Key Points:

Short and long-term leases have important differences that independent landlords should be familiar with:

- A short-term lease is shorter than the standard length of six months or a year.

- Typically, you can charge more per night for short-term leases, but they are often more work than long-term

- Be aware that laws for short-term and long-term leases can be different

- It’s important to thoroughly screen tenants even if they’re only staying for a short period of time

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Choosing to do a long-term or short-term lease agreement is like the difference between a sprint and a marathon. Both methods of running can get you where you’re going, but each has different strategies, approaches, and watchouts. No matter what you choose, if you’re not fully ready for the path ahead, your race to the top could end in disaster.

According to the U.S. Federal Reserve, about 27% of American adults rented homes in 2023. That means there are millions of Americans who rent––and each has their own individual circumstances and housing needs. This means, if you’re an independent landlord, the chances are you’ll eventually come across someone who asks if you’re willing to do a short-term lease.

There are many legitimate reasons someone might want a short-term lease, such as filling in a housing gap before a planned move. On top of that, short-term rental agreements may be a good way to make even more money.

However, short-term lease agreements also come with a more intense workload and sometimes an even higher potential for housing scams. This is why it is so important to vet all residents with a reputable tenants screening service like SmartMove®. This is the case regardless of the length of the lease.

This article covers the basics of short-term lease agreements. It includes the pros and cons of a short-term rental vs. long-term rental, when it may be best to use a long vs. short-term rental.

How Long is a Short-Term Lease?

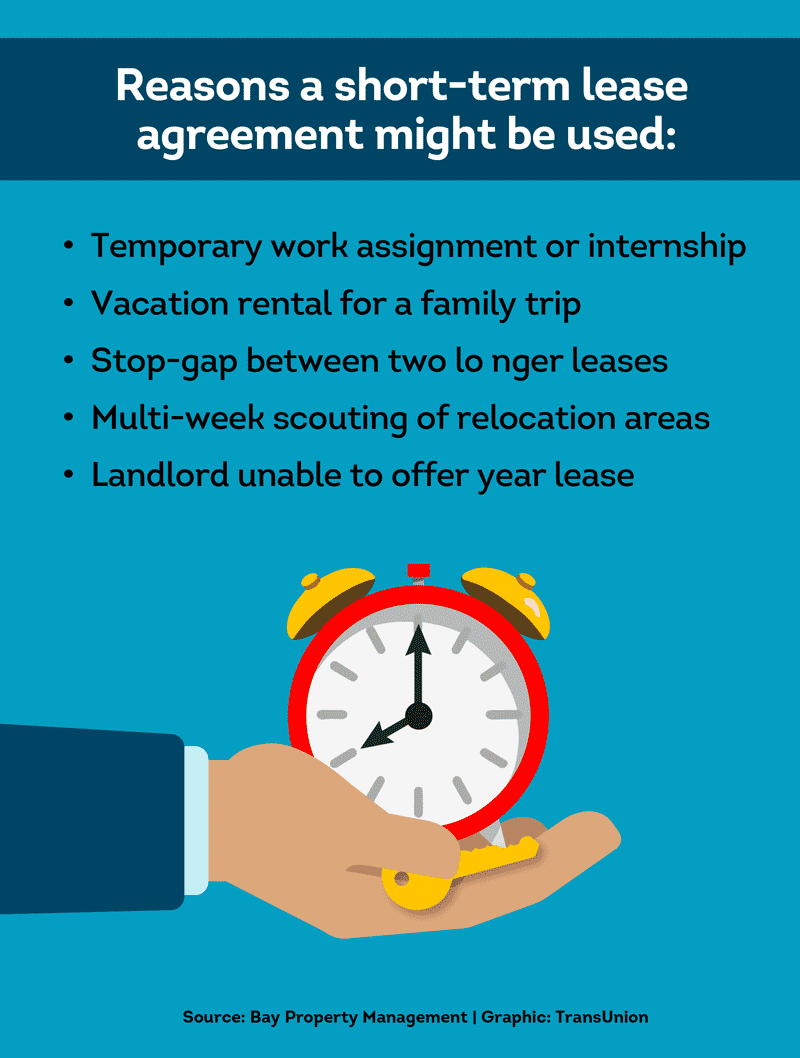

In general, a “short-term lease” is a rental agreement that is shorter than the standard length of six months or a year. According to, Osprey Property Management Group, short-term lease agreements are typically used for temporary accommodations and usually last three to six months ..

There are many reasons someone might use a short-term lease agreement, such as:

- During a visit for a temporary work assignment or internship

- Getting a vacation rental for a family trip

- Staying a few weeks after a year-long lease ends as you wait for a new lease to begin somewhere else

- A scouting trip while a family explores relocating to a new area

- Changing a year-long lease to month-to-month

- A landlord plans to sell a rental property in a few months and may not offer a full year’s lease

A short-term lease can sometimes be a little more work, as it may require more turnover, preparation, and communication. However, there could be additional benefits, such as charging a higher rate.

