Summary:

Over one-third of American housing is filled by renters. However, tenants don’t always know their rights when it comes to background screening. There are laws that dictate what information landlords can get about you and how they can make decisions with your background screening information. You have the right to our own copy of many consumer reports landlords use to make rental decisions. You also have the right to dispute any inaccurate report information with the screening company.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

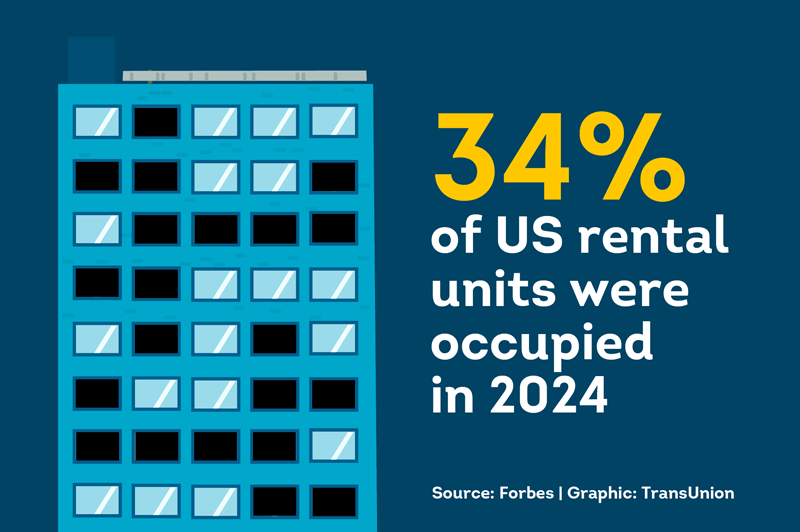

Do you live in a rented apartment or house? If so, you are one of the millions of Americans who may go through potentially stressful tenant experiences like rental applications and background checks every single year.

According to Forbes, out of all available units in the U.S., about 34% of units were occupied by renters in 2024. However, although over one-third of the housing market lives in rentals, many people are unaware of their rights as tenants––especially when it comes to background screening.

Before signing a rental agreement, most landlords conduct background checks. As part of this process, many use professional tenant screening companies, such as SmartMove®. Landlords often run these reports to obtain information that may help protect their property.

However, not every potential landlord always conducts these screenings properly––especially if they attempt to do it themselves. On top of that, the process can often appear mysterious or confusing to tenants.

Whether intentionally or not, landlords can make mistakes when it comes to background checks. Unfortunately, improper screening, mishandling of tenant data, and discriminatory decision-making may happen.

To further complicate matters, rental screening laws vary from state to state. In one example, the U.S. Department of Justice is even suing a St. Louis area apartment complex, alleging a violation of the Fair Housing Act by banning potential tenants with any past felony conviction.

This article is meant to help explain the basics of rental background checks from a tenant’s perspective: why they happen, how they can be used, and what rights you have as a tenant during background screening.

DISCLAIMER: Please be mindful that we do not intend this information to be complete or as legal advice (and you should not treat it as complete or legal advice). Before following any of the information, please consult your legal counsel for guidance based on federal, state and/or local laws, and to assist with any questions to determine how this information may be conducted or impact you.

Here’s what it includes:

Why Do Landlords Run Background Checks for Renting?

A lease or rental agreement is a legal contract between a landlord and tenant. Before entering a legal agreement, it makes sense that both sides want to vet the other party to increase the chances of a mutually respectful, stress-free experience. For landlords, this means screening potential tenants.

According to legal site NOLO, landlords can generally set whatever criteria they want for tenants, as long as it’s reasonable and doesn’t violate any laws. So, when landlords run background checks, the purpose is to see if the potential tenant matches their criteria.

Landlords might look into things like a potential tenant’s:

- Financial history and responsibility with money

- Criminal record and likelihood of posing a threat to the property

- Employment status and how they plan to pay rent

- Rental history, sometimes including past eviction reports and reference checks

- The number of people who might live in the rental

- If they have good communication and are generally responsible

- If they smoke or have pets

In short, landlords want to check out potential tenants to assess if they have the means to pay the rent, if they have been responsible tenants in the past, and if they pose a threat to the safety of the property.

