Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

The process to apply for a rental unit looks much different than in years past. Rather than meeting with a landlord in person, applicants can send an application online without ever meeting face-to-face. While this convenience can provide landlords with a larger pool of applicants, it can come with a few drawbacks—most notably, fraud.

Fraud has been commonplace in the rental housing industry for years, but today’s digital landscape has accelerated housing scams, and the industry is finding it hard to keep up. As a landlord or property management company, reducing cases of rental fraud should be a top priority, not only to protect your property but to protect yourself and your small rental business.

To mitigate risk, it’s important that landlords understand what these risks are in the first place. TransUnion commissioned Forrester Consulting titled: Misunderstand And Inconsistency: The State Of Fraud In The Rental Housing Industry. It explores fraud in the rental housing industry to help landlords stay protected. It’s important for landlords to use robust technology solutions that identify and prevent fraud to maintain a successful rental business. You can view the full report here.

TransUnion also conducted its own in-depth industry study in 2020 titled Fraud in the Multi family Industry. Together these two studies highlight some of the big challenges landlords face when it comes to addressing fraud in the rental housing industry.

Throughout this post, you’ll find eye-opening rental industry fraud statistics, types of fraud that landlords face, recommendations for the future, and more. Our infographic sheds light on some of the weaknesses landlords face when fighting fraud and how landlords can protect themselves. Read through for an in-depth look at fraud in the rental housing industry, or use the links below to navigate the post.

The Rise of Fraud in the Rental Industry

Digital interactions are becoming increasingly popular between landlords and tenants, especially in urban centers where virtual communication is often preferred. While the digital age offers many benefits, such as larger applicant pools and easier communication, it has opened the door to more fraudulent applications.

Today, many landlords and property management companies in urban corridors have transitioned from in-person interactions with rental applicants to digital interactions to cater to customer preferences. However, this has made it more difficult to verify application validity and find tenants with good qualities.

In fact, between 2016 and 2018, 97% of property management companies have experienced fraud in some capacity, with 80% experiencing it up to 20 times, according to the Forrester study. Overall, about 59% of rental applications are submitted online versus in-person, and this digitization of the rental application process has opened new avenues for fraud.

In addition to the switch from in-person applications to digital applications, the COVID-19 pandemic was another contributing factor to the rise of fraud in the rental housing industry. TransUnion’s 2020 study explored how multifamily property managers were managing fraud in the changing environment.

They found that

- 41% of respondents discovered fraud after move-in

- 67% are concerned about the future of fraud growth

Over the course of the coronavirus pandemic, fraud has steadily increased, and 22% of applicants failed authentication or were identified as high risk. During the pandemic, fraud reached a high of 15% compared to 10.3% over the same period in 2019.

It’s important for landlords to understand the risk factors of fraud, as it can result in several negative consequences. Some lasting impacts of fraud, as identified by Forrester, include:

- Increased repetitional damage: 59%

- Increased evictions: 51%

- Internal time spent comparing applications to find discrepancies: 46%

- Increased financial loss: 35%

- Lighter vacancies: 32%

- Increased bad debt: 22%

These are just some of the lasting impacts of fraud that landlords can experience, which is why having the right systems and practices in place are essential to mitigating risk.

Types of Fraud Landlords Face

With increased digitization comes more types of fraud. Data breaches are becoming more commonplace, and Forrester estimates that one recent breach alone caused an increase of 5% to 10% in identity theft-related fraud in the U.S. With fraudsters becoming smarter, companies are having difficulties staying ahead of their advanced tactics. Some types of fraud landlords should be aware of include:

- Rental application fraud: This the practice of lying on a rental application, whether it be providing false income or uploading an altered photo.

- Synthetic fraud: This is one of the fastest-growing types of fraud. It’s where an applicant creates a fake identity using real and false information. For example, a fraudster may create a fake Social Security number and pair it with a real address to create a fake identity to gain access to a rental property.

- First-party fraud: This type of fraud is performed by the individual, which is typically the tenant, where they use fake or altered information, such as pay stubs and previous addresses, to qualify for a rental property.

- Third-party fraud: This is when an individual uses another person’s identity or information to qualify for a rental property, such as misrepresenting who they are with someone else’s Social Security number, name, and date of birth.

These are some of the most common types of fraud that landlords can face. It’s important to be aware of them and take steps prevent them from occurring in the first place.

