leasing or lending situation. And, in today’s rental market, you may encounter the need for a guarantor on a lease more often than you’d expect.

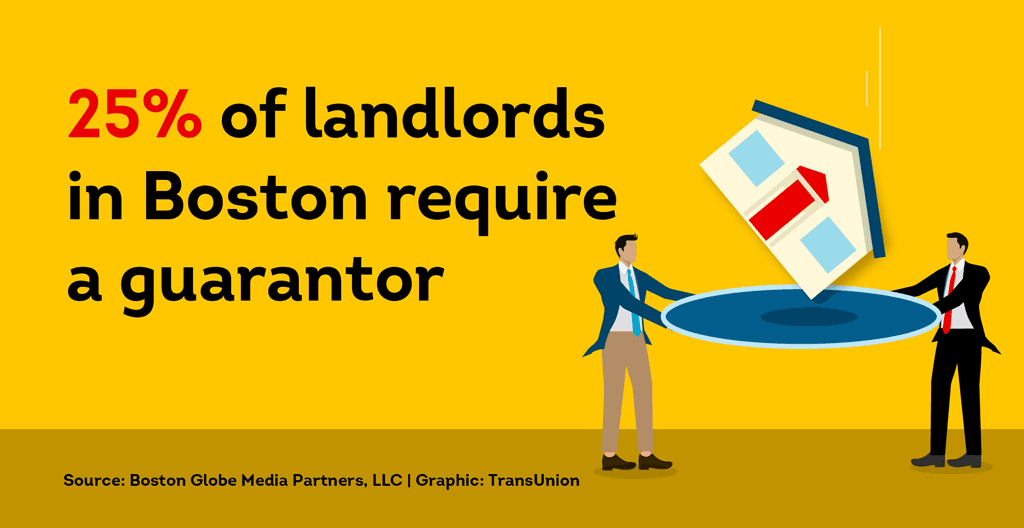

Guarantors can be a common thing, but may be more prevalent in some areas. In fact, according to Boston Globe Media Partners, LLC, some property management companies are seeing Boston landlords require guarantors in about 25 percent of rental deals. That’s almost one in every four applicants!

Landlords should not make leasing decisions based only on their gut. With tenant screening reports through an established service like SmartMove®, you get data about your rental applicant’s past behavior. These reports can help inform whether or not you should consider a guarantor for extra security.

This article is meant to provide the basics about this vital role in the leasing process including: what is a guarantor on a lease, what is a guarantor vs. cosigner, when you might want to request one, and how to use screening reports to help make confident decisions.

No Financial or Legal Advice: We do not guarantee the accuracy or completeness of the information provided. This information is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. TransUnion Rental Screening Solutions Inc. and its affiliates do not provide financial or legal advice.

Here’s the breakdown:

1: What is a Guarantor and Why Are They Needed?

When it comes to renting out property, there’s always some financial risk involved. After all, in order to make money as a landlord, you need to have tenants that pay their rent on full, on time, and every month. But what if your rental prospect’s rental or financial history has you second guessing their ability to meet your payment standards?

In these cases, you might want to consider requiring a guarantor. According to legal site NOLO, a guarantor is:

"A person or entity that makes a legally binding promise to be responsible for another's debt or performance under a contract, if the other defaults or fails to perform.

When it comes to rental situations specifically, a guarantor is generally someone who agrees to be financially responsible for the rent if the tenant on the lease defaults (e.g. doesn’t pay the rent).

Bonus: Who is a Guarantor on a Lease, Usually?

Generally, a guarantor on the lease should be someone who is responsible, financially stable, and a good communicator. According to Investopedia, a guarantor usually:

- Has a high credit score and no major red flags on a credit check

- Has an income that is some multiplier of the monthly rent

- Should be over 18

Often, especially when renting to college students, tenants might have their parents, grandparents, or other close relatives act as a guarantor. Additionally, there are private companies that can be guarantors for tenants, as well.

2: Guarantor vs. Cosigner––What’s the Difference?

