Summary:

- Normal “wear and tear” is the expected damage that may result from someone living in a home for an extended time

- Wear and tear can includes things like worn carpet, nail holes, small scuffs, or faded curtains

- Landlords generally cannot deduct these costs from security deposits

- Typically, only expenses for actual tenant damages may be deducted from tenant deposits

Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

If you check your shiny, new suitcase on an airplane, you can’t be surprised if it comes back with a few scuffs and dents. However, if it rolls down the baggage claim in pieces with your clothes covered in tire marks, then you’ve got a problem––and likely grounds to try to get your money back.

Similarly, when renting out property, there’s a difference between expected wear and all out damage caused by accidents or negligence. And, while it may be easy to determine a wall scuff mark from a hole punched into it, plenty of rental property damages lies somewhere in between.

For example, what if there are twenty small nail holes on a single wall? Is that expected? Or is that above and beyond reasonable damage?

You have a responsibility to your tenants to be fair and honest. However, you also have a responsibility to your business to hold residents accountable for their actions. But, do you really know what’s considered normal wear and tear vs. tenant damage? And, if so, what you may deduct from a security deposit?

If you don’t know how to tell the difference and manage the security deposit correctly, it could get you in trouble.

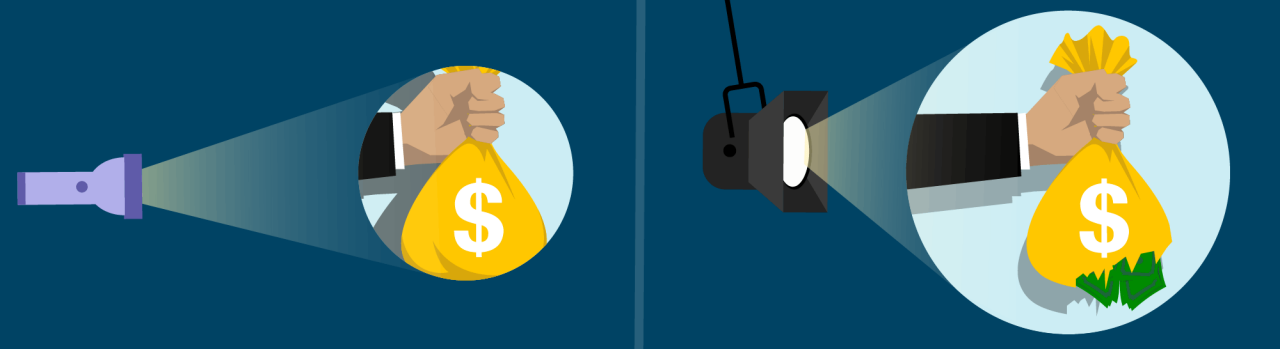

In fact, according to the Federal Trade Commission, recently, a U.S. housing company has agreed to pay a $48 million settlement to refund tenants harmed by its actions, which, among other allegations, includes unlawfully withholding security deposits to cover normal wear and tear.

While this lawsuit occurred with a large housing company, independent landlords still have plenty to worry about when it comes to damage––and potentially more to lose. This is why many landlords try to minimize risk by selecting responsible tenants, a process that should include tenant screening through a well-established company like SmartMove®.

However, even the best tenants can have an accident. That’s when knowing the definition of wear and tear is essential.

Read on to learn the difference between wear and tear and damage, so that you can determine when to use security deposits and when it’s appropriate to cover repair costs yourself.

This article covers the following topics:

Definition: What Does “Normal Wear and Tear” Mean?

“Normal wear and tear” or “reasonable wear and tear” are common terms associated with the condition of rental property. According to Bay Property Management Group, normal wear and tear usually refers to “the overall decline of a rental unit from daily tenant use.”

Essentially, it’s the natural aging and deterioration that occurs from people living in a space for an extended time. This kind of expected wear is separate from damages that occur as a result of tenant neglect or abuse.

“Normal wear and tear” sometimes goes under a few different names and terms, including:

- Normal wear and tear

- Reasonable wear and tear

- Natural wear and tear

- Wear & Tear

Whatever you call it, wear and tear happens to every property. It is a reality you must know how to handle as a landlord.

Wear and Tear vs Other Types of Damage

According to legal site NOLO, there is a difference between expected wear and tear and actual damage––and it can sometimes be hard to distinguish which is which.

In any rental property, there are certain areas expected to decline in condition as a result of normal, everyday use. For instance, you can anticipate dulling and slight discoloration on tile floors from simply being walked on every day.

