Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Get a better understanding about SmartMove’s credit report and how SmartMove’s powerful information and insights make it possible to achieve trust in the moment.

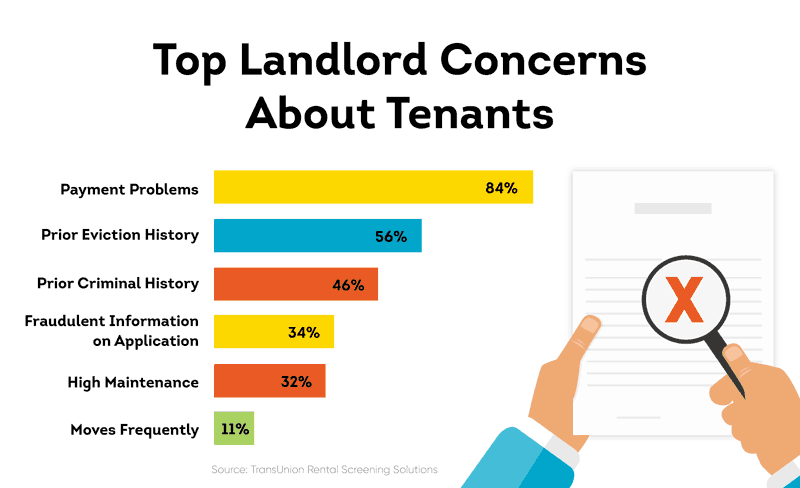

As a landlord, finding dependable tenants is the key to running a successful rental business. According to a SmartMove survey, property owners cited non-payment of rent as their number one concern, and for good reason. The last thing a landlord wants is to dip further into their own pockets to pay for a second mortgage or deal with the burden of an unexpected rental vacancy.

A full-credit report from SmartMove can provide crucial financial insights and is a great way to better understand how your applicant handles their financial responsibilities.

The credit report provides a more holistic view of an applicant’s financial situation, allowing you to review aspects such as their payment history, amount of debt they’re carrying, and other financial characteristics that are essential to vetting your applicant. Unique to SmartMove, landlords also receive an applicant’s ResidentScore, which comes with every package. ResidentScore is SmartMove’s proprietary credit score that is designed specifically for the rental screening industry and is proven to predict eviction risk 15% better than other generic scores.

A credit report, accompanied with ResidentScore, can help you learn pertinent facts about your applicant to help you make a more informed leasing decision. This is why it’s necessary for landlords to know how to read a credit report to uncover the full story about your rental applicant.

Below, we’ll answer important questions, such as what to look for in a credit report, how to interpret credit report results, and how SmartMove credit reports can help landlords be more confident and make trust in the moment achievable.

Why Landlords Should Review Credit Reports

Reviewing an applicant’s entire credit report is essential. Doing so gives you a fuller understanding of how they handle their finances and manage their debt, along with other key financial insights. Our survey of landlords reveals that their number one concern is nonpayment of rent, and may require you to:

- Pay the rental unit mortgage out of your own pocket

- Deal with financial stress

- Address potential unplanned turnover or even a time-consuming eviction

- Face a costly vacancy

Getting an applicant’s credit score is good start, but reading the entire credit report can give you the whole story of your prospective applicant’s financial state, which can help you choose a tenant that is right fit for you.

Credit reports for tenant screening may provide information about:

- Past and present credit accounts

- Accounts in good standing and accounts that are late

- Account balances that are due and payment history

- Negative accounts with late payments or debts significantly in arrears that have been sent to a collection agency

- Tax liens

- Collections

- Negative accounts paid or charged-off

Now that you know more about what kinds of information you can learn from a credit report, let’s take a look at how to read a credit report in the next section.

How to Read a Credit Report

A credit report provides crucial information about your applicant that can help you land your next great tenant. It’s important that you know how to read it. You’ll be in a better position to better understand how your applicant handles their finances.

Credit reports contain information on past and current credit accounts and distinguish between accounts in good standing and those that are past due. They also display account balances that are due, payment histories, and negative accounts with late payments or debts that have been transferred to a collection agency.

