Summary:

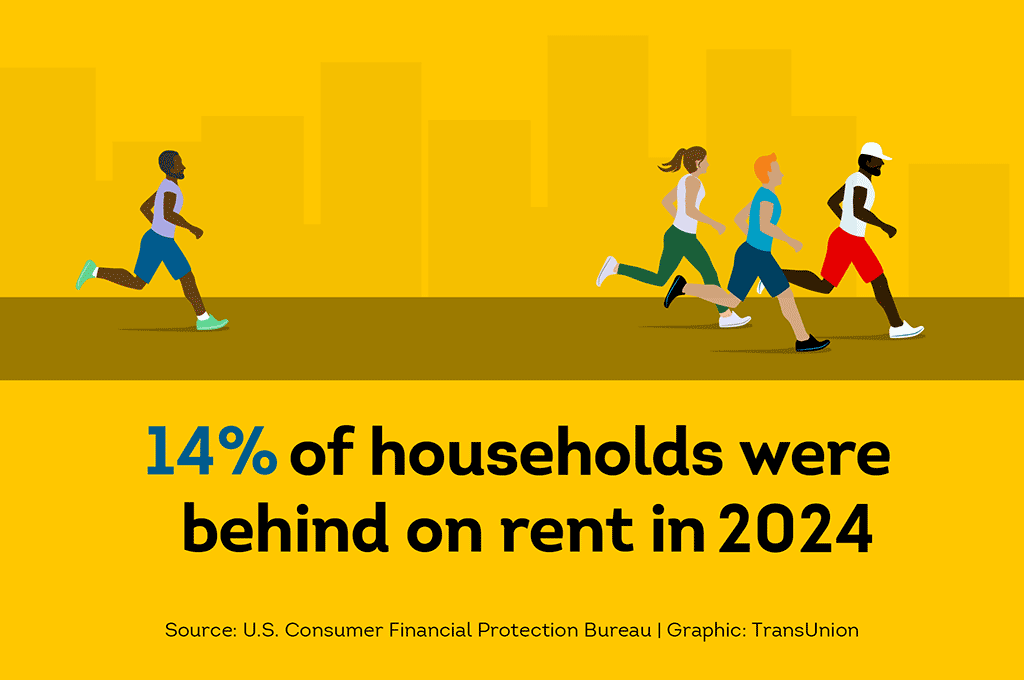

- 14% of tenants were behind on their rent payments at the end of 2024, according to a U.S. government report.

