Summary:

To protect your rental property investment, it's imperative to verify rental applicant employment and work history. Make sure to request financial documents such as paystubs and tax returns, request employer letters, and analyze tenant background check results. Without careful review of a rental applicant's finances, you risk placing an ill-fitting tenant.

Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

How uncomfortable would you be if you discovered your new tenant was unemployed? Would you worry they couldn’t cover rent? Most landlords would say yes. In fact, the biggest fear for the majority of independent landlords is rent non-payment, according to a recent SmartMove survey.

Employment and salary verification is the process of confirming a rental applicant’s current and past work and pay. This review ensures the person earns sufficient income to afford the posted rental rate. Without meticulously screening all tenants, you risk losing thousands through devastating eviction proceedings.

Unfortunately, you can’t always take a rental applicant’s word as truth. Falsifying proof of employment is one of the most common rental scams. Careful investigation of employment documentation can also reveal false income claims, concerning gaps in work, or even made-up employers and job titles—things that, if left unchecked, could land you with a renter that destroys your property and tanks your reputation.

Renter salary and work verification is a critical step in the pre-lease tenant screening process. Pairing careful employment review with SmartMove tenant background checks can boost confidence that your prospective tenant is trustworthy and a good fit for your rental.

Here are the main considerations when reviewing a rental applicant’s employment history:

- Request Income Documentation

- Issue an Employment Verification Request

- Analyze tenant background screening reports

Request Income Documentation

Bluntly asking “How much do you make” at a party might land you some strange, or even offended looks. However, as an independent landlord with hundreds of thousands—often millions—of dollars worth of property at stake, asking the question is not inappropriate at all.

To protect your investment, it’s your responsibility to confirm how much a potential tenant brings in each month and compare the total to the unit’s rent rate. If the rent-to-income ratio is off, you risk leasing to someone who may not make enough money and might eventually stop paying you.

Most landlords look for income that’s at least 3x the monthly rent.

- Example: if you charge $1000 a month for your unit, you should verify the rental applicant earns at least $3000 each month.

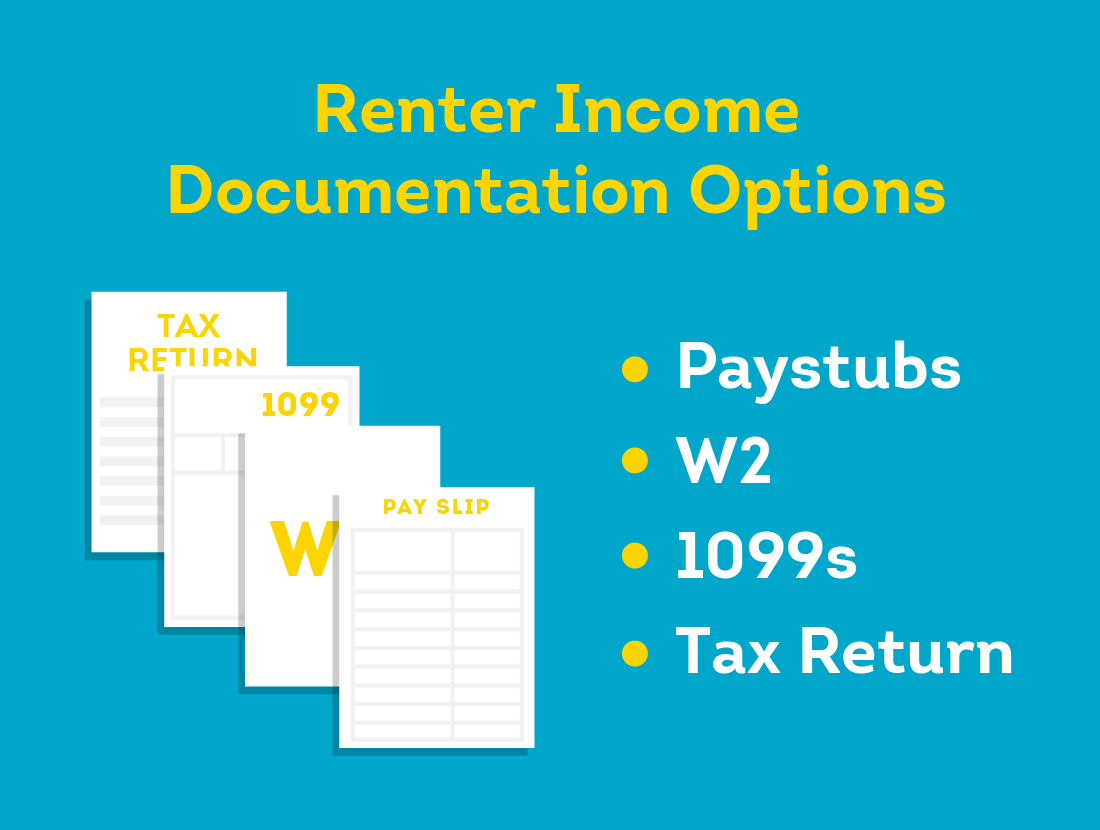

Examples of income documentation include:

Pay Stubs

Proof of consistent, ongoing employment can help you make better leasing decisions. When accepting paystubs from rental applicants, it’s a good practice to ask for recent checks dated in the last three months.