This inevitable physical decline occurs during the course of a tenant’s occupancy; the longer a tenant occupies the unit, the more wear and tear can be expected. As the landlord, you are responsible for paying for these repairs and improvements.

Unexpected property damage, on the other hand, harms the value, usefulness, or normal functioning of the rental property and is the result of abuse and neglect, not ordinary use. For example, you wouldn’t expect cracked or missing tiles from normal, everyday use. This type of damage doesn’t occur naturally or organically. It may have happened on purpose, by accident, or due to neglect.

The section below includes several examples of wear and tear vs. damage the tenant is responsible for covering.

Pro Tip:

You may be able to deduct the cost of making repairs and improvements on your annual return. Learn more about tax deductions for landlords.

Examples of “Wear and Tear” in Rentals

There are countless aspects of a rental property that will inevitably deteriorate. As your tenant walks through the property, opens and closes doors, and uses fixtures or appliances on a daily basis, normal deterioration occurs.

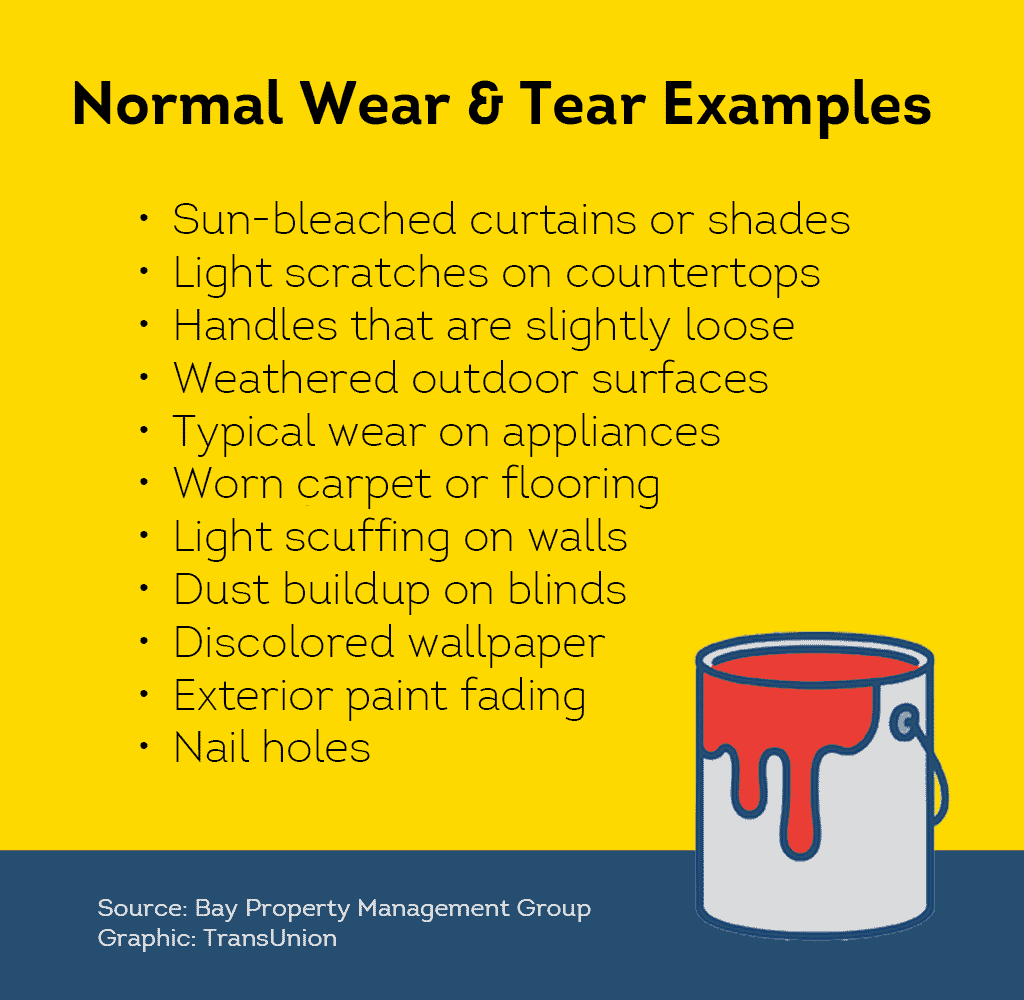

According to the article mentioned above from Bay Property Management Group, some examples of normal wear and tear in rental property include:

- Discolored wallpaper

- Light scuffing on walls

- Dust buildup on blinds

- Nail holes

- Worn carpet or flooring

- Handles that are slightly loose

- Sun-bleached curtains or shades

- Light scratches on countertops

- Typical wear on appliances

- Exterior paint fading

- Weathered outdoor surfaces

The article states that the landlord is expected to pay for repairs or fixes for minor wear and tear. Further, according to NOLO, landlord’s may not use a tenant’s security deposit to cover wear and tear.