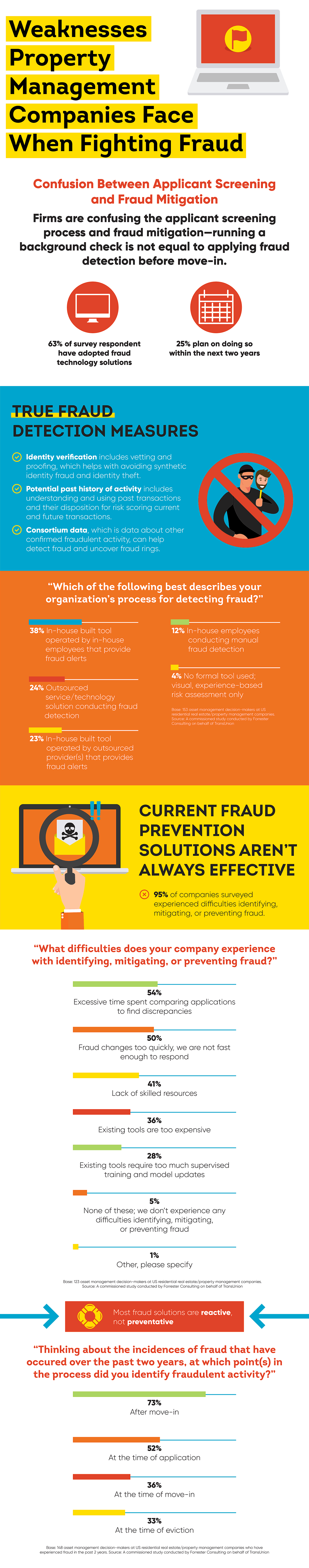

Weaknesses Property Management Companies Face When Fighting Fraud

The rapid increase of fraud in the rental housing industry is proving to be a challenge for many landlords and property management companies. One of the most significant weaknesses is that most landlords are confusing applicant screening with fraud mitigation. While tenant screening is an important step that all landlords should take when vetting applicants, it isn’t a fool-proof measure to prevent fraud. Adopting fraud mitigation measures will help landlords be more effective in getting quality renters and become more cost-efficient by reducing involuntary turnover costs.

Another weakness is that many fraud solutions are reactive and not proactive, meaning actions aren’t taking place until after the damage is done. However, 63% of respondents to the Forrester survey claim to have adopted fraud technology solutions, with a quarter intending to do so within the next two years. But these solutions aren’t always effective, and 95% of companies surveyed experienced difficulties identifying, mitigating, or preventing fraud. Additionally, 73% of respondents experienced fraud after an applicant moved in, and over 70% identified the fraud within the first six months after move-in. This lack of prevention has led to forced tenant turnover well before the typical end-of-lease cycle, costing landlords time and money.

One cause is that most fraud solutions are manual and lack advanced capabilities, such as identity verification and comparing an applicant’s risk to indicators established by the company.

Some examples of true fraud detection measures include:

- Identity verification includes vetting and proofing, which helps with avoiding synthetic identity fraud and identity theft.

- Potential past history of activity includes understanding and using past transactions and their disposition for risk scoring current and future transactions.

- Consortium data, which is data about other confirmed fraudulent activity, can help detect fraud and uncover fraud rings.

