Summary:

In rental situations, an identity check is a report that helps confirm a rental applicant is really who they say they are. Verifying a prospective tenant’s identity compares their self-supplied personal data to TransUnion data to help determine if they match. Running this kind of identity report may help you spot false positives, help mitigate becoming a victim of rental fraud, and may even help you prevent potential lawsuits.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

A car may look incredible at the dealership, but most buyers like to check under the hood to make sure they’re not buying a lemon. Similarly, identity verification can help you confirm your tenant is actually who they say they are before signing a contract.

And, with all the potential hazards on the long road of independent property management, it’s becoming even more important to confirm your rental applicant’s identity.

Landlords all over the country use services like SmartMove® to run fast online tenant screening and learn about rental applicants. However, not all understand the benefits of including an identity check within these reports.

According to a 2024 SmartMove® survey, the number one fear of landlords is payment problems, such as paying late or not even paying rent at all. And this makes sense; to make money as a landlord, you have to select tenants that will pay the rent in full, on time, and every month.

But, what if the financial reports you’re using to make your decision don’t actually belong to your potential tenant? According to the Federal Trade Commission, Americans lost over $10 billion to identity fraud in 2023. Imposter scams, such as when someone pretends to be someone else, accounted for $2.7 billion of these losses.

How would your rental business fair if caught up in a rental scam or housing discrimination lawsuit due to risky tenant screening?

This article explores identity verification for tenants: what it is, what these reports include, how to get an identity check for potential tenants, and some of the benefits of verifying your rental applicant is who they say they are.

Here’s what it includes:

What is Identity Verification?

An identity check, also called “identity verification” is a report offered by SmartMove® that may help confirm a person is actually who they say they are. Verifying someone’s identity is an important step in the tenant screening process for many reasons.

What Identity Verification Reports Include

The term “identity verification” can potentially mean different things to different people and companies. With SmartMove®, an “identity check” is a specific screening report that checks a tenant’s self-reported personal information against TransUnion data.

This type of screening can provide some extra peace of mind that your rental applicant is actually who they say they are. Specifically, at SmartMove®, an identity check looks at:

- Deceased person alerts:Is the Social Security Number, name and birthday, or other data associated with someone who is listed as deceased? If so, it could be an indicator of identity fraud.

- Social Security Number Check: Does the SSN the rental applicant supplied match TransUnion data for the name and birthday provided?

- Address check:This helps verify the current and previous addresses are consistent with what’s on file.

- Name check: Does the legal name provided by the prospective tenant match the birthday and SSN on record with TransUnion? This report may help you find out.

- Date of Birth: This verification helps confirm the applicant’s DOB matches the SSN and other data. It can be especially helpful if the applicant has a common name.

Having this extra check while reviewing potential tenants may help you make more confident leasing decisions.

How to Run an Identity Check on a Tenant

With SmartMove®, getting an identity check report is simple and easy. In most cases, you can get results on the same day––often just minutes after your rental applicant completes the ID verification.

Trusted by over 600,000 property owners and over 4.4 million tenants, SmartMove® tenant screening is fast and easy to use. Here’s how to conduct quick, online identity checks on rental applicants:

- Create a Free Account or Login into Your SmartMove® Account

- Invite Your Applicant to Screen

- Applicant Receives Email Invitation and Authenticates Their Identity.

- You receive a report showing if everything matches, as well as potential fraud alerts

What an Identity Check Report Looks Like and How to Read It

The end result of an identity check with SmartMove® is a report that contains two main sections. In most cases, here’s what may see:

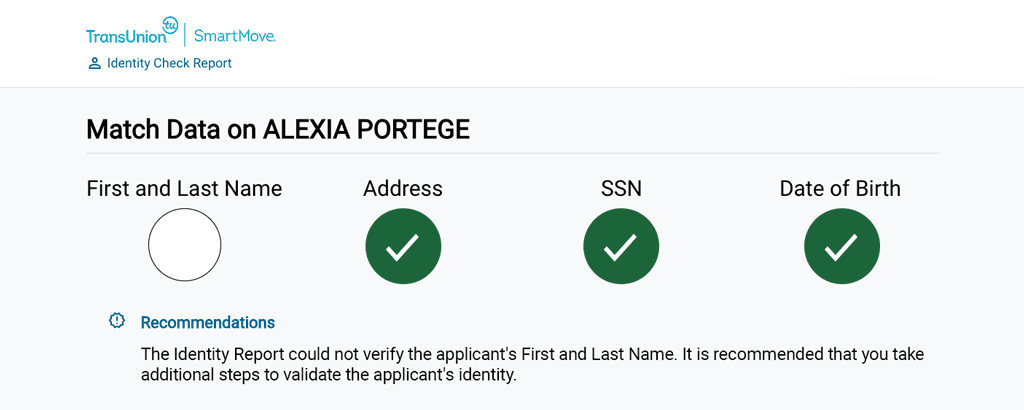

Section 1: Verification Summary & Recommendations

At the top of the report, you’ll see a summary of each completed check and the result. In cases where the rental applicant’s data matches TransUnion data, you will see a green checkmark.