Credit reports from SmartMove consist of five main sections, including:

- Basic identifying information

- Profile summary

- Tradelines

- Collections

- Inquiries

Each section provides information that can give landlords the complete picture of an applicant’s financial behaviors. Below, we’ll provide samples of each section of our tenant credit reports and information on how to read them.

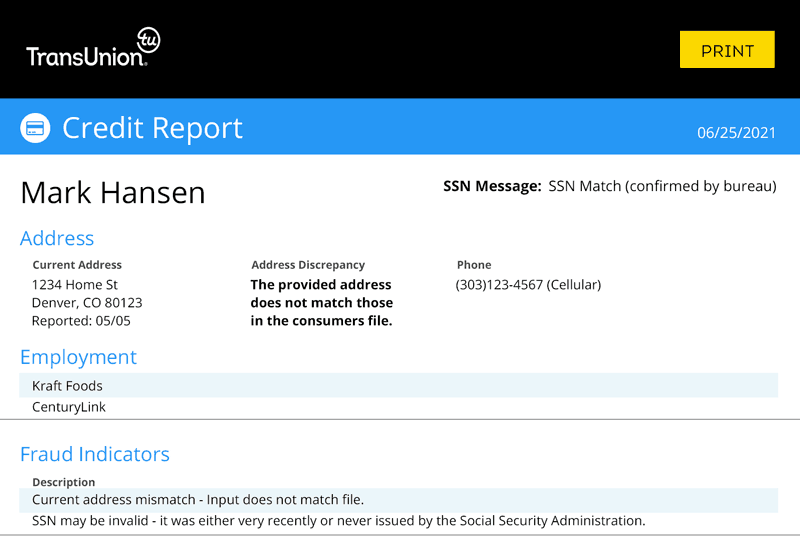

Basic Identifying Information

The first section on a SmartMove credit report is an applicant’s basic identifying information. This includes an applicant’s name, current address, recent employer history, and phone number. Having this information allows you to compare it to the information they provided on their rental application so that you can ensure everything lines up. An applicant with missing or inaccurate personal information can be a red flag. With the ability to double-check basic identifying information, you can have more confidence knowing an applicant is who they say they are as you take time to make a tenant decision.

Note: SmartMove doesn’t share the renter’s social security number with their potential landlord. In fact, landlords don’t need an applicant’s SSN to start the process, just their email address. This makes trust in the moment achievable because SmartMove acts as the middle man and helps to keep sensitive renter information from falling into the wrong hands.

Credit Profile Tradeline Summary:

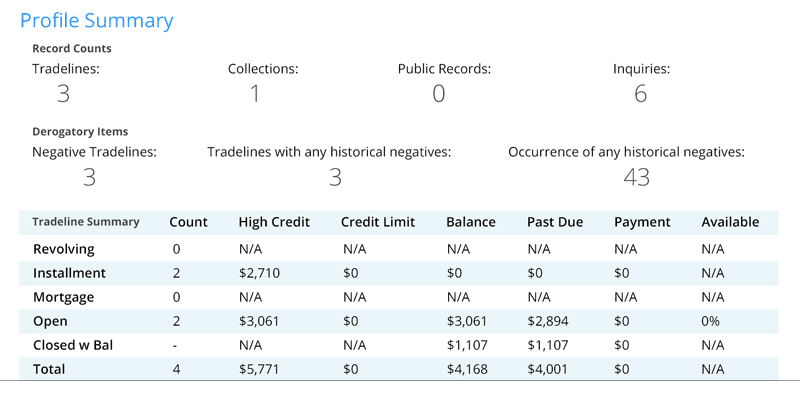

The Consumer Credit Profile Summary shows an overview of an applicant’s overall activity. This section is broken into three parts to evaluate factors such as payment history, debt levels, and monthly financial obligations.

The top portion of the profile summary contains:

- Total number of tradelines, which is the sum of revolving, mortgage, installment, and open accounts

- Total number of accounts sent to collections

- Total number of public records

- Total number of inquiries

The middle section includes delinquency status, which provides the following information:

- Total number of negative tradelines

- Total number of tradelines with any historical negatives

- Total number of derogatory occurrences

The final section includes a chart with more in-depth credit history information organized by account type:

- Total number of credit accounts

- Each account’s highest outstanding balance

- Maximum credit limit approved by the lender

- The amount owed on the date of the credit report

- Amount past due on the date of the credit report

- Monthly payment amount due based on payment terms

- Amount of available credit for revolving accounts

An applicant’s Profile Summary gives landlords a complete overview of their financial standing. With this information on hand, landlords can analyze how many accounts an applicant has, their amount of debt, payment history, and other important factors to better assess risk.