What Is Considered “Unexpected Damage”?

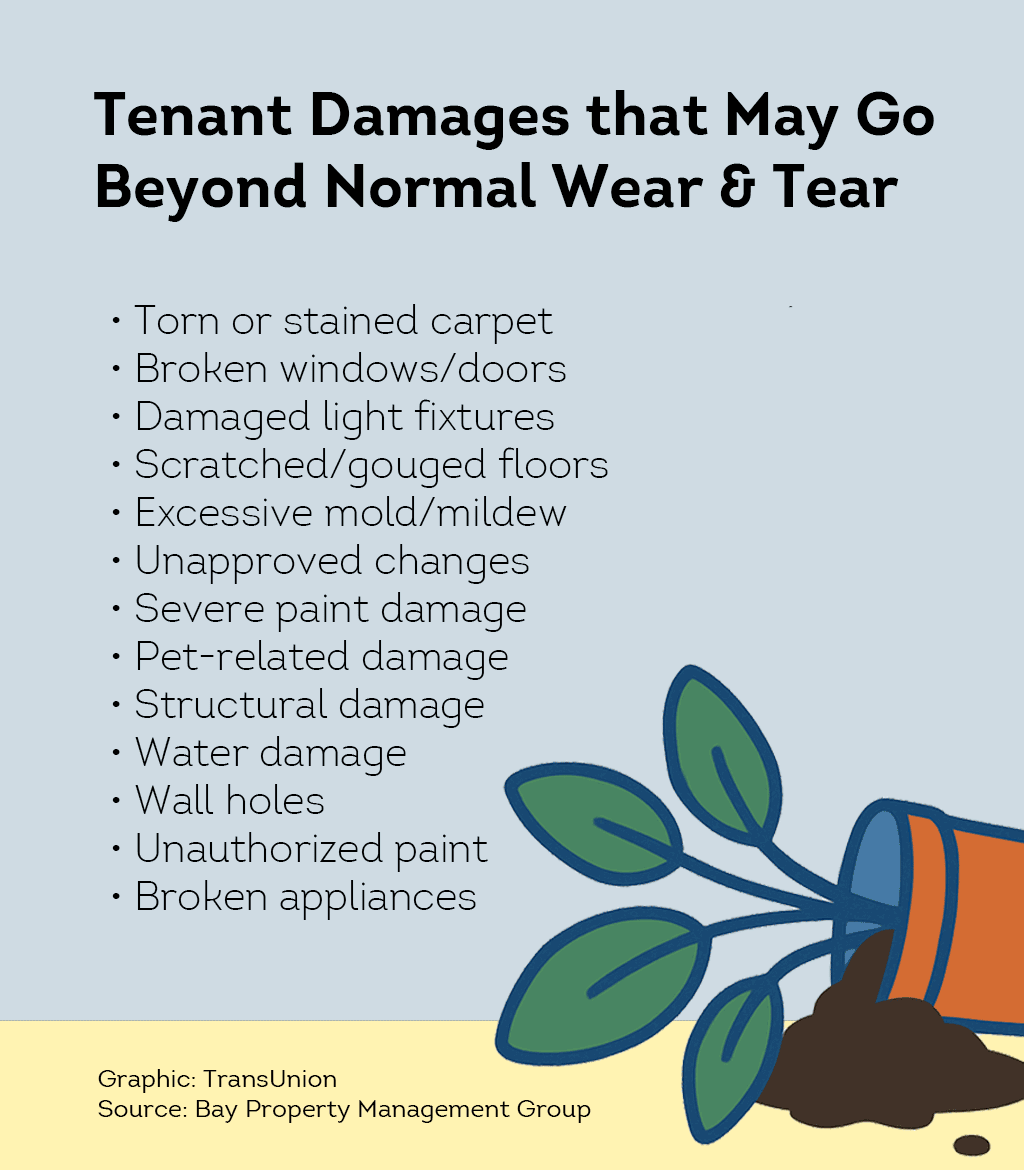

On the other hand, unexpected damage goes beyond normal wear and tear. This type of damage can be accidental, committed purposefully by your tenant, or be a result of neglect, such as excessive filth.