Consider Interviewing Your Landlord, Too

A rental agreement is a two-way relationship. As your potential landlord vets you, it is also a good idea to check them out, too. You might ask them questions, read online reviews, or check into your potential landlord’s track record to assess things like:

- Promptness and quality of repairs

- If they have a history of returning security deposits

- Giving proper notice before entering or coming onsite

- Communication skills and respectful behavior

- Convenience of rental payment methods

- Pet policies

- Other qualities that make a great landlord

Knowing what to expect with your landlord ahead of time can help you make more confident decisions about where to live and who to trust with your personal information.

What Information and Reports Do Landlords Look At?

Landlords and property managers look for a variety of information before making decisions about potential tenants. In general, some of the things potential landlords property managers look for include:

Financial Screening

As it sounds, financial screening is a deep dive into a tenant’s relationship to and history with money. Essentially, landlords want to answer questions like:

- Does the tenant have enough income to pay for the rent among their other financial obligations? If so, how?

- Are they employed? Where? For how long?

- Does the tenant have a history of paying debts on time?

- Are they likely to pay the rent every month or not?

There are several ways landlords might assess a potential tenant’s financial records. Many do some form of employment history verification and/or ask for a tenant credit report.

Pro Tip:

SmartMove helps make it easier for landlords and tenants by simplifying the financial verification process. Income Insights helps identify if the income you claim on your rental application matches your salary.

Rental History Screening

This type of assessment looks at a tenant’s history with other rentals. Landlords often look at patterns and past situations to help try to predict how you might behave in their property. Often, landlords want to know:

- Does this person have a history of property destruction?

- Has this person been evicted several times due to rental nonpayment?

- Is this person a responsible, communicative tenant?

- Will this person notify me if there is a maintenance problem?

- Will this person be a respectful neighbor?

Two of the ways landlords assess rental history are eviction history reports and previous landlord reference checks.

Criminal History and Identity Checks

When landlords screen potential tenants, they often want to check for potential red flags.

Typically, landlords screen prospective tenants with the following questions in mind:

- Does this person have a relevant criminal history that could pose a threat to the property?

- Is the tenant on any watchlists, such as the FBI’s Most Wanted, National Sex Offender Registry, Department of Homeland Security, or Drug Enforcement Agency?

- Is this applicant really who they say they are? Or, could they be a scammer or attempting identity theft?

To help discover potential threats, it’s common for landlords to run criminal background checks and other reports like identity checks.

Landlords often gather and analyze all of the data mentioned above to help them make more informed leasing decisions. That said, it is important to note that, in some locations, landlords are not allowed to get certain reports or make decisions based on some of the information contained in the reports.

As a tenant, it’s important to know your rights, especially when it comes to local regulations in your state or city. Learning more about what’s allowed and what’s not allowed can help protect your rights and personal data.

What are Potential Landlords Allowed to Ask You?

Although landlords want as much information about tenants as possible, they are not always entitled to bottomless personal data. The exact data and information landlords may use to make a rental decision can vary by location.

To learn more about specific rental and housing laws in your area, check out your local branch of the U.S. Department of Housing and Urban Development (HUD).

Is a Rental Background Check Legal?

Are tenant background checks legal? A very short and incomplete answer is: “Generally, yes.” According to the Federal Trade Commission (FTC), “a landlord may ask a tenant background check company — also called a tenant screening company — to put together a report about you and other members of your household” before you move into a new place.

However, a more complete answer is: it depends what you mean by “background check” and it depends where you live. First, the term “background check” can include a variety of reports and information about potential tenants.

To help protect your rights, it’s important to look up laws in your area.

Note: Not all SmartMove reports are available in all states and cities.

Do Landlord Credit Reports Hurt My Credit?

Credit reports are another area that can get fuzzy. The short answer is: it depends.

According to Credit Karma, there are two ways for someone to get your credit report: a “hard inquiry” or a “soft inquiry.”

1.Hard Inquiry

Also called a "hard pull", these are typically used by financial institutions to learn about your credit when you do things like apply for a loan. You typically don't give explicit permission for hard checks and they can lower your credit score by a few points.

2.Soft Inquiry

Also called a "soft pull" or "push", this method is typically used by background check companies to find out information about you. Here, you typically give direct consent to a company to check your credit. Generally, soft inquiries have no impact on your credit score.

Conducting online tenant credit screening through services like SmartMove, results in a “soft inquiry” or “soft pull”.

Your Rights as a Tenant During a Rental Background Check

There are several laws that protect a person’s personal data. When it comes to tenant background checks, one of the most common laws to encounter is the Fair Credit Reporting Act (FCRA).

