Summary:

Running background checks on potential tenants is critical. However, some rental applicant data is federally protected by FCRA laws. Violating FCRA laws—even on accident—can land you in the courthouse. Learn what FCRA is, what it does, as well as how to conduct FCRA-compliant background screening and tenant credit checks.

Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

As it’s often said, the devil is in the details. As a landlord you must pay attention to a lot of details—or risk vicious consequences. One task that puts many independent landlords at risk of legal trouble is screening tenants before they move in.

Yes, it’s absolutely imperative to run background checks on rental applicants. However, a lot of the information gleaned in tenant screening and credit reports is federally protected data. That means, if you don’t run your checks perfectly or manage tenant reports correctly, you could pay the price.

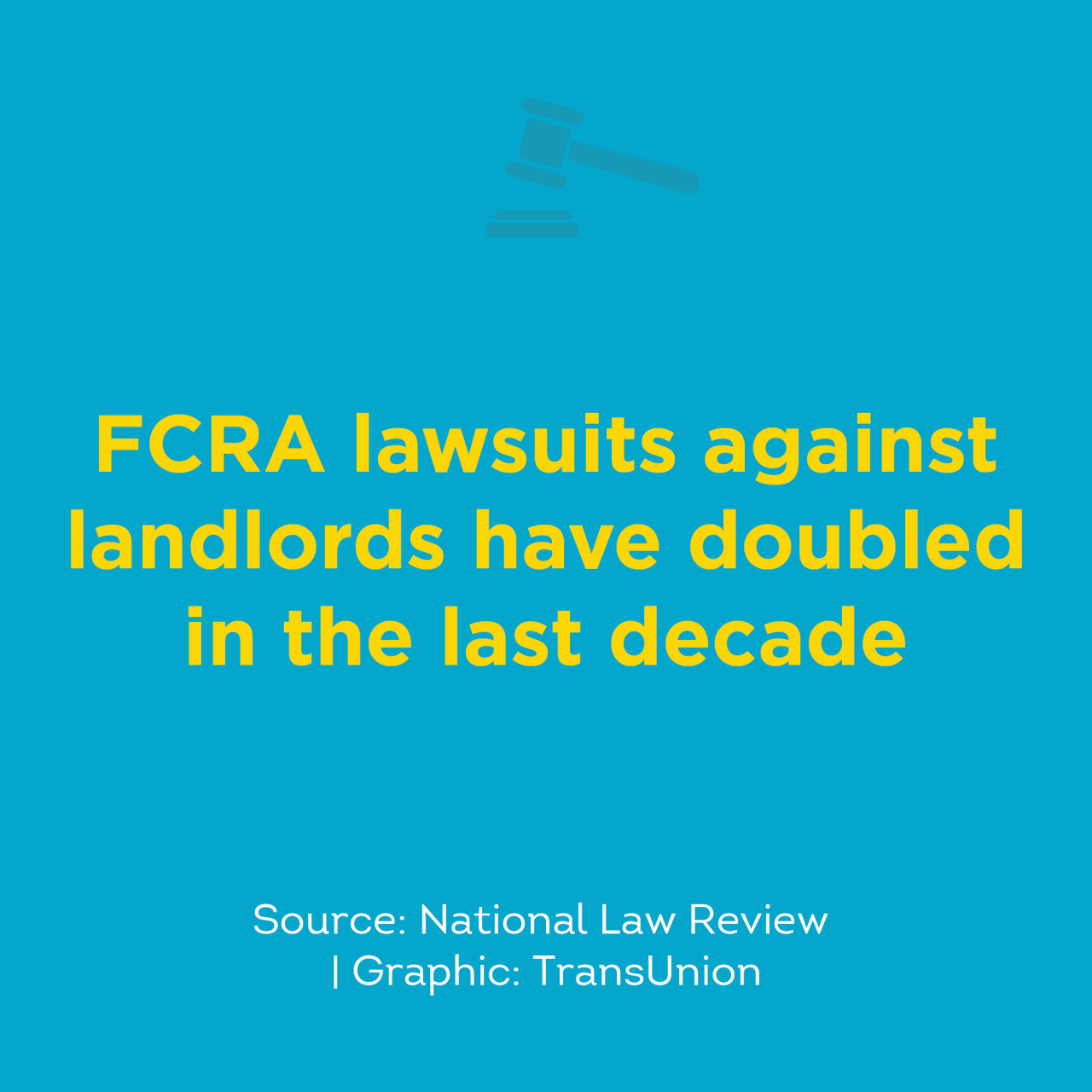

The Fair Credit Reporting Act (FCRA) is a critical set of regulations that protect the kinds of consumer data that show up on tenant background checks. According to the National Law Review, FCRA lawsuits have doubled over the last decade and settlement payouts can easily reach tens of thousands of dollars.

Could your property business sustain such an immense financial hit? Probably not. That’s why it’s essential to learn more about these laws and conduct thorough tenant background checks through an FCRA-compliant service like SmartMove.