Then, underneath, you may see suggested recommendations about what to do next based on the result of the check. For example, in the report above, you can see the identity check could not verify a match with the candidate’s first and last name.

This doesn’t mean something is fishy. The lack of verification could occur for a variety of reasons. However, as you can see, the suggested recommendation is that a landlord should take additional steps to validate the applicant’s identity.

Pro Tip:

In addition to checking someone’s identity, it’s essential to confirm potential tenants can actually pay the rent. Learn how to get better proof of income from rental applicants.

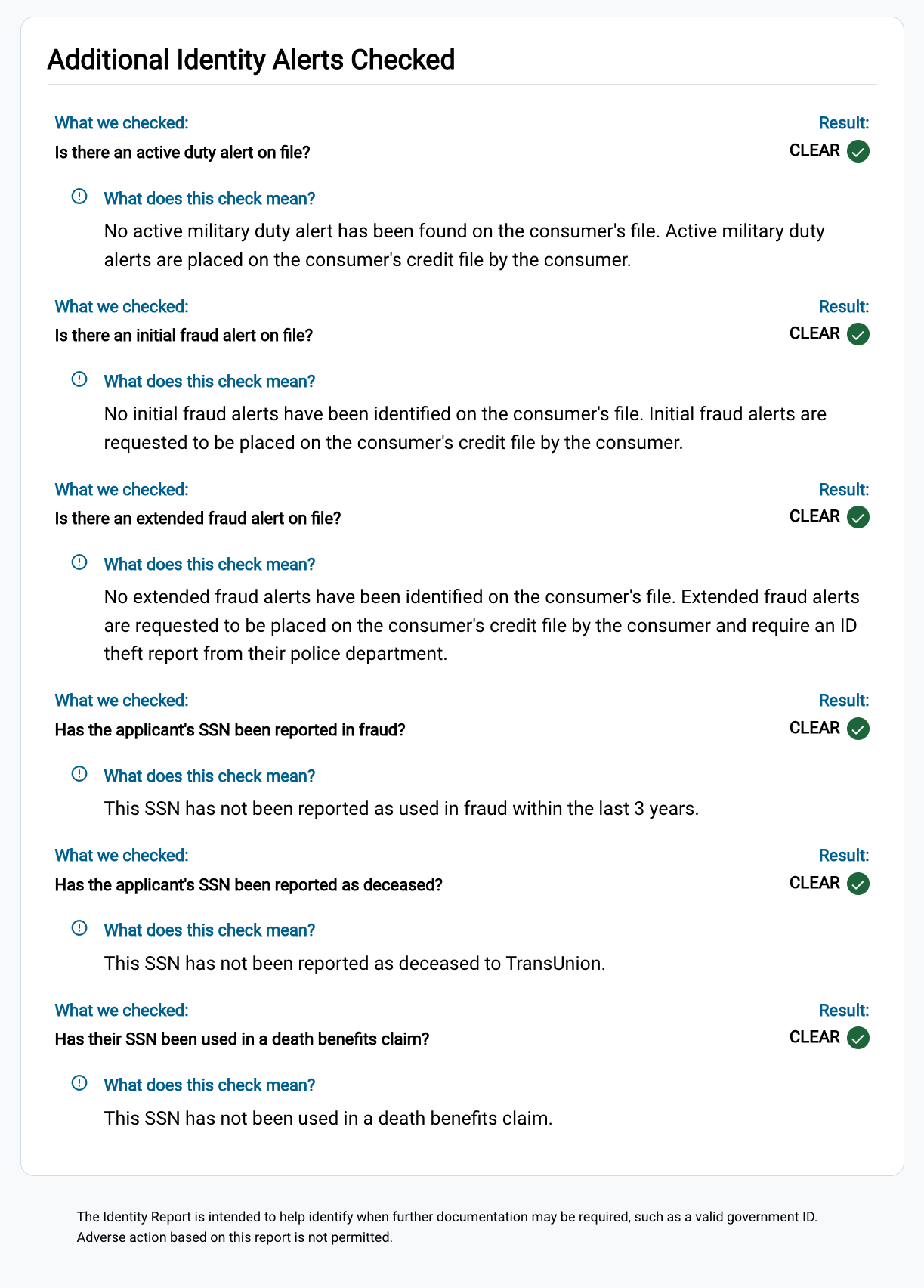

Section 2: Results of Checks for Fraud and Other Alerts

The bottom section of a SmartMove® identity check lists each kind of alert your rental applicant’s data was checked against and the result of each search.

