Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

The point of renting out property is to make money. However, not all landlords are doing everything they can to improve profit margins. To help maximize rental income, there are several things you can do. These include: always screen tenants with a reputable service like SmartMove, rent parking spots to tenants, install money-saving items like solar panels, require renters insurance in case of damages, and consider short-term rentals.

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

You shouldn't go to a waterpark if you don't want to get wet. Similarly, you shouldn't get into property management if you don't want to occasionally dip your toe into the waters of financial decision-making.

The goal of owning a rental property is to make money. While having a passive income source is one of the top benefits of being a landlord, that doesn't mean you can just set up shop and never have to look at a ledger again. If you're not careful about who you rent to or where you spend your money, you could end up sinking your whole operation.

The cost of evicting a tenant can reach $10,000. That amount could easily wipe out several years of rental profits for many independent landlords. Because of the risks, it's essential to do everything you can to find the right renters and protect your income.

From reinvesting in money-saving fixtures and on-site perks, to widening your rental windows and conducting lightning-fast, affordable tenant screening with a service like SmartMove®, there are many things you can do to help maximize your rental income.

The article below covers five ideas that could potentially help you make the most out of your rental business.

1. Screen Tenants

Eviction. Endless legal proceedings. Property damage. Assault. Negligence. Refusal to vacate. Rent non-payment. The list of nightmare possibilities goes on and on. Placing the wrong tenants can be outright dangerous--and extremely expensive.

One of the best ways to maximize rental income is to place reliable, trustworthy tenants in the first place. Thorough, consistent tenant screening can help you find better renters that are more likely to pay on time and respect your property.

When screening tenants, follow these five tenant screening steps:

- Host individual in-person or virtual property showings so you get to know a prospective tenant

- Require a rental application and know what questions to ask

- Learn how to verify rental applicant income and spot fraud

- Conduct thorough landlord reference checks to see if the tenant has a history of paying rent on time and taking care of the property

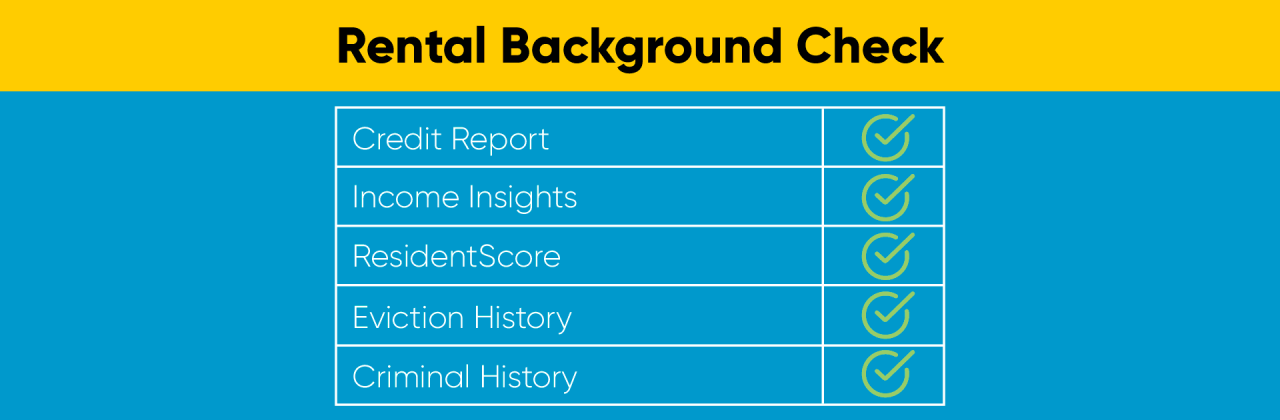

- Require a tenant credit report and criminal background check and run reports through reputable, FCRA-compliant providers

Screening can be extremely affordable--especially when compared to the cost of a bad tenant. Using a fast, professional tenant background check provider like SmartMove can be an excellent way to maximize your rental profits and discover more responsible tenants.