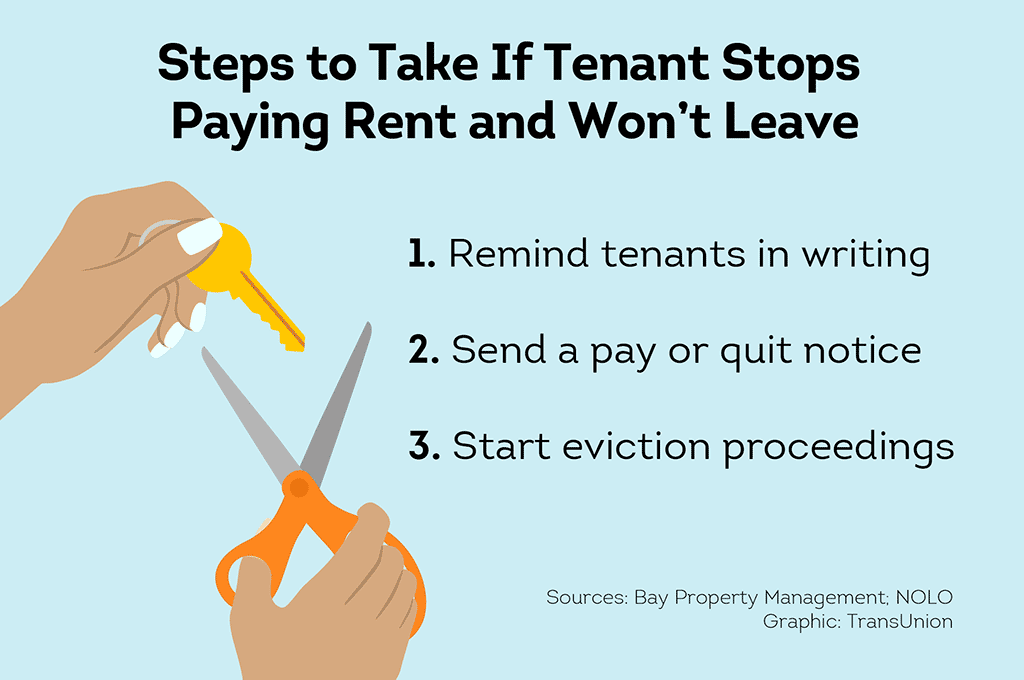

- If you have tenants not paying rent who won’t leave, you may want to consider following these suggestions to help get them out.

- Removing a tenant often involves sending an informal reminder, providing a Pay or Quit Notice, and even eventually going to court to start an eviction proceeding.

- Eviction laws and processes can vary by state and city, so it’s important to get guidance for your legal counsel on the regulations and rules in your area.

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

A property business, like a hot air balloon, only works if someone continues to feed the flame. As soon as the fire goes out, the balloon sinks right back to the ground where you started. And, when it comes to tenants not paying rent, you might be in for a bumpy landing.

As reported by Tourtelot Property Management, successful rent collection and protecting cash flow are two of the biggest challenges landlords face. After all, in order to make money, you need tenants to pay. But, that doesn’t always happen.

In addition, the U.S. Consumer Financial Protection Bureau has stated, about 14% of households were behind on rent at the end of 2024––that’s almost six million Americans. Could your next tenants be among their ranks?

Sometimes, the signs your tenant might stop paying rent may be obvious and you can spot them ahead of time. That’s why so many independent landlords try to proactively catch potential red flags with tenant screening with services like SmartMove.

However, at other times, a tenant’s situation may change quickly in ways no one could predict. For example, a loss of a job, the death of a loved one, a new child, or any number of life events could blindside both you and your tenant.

This article covers the following topics:

No matter why your tenant stops paying rent, this article covers ideas for approaching the situation and different things you may want to consider to help rectify it.

When is Rent Considered Late?

This may seem obvious, but it’s important for landlords to know when rent is actually considered late. And, as most landlord and tenant-related issues, the primary source for answers is your lease or rental agreement.

According to Bay Property Management Group, rent is due on the date specified in your lease, which is usually the first of the month. Anything after that is generally considered late.

Rental Payment Grace Periods––When You Can Charge a Late Fee

A “grace period” is a small window, usually around 3-5 days, where a tenant can pay their late rent and not get charged a fee. According to legal site Justia, some states mandate grace periods, while others are at the landlord’s discretion. Either way, your grace period may be outlined in the lease.

If you plan to charge late fees, you may want to outline your late fee policy, what’s owed, how to pay, and when penalties kick in inside your lease agreement.

Pro Tip:

If you fear a rental applicant may have trouble meeting their rental payments on their own, you might consider requiring a guarantor or co-signer to help reduce the risk.

Why Your Tenant May Not BE Paying Rent (And What It Could Mean for You)

There are several reasons why someone might stop paying rent. Depending on the situation, you might have slightly different responses. Here are a few possibilities why someone might stop paying rent––and how that might impact your response.

1: Family Change: Such as New Baby or Loss of a Loved One

Before move-in, you did a thorough employment and previous eviction check. Everything looked good. However, now, your otherwise great tenant won’t pay rent. What gives? One possibility is a life change.

If your tenants recently had major positive or negative changes to their lives, they might be forgetful about paying rent on time. Examples include:

- Birth of a child

- Loss of a family member

- A period of intense travel

- A traumatic or stressful event

- A wedding or divorce

- Other major life events

Any of the above might distract even a responsible tenant enough to miss a payment or two.

What This Could Mean for You

Everyone is human. If you have tenants who have otherwise always paid consistently and honestly forgot for an understandable reason, then just a gentle reminder might be sufficient to get them back on track.

Pro Tip:

It’s essential to verify potential tenants can afford the rent. In addition to a credit check, use Income Insights to help identify your tenant actually makes what they claim on the rental application. Then, ResidentScore® helps you predict eviction risk better than a traditional credit score.

2: Loss of Job or Income

In this scenario, you asked tenant screening questions about employment and got data to back it up. The tenant started the lease with sufficient income, but at some point during the tenancy, they lost their job. Now, they may no longer be able to afford the rent.

