Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Running an apartment background check is a great way for landlords to protect their property and other tenants. Through background checks, you can get vital information, such as criminal history, past evictions, and employment verification. You can also receive detailed credit reports that can give you a clearer picture of a prospective tenant’s financial situation. To learn how to run an apartment background check, continue reading below.

Being a landlord can feel like a game of Texas Hold ‘Em. You’re looking around the table at prospective tenants, wondering if they’re bluffing or what they really have cooking in their hand. If you play your cards right, you might win the jackpot. Likewise, one bad decision could means losing all your chips.

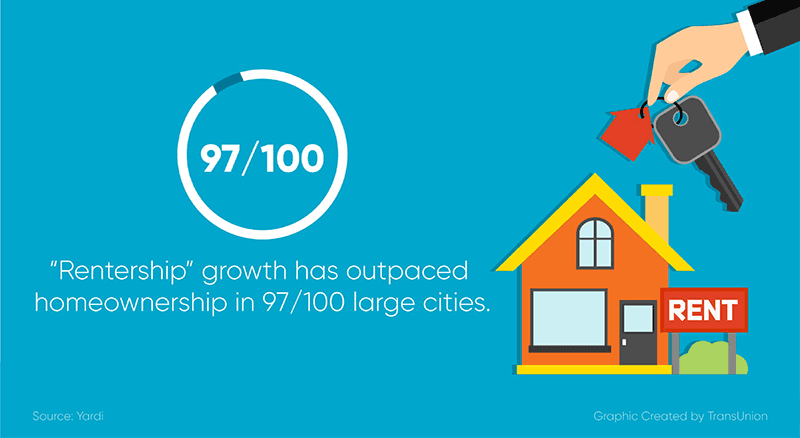

Landlords often win big from strong rental markets. Between 2006 and 2016, rentership growth outpaced homeownership in 97 of 100 large U.S. cities according to RentCafe. This is good news for you. Strong rental markets make for bigger applicant pools, which means landlords can be pickier about tenants.

However, though the recent odds favor landlords, the threat of expensive repairs, property destruction, and legal action looms behind every next deal. While nonpayment of rent is a landlords’ top concern, eviction is a close second. Legal proceedings can cost thousands of dollars and take weeks—or even months—to complete. Even tenant turn-over can reach upwards of $1,750 a month.

To protect yourself, you need some confidence that all potential renters are qualified and likely to honor their lease terms, regarding:

- Duration of tenancy

- Unit maintenance

- Rental payments

Unlike poker, keeping an ace up your sleeve isn’t cheating. In fact, it’s essential to protecting your assets. What is the secret weapon for independent landlords thorough apartment background checks and rental screening through a reputable service like SmartMove.

Without running an apartment background check, it could be impossible to determine if your prospective tenant can meet their financial responsibilities—or if your rental business might fold.

What is Included in a Background Check for an Apartment

Running apartment background checks provides landlords with information that helps assess candidates. A thorough apartment background check should include the following:

- Criminal history

- Detailed credit report

- Income verification

- Past evictions

- Employment verification

Each category is explained in detail in the sections below. Additionally, you’ll find instructions for how to conduct a legal background check for a rental property on your own.

Criminal Background Check

A SmartMove user survey showed that at least 60% of landlords agree that criminal history is more important than credit history. It certainly makes sense. While the ability to pay rent on time is essential for steady rental income, there’s ultimately no price tag you can put on safety.

You might have a good gut feeling about a prospective tenant. Unfortunately, that’s rarely enough. It’s shockingly common for rental applicants to have a criminal past. TransUnion SmartMove data shows that as many as 28% (nearly one-third) of screened tenants have a criminal hit on their record. Are you willing to take those odds?

Not every past crime spells certain doom for your rental business. Some could be unrelated misdemeanors, traffic violations, or charges from decades ago. Still, it’s essential to check for patterns that could put your property and business at risk.

