Summary:

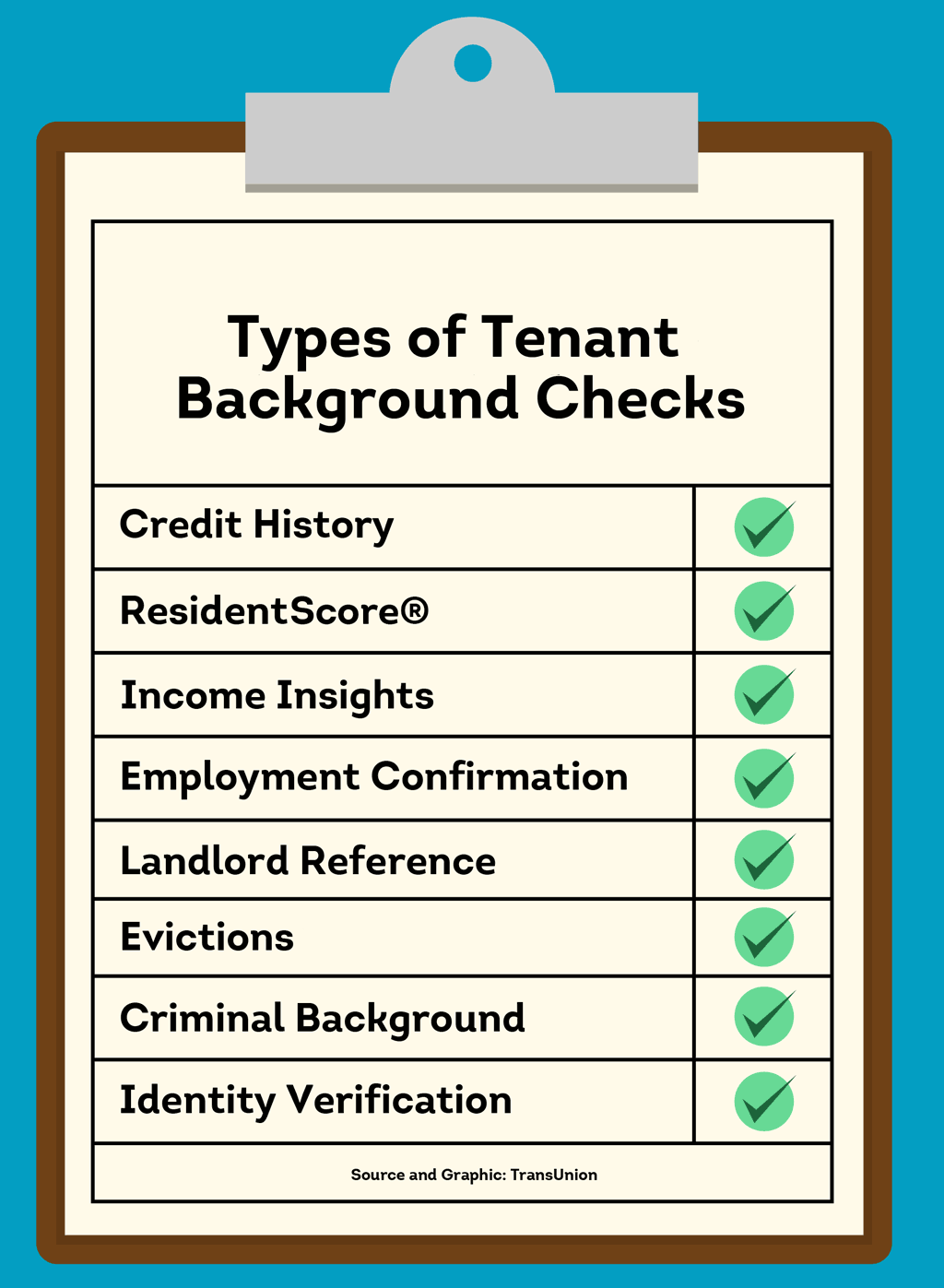

When choosing your next rental residents, it’s essential to screen them to help protect yourself and reduce potentially disastrous outcomes. The most common kinds of tenant background checks include: eviction, criminal background check, landlord reference checks, credit checks, Income Insights, ResidentScore®, and identity verification. This kind of screening may help weed out ill-fitting candidates.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

When judging a diamond, a jeweler examines the gem from every angle to check if it really is flawless––or if it’s just an impressive fake. The same goes for tenant background checks.