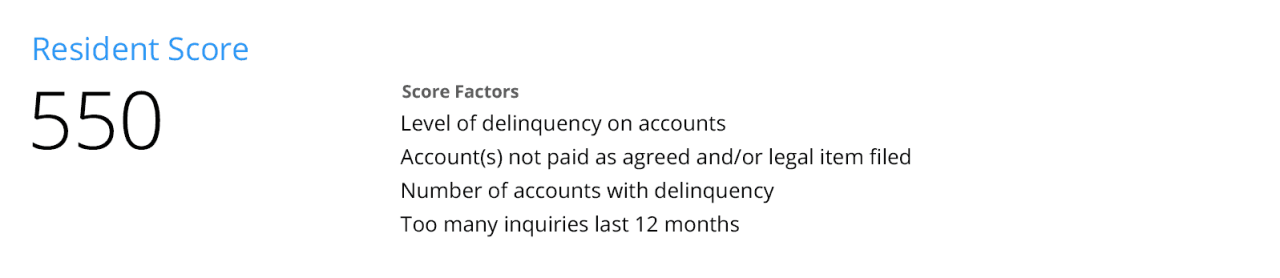

SmartMove ResidentScore:

ResidentScore is important for a variety of reasons. Typical credit scores are used to predict the outcome of a loan, not rental performance, which is why TransUnion built ResidentScore. ResidentScore is a kind of credit score, but is designed specifically for tenant screening. It helps landlords understand an applicant’s level of risk. ResidentScore is proprietary to SmartMove and is powered by an analysis of more than 500,000 actual resident records.

ResidentScore makes trust in the moment possible because:

- Predicts risk 15% better than a typical credit score

- Identifies 19% more skips than other typical credit scores

- Scores more applicants with limited history or thin files

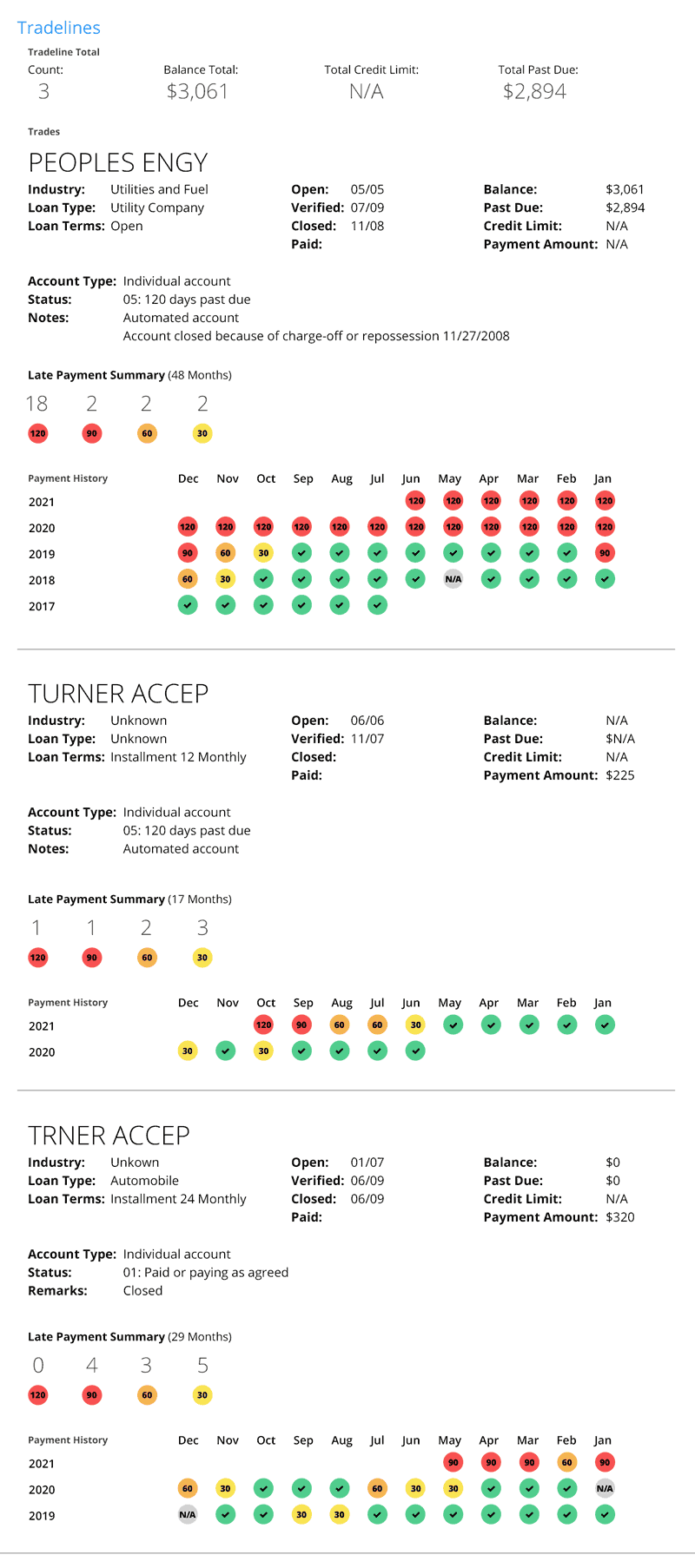

Credit Report Tradelines:

Tradelines help describe consumer accounts by reporting information to consumer reporting agencies, such as TransUnion. Tradelines provide detailed information about different types of credit accounts, such as mortgage, revolving, open and close, and installment accounts. Examples of these accounts can include home loans, auto loans, credit cards, and other lines of credit, along with a consumer’s additional debt obligations.

Information landlords can review include:

- Account name

- Account type

- Credit balance

- Credit limit

- Who’s liable for payment

- Payment status

- Date of delinquency

- Date account was opened

- Date account was closed

These tradelines can help you get a better picture of an applicant’s financial history and habits. You can also review their payment history, which will be broken down into 30, 60, 90, 120, or 180 days delinquent. Having access to this information is especially important for landlords, as it enables trust in the moment.

Lastly, a tradeline summary will also note derogatory accounts, which are accounts that are significantly late, and will show whether a creditor determined a consumer is in default. Foreclosures, charge-offs, and accounts reported or sent to debt collectors are examples of derogatory accounts that can stay on a credit report for seven years or longer after the last activity date.

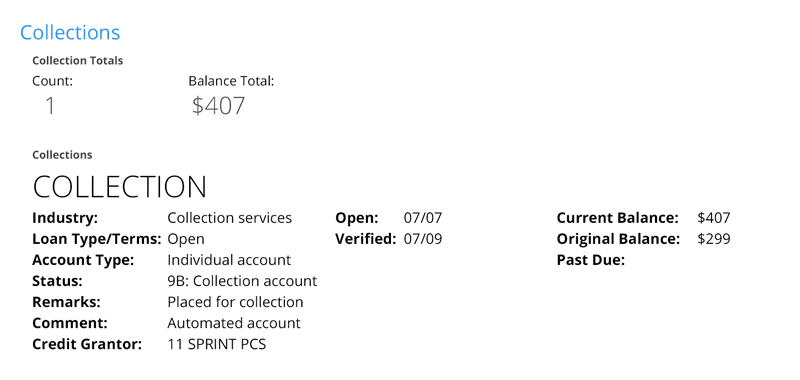

Credit Report Collections:

Another crucial component to a credit report is a Summary of Collections, in which you’ll find any accounts that a creditor has sent to a collections agency. You’ll be able to identify accounts that are significantly overdue. Examples of unsecured debt that might show up in this section include credit cards or personal loans. The collection information you’ll be able to review include:

- Name of the collection agency

- Account type

- MOP (Manner of Payment) code and status

- Debt collector status of collection

- Original creditor

- Original balance of the collection

- Current amount owed

Looking at an applicant’s collection history is another crucial insight for landlords, as it allows them to see what payments they fell behind on and assess their risk level. If an applicant has multiple accounts that have been sent to collections, then it may be a red flag.