While both guarantors and cosigners can be financially responsible in a lease, they are not quite the same. According to Bay Property Management Group, there are several key differences between a guarantor and a cosigner, including:

- When they are financially responsible: A cosigner shares financial responsibility for a lease from the start, whereas a guarantor only needs to step in if the tenant defaults.

- Role in lease: A guarantor has financial responsibility and typically does not have to occupy the unit. On the other hand, a cosigner is also bound to the terms of a lease and might also live in the unit.

- Background checks and financial screening: Both typically undergo financial screening, such as credit checks.

If you think about renting like a circus, a cosigner shares a tandem bike with a tenant as they ride across a highwire together. Meanwhile, a guarantor is the one keeping the safety net in place below.

Pro Tip:

No matter if you have one cosigner or four, it’s important to know who will be living on your property. Learn what questions to ask on a rental application to help protect your investment.

3: When Might a Landlord Require a Guarantor?

In general, landlords like to have guarantors when a rental applicant has insufficient or spotty rental, financial, or employment history.

According to insurance site Lemonade, there are several circumstances under which landlords might ask for this extra bit of insurance to help make sure the rent gets paid every month.

These include:

Poor Credit or Shaky Financial History

One of the most common reasons a landlord might require a guarantor is insufficient income. These are meant to just be general examples, as personal circumstances may vary. Some potential scenarios here could include:

- A tenant’s salary doesn’t meet the income-to-rent ratio

- They have credit report concerns, such as large amounts of debt

- They have no credit cards, have not borrowed money, or have an otherwise thin credit history

- They have a low credit score or ResidentScore®

- They are recovering from bankruptcy or foreclosure

Unstable Work History or Employment That’s Difficult to Confirm

Along with checking their record paying debts, it’s helpful to see what a potential tenant has coming in each month by verifying their income. After all, you need to know they make enough money to cover the rent.

Here are times when a landlord might ask for a guarantor based on a rental applicant’s employment situation. Again, these are meant to just be general examples. Personal circumstances vary.

- The tenant is a student, doesn’t work because they are in college, or are too young to have an extensive work history

- Recently started a new job and can’t provide several months of paystubs

- They have an irregular, part-time, or seasonal work

- They’re self-employed and cannot provide clear paystubs or other documentation showing their income

No Rental History or Underwhelming References

Along with financial concerns, landlords often want to know how a potential tenant has behaved in other rental situations. Here are some common example conditions when a person’s history might cause a landlord to want a guarantor on a lease:

- Lack of rental history, for example with first-time tenants

- Poor landlord references

- A history of rent non-payment or other issues

- A pattern of evictions due to money problems

These are meant to just be general examples. Personal circumstances vary.

Check Before You Require a Guarantor: Local Laws and Regulations

Do note that some states and cities have laws around when you are and are not allowed to require a guarantor for a lease.

Example: According to the NYC Commission on Human Rights, New York City residents who receive housing vouchers cannot be required to have a guarantor based on insufficient income.

Before you require tenants to have a guarantor, make sure you check to see what, if any, laws apply in your area. If you have questions about your process, contact qualified legal counsel.

4: Can Using Screening Reports to Help Determine if Someone Needs a Guarantor?

Running tenant screening is imperative to helping find good tenants and making confident leasing decisions.

Some screening, such as landlord reference checks, are often run by landlords manually. However, you can also simplify the process by getting professional screening reports from an established service like SmartMove. These reports can help you better assess whether or not your applicant needs a guarantor.

Here are the types of professional screening reports you can receive, their purposes, and what you can learn from each:

Financial Track Record: Are They Likely to Pay the Rent?

Looking into a rental applicant’s past can help you assess how they’ve managed past obligations and how likely they are to pay your rent.

First, learn how to run and read a credit report. Know how to spot red flags and how to check if someone is stretched too thin financially. You can also see if they have a healthy credit history and a habit of paying their debts on time.