What This Could Mean for You

This scenario can be tricky. On the one hand, it's natural to empathize with someone going through a hard time. On the other, if they don’t have a job and aren’t paying rent anymore, that means you won’t get paid anymore, either. You could fall behind on your own mortgage.

OKC Home Realty Services advises that, yes, rental non-payment is grounds for eviction. However, if your tenant falls behind on their rent, you may first have an open and honest conversation.

Discuss things like:

- Lease terms and deadlines

- If you’re willing to accept rent installments or other arrangements

- How long you’re willing to help them out

- If you know of any rental assistance programs

No matter what you decide, you may want to solidify your agreement in writing, so that you both have a record of the arrangement.

3: Scammers Who Have No Intention of Ever Paying Rent

Some people inevitably fall on hard times. Others, like fraudsters, create hard times. Unfortunately, rental scammers exist––and they’re one reason landlords choose to run identity checks on rental applications.

Even worse, scammers can be savvy and know how to manipulate landlords to their advantage. This means that if you do end up with a rental scammer on your property, it can be an ordeal to get them out.

Real Life Example: Rental Scam Nightmare

According to an article from NBC Boston, one Massachusetts couple learned how to game the system and have been scamming landlords and living rent free for decades. This “professional tenant” couple have been evicted over 16 times and have racked up over $100,000 in unpaid rent.

What This Could Mean for You

According to the NBC article, one reason the couple got away with the scam is because 1) they knew exactly how to act, and 2) they convinced landlords to accept documents they provided, such as pay stubs.

You may be able to help catch rental scammers before signing a lease by getting data from an established, background check company.

The Bottom Line When Tenants Stop Paying Rent

As you can see, context matters. Whether it’s a life change, simple forgetfulness, lost income, or an all-out scam, the reason rent is late might alter how you deal with the situation.

Pro Tip:

While you want to conduct as thorough vetting as possible, it’s essential to respect the law and the rights of tenants during rental screening. If not, you could be the one in legal trouble.

What to Do If Tenant is Not Paying Rent and Won’t Leave

Unfortunately, some landlords face situations in which tenants stop paying rent and won’t leave. According to Bay Property Management group, there are a few things you can do, including sending an informal reminder, providing a “pay or quit” notice, and starting formal eviction proceedings.

Each is explained in more detail below.

1: Remind Tenants in Writing

Once you’ve confirmed the rent is late according to the lease terms, the first step may be a gentle, reminder in the form of a Late Rent Payment Notice. You can send it shortly after the rent is due. This may be best done in writing, such as a text or email, so that you have a record of the reminder.

The Bay Property Management group article explains you may want to include the following in your late payment reminder:

- The date rent was due

- The amount due

- Any information about late fees or penalties

- A deadline to pay before further action is taken

If this is the first time a tenant’s rent is late or it was an honest mistake, consider keeping the message professional, but relatively casual. In this case, they may pay you quickly and you can both move on.

However, if they are not communicative or have made a pattern of paying rent late, you may not want to be casual. You may need to send a firmer warning and stick to your late payment policies. As always, keep all communication documented and organized in your landlord files.

2: Send a Pay or Quit Notice

If your tenant does not pay overdue rent after your informal reminders and offers of help, you may need to take it up a notch with a “pay or quit notice”.

According to NOLO law dictionary, a pay or quit notice is given to a tenant to let them know that they either have to pay rent by the deadline or leave the property. If they do neither, then landlords can begin filing eviction paperwork.

What a “Pay or Quit Notice” Should Include and When to Consider Sending It

Law site LegalZoom explains that the exact specifics for what you need to include and how far in advance you need to send it can vary by state. Here are two general examples below just to highlight some of the differences between locations.

- Massachusetts: According to the Massachusetts Court System website, in general, landlords may give a tenant 14 days to pay or quit due to rental nonpayment.

- California: On the other hand, in California, landlords may give tenants three business days to pay or quit, in some cases.

As you can see from such big differences, it’s essential to check with your local government for specific information. Then, follow up with qualified legal counsel if you have any questions.

Pro Tip:

Even if you have one responsible tenant, their irresponsible partner or roommate could wreak havoc on your rental property. Read how to screen multiple tenants for your unit.