According to NOLO, landlords may use a security deposit for cleaning or repairs necessary to restore the rental unit to its condition at the beginning of the tenancy––as long as it’s not considered normal wear and tear.

According to the same Bay Property Management Group article, damages that go beyond natural wear and tear might include:

- Wall holes

- Torn or stained carpet

- Broken windows/doors

- Damaged light fixtures

- Scratched/gouged floors

- Broken appliances

- Excessive mold/mildew

- Severe paint damage

- Structural damage

- Pet-related damage

- Water damage

- Unauthorized paint

- Unapproved changes

Landlord Damage and the Implied Warranty of Habitability

However, do note that major damages are not always caused by a tenant. For example, landlord negligence can cause an extreme amount of harm. Examples of damage caused by landlord negligence might include (but are not limited to):

- Structural repairs, such as cracked roofs or ceilings

- Repairs due to faulty or inadequate design

- Damage due to unmaintained pipes and plumbing

According to legal site FindLaw, landlords are subject to an “implied warranty of habitability,” which requires you to keep your rental property well-maintained and livable. Although exact laws vary from place to place, FindLaw shares that most states would likely consider the following to be in violation of the regulations:

- Hot water not working

- Unsafe common areas - Blocked entrances or exits that restrict access

- Non-functional carbon monoxide or smoke detectors

- Exposed lead paint or other harmful chemicals

- Significant Water damage

- Structural damage

- Insect or rodent infestations

- Lax safety features, such as not having deadbolt locks

Like with other repairs, you are generally responsible for covering maintenance expenses for fixes that are not due to tenant damage or negligence.

Pro Tip:

Finding responsible tenants from the start can be a proactive way to help reduce the chance of damages due to negligence. Learn how to screen tenants for the first time and help weed out potential concerns.

When Landlords Can Use Security Deposits to Cover Damage

According to real estate investment site The Close, if the deterioration of your property crosses the line from “normal wear and tear” into actual damage, you may be eligible to use a portion of your tenant’s security deposit to pay for repairs.

The Close article mentioned above further explains that, while exact laws vary by state, you typically can’t just keep the check or a portion of the deposit and call it a day. Rather, you must follow a process to assess, discuss, and document any damages you plan to cover with the security deposit.

This may involve things like:

- Getting quotes from contractors

- Sending an itemized list of damages to the tenant

- Proof of payment (if using the deposit for unpaid rent)

- Taking your tenant to court if damages exceed the security deposit

Of course, all of this information should be well-documented and organized. Whether you will be able to recover from your tenant due to damage to your property––and exactly what you need to do to keep it––will depend on local law.

Pro Tip:

Being organized is essential for a smooth property business. Aside from keeping detailed notes about security deposits and damages, learn what other landlord documents you should already be keeping.

5 Tips for Handling Rental Damage (Wear & Tear and Tenant Negligence)

When it comes to renting out property, there are a few things you can do that may help reduce the likelihood of you paying for catastrophic damages after your tenant moves out.

Here are a few things you might consider to help make dealing with damages smoother and easier for both you and your tenants.

Tip 1: Have Clear Lease Terms and Provide Care Instructions

Make sure to clearly spell out who is responsible for what kinds of repairs in your lease or rental agreement. That way, according to Bay Property Management Group, if there are damages at the end of the term, you can refer to the lease agreement to understand your and the tenant’s responsibilities.

Additionally, Bay Property Management group also suggests providing tenants with clear care and maintenance instructions to help prevent issues. For example, if your washing machine requires a certain kind of detergent to prevent buildup, then your tenants should know that.

Tip 2: Conduct Screening Before Selecting Tenants

As it’s often said, the best offense is a good defense. Sure, accidents can happen to anyone. However, you may be able to prevent some damage by placing good, safe tenants from the start––and that means tenant screening.

For example, out of the following two fake tenants, which one would you feel more comfortable letting on your property?

- Tenant 1: Has no previous evictions and a criminal background that includes a few speeding tickets. Their previous landlords say they were only late on rent once, communicated well, and took good care of the place.

- Tenant 2: Has a history of eviction and a criminal record report showing multiple charges for property damage, and trespassing. Their previous landlords said they punched holes in the wall, sold off the appliances, and never told them about a problem with the sink, which left extensive water damage.