Review paychecks for any red flags. For example, make sure that both the company and employees names are spelled correctly, and that the EIN is the correct length. If there’s contact information on the paystub, verify the address, website, or phone number are all accurate for that business.Employers provide different types of payment documentation to their workers. Be prepared to review digital PDFs or even literal paper pay stubs.

W2

If a formal employer paid your rental applicant more than $600 last year, your prospective tenant should have a W2 form handy. These forms are not only useful at tax time but can also show evidence of stable employment. A person who has held the same position for several years and does not have significant gaps in employment could demonstrate that they have a steady job and income with a W-2. Additionally, a history of sticking with the same employer could be a good thing. It may indicate the tenant will renew their lease, since they don’t have a history of job hopping that would require them to move.

1099

The Gig Economy is booming. Pew Research Center states at least 16% of Americans worked through an online gig website in 2021. A 1099 is common for people who have short-term, temporary work, do consulting, or are self-employed and small business owners.

Depending on their work situation, your rental applicant may have several 1099s. Ask for as many as you need to establish sufficient income over time. Landlords often require more financial documentation from these workers, as 1099 contractors are temporary by definition.

If sorting through piles of 1099s is too overwhelming, you can skip the math and just ask for:

Tax Returns

The higher the rent, the more it’s recommended you ask for a tax return. Seeing a rental applicant’s complete tax return can give you a clearer picture of their full financial situation. After all, some people are traditional employees, some independent contractors, and others might live off their savings and not have usual employment documents.

No matter their income source, a tax return should include everything you need to make more informed leasing decisions—assuming it’s a legitimate document.

Help backup the rental applicant’s self-reported claims with Income Insights, a proprietary report from SmartMove. This helpful report analyzes your rental applicant’s spending and income, then recommends if you should request more financial verification before a lease is signed.

Send Out an Employment and/or Salary Verification Request

As financial documentation can be forged, it’s highly recommended to get your rental applicant’s employment information directly from the source. Salary verification requests ask an applicant’s current or former employers to confirm work details.

Salary verification letters request information, such as:

- Employee’s full name

- Position and job title

- Employment dates

- Wages and pay frequency

- Current employment status

- How long the position is expected to continue

Check out Indeed for a sample employee verification request, as well as a sample employee verification letter.

Ask to be mailed a hardcopy on company letterhead, if available. At the very least you want to get an email from the corporate HR email address.

If getting a letter is not possible, you can also contact the employer by phone to verify the information. Just make sure to independently check the name, position, and phone number of the contact provided by the rental applicant.

After the call ends, make a detailed note that includes the date, person you spoke with, and any information gleaned. Keep this document in your rental files.

Analyze Tenant Background Screening Reports

It’s easy for a renter to exaggerate their role, title, and income to appear more attractive to landlords—especially in a tight rental market. Don’t risk renting out your livelihood based solely on a prospective tenant’s word. Always backup their claims and your gut feeling with hard data.

Top online renter background check services can often provide financial and employment records, which you can check against the applicant supplied work information. Having data confirmed by a reputable, FCRA-compliant third-party can help you verify your rental applicant’s work history and feel more confident that they can afford your rental rate.

When reviewing tenant financial background checks, ask yourself the following questions:

- Has your applicant been consistently employed

- Is their employment likely to continue in the future

- Do the employers on the background check match what was provided by the applicant

- Do they make enough money to afford the rent

Beyond the employment insights you may obtain, there’s even more to be gained with the information found in the additional reports that are normally included with online background checks for tenants.

Verify Rental Applicant Employment and History with SmartMove

Landlords who fail to verify their rental applicant’s work history and salary are more likely to face debilitating nonpayment issues in the future. Eviction proceedings, property destruction, legal fees—the bills add up and are often more than an independent landlord can endure.

Get the facts with comprehensive renter screening through SmartMove. In just minutes, you’ll receive crucial information for landlords, including:

- Credit Report: Get details about your prospective tenant’s payment history, level of debt, and other financial factors. Every SmartMove background check also includes an applicant’s ResidentScore, a proprietary credit score proven to identify 15% more evictions and 19% more skipped payments than traditional credit reports.

- Eviction history. The best predictor of a future eviction is a past eviction. Running an eviction history report could help reveal past financial misrepresentation, unlawful detainers, failure to pay, and tenant judgments for rent and possession—potentially dangerous patterns that could obliterate your rental business.

- Criminal History. Has your rental applicant been convicted of any relevant crimes, such as financial fraud SmartMove criminal record checks scan hundreds of millions of criminal records for your rental applicant’s legal name. Both state and national databases are scoured in a matter of seconds, so you can reduce your worries about potential trouble.

- Income Insights: Determining if your tenant can afford the rent is the most important task for a landlord. Income Insights helps you instantly determine whether additional proof of income should be collected from an applicant.

You don’t need to be a document expert to find great renters. Skip the guesswork and help make more confident leasing decisions with TransUnion SmartMove online background checks.

SmartMove, Great Reports. Great Convenience. Great Tenants

Sign up for FREE and pass the cost on

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.