Pro Tip:

Is your rent priced appropriately for your area? Help determine what to charge for rent and tips to help analyze your local market for a price that’s attractive to both you and your tenants.

Short-Term Lease vs. Short-Term Rental or Vacation Rental

Some types of short-term lease agreements might be considered “short-term rentals” (STR). According to vacation housing site Booking.com, STRs “are typically categorized as private properties” that are rented out as accommodations to guests for limited periods of time.”

Classic examples of STRs might include things like:

- A room in a private home through AirBnb

- Renting someone’s lake house through VRBO

- Booking a glammed up treehouse or carriage house in someone’s backyard

These types of rentals can be quite lucrative. In fact, according to data site Future Market Insights, the STR industry was expected to reach $1.49 billion in 2025.

Some states, counties, or even cities have laws dictating what’s considered a “short-term rental.” For example, the City of Honolulu website designate short-term rentals as “lodgings that provide guest accommodation for less than 30 consecutive days.”

The Booking.com article, mentioned above, warns that “short-term rentals” may require special licenses, permits, zoning restrictions, health and safety requirements, insurance, and protections that could differ from traditional leases. Additionally, the IRS provides guidance on how renting out residential and vacation property may impact your taxes.

If you’re considering offering a space as a short-term rental, please consult your legal counsel for guidance based on federal, state and/or local laws, and to assist with any questions to determine how this may impact you.

Pro Tip:

Short-term rentals aren’t just limited to handing over your entire property. Read about generating extra income by renting out a room in your home.