Often grouped under one term, “tenant screening” actually includes a variety of different checks, reports, and processes to help ensure the person you want to place in your unit is a 14-carat tenant––and not just full of hidden flaws.

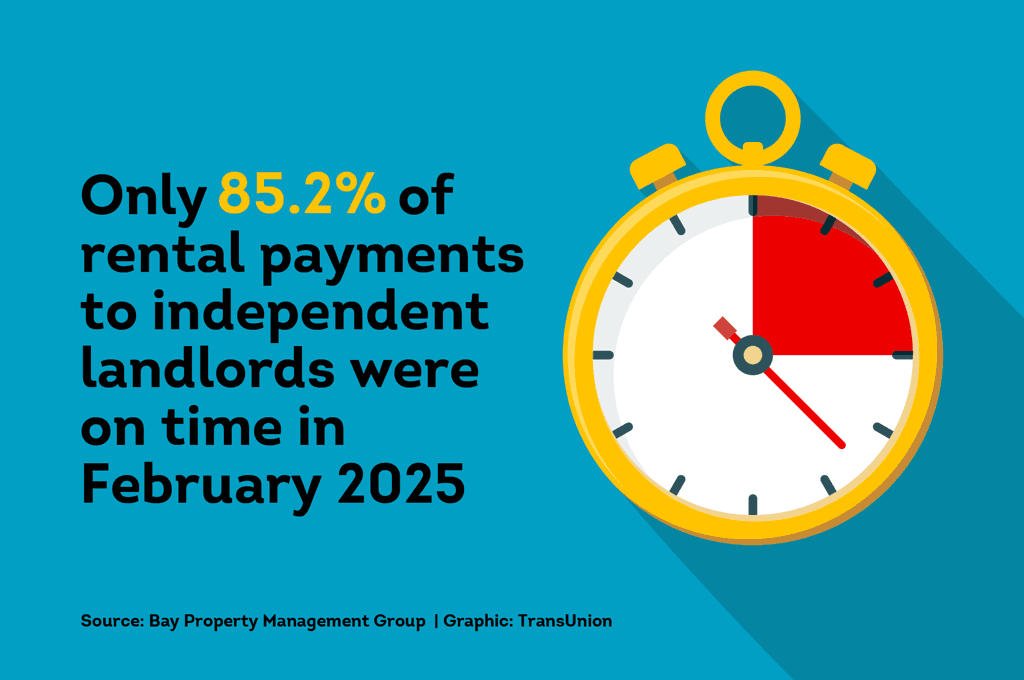

And there’s good reason to be cautious––especially for independent landlords who lack the resources of property management corporations. According to data from real estate advisor firm Chandan Economics, across the U.S., only 85.2% of rental payments to independent landlords were on time in February 2025. This is part of a downward trend that has continued since April 2023.

How would your rental business fare with only getting paid 85% of the time?

On top of that, given the time and cost it takes to evict tenants, it’s absolutely imperative to try to place great tenants from the start. Part of that task means tenant background checks through a reputable service like SmartMove®.

This article covers the most common types of tenant background checks, why and how to run them, what’s involved and other rental screening tips for independent landlords

What is a Tenant Background Check?

Tenant background checks go by many names. Some of these include:

- Rental background check

- Renter screening

- Tenant screening

- Lease applicant screening

- Rental qualification check

- Landlord verification

The list goes on and on. But, no matter what a property manager calls it, these so-called tenant background checks all refer to the same thing:

- A tenant background check is a system of reviewing information that’s used by landlords to evaluate and verify a person's background, financial qualifications, or rental history before making a leasing decision.

According to the Consumer Financial Protection Bureau, a tenant background check includes a mix of documents and data from different sources. Most commonly, landlords might review items like:

- Information received directly from a potential tenant on a rental application. This could include previous addresses and landlord contact information, income and work details, and the names of anyone applying to live in the unit.

- Documents provided by the rental applicant, such as pay stubs, employment confirmation letters, or tax returns.

- Reports from a background check service. These might include things like credit reports, criminal background checks, identity verification, and more.

While it’s fine to receive some documents directly from tenants, it’s unwise to rely solely on applicant-provided information to help make your decision. The third category––reports from a background check company––is one of the essential parts of a rental background check.

Pro Tip:

These days, it’s common for someone to live with a romantic partner, family member, friend, or roommate––especially in areas with higher rental costs. Learn how to screen multiple people for your unit to help better protect yourself against unauthorized tenants.