3: Start Eviction Proceedings

After you’ve communicated with your tenant, sent a Pay or Quit notice, and completed other options or tasks required by your state, you may want to file an eviction case. The LegalZoom article explains if your tenant does not meet the payment deadlines, you may officially file for eviction.

Like with Pay or Quit notices, the exact laws and process for how and when to evict someone may vary from state to state. However, according to legal site NOLO, many follow a similar pattern:

- The landlord sends tenants a notice to pay or quit

- If the tenant still doesn’t pay the rent, the landlord generally goes to a judge, files a complaint, and sends the tenant a summons

- The tenant and landlord may have to appear before a judge

- If the court sides with the landlord, the tenant is required to leave the property

- Then, if the tenant still doesn’t leave, the landlord may have to get law enforcement involved to help remove the tenant

Again, this is just an example eviction process for informational purposes and reference. It’s critical to understand how evictions work in your area by discussing the process with a qualified legal counsel.

What is a Cash for Keys Agreement?

If a tenant does not respond to written reminders and does not pay overdue rent, some landlords opt to prevent the hassle of formal eviction proceedings with what’s called a “Cash for Keys” agreement.

According to House Buyers of America, a “cash for keys” agreement is an arrangement where a landlord offers a tenant cash to quit the lease and leave the property. This side steps the need to take tenants to court and may be cheaper than an eviction.

Cash for Keys agreements are binding agreements between landlords and tenants directly. They don’t require involving the court system and may help avoid a formal eviction process. Generally, here’s how it works:

- Landlords offer a tenant a specific amount of money for leaving

- The tenant agrees and they put the details of the agreement in writing

- Once the tenant moves out and meets the terms of the agreement, the landlord pays the tenant the specified amount

According to landlord insurance site Steadily, Cash for Keys agreements are legal in all 50 states, assuming protocol and applicable laws are followed. Please consult legal counsel for guidance based on federal, state and/or local laws, and to assist with any questions to determine how this information may be conducted or impact you.

Help Prevent Rental Non-Payment with Fast Tenant Screening through SmartMove

Venturing out into the world of property business is risky––even with the best tenants. Don’t leave your rental profits up in the air with people who may not pay. Help place responsible residents from the start with fast, flexible tenant screening through SmartMove.

Are your tenant’s financial claims the real deal or are they filled with nothing but hot air? Help get additional information on your applicant with financial screening, including:

- Credit report: Know more about your tenant’s financial history to see if they typically pay their debts.

- ResidentScore: Exclusively available through SmartMove, this proprietary score is calculated through hundreds of thousands of real-world rental outcomes and helps predict eviction risk 15% better than a traditional credit score alone.

- Income Insights: This proprietary report helps identify if your rental applicant’s real-world income actually matches what they put on their rental application––or if you’re wise to get additional documentation.

Financial history isn’t the only major watch-out when finding quality tenants. A criminal background report checks your tenant’s info against millions of federal and state-level crime records looking for a potential match to your applicant. Identity verification helps confirm they’re actually who they say they are.

Meanwhile, an eviction report scans for past eviction-related court proceedings. Knowing more about your rental applicant’s past can help you make more confident leasing decisions.

Through SmartMove, you get fast, flexible screening reports with upfront pricing and no hidden fees. With reports delivered quickly, you don’t have to wait around to make your decisions. Simply create a free account and start screening today.

Don’t let a non-paying tenant ground your property business. Set off to new heights with flexible, online tenant screening through SmartMove.

FAQs: Tenant Not Paying Rent

Depending on state and local laws, accepting a partial payment after issuing a Pay or Quit notice may affect your ability to proceed with eviction reset the eviction timeline, or waive your right to enforce the notice.Always consult with legal counsel before accepting partial payments.

A Late Rent Payment Notice should clearly outline:

- The date rent was due

- The amount owed

- Any applicable late fees

- A deadline to pay before further action is taken

A tenant’s financial situation may change unexpectedly during the lease term. If a tenant loses their job and falls behind on rent, landlords may consider discussing the situation openly and reviewing lease terms together.

It’s important to document any agreements in writing and consult legal counsel to ensure compliance with local laws and lease obligations.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.