Additionally, check out ResidentScore®, a proprietary, rental-specific calculation that helps predict evictions 15% better than a typical credit score alone.

Employment and Income: Do They Have Enough Money to Pay Rent?

In addition to good payment and financial habits, you also need to check if someone makes enough money to afford your lease.

For the most part, landlords verify a rental applicant’s work history manually. However, you can help save time in the process with a report that’s available only through SmartMove. Income Insights helps you confirm that an applicant’s income matches what they claim on the rental application.

If so, you may feel more comfortable that the applicant has the means to pay the rent. If not, you may ask for additional documentation––or even request they have a guarantor.

Past Evictions and Criminal History: How Have They Acted in the Past?

Knowing how someone has acted in past rental situations may help you predict how they may act in your property. An eviction history report helps you learn more about a potential tenant’s eviction track record.

Additionally, a criminal background check can help you see any relevant crimes that might be a threat to your property.

5: What are the Pros and Cons of Requiring a Guarantor?

In rental situations, having a guarantor might be a big benefit to landlords. According to rental payment site Rhino, some of the landlord benefits to having a guarantor include:

- Helping reduce risk: having a backup person to pay rent if the tenant defaults can help reduce the chance of rental non-payment.

- Increased peace of mind and security: The landlord has someone to fall back on, which helps increase confidence and financial security, especially in cases where there is insufficient history to predict outcomes (such as first-time renters)

- Encourages tenants to be responsible: Knowing they are financially obligated to not just a landlord but also their guarantor (often a family member), can help encourage tenants to act responsibly and pay on time.

On the other hand, here are some of the cons of requiring a guarantor, as a landlord:

- No guarantee the guarantor will pay: The whole point of having a guarantor is to help reduce the chance of you not receiving rent. However, even with a guarantor, there’s no guarantee either will pay. Then, if they don’t, you may be stuck trying to get payment from two different people.

- Increased administrative work: With a guarantor, you may need to do double the work for financial screening, communicating with both the tenant and guarantor, and keeping proper documents. However, the benefits a guarantor brings may be worth the effort.

As you can see, while requiring a guarantor does not remove all possibility of a negative outcome, it can be a potential solution when you’re not sure about a potential tenant.

Pro Tip:

Help reduce non-payment by making it easy for tenants to pay the rent. Switching to online rent payments can mean timely reminders, automatic payments, and much less administrative burden for both sides.

Help Determine If You Need a Guarantor with SmartMove Tenant Screening

Potential red flags on a rental application don’t necessarily mean you need to slam on the brakes. Get data about a potential tenant’s financial, eviction, and criminal history with fast, affordable tenant screening through SmartMove.

Will your tenant be just fine paying rent on their own, or would they be better off with a financial safety net? Background check reports help put you in the driver’s seat. With SmartMove, you can get:

- Credit reports, that let you see how rental applicants have managed financial obligations in the past.

- Income Insights, help confirm the applicant makes the salary information they claimed on their application. If not, you may want to get additional financial documentation or even a guarantor.

- Included in every SmartMove package, ResidentScore is a proprietary score designed for landlords and tenants, to help predict eviction risk 15% better than a typical credit score alone.

On top of financial screening, it’s important to help reduce potential threats to your property. Criminal records reports scour millions of criminal records searching for a potential match for your tenant. Meanwhile, identity verification helps confirm they are really who they say they are.

A previous eviction check helps you see if your rental applicant has any eviction-related proceedings on their record. This may help you decide if you want to require some additional insurance in the form of a guarantor.

Once your applicant enters their information, most reports are typically delivered the same day. Backed by major credit agency TransUnion, you get fast, flexible online reports built-on forty years of expertise.

Designed for independent landlords, there are no sign-up costs, subscriptions, minimums or hidden fees. Simply sign up and start screening immediately.

Don’t let financial fears bring your property business to a screeching halt. Get real data for the road ahead with fast, affordable tenant screening through SmartMove.

SmartMove

Great Reports. Great Convenience. Great Tenants.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.