How Landlords Can Protect Themselves From Fraud

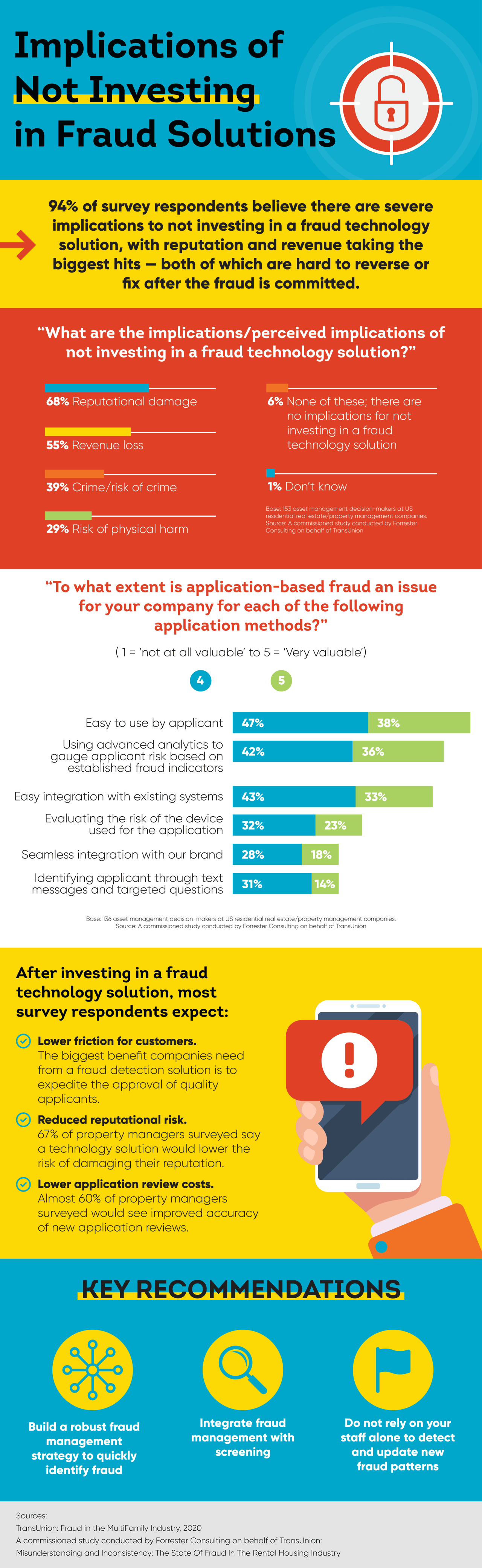

Landlords put a lot on the line when operating their rental business, such as their reputation and their finances, which is why it’s essential to enact protective measures. Forrester reported that 94% of survey respondents believe there are severe implications to not investing in fraud technology solutions. These respondents claimed reputational damage and revenue loss were the most significant implications of not investing in fraud solutions.

However, most landlords and property management companies are hopeful. After investing in a fraud technology solution, most survey respondents expect:

- Lower friction for customers. The biggest benefit companies need from a fraud detection solution is to expedite the approval of quality applicants.

- Reduced reputational risk. 67% of property managers surveyed say a technology solution would lower the risk of damaging their reputation.

- Lower application review costs. Almost 60% of property managers surveyed would see improved accuracy of new application reviews.

To reach this level of confidence in fraud technology solutions, landlords must take action. Some key recommendations for landlords to protect themselves and their properties from fraud include:

- Building a robust fraud management strategy to quickly identify fraud: Get one step ahead of fraudsters. Landlords should implement fraud management measures when a rental application is submitted first, rather than after screening, or worse—after a tenant moves in.

- Integrating fraud management with screening: Background screening and fraud management shouldn’t be used separately from one another. Rather, landlords should screen and implement fraud management and risk scoring tools at the same time to get a holistic view of an applicant.

- Not relying on staff alone to detect and update new fraud patterns: Fraud patterns are constantly changing and advancing, which is why a versatile screening solution integrated with a fraud management functionality that’s regularly updated should be used to detect emerging and complex types of rental fraud.

Protect Your Property With SmartMove’s Identity Verification

As fraud in the rental housing industry accelerates, it’s important to be proactive to stay protected. With SmartMove’s built in identity verification, you can have more peace of mind knowing the applicants you are screening are who they say they are.

SmartMove uses sophisticated knowledge-based verification technology to authenticate your applicants. Knowledge-based authenticationprovides greater certainty that the applicant is who they say they are by delivering an out-of-wallet examination, the complexity of which is driven dynamically by the risk of the transaction.

No matter what applicant you have, we’ve got you covered. Our question set draws from many kinds of data sources to offer dynamic, effective and trustworthy authentication.

Sampling of available data sources

With SmartMove Identity Verification you can get:

- Sophisticated logic: Exam creation uses parameter-driven questions, use of dummy or “red herring” questions and time to answer limits to authenticate identity.

- Diverse data sources: Includes demographic, credit and non-credit data to reduce ability of fraudsters to get answers from public record searches or data breaches.

- Compliance with regulations: Minimize risk of fraud while satisfying Know Your Customer (KYC) compliance with federal law.

- Applicant-friendly process: Can reduce abandonment and process good applicants quickly

With effective screening tools, SmartMove helps landlords make confident leasing decisions.

- Built-in ID authentication, as we explained above our process uses sophisticated knowledge-base verification to ensure your applicant is who they say they are.

- ResidentScore, our proprietary credit score for the rental industry, is proven to reduce eviction risk better than a generic credit score.

- Income Insights, a report that helps to analyze applicant self-reported income, helps to reduce renter payment risk.

With unique insights and critical delivered information fast, landlords can fill their rental unit quickly and with more confidence. Plus, our quick process enables renters to be screened right away and potentially move into their dream rental unit the same day.

Sign up for free and screen quickly and confidently.

Screen with SmartMove today!

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.