Criminal background checks result in reports that may show offenses at county, state, and federal levels. Most display various offense information such as:

- Current pending charges

- Misdemeanor convictions

- Felony convictions

- Acquitted charges

- Dismissed charges

Running a criminal background check when conducting tenant screening helps:

- Ensure safety: You’re responsible for the safety of other tenants, neighbors, your property, and yourself.

- Avoid property damage: Background checks can help reveal an applicant’s potentially dangerous tendencies and help you predict if your tenant is likely to damage your unit and livelihood.

- Narrow your pool of applicants: The prospect of going through a criminal background check may dissuade fraudsters with ill-intentions from applying. This may result in a smaller but more qualified applicant pool.

Pro Tip: It's fine to mention the criminal record check requirement within your mandatory tenant screening policy. However, you should not say that applicants with a criminal history are banned from applying. Doing so may be considered a form of discrimination.

As you learn how to conduct an apartment background check, follow all government regulations regarding denying applicants based on criminal history. The US Department of Housing and Urban Development (HUD) states that the use of blanket policies to deny applicants with criminal records might lead to a disparate impact on protected classes.

Reduce the risk of legal action by speaking with legal counsel about your responsibilities and rights while screening potential tenants. Additionally, always use an FCRA-compliant criminal background check service when screening potential tenants.

Credit Report

Rent non-payment is a major concern for landlords. It disrupts your cash flow, and can leave you unable to handle your own financial responsibilities. In some cases, it can also cause a crippling eviction process.

A credit score alone doesn’t tell you everything. Not surprisingly, a SmartMove survey revealed four out of five landlords cited that reviewing the full credit report as important to understanding the applicant’s credit history.

There are a few different options to check a potential tenant’s credit. Whatever service you choose, make sure the report includes the following features:

- Verification of name and address

- A summary of active accounts and credit lines

- Any debts incurred, including credit card debt, mortgage, car payments, and student loans

- Payment history

- FCRA-compliance

- Employment history to provide proof of income (when available)*

* Not all employment history may be available or contained within a credit report. Credit history often proves invaluable, as you can gain insight into past financial behavior. Previous action may be a good indicator of whether or not someone will pay rent on time and could help reduce the risk of non-payment down the road.

What’s a good and bad credit score

The higher the number, the stronger the credit score—that’s what the guidance always says. However, according to TransUnion, there’s no definitive “good” credit score. Fox Business reports that 30% of Americans have subprime credit, but what exactly does that mean What‘s the ideal number on a credit report

As it turns out, a bad credit score is typically anything lower than 540. However, for landlords, credit scores don’t tell the whole story. In addition to borrowing history, it’s crucial to verify an applicant’s income.

Income Verification

“Does the applicant earn enough to afford rent”—that’s the ultimate question. As a landlord, it’s your prerogative to answer that before signing any lease or handing over the keys.

Income level can be the difference between consistent rental revenue and chasing down overdue tenants. That helps explain why 59% of landlords place greater emphasis on tenant salary rather than previous credit history.

If your tenant doesn’t make enough to tackle rent each month, then you are left holding the bag. No matter what happens, you’re still responsible for monthly mortgage and other payments. To make matters worse, you also burn time trying to track down your delinquent tenant to get them to pay.

Additionally, it’s not uncommon for younger tenants and college renters to have low or weak scores due to a lack of credit history. In that case, income level may be a better indicator of their ability to pay rent on time every month.

