Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

(Updated: We’ve recently updated this article to add 5 more mistakes that can kill profit. See mistakes 6-10 for our latest additions.)

When you first started looking into purchasing a rental property, you likely had dreams of a profitable return on your investment. After all, no one goes into business to lose money. But what if you were losing money in ways you didn’t even realize? Below are some the mistakes landlords make that eat into their rental profits.

1. Not Properly Crunching Your Numbers

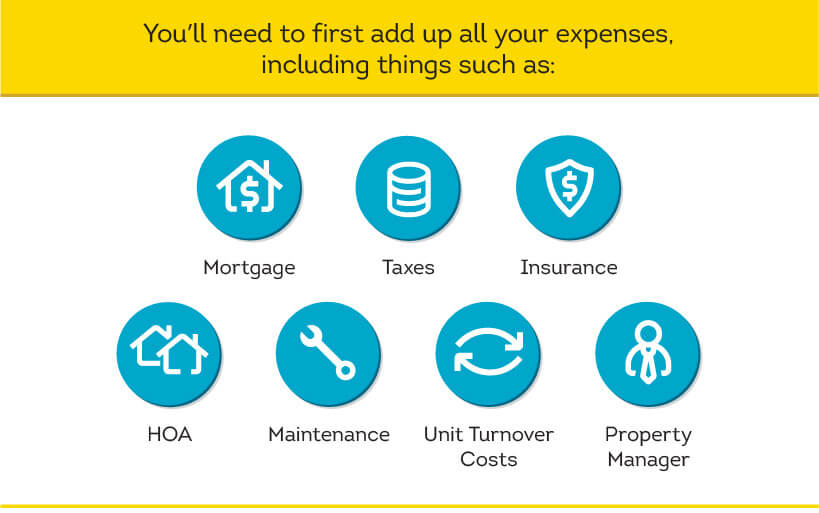

When looking to buy an investment property, it’s crucial to first calculate all your expenses and what you can reasonably expect to get in rental profit. If you skip this step, you could wind up in trouble when you realize that your monthly rental income only covers part of your monthly rental expenses. Doing the math may sound like a pain, but it’s worth it when you consider your bottom line.

Once you know your expenses you’ll be better able to set a rent price to help make a reasonable monthly profit. In terms of profitability, one guideline to use is the 2% rule of thumb. It reasons that if your rent is 2% of the purchase price, you are more likely to generate positive cash flow. But the market drives rental prices, so you’ll have to do your research to determine what you’re able to rent for in the neighborhood. Renting for under market value risks tanking your monthly profit, but so will vacancies. If an asking price is too high, you could be left with an empty apartment for several months, and you’ll likely end up renting for whatever the going market rate is.

Do your research ahead of time. The rent prices of comparable properties will give you a good idea of how much you will be able to charge your own tenants. Check the market rate for rent in the area you’re considering by checking with property managers who handle similar properties, asking real estate agents, and looking at rental advertisements. You’ll want to revisit this step during each tenant turnover or lease renewal to be sure you’re charging appropriate rent and raising rent during renewals.

2. Choosing a Bad Rental Location

Location is a highly influential factor as to why renters choose to rent where they do. If you’re a new investor looking for a rental property, work with a real estate agent who is familiar with the area and can point you to some of the better neighborhoods for rentals. In general, tenants look for areas that are close to public transportation, dining, shopping, schools and universities.

If the location of your rental is undesirable, you’re going to struggle to find renters. This means your unit will take longer to turnover, you won’t be able to charge as much in rent. Plus, you’ll end up with a smaller pool of renters to choose from because it might take longer to find someone who’s a good fit for your rental. All of these factors can cause you to lose out on income, therefore, location is a key factor in choosing a successful and profitable investment property.

3. Taking Too Long to Turnover a Unit

The expenses of turning over a unit can add up quickly (mortgage, utilities, cleaning, repairs, and advertising), and the longer the unit is empty the more the expenses start to pile up. In order to be profitable as a landlord, you want to turn over the unit quickly to avoid extended vacancy periods.

On the other hand, rushing to fill a vacancy without thoroughly screening a tenant can be expensive in the long run. Evictions cost $3500 on average, so you’ll want to be sure you aren’t skipping this important step.

4. Ignoring Maintenance Issues

Not addressing rental property maintenance issues quickly can lead to much bigger problems down the road. What may have started out as a small leak that goes unfixed could become a huge problem one day when the unit is flooded. In the event of a tenant turnover, you may want to take advantage of the vacant property and perform maintenance without the hassle of scheduling conflicts and bothering any current tenants. A rental unit that’s in good condition when you’re looking for a new tenant is much more likely to attract a better quality renter.

Regular rental property inspections can help prevent much bigger issues down the road, but you’ll also want to consider keeping the lines of communication open. A good landlord-tenant relationship is communicative and cooperative. Maintenance repairs can be inconvenient for a tenant, but if they feel that the landlord will be respectful of their time and get repairs done quickly, they’ll be more likely to report a dripping faucet (which can lead to mold in the wall) or an electrical issue (a possible fire hazard). Staying on top of maintenance also indicates to a tenant the type of condition you expect the property to be returned in. After all, if you don’t care about the property, why should they?

With all of that said, you’ll want to be efficient in completing renovations and repairs. Taking too long to get the unit ready can cause you to miss out on rental income which can add to your turnover costs. You also don’t want to over-improve the property above the market rental rate, because it’s not likely that you will get a return on this investment.