Why Run Tenant Background Checks?

There are several reasons for getting the skinny on a potential tenant before signing a lease or rental agreement. These may include:

1. Confirm your applicant’s income

According to a 2024 SmartMove user survey, “payment problems” ranked as the top concern of landlords. This includes both late payments and tenants not paying rent at all.

This fear is not surprising, considering the significant financial and time cost of an eviction.

In order to make money as a landlord (and help avoid scenarios where you may have to evict a tenant for nonpayment), you need to get paid on time, in full, and every month. Financial screening helps confirm the potential applicant’s income.

2. Check if your applicant has a history of paying debts timely

Just because someone has a sufficient income, doesn’t mean they are responsible with money. In addition to confirming your potential tenant makes enough money, it’s also wise to check if they have a history of paying their debts on time.

Things like a tenant credit check can help show your tenant’s financial track record. Knowing how they’ve handled past financial obligations might help you predict how they might approach your monthly rental payment.

3. Help protect your property

As an independent landlord, the last thing you want to deal with is a tenant who may destroy your property or you may have to evict.

Tenant background screening can help you get a better picture of how your rental applicant has behaved in the past.

You can learn more by checking for things like:

- Relevant criminal history

- Eviction-related proceedings

- What previous landlords have to say about them

All of this can help give you a better picture of how a rental applicant might act in your property.

4. Confirm your potential tenant is actually who they say they are

Finally, tenant screening can help you make sure your rental applicant is actually who they say they are. Why is this important? For one, using fake documents, such as falsified work verification, is one rental scam landlords encounter.

Outside of fraudulent activities, identity verification may help you confirm that the reports and documents you’re looking at belong to the potential tenant in front of you––and not someone with a similar name or Social Security Number.

Pro Tip:

Even if your tenant is wonderful, unfortunate accidents can still happen. This is why you may want to consider requiring renter’s insurance for all tenants.

What do Tenant Background Checks Include?

Tenant background checks can include a variety of data about a potential tenant’s financial, personal, employment, and rental background. The exact reports and data can vary slightly depending on the landlord. However, most rental screening includes similar reports and reviews.

Below, you’ll find common types of tenant background checks. To make it easier to read, they’ve been separated into three categories––Financial, Rental, and Personal background checks.

Financial Screening

In tenant background checks, “financial screening” refers to a set of reviews of financial documents, reports, and other information that helps you determine:

- Your rental applicant’s income, and

- Your rental applicant’s past financial behavior

Here are three common types of financial tenant background checks:

1. Tenant Credit Check

A credit check for tenants dives into your rental applicant’s financial habits to help better understand their relationship with money.

What can landlords learn from tenant credit checks?

There are several reasons to use credit reports while making rental decisions. For example, credit reports may help you:

- Spot potential credit check concerns

- See if the prospective tenant has a history of paying debts on time

- Assess how responsible they are with money

- Predict the likelihood they’ll pay rent based on previous behavior

On top of a credit report, with every SmartMove screening package, you also get a proprietary ResidentScore®. Check below to learn more about this helpful calculation.

Pro Tip:

A tenant’s credit background isn’t the only bottom line you need to worry about when renting out property; you also need to watch out for your own finances. For example, one way to possibly hold on to more of your money is through rental depreciation.

2. ResidentScore

Traditionally, many landlords have used credit scores in their tenant evaluations. However, this can be a bit tricky for a few reasons.

The purpose of a traditional credit score is to help assess risk in money lending situations, such as for car or home loans. Because it was not necessarily meant for leasing situations, a traditional credit score isn’t always the best predictor of rental outcomes.

Enter ResidentScore. ResidentScore is a proprietary calculation specifically designed for landlords and tenants.

According to SmartMove research, the benefits of a ResidentScore over a traditional credit score include:

- ResidentScore helps predict potential eviction risk 15% more than a traditional credit score

- Built specifically to help identify the potential risk of eviction

Even better, this proprietary scoring system is included in every SmartMove screening package.

3. Income Insights

To further simplify the process of assessing tenant finances, consider getting Income Insights. Available only through SmartMove, Income Insights helps confirm your rental applicant actually makes the salary they claim on the rental application.

Why would you want this report? It may help make your review process faster and simpler. Here’s how:

- Your applicant completes your rental application, writes down the income they receive, and hands you a stack of supporting documentation––pay slips, tax returns, employer letters, the works.