Among other things, FCRA laws say who can access your personal information, for what purposes, and what they see on reports about you.

As a tenant, you have several rights during a tenant background check. According to the FTC, if a landlord decides not to rent to you or takes other negative actions based on information in your background screening report, they are required to provide an adverse action notice that, in summary:

- Provides the name and contact information from the company providing the report

- Includes a statement that the CRA that supplied the report did not make the decision to take the unfavorable action and can't give specific reasons for it.

- Explains you have a right to dispute any inaccurate information with the reporting agency

Additionally, the local laws in your area may grant you additional rights on top of these federal mandates

Pro Tip:

If you do find errors on reports, the FCRA provides guidance on how to dispute errors on tenant background checks.

How to Get a Copy of Your Background Check Report

According to the FTC, you are entitled to a copy of the credit report, from the three nationwide credit bureaus — Equifax, Experian, and TransUnion.

There are 2 other ways to obtain copies of background screening reports:

- Use a screening service that automatically includes report copies for all parties. SmartMove, for example, provides most reports to both you and your potential landlord. This helps you access your report to help you determine whether to dispute any inaccurate information with the reporting company. Other background check services may only provide a report copy to your landlord.

- Ask your landlord to send you a copy. If your landlord uses a service that doesn’t automatically send you a copy of your background check, you will have to ask them for a copy. While landlords are required to give you a copy, waiting for them to send it to you could take some time, especially if they send a paper copy through snail mail.

What Should I Do if My Landlord Rejects My Rental Application?

According to the NOLO article mentioned earlier, there are several reasons why landlords may reject tenants, such as:

- Insufficient income

- Poor credit

- A relevant criminal or eviction history (when allowed by your state)

- Poor references

- Occupant limit (for example, six people in a space with a septic system that can only handle two people)

- If you’re a smoker

- If you have pets

- Other reasons that are not part of a protected class

In these cases, NOLO advises there’s not much you can do besides trying to talk to and negotiate with the landlord to see if they’re willing to reconsider. Of course, always consult qualified legal counsel if you have any specific questions or concerns.

There are reasons for rejecting a rental application that may be unlawful. Unlawful reasons to reject a potential tenant include:

- Fair Housing Act violations: According to the Fair Housing Act, it’s unlawful to discriminate against tenants based on race, color, national origin, religion, sex (including sexual orientation and gender identity), family status, or disability.

- Local Laws about consumer reports: Some states have laws in place that prohibit or limit the use of screening reports like eviction or criminal history.

The Consumer Financial Protection Bureau advises what to do if your rental application is rejected based on information in a consumer report, such as a credit report.

Further, if you believe you were a victim of housing discrimination, HUD provides instructions on action you can take, including how to file a complaint.

Help Protect Your Rights with SmartMove Screening

For tenants, rental background checks can feel like taking an exam where you don’t get to see the questions. However, it doesn’t have to be that way. Help illuminate the screening process and promote transparency with SmartMove.

When using SmartMove, your completed background checks can then be found in your SmartMove dashboard for a limited time.

While you don’t always get a say in how your landlord conducts business, you can still be an advocate for your own private information. Here are a few ways you can help protect your rights as a tenant when it comes to rental background checks:

- When it comes time for rental background checks, ask your landlord about the background screening service they use and how they protect your personal information.

- Learn about the proper use of criminal record reports, previous eviction checks, and other background screening data in your area––and check that your landlord uses this information accordingly.

- Confirm your landlord runs a “soft inquiry” for a credit report, which doesn’t hurt your credit score.

- If your rental application gets rejected based on the results of your screening report, follow the FTC Guidance to get a copy of your report, check it for errors, and correct any inaccuracies.

- Encourage your landlord to use a reputable screening service that has helpful built-in, such as providing you with access to a copy of your report, like SmartMove

- If you do believe you’ve been discriminated against, know what to do and where to get help. The U.S. Department of Housing and Urban Development provides guidance for this and similar issues.

With SmartMove, you have access to the same reports your potential landlord sees. You can review your reports to check for any potential inaccuracies.

All reports are backed by TransUnion, a major credit agency with over four decades of data expertise. This means data quality that’s better optimized for different states and locations.

Rental background checks don’t have to leave you in the dark. By learning more about your rights and encouraging your landlord to use professional screening methods, you can help set yourself up for better rental success.

SmartMove

Great Reports. Great Convenience. Great Tenants.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.