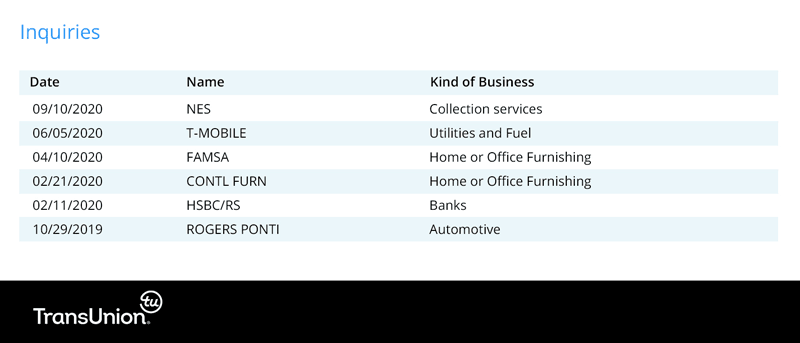

Credit Report Inquiries:

The final section of a SmartMove credit report includes inquiries. The Inquiries section contains a list of companies that have reviewed a consumer’s credit file during the last one to three years, depending on the applicant’s geographic location and the reason for the inquiry. Inquiries allow landlords to understand a applicant’s credit activity. Typically, if an applicant accumulates a large number of inquiries in a short period of time, it can indicate that they might be taking on more debt. This is because additional lines of credit can suggest they’re overextending their financial limits, which can result in them falling behind on payments or defaulting and getting sent to collections.

The Inquiries section on a SmartMove credit report highlights “hard inquiries,” which occur when lenders review a consumer’s credit profile to determine whether they should provide them with a line of credit. Generally, hard inquiries will impact a consumer’s credit score.

Note: When applicants are screened with SmartMove it won’t negatively impact their credit profile. Our credit report will result in a soft inquiry, which means applicants can have peace of mind knowing their credit score won’t be impacted, while landlords can gain trust by reviewing their financial habits and history. With both parties’ needs in mind, trust can be built so landlords and tenants can achieve their goals.

At SmartMove, we provide credit reports that are easy to read and interpret. From basic identifying information to inquiries, these five components of a credit report can give landlords confidence in the applicant they’re vetting.

Red Flags Credit Reports Can Help You Spot

How can you be sure that your applicant is right for you? Without a credit report that gives you their whole financial story, choosing a reliable tenant can be difficult to accomplish. After all, it wouldn’t be wise to rely solely on your gut.

SmartMove makes it possible to get important tenant information quickly. We’ve screened millions of renters and counting. For more than a decade, we’ve helped 3+ million landlords and 400+ companies make better leasing decisions.

With SmartMove landlord credit checks, you will get access to TransUnion credit data, which allows you to get a more detailed view of your applicant’s financial picture. With this information on hand, determining whether an applicant is reliable and right for you can be done nearly instantly so you can reduce rental property vacancies.

To help you better assess potential risk, credit reports from SmartMove will help you potential spot red flags, such as:

- Low credit score

- Late payments

- Payment gaps

- Derogatory marks

- Significant debt

- Delinquent accounts in rental history

Identifying these red flags from the start can help you ensure you have more confidence in the person you select to lease your rental unit.

SmartMove makes trust in the moment possible for both landlords and their prospective tenants. An applicant-friendly process, combined with fast report delivery along with robust insights enables you to make more confident leasing decisions quickly. This quick information exchange ultimately builds trust fast. It enables a more informed decision you can make on the spot. It makes it possible for the applicant to get approved and potentially move in the same day.

Better Assess Risk With ResidentScore

SmartMove is built to serve independent landlords and to deliver the crucial information they need to make a more informed leasing decision.

There are many kinds of credit scores. Oftentimes, those credit scores help banks appraise risk for loans like auto loans or mortgages. But SmartMove is different. We help landlords better analyze renter risk with ResidentScore, our proprietary credit scoring model built for rental screening, which is proven to predict eviction risk 15% better than a typical credit score and identifies 19% more skips. In addition, ResidentScore has the ability to score those with limited history or a thin file.