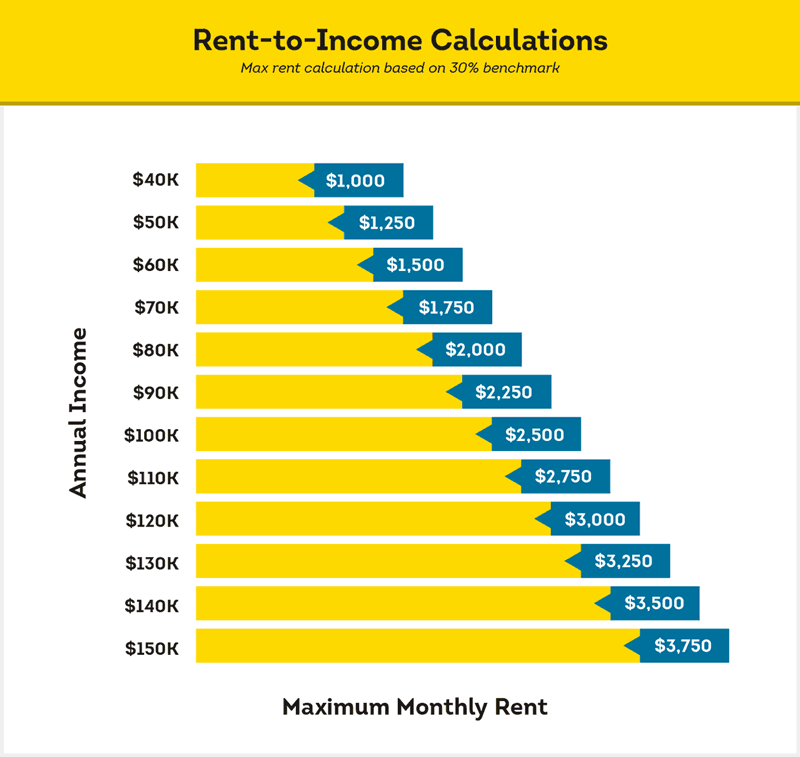

How much income is sufficient

There are millions of units for rent across the country. The amount of income you should look for on your apartment background check will differ dramatically based on local fair market rent in your specific location.

Before looking at any tenants, you should first use rent-to-income ratio to see how much a prospective tenant needs to make to afford the rental property. The industry standard is an income 3x the monthly rental rate, but this may vary by location and situation.

If you don’t have a calculator handy, then reference our chart below to look up the maximum rent your tenants can likely afford based on their gross income.

Make sure to verify self-reported income by your applicant. Your diligence may help you weed out misrepresentations or falsifications on rental applications.

Eviction History

The best predictor for a future eviction is a past eviction. Evicted residents have nearly 3 times as many prior evictions and rental-related collection records as non-evicted residents. Although people can certainly change, sometimes eviction become serial. As a landlord, it's better to know about this pattern ahead of time.

On average, evictions cost $3,500 per unit, which may be well above the cost of a few months of vacancy—and definitely more than independent landlords can afford. The eviction process is also time consuming, taking up to four weeks to complete. In terms of time, stress, and expense, eviction proceedings are one of the worst scenarios a landlord can encounter.

Pro Tip: In addition to an eviction check, many landlords contact an applicants’ previous residence and ask reference questions to help verify their rental history. This landlord reference check can provide a more comprehensive picture of an individual's behavior and help predict how they will treat your property.

Employment History

A tenant might have enough money to pay rent now, but what about in a few months? It’s important to consider the future as well as the present. In addition to verifying income, it’s smart to confirm a tenant is gainfully employed. According to a SmartMove survey 86% of landlords verify rental applicants actually hold the job they say they do.

On your application, have your tenant list their employer’s information. Contact the company and confirm that the applicant has the job and salary specified. You can also verify their start date to make sure it matches the application.

Likewise, you could ask for an employer letter. However, be warned that any documents provided directly by the tenant carry a higher risk of fraud. If you receive an employer letter, it’s still a good idea to do a manual reference check.

How to Run an Apartment Background Check

There are two main options for running an apartment background check:

Use a Traditional Background Check Service

A traditional background check company may provide information about the following:

- Misdemeanor and felony criminal records

- Sex offender status

- Social Security Number validation

- Employment verification

- Credit reports

- Eviction history

Although many of these services provide landlords with robust information, they’re not always conducive to quick tenant placement. It sometimes takes weeks to complete a traditional screening process. In the meantime, landlords lose outon rental income as they wait for answers.