- You try to go through all of the documents, but you’re a busy independent landlord and it takes a lot of time to check the validity of each piece of paper and verify all the information is correct.

- Instead of manually checking, you get Income Insights. The report checks your rental applicant’s self-reported income against their financial behavior to see if it matches.

- Once you have the report, you can feel more confident that your rental applicant’s real-world salary matches what they put on the application and you don’t necessarily need to spend your time thumbing through the stack of documents. However, if it doesn’t match, it could be a sign that more income verification is needed.

Like all SmartMove reports, most reports are delivered same day after the applicant verifies their identity. This means you don’t have to wait around for reports before making your decisions.

4. Employment Confirmation

A huge part of tenant background checks is confirming your applicant can pay the rent on time and every month. Checking that your tenant has regular money coming in is a part of that. For most tenants, a steady income comes through a regular job.

This means, if you need additional verification beyond Income Insights explained above, you may need to confirm your prospective tenant’s work and pay through employment and salary verification.

This type of background check might include looking at documents like:

- W-2

- Tax return

- 1099

- Letters or verification directly from the employer

Whenever possible, it’s important to get work letters directly from your rental applicant’s employer, rather than from the applicant. Work letters may include things like:

- Employee’s full name

- Position and job title

- Employment dates

- Wages and pay frequency

- Current employment status

- How long the position is expected to continue

Rental History

In addition to financial background, it’s helpful to seek information about someone’s past behavior in other rentals. After all, learning if someone had issues in their last eight apartments or never paid rent might influence your leasing decisions.

Checking into rental history might include the following:

5. Previous Landlord Reference Checks

With a rental reference check, you contact a rental applicant’s previous landlords or property management team to learn more about how they acted as a renter.

According to Bigger Pockets, some common questions to ask during a landlord reference check include:

- Did the applicant pay their rent on time?

- Did they leave the property in good condition?

- Was the applicant disruptive to neighbors or other tenants?

These are just some of the questions you might ask previous landlords. Check the linked article above for the full list.

Pro Tip:

Once you’ve placed a great tenant, you may not be eager for them to leave after only one year. However, is their sticking around always a good thing? Learn more about renewing a rental lease agreement.