2. Rent Parking Spots and Storage to Tenants

Providing on-site parking is one of the top ways to attract renters. Having perks like parking and storage means you can increase your rental price to reflect these benefits. Alternatively, you could charge an additional fee if only some tenants are interested in renting parking or storage.

If you don't want to deal with the management of spot rental, you could even use a service like SpotHero to rent your parking spot on an hourly, daily, or monthly basis.

If you include parking or storage in your rental price, make sure to mention this when writing your rental ad. You can also call out that your building has parking or storage for an additional fee if you prefer to rent it separately. Keeping parking and storage separate can make your rental price more appealing and help you find tenants who are seeking the amenities you have to offer.

3. Require Renters Insurance

Requiring renters insurance is a smart business decision. The goal is to make sure you don't end up with costly bills for damage you shouldn't have to pay for. Renters insurance is a very reasonable price for tenants. It typically costs about ten dollars per month but can cover thousands of dollars in damages. It can cover damage from flooding, faulty wiring, fires, theft, vandalism, falling objects, and more.

Tenants with renters insurance are less likely to ask their landlord to cover damages because their insurance will cover the cost. On the other hand, tenants without renters insurance are more inclined to ask you to pay for damage. To help avoid having to pay for expensive damage, you should require renters insurance.

4. Install Solar Panels on Your Roof

Solar panels capture the sun's energy and convert it to electricity. According to provider Solar Nation, switching to solar can lower your electricity expense significantly. For example, southern California residents can save about $137 per month, Chicago residents can save $67 per month, and Boston residents can save $103 per month. Cutting utility expenses is a smart way to save money. You can say "utilities included" in your rental listing and justify a higher rent price.

According to finance site NerdWallet, solar panel typically costs between $15,000 and $25,000. Despite its high up-front cost, solar can save you much more in the long run. While solar can be a money-saving alternative for many people, solar panels are most likely to maximize profit if you live in an area with a lot of sun, above average energy costs, and have eligibility for rebates or other governmental incentives.

You can also rent your rooftop space to nearby buildings so they can install their own solar panels. Some buildings have better attributes for installing solar panels. Your roof is good for solar panels if it's newer, exposed to sunlight for the majority of the day, and has open space for equipment.

5. Consider Short Term Rentals

Services like AirBnB and VRBO allow you to list your rental property as a short-term rental. These services typically cater to individuals who are traveling and want to rent a space for the short-term. You can rent out your property for one night, one week, etc.

There are some important differences between short-term rentals and signing rental leases. For one, there's the potential to make more money in a shorter amount of time. However, short-term rentals will probably not be rented every day, meaning you might have a higher vacancy rate. Plus, there's some additional risk of letting people stay short-term, including potential damage. That being said, short-term rentals can potentially allow you to make money per day, rather than per month.

Help Maximize Your Rental Income with SmartMove

Trying to run an independent landlord business is like swimming in the deep end. If you're not constantly working to stay afloat, you could soon find yourself--and your rental profits--gasping for air. Help keep your head above water with in-depth tenant screening through SmartMove.

Requiring renter's insurance may help cover the cost of some damages. However, an even better way to save money is finding responsible tenants who won't destroy your property in the first place. SmartMove criminal record checks scour millions of felony and misdemeanor records, searching for a match to your potential tenant. Knowing if your rental applicant has a relevant criminal past can help you better protect yourself, your other renters, and your property.

As you get to know applicants through property tours, application questions, and reference checks, make sure to learn more about any previous rental problems. Eviction reports can help you learn if your potential tenant might be an eviction risk. Meanwhile, a tenant credit check, Income Insights, and a ResidentScore can help you verify your rental applicant's financial track record, so you can feel more confident they will pay the rent on time, every month.

Hold on to more of your money. With SmartMove, you get lightning-fast, ultra-affordable tenant reports backed by TransUnion--a major credit agency. There are no sign-up costs, maintenance fees, subscription costs, monthly minimums, or any hidden costs. Simply sign up, start screening, and pay only for what you need, only when you need it.

As you dive into property management, don't let your hard-earned profits careen into a belly flop. Help maximize your rental income with screening through SmartMove.

SmartMove

Great Reports. Great Convenience. Great Tenants.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.