This article covers the basics about FCRA compliance and how it applies to landlords. However, it should be seen as only a reference and not taken as legal advice. As always, contact your legal representation with any questions or doubts about complying to any laws.

What is the FCRA?

The Fair Credit Reporting Act (FCRA) is a law that protects the privacy of consumers and promotes the fairness and accuracy of managing consumer data. It was signed into law in 1970.

Among other stipulations, the FCRA dictates how consumer data companies can manage and share data, when third parties are allowed to access consumer information, how the retrieved information can be used, and what to do if the data causes someone to take adverse action (such as deciding not to rent out a property or denying a loan).

To access protected consumer data, a third party (in this case you, the landlord) need what’s called “Permissible Purpose.” This means that you first must have a valid reason to request someone’s data from a reporting agency. Legitimate reasons might include situations where information is required for employment, insurance, business, or other financial purposes.

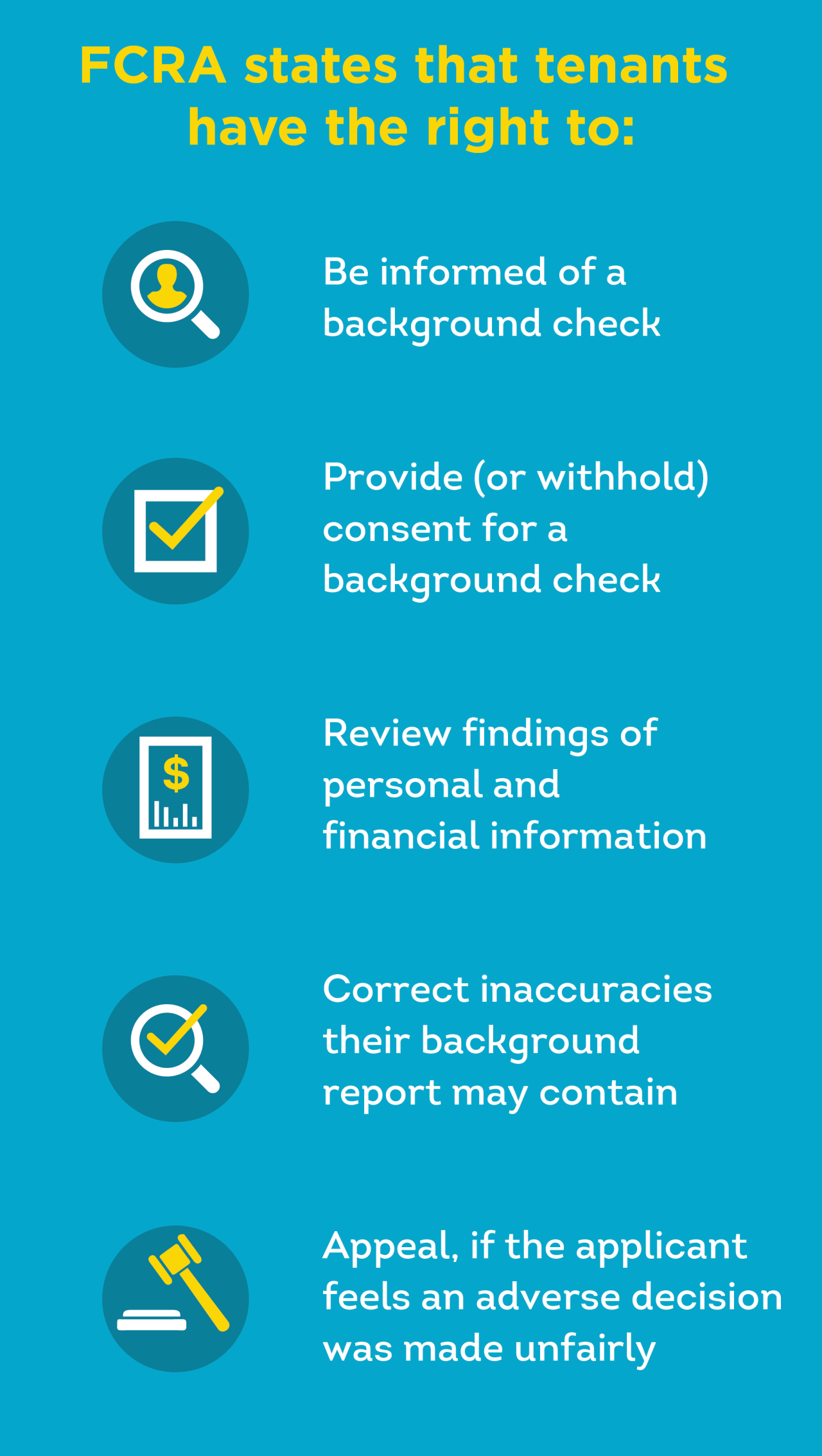

In addition to Permissible Purpose and other stipulations, the FCRA states consumers have the right to:

- Be informed of a background check

- Provide (or withhold) consent for a background check

- Review findings pertaining to their personal and financial information

- Correct any inaccuracies their background report may contain

- Appeal, if the applicant feels an adverse decision was made unfairly

What does FCRA Compliance Mean for Independent Landlords?