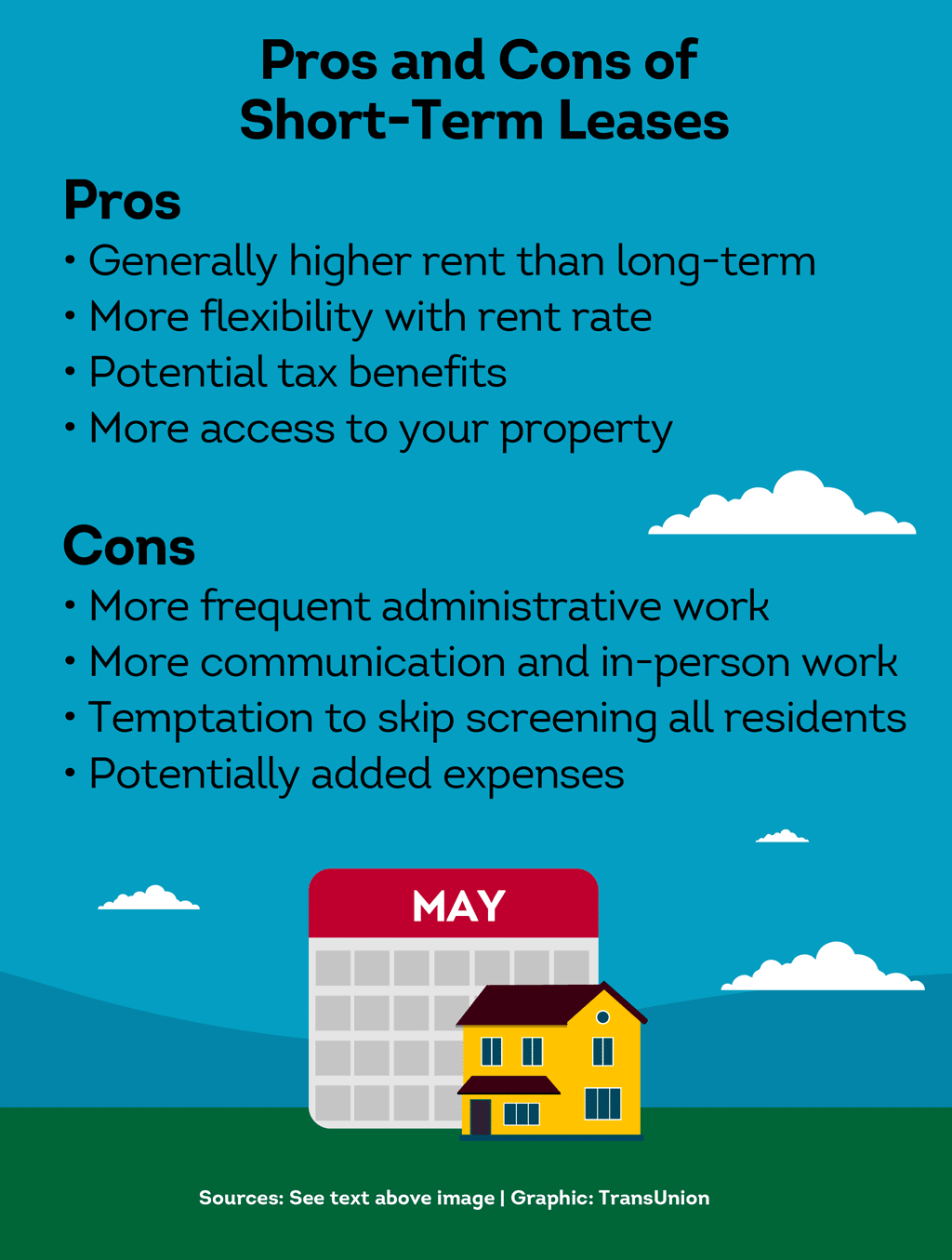

Pros and Cons of a Short-Term Rental (vs. Long-Term Rental)

Because there is often more turnover more frequently than long-term leases, short-term rentals can be more work than long-term rentals. Despite the additional workload, there can be many benefits of offering a short-term lease.

Pros of a Short-Term Lease

Here are some potential benefits of short-term lease agreements and rentals. Keep in mind, individual circumstances may vary:

- Generally higher rent: The Osprey Property Management Group article, listed above, short-term leases allow you to change costs more frequently to keep up with the market. With the added work and convenience of tenant flexibility, you may be able to charge more per night than you would with a longer-term rental.

- More flexibility with rent price. Along with higher rates, shorter rental agreements may allow you to be more flexible with rent prices. For example,. seasonality is one of the factors may impact your rental rate. With short-term rentals, you could adjust your rates even more advantageously to the local market.

- Potential Tax Benefits: According to ,SmartAsset, there may be some tax benefits – as long as the criteria is met. These deductions may be different from the usual tax deductions for landlords who rent for longer time periods.

- More access to your property: With a long-term lease, you may only get to check the state of your unit through the occasional property inspection. This might only happen a few times a year. With a short-term rental, you can access your property more frequently to keep an eye on things.

Cons of a Short-Term Lease

On the other hand, there are a few things that can help make short-term lease agreements more challenging for landlords. Keep in mind not all of them may apply to your situation:

- Added administrative work. With a yearly lease, you may only need to publish a rental ad, review applications, and screen tenants once a year. With a short-term lease, you may need to do the process every few weeks. This helps emphasizes the need for keeping well-organized landlord files.

- More communication and in-person work. Similar to the above, more frequent turnover means more communication with potential tenants, more in-person or virtual property tours, more cleaning, more questions, and more move-in/out inspections.

- Temptation to skip screening all residents. With so many people coming in and out, it can be tempting to skip Thankfully, with online services like SmartMove, you can get fast, tenant background checks with most reports delivered same day after the applicant verifies their identity.

- Potentially more expenses. In a long-term lease, tenants typically take care of things like lawncare, trash disposal, cleaning, or setting up and paying utilities. In short-term rental situations––especially in arrangements by the day, week, or single month––these tasks typically fall to the landlord, which may increase operating expenses.

These are just some of the things that can add time and money if you allow short-term lease agreements for your property. However, even with the above, short-term rentals may still be worth it––if you do your due diligence.

Pro Tip:

Allowing short-term rentals is one way to possibly maximize your rental income. Check out the article for additional recommendations.

Short-Term Lease Considerations

If you’re considering short-term rentals, here are a few things to keep in mind:

1. Pay attention to local laws. While short-term rental popularity is high, STRs may also be controversial, especially in competitive rental markets that are low on long-term housing. For example, according to Wired Magazine, in 2023, the city of New York passed legislation limiting the leasing of short-term rentals. Other cities and locales may follow suit, so it’s important to keep up with regulations to not run afoul of the law.

2. Screen potential tenants. Just because someone will only rent your space for a few weeks, doesn’t mean they may not cause damage. Additionally, with shorter-term leases, you introduce more people into your property, which could increase your risk. Whether you’re providing long or short-term lease agreements, it’s helpful to learn more about potential occupants.

This includes:

- Criminal background check: check your rental applicant’s information against millions criminal records to help determine if there are any potential matches.

- Past evictions: knowing more about a rental applicant’s previous housing track record can help you make more confident leasing decisions.

- Identity check: help confirm your rental applicant is actually who they say they are-––especially for short-term lease agreements when the tenants can be more transient.

- Financial history: help determine if your applicant actually has the means to pay the full amount of rent––even if it’s for only a few months. You can run a tenant credit check, and even help verify their salary matches what they claim with Income Insights.

Plus, included in every SmartMove, package, you get a ResidentScore®, a proprietary calculation that helps predict future eviction risk 15% better than a traditional credit score alone.