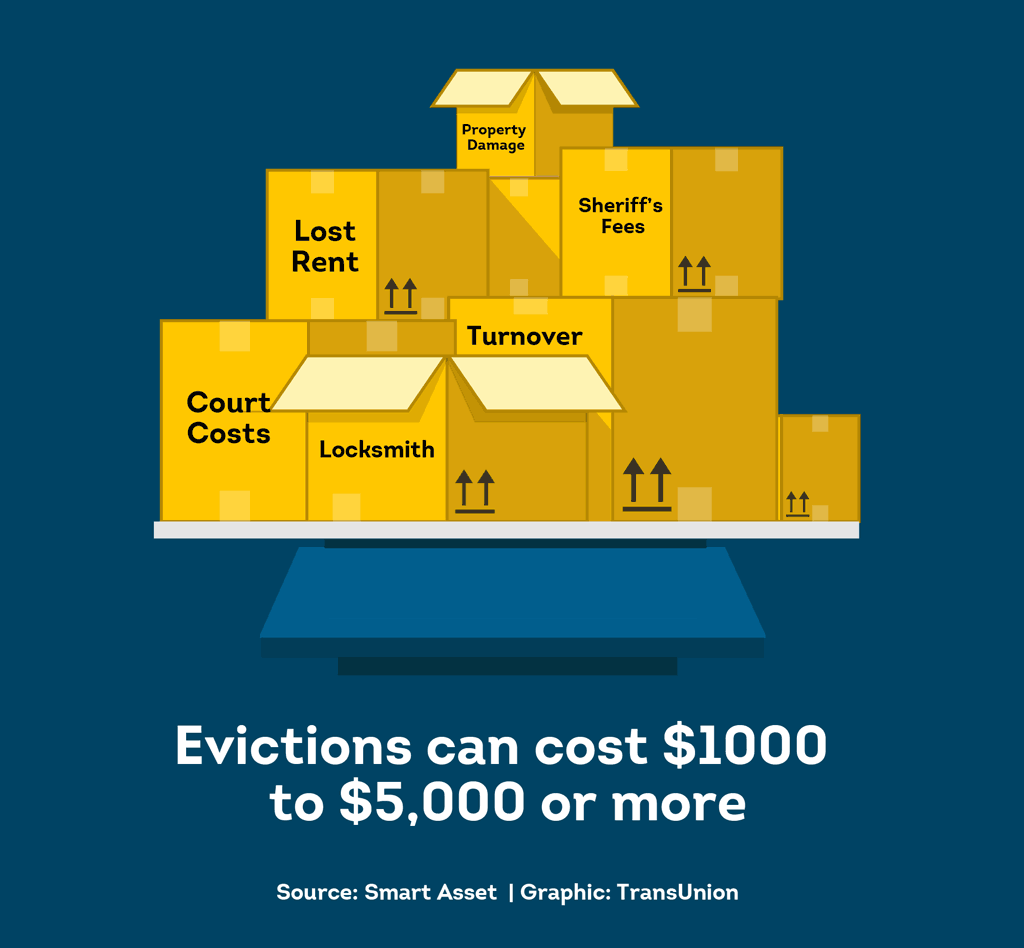

6. Past Eviction Check

There are many reasons to check for prior evictions, including helping protect yourself against a potentially massive financial hit. According to money site SmartAsset, an eviction can cost you between $1,000 and more than $5,000 depending on a number of factors and fees, including:

- Court costs ($50 to $500)

- Sheriff’s Fees ($50 to $400)

- Locksmith fees ($100 to $200)

- Property damages (varies greatly, depending on the extent of the damage)

- Turnover costs ($1,000 to $5,000)

- Lost rent (varies, depending on rental rate)

Although these are just estimates and not all fees are required in every case, you can see how quickly the costs related to evictions can really add up.

Checking for past evictions is a responsible way to see if your potential tenant has any concerning housing-related patterns that could leave you out to dry.

With SmartMove, Evictions-Related Proceedings Reports are produced after searching eviction records to help identify potential eviction-related proceedings they may or may not have told you about. This can help you feel more confident in your decision.

Personal Background

Finally, as a landlord, it is your responsibility to do everything you can to maintain a safe, habitable environment for your renters and neighbors, as well as protect your property.

7. Criminal Background Check

Does your potential tenant have a history of rental property destruction or other related crimes? Are they on the national sex offender registry? You may help find out with a criminal background check.

SmartMove criminal background reports scour hundreds of millions of criminal searching for a potential match to your rental applicant. Checking past behavior may help you:

- Promote safety

- Protect your property

Knowing more about your candidate’s past may help you make more confident leasing decisions.

8. Identity Verification

Last, but not least, identity verification helps you confirm your tenant is actually who they say they are. SmartMove identity checks compare your tenant’s self-reported information to TransUnion databases to search for a potential match.

It checks for data like:

- Name and birthdate

- Social Security Number

- Past and current address

- Potential fraud, including deceased persons alerts

Especially in the age of rental fraud and identity theft, confirming a potential tenant is who they say they are may help you prevent getting taken for a ride by a scammer.

Help Boost Your Tenant Background Checks with SmartMove

Is your potential tenant the real thing or only Fool’s Gold? Help discover more about rental applicants with fast, flexible screening through SmartMove.

Unfortunately, you can’t rely only on information supplied by your applicant directly. Instead, it’s important to back up their claims. SmartMove was designed for independent landlords. There are no sign-up costs, subscriptions, minimums or hidden fees. Simply sign up and start screening immediately.

Reports are backed by TransUnion––a major credit agency with four decades of data expertise. Dig into your candidate’s background with reports like:

- Credit checks: Help understand your rental applicants' financial track record and their history of paying debts. On top of that, included in every SmartMove package, a ResidentScore helps predict future eviction risk 15% better than a general credit score alone.

- Income Insights: Does your applicant actually make the salary they claim on the rental application? This report may help you find out.

- Criminal background checks: This report scours millions of criminal records searching for a potential match to your applicant.

- Identity Verification: Help confirm your potential tenant is actually who they say they are.

- Eviction checks: This helps you see past eviction-related proceedings which may be connected to your rental applicant.

Trusted by over 600,000 landlords and over 4.4 million tenants, SmartMove provides reports that are typically delivered same day after the applicant verifies their identity. Faster results mean you don’t have to wait around to make more confident leasing decisions. Create a free account and start screening today.

Don’t take a tenant on their word alone. Examine your rental applicant from multiple angles with quick, flexible tenant screening through SmartMove.

SmartMove

Great Reports. Great Convenience. Great Insights.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.