Landlords typically run into FCRA issues when conducting tenant background checks that include credit reports. Knowing how to read tenant credit reports can be a good way to understand your rental applicant’s financial track record. However, if you run a credit report, you should always make sure you’re doing it the right way.

First, determine that you have a Permissible Purpose for running a background check (see section above). Once you’re ready to run the background check, you have different responsibilities at every stage:

- Before Check: You must get consent from the rental applicant to run a background check and inform them that information gleaned from the report could be used for hiring leasing decisions. To simplify this process, some landlords include a credit report clause in the rental application.

- During Check/Before Adverse Action: If something unexpected comes up on the report that changes your leasing decision, the FCRA requires that you take some specific actions. You must notify the applicant, provide a copy of the report, and send them the FCRA Summary of Rights statement. Then, you must give them time to correct any inaccuracies or errors.

- After Adverse Action: If you decide not to accept the rental applicant after getting the results of the background check, you must provide them with an adverse action notice. This notice includes information about the screening company, how to dispute the findings, and details about what to do in the future.

Why Credit Reports are Essential for Rental Applicants

To have a successful rental business, you must do your best to confirm your potential tenant can pay the rent. Renter credit checks help you review your applicant’s relationship with money and see if they have a history of paying bills on time. They can help you make more informed leasing decisions.

But why stop there? Even more accurate than a typical credit check, a ResidentScore is a special report created just for landlords. It reveals more insights to a rental applicant’s finances and helps predict a tenant’s ability to pay the rent better than a regular credit report.

Examples of “Adverse Action” in Leasing Decisions

You may be excited about a potential tenant. However, that glee might fade after you get the results of their background check and see the unending list of fraud, felonies, property destruction, and vandalism that could potentially harm your property and other tenants. Naturally, you may second-guess your leasing decision in this case.

Deciding not to rent to someone based on the information from a background check is considered an “Adverse Action” in the language of FCRA. However, refusing to rent to an applicant is just one example.

According to the Federal Trade Commission, when it comes to landlords and tenants, “adverse action” includes:

- Denying the rental application;

- Requiring a co-signer on the lease;

- Requiring a deposit that would not be required for another applicant;

- Requiring a larger deposit than might be required for another applicant; and

- Raising the rent to a higher amount than you would for a different applicant.

If you take any of the adverse actions described above, you must notify the applicant and communicate the reason for the decision, following the steps outlined in the previous section.

Consequences of Violating FCRA Requirements

Like any federal law, violating consumer rights by not following FCRA can have seriously devastating consequences—especially for independent landlords. Housing lawsuits are often costly. They can completely devour your precious time and money.

The Federal Trade Commission stipulates that, if someone’s FCRA rights are violated, they can sue for the following damages and penalties:

- Actual or statutory damages;

- Attorney and legal fees

- Court costs

- Punitive damages (for willful violations)

All these damages can soon add up to an overwhelming amount. If you’re not careful, you could lose all of your rental profits to housing lawsuits.

How to Comply with FCRA During Rental Background Checks

Thankfully, FCRA-violations are largely preventable. If you know how to properly conduct a background check and stick to the letter of the law, the chances of being sued reduce drastically.

One way to help avoid legal transgressions is to use an FCRA-compliant background check provider. SmartMove has all required communication built-in, so you don’t have to worry about sending the right documents to renters. Additionally, reports are stored securely on the SmartMove website. You can focus on screening tenants instead of properly storing or disposing of reports.

Pro Tip:

You should run your renter application, screening process, and any compliance questions by your legal counsel, to help verify you’re not setting yourself up for trouble.

Run FCRA-Compliant Tenant Background Checks with SmartMove

As an independent landlord, potential danger is lurking around every corner. If you overlook a drip, it could transform into a full-blown burst pipe. Similarly, if you neglect a single detail of FCRA laws, your mistake can spiral into an expensive and destructive lawsuit that could cost you thousands.

Help protect your rental investment from the worst with FCRA-compliant background checks through SmartMove. Tenant credit reports can show you more about a rental applicant’s past, but handling them improperly could result in legal nightmares. With built-in consent, automatic communication, and data backed by TransUnion—a major credit reporting agency—you can feel more confident that your tenant screening process aligns with federal consumer data laws.

Reveal past crimes that could put your rental business at risk—without breaking the law yourself. FCRA-compliant criminal records checks and eviction reports can give you more of the information you need to make more confident leasing decisions.

You don’t need to move to the dark side to get the skinny on your rental applicant. Do rental background checks the right way with FCRA-compliant screening through SmartMove.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.