Summary:

While similar, there is a difference between a lease and a rental agreement. Leases are typically long-term, lasting for a standard period––usually six months or a year. On the other hand, rental agreements are designed for short-term stays, such as month-to-month rentals, vacation rentals, or other temporary arrangements.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

The difference between a lease and a rental agreement is like the difference between a Phillips and flat-head screwdriver. While both have the same general purpose, you use them in slightly different circumstances.

According to the U.S. Census Bureau, about 65% of Americans own their own home. This leaves about one-third of American adults as possible tenants. In some rental scenarios, you’re likely to come across someone who wants a rental agreement instead of a lease.

This article covers the differences between a lease and a rental agreement, the circumstances when you might use one over the other, and pros and cons for both.

Here’s what it includes:

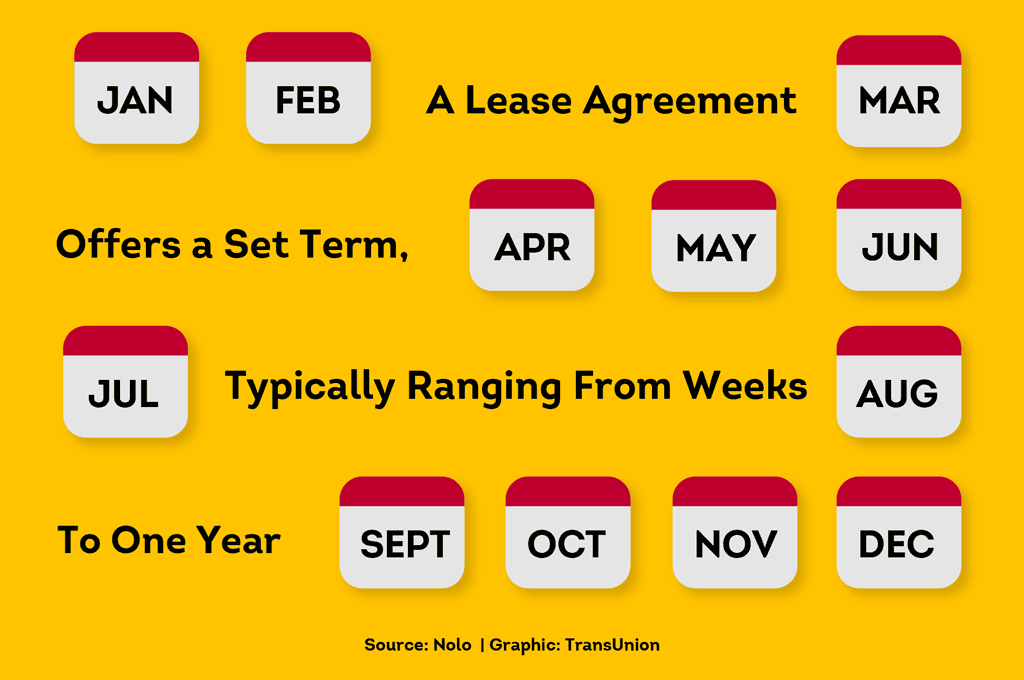

What is a Lease Agreement?

Often, the terms “lease agreement” and “rental agreement” are used interchangeably to mean the same thing.In reality, there is one major difference between the two. Knowing how leases and rental agreements work can help you manage your property more strategically.

First up: Leases.

According to legal site Nolo, a lease is a contract between a tenant and landlord that gives a tenant the right to live in a property for a fixed period of time, typically covering a 6 or 12-month rental period.

Residential leases are tenant contracts that define in clear, thorough terms the expectations between the landlord and tenant. According to Belkin Burden Goldman, LLP Common lease terms include things like:

- The rental rate

- Start and end date of the tenancy

- Maintenance and repair expectations

A strong, well thought out, and well-worded lease can help ensure best interests on both sides. If you want to alter the agreement, you may need without written consent from the other — check with your legal counsel.

Pro Tip:

Typically, changes to a lease require the agreement of both sides. However, there are a few different situations when a lease can be broken.

What is a Rental Agreement?

Rental agreements are very similar to lease agreements. According to the same Nolo article linked above, the biggest difference between a lease and rental a agreement is the length of the contract term.

Unlike a long-term lease, a rental agreement provides tenancy for a shorter period of time—usually 30 days.

Some rental agreements may be “month-to-month,” and automatically renew at the end of each month, unless changed by the tenant or landlord — check your documents’ wording for more clarity.

These short-term leases can be much more flexible than long-term leases.

Some landlords might use these shorter-term rental agreements for things like:

- Vacation rentals

- Additional month or two after a longer-term lease ends

- Getting a temporary tenant or subletter to fill in the gaps between longer-term tenants to help reduce vacancy

- They just prefer it

Pro Tip:

A rental agreement doesn’t always have to apply to an entire apartment or property. Learn about renting out a room in your home for additional income.