3. Stay organized. With the increased workload through administration, communication, and maintenance like cleaning, it’s important to stay organized––especially if you’re used to only long-term leases. It’s also helpful to learn how to handle resident complaints if they arise.

The bottom line: once you get into a groove and overcome potential challenges like the ones above, a short-term lease may be a fantastic way to bring in extra income.

When is a Short-Term Lease Better than Long-Term Lease?

When deciding how to optimize your independent property business, you may need to decide between long-term and short-term lease agreements. While each have their pros and cons, there are a few general considerations for helping choose between long and short-term rentals.

When to use a Short-Term Lease

Based on the pros and cons in the sections above, a short-term lease may be a good idea if:

- You want to prioritize higher-income over less work

- You have the time to manage administrative and turnover tasks

- You don’t mind being more hands-on or paying for management services

- You’re in a competitive rental area where the market fluctuates frequently

- You know how to screen tenants and know what potential warning signs to look for

- You know local laws permit short-term leases

- You’re in an area with a lot of temporary visitors

If the above points resonate with you, then short-term leasing may be a good option.

When to use a Long-Term Lease

On the other hand, longer-term leases might be better fit if:

- You want your property business to be as passive as possible

- You don’t have the time to keep up with regular ads, screening, maintenance, and communication

- You’re in an area without much fluctuation or competition in the rental market

- Your area has little tourism and visitors and most of your tenants tend to be long-term

If these considerations sound more your speed, then maybe sticking with long-term leases is the way to go. Additionally, it doesn’t have to be all or nothing. You mat consider offering short-term lease agreements in only some cases.

For example, if you’ve had great tenants who need an extra month or two, then adding a short-term lease at the end of the existing term could benefit both you and your residents.

Help Protect Any-Length Lease with SmartMove Tenant Screening

Just because a lease is less involved than usual doesn’t mean your screening should be. Vet anyone you lease your property to with flexible tenant screening through SmartMove.

Is your temporary visitor who they say they are? Criminal records reports zip through millions of criminal records searching for a potential match for your rental applicant. Meanwhile, identity checks help confirm they are actually who they claim.

Even if the lease is short-term, you may still need to confirm if potential tenants can afford it. A credit check helps you understand a rental applicant’s financial track record, while a ResidentScore helps predict future eviction risk 15% better than a traditional credit score alone. You can even help verify prospective tenants actually make what they claim on their application with Income Insights.

The world of short-term leases can be fast-paced. Thankfully, with SmartMove, you don’t need to wait around for results. Designed specifically for independent landlords with only occasional screening needs, most tenant reports are delivered same day after your rental applicant verifies their identity.

Reports are backed by TransUnion, a major credit agency with four decades of data expertise. There are no sign-up costs, subscriptions, minimums or hidden fees. Simply sign up and start screening.

In the frenzied race of independent property management, don’t let distractions knock you down. Zoom past with fast, flexible tenant screening through SmartMove.

SmartMove

Great Reports. Great Convenience. Great Insights.

Short-Term Rental FAQs

Deciding what to charge for a short-term lease or vacation rental is similar to deciding what to charge for rent in general. Here are a few strategies for finding the sweet spot:

- Research similar rental properties in your area through sites like VRBO, AirBnB, and similar. Compare features, amenities, size, and location to determine if you should charge more or less.

- In addition to other short-term rentals, check out local hotel rates. Depending on the length of stay, hotels, motels, and bed and breakfasts could also be your competition.

- Pay attention to the season, and be prepared to increase or lower prices based on demand. According to Apartment List, the demand for rental property is highest during the spring and summer.

Finally, although primarily meant for longer term housing, you can also look up prices on the Department of Urban Housing and Development’s fair market rent documentation system. As longer-term rentals usually cost less than short-term rentals, this data can give you a potential minimum amount to charge.

Yes. It’s always a good idea to thoroughly vet anyone you are renting to––even if they’re just staying a short time. Some short-term rental platforms have built-in efforts to help deter problem residents, such as the host and guest rating system on AirBnb. But, is that enough? And, is that sufficient if someone signs a lease to stay in your home for three months? Thankfully, checking into a potential tenant’s criminal, financial, and eviction history doesn’t have to take a long time. With flexible, online services like SmartMove, you can get fast tenant screening with very little time and effort.

There could be, depending on your location, what kinds of services you offer, and how often you have guests. According to home monitoring company Minut, landlords are not always required to report income from short-term rentals if they rent property fewer than 14 days a year.

However, short-term rentals might also cost you more than longer-term leases in some places. The Minut articles explains that your tax burdens can change both depending on the city and the length of time someone stays.

You can read more about federal taxes for short-term rentals on the IRS website. Then, look into the rules for your state and city. Contact a qualified accountant or CPA to understand how short-term rentals affect your tax requirements.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.