5. Skipping Tenant Screening

In the interest of turning over your unit quickly, you may be tempted to skip tenant screening, but this is a mistake that can cost you much more in the long run. Tenant screening offers many benefits. It helps you ensure you have a renter in your property that will pay their rent and be a reliable tenant. A tenant screening service such as SmartMove is quick and easy and allows you to pass on the screening fee to the applicant.

A reputable tenant screening service saves you time, energy, and money. Spending a little time and effort on screening tenants now could prevent costly evictions later. It’s hard to put a price on a respectful, stress-free tenant that pays on time and takes care of the property.

6. Not Paying Enough Attention to the Security Deposit

Collecting a security deposit to cover minor damages during tenancy or after a tenant moves out is standard operating procedure for most landlords but many landlords don’t give it much thought outside of how much to collect. That’s a common mistake with rental properties.

There are 3 distinct areas to pay attention to regarding the security deposit: figuring out how much to collect, abiding by state laws and knowing what security deposits cover.

It is important to collect a reasonable amount of money for a deposit. The deposit can serve be an effective tool to deter tenant neglect or breach of contract with the rental agreement.

It is important to be aware that there are laws regulating the security deposit, as each state sets its own limits on how much money a landlord can even collect and under what circumstances.

There are real consequences for violating a state’s security deposit law. Many states have penalties that can cost the landlord multiple times the value of the deposit.

It’s also important to understand what a security deposit does and does not cover, as this also varies by state and could be contested in court. Generally, it does not cover normal “wear and tear” such as new carpeting or a fresh coat of paint. However, in addition to repairs beyond wear and tear, such as a broken window, in many states landlords can often use a security deposit to cover unpaid rent. It goes without saying, but landlords should keep all receipts and document the work meticulously, especially if they do any of the repairs themselves.

7. Keeping Sloppy Documentation and Paperwork

The common mistake that landlords with rental properties make when dealing with security deposits brings us to another pitfall: keeping sloppy documentation. Like any business, rental properties must pay attention to the paperwork. A paper trail is particularly important when dealing with the finances, from tracking expenses to accounting for a security deposit to paying taxes. In particular, improper payment of taxes can lead to all sorts of problems such as audits or penalties. Conversely, a landlord who keeps meticulous financial records on expenses might be rewarded with tax breaks every April 15.

The lease is probably the most important piece of paperwork, as it is a legally binding document between a landlord and tenant. Many landlords, however, use a generic lease without paying attention to the details. Some of these leases may take into account local laws and regulations. Landlords should either get a professionally prepared lease or do their homework to ensure the lease is legally compliant and protects their best interests.

A landlord should keep a file on each tenant that includes references, contact information, security deposit, etc. Basically, anything that has to do with that tenant before, during and after tenancy.

8. Not Conducting a Move-In and Move-Out Inspection

Ignoring the move-in/move-out inspections is another common mistake landlords with rental properties can easily avoid. This one is also related to keeping proper documentation and paying attention to the security deposit. Simply put, if you don’t document the condition of the property before the tenant moves in, it becomes quite difficult to prove that he or she caused any damage found after moving out. It becomes a “he said, she said” situation. Keep in mind, local law may regulate whether an inspection should be done and how it should be conducted.

A comprehensive rental property inspection can help protect the landlord’s investment and clarify expectations with the tenant. Every damaged item, scratch on the hardwood floor or scuff on the wall should be noted in a report, along with photographs. Then put this report with your tenant file. A move-out inspection should be done, as well. Proper inspection documentation will go a long way to helping a landlord if he or she needs to tap the security deposit for repairs.

9. Investing in Upgrades That Don't Add Value

It’s a good idea to keep your rental updated in order to attract quality tenants, but some landlords spend a great deal of money on a home upgrades that aren’t valuable to tenants. By researching the top amenities and features tenants want, you can avoid sinking a lot of money into an undesirable upgrade.

For instance, most experts argue against installing a pool to add value to a single family property, as the expense to construct and maintain the pool will be hard to recover in the rent unless the landlord plans to hold the property for a long time. However, a pool could make sense in a large multi-family property where the costs of installation and maintenance can be spread across a number of units. The location of the property also plays a role: a pool in Miami makes more sense than one in Denver.

Improvements should be thought out carefully. The kitchen is a good target to upgrade appliances to attract higher-paying renters, as it often serves as the hub of the household. But landlords should avoid doing fancy, customized designs that appeal to their own aesthetics. Spaces should be utilitarian. Rather than trying to convert a small, awkward nook into an office, think about installing an in-unit laundry, a far more desirable upgrade.

10. Being the Good Guy

There are ways to be a great landlord and still run a profitable enterprise. Renting property is a business with financial and legal consequences. A landlord should act courteously, professionally and provide good customer service. A landlord should socialize with a tenant or connect with one on Facebook. It’s easy to sympathize with tenants and let their problems become your problems, and have it interfere with your business goals, especially when it comes to collecting rent on time.

Establish clear policies and stick to the rent due date, applying any applicable penalties for late payments as outlined in the lease. A one-month lapse in rent can easily turn into two, meaning loss income before a landlord can even begin a costly eviction process. As always, keep meticulous records (see number two above). And, finally, do not accept partial payments, as the courts interpret partial payments from tenants as an acceptance of terms by the landlord.

The bottom line when interacting with tenants: Be personable but don’t make it personal.

Conclusion

In the end, the tenant screening process is the most important way you can protect your investment property. By looking at a tailored ResidentScore in combination with a full SmartMove tenant screening services, you can get an in-depth look at an applicant’s background. TransUnion studies show that the end result is a higher quality tenant with an average increased tenure of nine months. That means less money lost during tenant turnovers, and more money in your pocket.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.