Moreover, traditional firms are usually designed for large businesses with constant screening needs. With long application and review processes, monthly subscriptions, and service minimums, traditional background check companies can be unaffordable and unrealistic for small independent landlords.

Use Online Screening Made for Independent Landlords

Unlike traditional background check firms, online screening companies like SmartMove provide quick and convenient background checks. Timely information helps landlords vetted tenants in a matter of hours—or even minutes—not days or weeks.

Online screening places the power in the hands of the tenants and landlords themselves. The process is often straightforward and easy, while respecting the privacy of those involved.

Apartment Background Checks: Dos and Don’ts

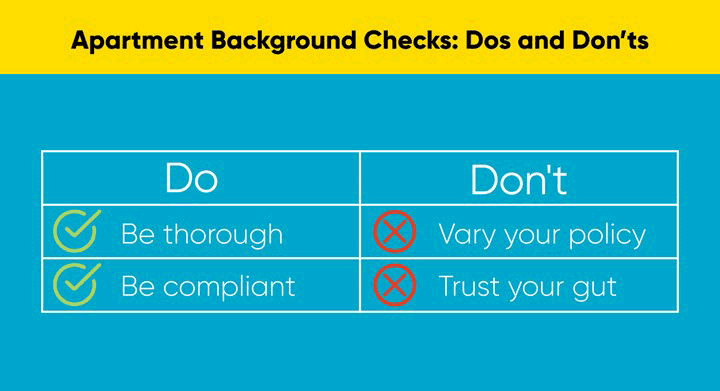

Do: Be Thorough

Even though you might be eager to fill a vacancy, don’t rush or cut corners when screening applicants. Carefully review all pertinent information before making a decision. Tenant screening should include, at minimum: criminal history, credit history, eviction history, income verification, and employment confirmation.

Do: Be Compliant

There’s a whole cluster of local and federal laws regarding tenant screening. When conducting background checks, it’s important to use a service that complies with these regulations. SmartMove follows the regulations. This gives users confidence that they are staying compliant and thus have less of a worry when it comes to lawsuits or litigation regarding background checks.

Don’t: Vary Your Background Check Processes

You should vet every prospective tenant to improve your odds of the smoothest leasing experience. It’s also important to apply your policy universally to avoid discrimination accusations. To reduce your risk of bias, don’t change your screening policies for individual candidates. Use the same process and criteria for everyone.

Don’t Go with Your Gut

Your gut makes great lunch decisions, but maybe not leasing decisions. Unfortunately, you can’t assume everything on every rental application is true. Dependable tenant screening can help you reinforce your gut instinct by verifying an applicant’s information is correct. Tenant screening can help you double-check that your prospective tenant is actually the right fit for your property, and ensure that what they’ve reported is true.

Final Notes: Run an Apartment Background Check with My SmartMove

Bringing in a new tenant always involves some risk. Ill–fitting occupants can lead to nonpayment, disruptive behavior, and property neglect. Before you put all your chips on the table, increase your odds of coming out on top by thoroughly screening potential rental candidates with SmartMove.

Designed specifically for independent landlords, SmartMove delivers lightning-fast reports about your rental applicant that are sourced from TransUnion, a trusted credit reporting agency. Tenant information is compared to 200+ million records to generate in-depth insights available through a variety of reports.

Use eviction history and criminal reports to learn more about potentially reckless or dangerous tenants. Income Insights helps verify that an applicant can actually pay the rent by comparing estimated income against the self-reported number on the rental application. A ResidentScore—included with every screening—is SmartMove’s proprietary credit score built for rental screening that is proven to identify 15% more evictions and 19% more skips than traditional credit scores.

Using SmartMove’s consumer-initiated process, FCRA-compliant reports are delivered in minutes. Simply create a free account and start screening immediately. Quick results mean faster decision-making on well-qualified tenants, which results in shorter vacancy rates and less rental income lost during turnover.

Don’t bet the house unless you have the data to back it up. Keep your screening as solid as your poker face with comprehensive renter background checks through SmartMove.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.