Understanding risk is essential to being a landlord. It helps you determine if your applicant is the right fit for you and your rental criteria. With ResidentScore, landlords can be more confident that they are evaluating an applicant’s creditworthiness as it pertains to a rental housing context. These insights, delivered quickly with our consumer push process, make it possible to achieve trust in the moment.

What You Get With SmartMove Tenant Screening

With SmartMove, you’ll receive critical tenant screening insights and powerful information nearly instantly.

SmartMove helps landlords make more confident leasing decisions on the spot. With the help of our comprehensive credit, background, eviction, and Income Insights reports and ResidentScore, it’s easy to gain trust in the moment because:

- You get access to TransUnion credit data

- You get built-in applicant identity verification

- You get ResidentScore, our proprietary credit score for the rental industry

- You get Income Insights, which helps you analyze renter income fast

- You get comprehensive, FCRA-compliant reports in minutes

With SmartMove, you get a convenient way to get critical screening information fast. Doing your own background searches, going to courthouses to get records, making income check calls to employers or waiting to get a credit report can cause delay or impair accuracy. SmartMove provides a way to accelerate the process to help you fill your unit faster and with more confidence.

We know that trust is a two-way street, which means that the applicant can also feel confident about the SmartMove process.

Applicant-friendly process:

- Applicant explicitly consents to screening and has the option to decline to be screened

- Applicant is put in control with our consumer “push” process that empowers them to share data with who they want when they want

- Applicant can safely share their sensitive personal data

- Applicant Social Security number or bank account numbers will not be shared with the landlord

- Applicant credit score not negatively impacted because our push process results in soft inquiry

Applicant can be evaluated in a matter of minutes which helps to move into your desired unit faster

SmartMove makes it easy for tenants to share information, decide when and with whom their data is pushed, avoid dinging their credit score, and land that rental unit faster. With trust achieved on both ends, landlords and applicants can achieve both of their goals.

Achieve Trust in the Moment and Make a Confident Leasing Decision On-The-Spot With SmartMove

SmartMove insights can inspire trust in the moment to help landlords choose great tenants on the spot, all while allowing the renter to be confident that able to share their personal information safely.

A big key to enabling trust in the moment is SmartMove’s consumer push process that enables applicants to quickly share their information. Nearly instantly, landlords can receive critical information, allowing them to make a more informed leasing decision. Our fast report delivery also comes with unique insights, such as ResidentScore with 15% better eviction prediction and Income Insights that quickly analyzes tenant income—both of which are only available at SmartMove.

SmartMove offers full credit, background, eviction history, and Income Insights reports. Importantly, every SmartMove package comes with ResidentScore, so landlords are better equipped to analyze potential renter risk.

Landlords also benefit from SmartMove’s built-in applicant identify verification, which can:

- Confirm that your tenant is who they say they are

- Help mitigate the risk of housing fraud

- Lower transaction abandonment

- Increase ability to choose a great tenant on the spot

For the renter, SmartMove’s process makes exchanging sensitive information fast and secure, so both landlords and prospective tenants can confidently achieve their goals. Applicants are put in charge of the process. They initiate the sharing of their data and explicitly consent to screening. Ultimately, applicants control when and with whom their details are shared. On top of that, our credit report results in a soft inquiry for the applicant, meaning they won’t have any adverse effects on their credit score.

Having these critical insights nearly instantly makes it easy for landlords to evaluate a potential tenant's responsibility and financial habits on the spot, better enabling them to make quick, yet confident leasing decisions on the fly.

Being an independent landlord isn’t always easy, which is why finding great tenants from the start is essential. At SmartMove, our credit reports make it easy to review key financial information, such as debt obligations, payment history, and more, so you can find a renter who will pay on time and respect your rental.

Now that you know how to read a credit report for tenant screening, it’s time to find a great tenant for your property. From start to finish, the process is easy:

- Sign-up for free

- Invite your applicant to be screened

- Choose who pays for the screening (you or your applicant)

- Get great reports in minutes

SmartMove uses data from TransUnion, one of the nation’s top credit reporting agencies that has 4 decades of consumer experience. With 9 out of 10 SmartMove users recommending our services, you can have confidence knowing you’ll find a trustworthy tenant for your rental with SmartMove.

Great Reports. Great Convenience. Great Tenants. That’s the power of SmartMove.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.