Typical Terms in Leases and Rental Agreements

Both lease and rental agreements may vary in terms of structure and flexibility. For instance, some contracts may include a smoking policy. Others might include an additional addendum regarding rules or regulations, such as excessive noise.

According to NOLO, common rental agreement and lease document terms may include things like:

- How long the tenant will live at the property

- How much the tenant must pay in rent and deposits

- How many people are allowed to live in the rental unit

- Which utilities the tenant is responsible for

- Whether pets are allowed

- Whether the tenant can sublease the unit

- When and how the landlord can enter the property

- Who covers legal fees if there’s a dispute about the lease or rental terms.

According to rental insurance company Steadily, landlords may need to include certain disclosures on their lease or rental agreements:

- Mold

- If there are any registered sex offenders in the area

- If there’s a history of bed bugs, or methamphetamine production on the property

When drafting your lease or rental agreement, always be sure to comply with your local, state, and federal laws and consult qualified legal counsel, if needed.

Lease Agreement vs. Rental Agreement: Pros and Cons

Consider the landlord-tenant relationship you’re looking for when evaluation the pros and cons of leases and rental agreements.

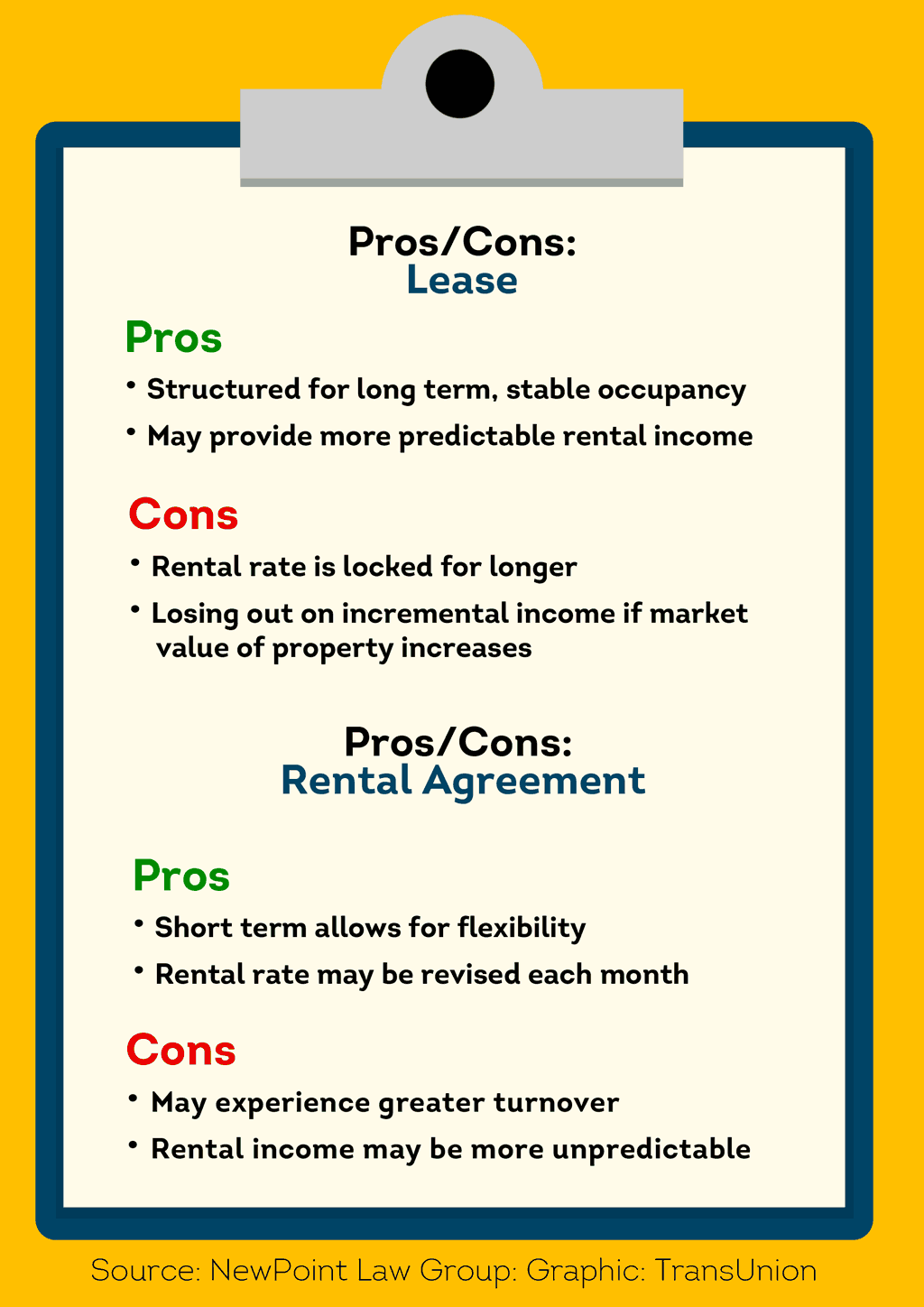

Here are some of the pros and cons of a lease from NewPoint Law Group:

Pros of a Lease:

If stability is your main priority, a lease may be the right option. Many landlords prefer leases to rental agreements because they feel they:

- Are structured for stable, long-term occupancy

- May offer a more predictable rental stream

- Are generally more hands-off

- Save time by reducing the frequency with which you need to post rental ads, communicate with potential residents, screen tenants, and more

- Cut down on turnover costs

Cons of a Lease:

That said, once a lease agreement is signed, the rental cost is considered set in stone until the end of the agreement. In an up-and-coming area with consistently growing property values, 12 months of a fixed rental cost could mean you miss out on substantial income from market increases.

According to the U.S. Census Bureau, 2023 brought the largest annual increase in rental costs since at least 2011. With a year-long lease, you would collect the same amount per month all year long. But, with a month-to-month lease, you would have more flexibility to reflect market changes––as long as you’re willing to work for it.

Next up: the pros and cons of a rental agreement.

Pros of a Rental Agreement:

By nature, rental agreements are short term. This means they are much more flexible when it comes to rent increases. Technically speaking, rent may be revised each month with a rental agreement to stay in-line with the current fair market rent — as long as rent increases comply with local law and the notice provisions that govern the month-to-month rental.

According to management site iProperty, some states have rent control laws that dictate how much and how often you can increase rent.

Disclaimer: Please be mindful that we do not intend this information to be complete or as legal advice (and you should not treat it as complete or legal advice). Before following any of the information, please consult your legal counsel for guidance based on federal, state and/or local laws, and to assist with any questions to determine how this information may be conducted or impact you.

Some other considerations for rental agreements:

- May attract a larger pool of tenants, including people who can’t commit to a longer lease due to jobs, school, or other future plans

- More flexibility with getting ill-fitting tenants out of your property sooner

- If you live next to a major hospital or university, you might pursue institutional contracts for traveling nurses or visiting professors

Cons of a Rental Agreement:

On the other hand, a tenant looking for a long-term lease may be scared away by the flexibility of a month-to-month lease. They may not want to risk frequent rent raises or indeterminate rental periods.

Plus, if your rental is located in an area with lower occupancy rates, you may have trouble keeping your unit rented for long periods of time.

Finally, the costs of more frequent tenant turnover should also be kept in mind. This includes strains on both your money and time, including:

- Advertising

- Hiring a management company if you don’t want to do it all yourself

- Cleaning costs

- Time for interviews, review, communication, tours

- High-quality screening

With short-term agreements, there may be a temptation to go lax on background checks. Thankfully, with SmartMove, you can get fast, reputable online background checks without wasting any time waiting around.

Bottom line on rental agreements: A rental agreement may be a good option if you want to prioritize profit, you are in an area with high-rental demand or a high transient population, you use fast, online tenants screening, and you have the time to put in the extra work.

Pro Tip:

Don’t skimp on running background checks on even short-term tenants. Learn how risky screening can ruin your rental business and help protect yourself.

Help Protect Your Property with SmartMove Tenant Screenings

A major part of a landlord’s task is finding the right tool for the job. No matter what contract type you choose, reduce your chances of potentially disastrous rental outcomes with fast, affordable tenant screening through SmartMove.

Regardless if someone is staying for a year or just a month, they can still damage your property. Thankfully, digging into a rental applicant’s past behavior can may help you prevent from selecting an ill-fitting tentant.

A criminal background check scours millions of federal and state-level crime records , in search of a potential match to your rental applicant. Meanwhile, an identity check helps confirm your potential tenant is actually who they say they are.

A previous eviction check helps you determine if they had possible eviction-related proceedings in their past.

Then even if someone is staying only for a few weeks, you still need to confirm they can pay the rent in full and on time. SmartMove offers several tools to help you analyze your rental applicant’s finances, including:

- Credit report: review your prospective tenant’s financial history to help understand if they have a history of meeting their financial obligations

- Income Insights: verify your rental applicant actual makes the salary they claim on your rental application––exclusive to SmartMove

- ResidentScore®: based on thousands of real-world rental outcomes, this propriety calculation helps landlords predict eviction risks 15% better than a traditional credit score alone.

Plus, screening doesn’t have to take ages or bog down your process. SmartMove reports are typically delivered after your applicants submits their personal information. Designed specifically for independent landlords, there are no sign-up costs, subscriptions, minimums or hidden fees. Simply sign up and start screening immediately.

Whether you choose a lease or rental agreement, get the right screening tool for the job with fast, flexible tenant background checks through SmartMove.

SmartMove

Great Reports. Great Convenience. Great Tenants.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.