Each listed alert includes:

- The name of the alert

- An explanation of what was searched and what it means

- The result of the check

Here’s what it may look like:

As you can imagine, knowing this additional identity information about potential tenants may help you make more informed leasing decisions and help prevent harmful rental outcomes.

Why Helping Verify Your Tenant’s Identity is Important

Now that you know a bit about what an identity check is, it’s helpful to understand why you might want one. There are several reasons to confirm your rental applicant is actually who they say they are.

In the shortest terms: it’s about helping protect yourself from potential disaster.

Here are three reasons to get an identity check for tenants:

1: Help Avoid Identity Fraud in Rental Scams

As an independent landlord, the last thing you need is a fraudster wiping out your hard-earned profits. The sad reality is that you must be vigilant to help protect yourself against people who see your property business as a target––and that means checking that your rental applicant is actually who they say they are.

In fact, one possible rental scam include potential tenants providing false documentation, such as fake credit reports, altered criminal records, or even completely made up verification of employment.

It makes sense that scammers who use fake or edited documents are trying to hide something––something you’re not going to like. Fake documents could include things like:

- A fudged criminal background check that omits relevant crimes.

- A falsified credit report that looks like the real thing, but leaves out any negative information.

- A fake past eviction report.

On top of that, research from data security firm SentiLink shows that people who commit synthetic fraud––when they completely make up an identity––are more likely to use common names. So, if you have a prospective tenant named “Joe Williams”, for example, an identity check may be extra important.

Sometimes, fake documents are laughably bad. It may be easy to spot spoofs and other potential tenant warning signs. However, other falsified reports may be expertly done and look incredibly convincing.

Pro Tip:

Rather than trusting any reports a tenant provides, get background checks directly from a reputable tenant screening service like SmartMove®.

2: Verify Your Rental Applicant is Actually Who They Say They Are

Even if there’s no reason to suspect foul play, it’s also essential to confirm the report and data you’re reviewing actually belongs to your rental applicant and not someone else.

According to law firm Lyngklip and Associates, it is not uncommon for consumer reports like credit records to include data from other people. These so-called “mixed reports” include data from one or more consumers.

According to the article, the most common reasons for these mix-ups are because both parties have:

- Similar names and birthdays

- Similar Social Security Numbers

- Family ties

So, if you happen to receive a report with data from the wrong “John Smith” or “Elizabeth Jones”, a few different things may happen:

- You might get records with the glowing credit history, instead of the one with a long list of debt and habit of not paying rent or bills on time

- You might get reports that incorrectly include shocking financial records and a less-than-ideal credit score that belongs to a different individual with a similar name.

Either way, the information could lead you to make a decision based on potentially inaccurate data. If you unknowingly choose a destructive or ill-fitting tenant, you may have to eventually evict them.

Eviction is often a landlord’s worst nightmare. This is because, according to money site SmartAsset, an eviction can cost you between $1,000 and more than $5,000 depending on a number of factors.

Without knowing the whole picture, you could have a property business catastrophe on your hands. And, if you end up not choosing someone because of information in their report , it may land you in legal hot water.

Pro Tip:

Always get tenant screening reports through a service like SmartMove®. All reports are backed by TransUnion, a major credit agency with over four decades of data expertise.

Help Protect Yourself from Identity Scams with SmartMove Tenant Screening

When choosing a tenant, as with buying a car, there’s too much at risk to skip a proper assessment. And, when it comes to renting out property, part of your 30-point inspection should include an identity check through a fast, online tenant screening service like SmartMove®.

To make money as a landlord, it’s necessary to verify your tenant can actually afford the rent. Take a deep dive into a potential tenant’s history with:

- Tenant credit check: learn about your rental applicant’s financial habits, including whether or not they regularly meet their financial obligations.

- ResidentScore®: included in every SmartMove® screening package, this proprietary, rental-specific score helps predict eviction risk 15% better than a typical credit score.

- Income Insights: exclusive to SmartMove®, this report helps verify your rental applicant makes the salary they claim on the rental application.

A criminal background check scours hundreds of millions of criminal records. Meanwhile, a past eviction check looks for previous eviction-related proceedings that potentially match your applicant.

These reports may help you make better decisions. An identity check may help you verify the self-supplied data matches TransUnion data or if you should request additional documentation.

When it comes to choosing tenants quality data is paramount. Trusted by over 600,000 property owners and over 4.4 million tenants, each SmartMove® report is backed by TransUnion, a credit agency with over forty years of data expertise.

Plus, SmartMove® screening reports were developed specifically for independent landlords with only occasional screening needs. That means you can get only the reports you need and only when you need them. There are no sign-up costs, subscriptions, minimums, or hidden fees. Simply sign up and start screening immediately.

Don’t let the flat tire of ill-fitting tenants leave your property business stranded. Zoom through the road ahead with quick, reputable tenant screening with SmartMove®.

SmartMove®

Great Reports. Great Convenience. Great Insights.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.