Out of these two, which would you prefer? Probably Tenant 1, right? However, you would never have this vital information without tenant screening.

When conducting tenant background checks with protecting your property in mind, it’s critical to look at things like:

- How they have behaved in past rentals. What does their eviction history look like? And, if you conduct a landlord reference check, what do previous property managers have to say? Have they damaged property beyond normal wear & tear?

- Do they communicate well? If so, they may be more likely to report minor issues before they become major problems. You can help assess their communication with these rental applicant questions.

- Do they have a history of relevant crimes? If your rental applicant has a habit of trashing every place they live and history of rental-related convictions, you probably want to know about it. Help find out through a criminal background check.

On top of these three areas, you should also conduct financial screening. After all, a credit report and proof of income may help you assess their general sense of responsibility––both with money and potentially your property.

Additionally, you may be able to better predict future evictions with a ResidentScore®. Exclusive to SmartMove and included in every screening package, this proprietary score was designed for rental situations,

Pro Tip:

Screening is essential, but so is doing it the right way. Like with managing security deposits improperly, risky screening practices may tank your property business.

Tip 3: Have Tenant Record All Damages During Move-In

According to The Close, you should always perform a move-in inspection with your tenant using a landlord checklist. That way, you can agree on the state of the property before the tenancy begins.

During the move-in inspection, it may be beneficial to take a moment to discuss with your tenant the expectations if unexpected damages are to arise.

If permitted by law, you might consider taking photos of the current condition of the rental unit upon move-in, including any existing damages or wear; these images can help clarify responsibility should a wear and tear dispute arise during your tenant’s occupancy.

Tip 4: Document Damage with Tenant During Move-Out

Similarly, when your tenant moves out, go through the same process. Take photos and list any problems. This is a good opportunity to make note of any new damage you may find and discuss the possibilities of repair and associated costs with your tenant.

According to Bay Property Management, if there is extensive damage, you should:

- Document each problem/instance of damage with pictures and written descriptions

- Notify the tenant of the damages and discuss responsibility

- Get repair estimates from a contractor and provide an itemized list to the tenant

- Repair the property and keep receipts

- Deduct the cost of repairs from the security deposit

During this entire process, you should make sure to 1) thoroughly document all communication and, 2) follow all relevant laws for your area. If you have any questions, make sure to contact qualified legal counsel.

Tip 5: Learn About Rental Laws in Your Area

Laws can vary greatly from state to state––or even from city to city. It’s a good idea to familiarize yourself with any special laws that apply where you live and where you rent out property.

According to legal site NOLO, some laws and regulations you may want to learn about include things like:

- If your state requires proposed repair costs before they occur or not

- If there are any special rules for returning security deposits

- What exactly is considered “normal wear and tear”

- The deadline for returning the security deposit

- What happens if tenant damages exceed the security deposit amount

These are just some of the details you’ll want to know about and follow. The same NOLO article also states that tenants can often sue landlords who don’t follow these laws––and may get punitive damages.

As always, if you have any questions or concerns about rental laws, you should contact qualified legal counsel.

Help Prevent Property Damage with SmartMove Tenant Screening

You want your property business to go places. But, destructive tenants who generate over-the-top damages could leave you stuck on the runway. Help assess exactly what you’re getting into with fast, flexible tenant screening through SmartMove.

Does your top rental applicant have any worrying patterns that could mean danger for your neighbors, other tenants, or property? Dig into their past to help find out. A criminal background check scours millions of criminal records looking for a potential match to your rental applicant. Meanwhile, an identity check helps confirm they really are who they say they are.

Then, assess their responsibility. An eviction history report helps you see their potential eviction-related court proceedings. A tenant credit check helps you take a deep dive into their financial track record and habits of paying on time.

On top of that, you can help confirm your potential tenant actually makes what they claim on the rental applicant with Income Insights. Included in every SmartMove screening package, ResidentScore is a proprietary calculation based on credit based data points. It helps predict eviction risks better than a typical credit score.

Designed specifically for independent landlords, SmartMove provides online screening reports that are backed by TransUnion––a major credit agency. There are no sign-up costs, subscriptions, minimums or hidden fees. Simply sign up for a free account and start screening immediately.

Don’t let destructive rental applicants run amok in your property. Help protect yourself from damage with quick, flexible tenant screening through SmartMove.

Rental Wear and Tear FAQs

See below to answers to commonly asked questions about normal wear and tear in rentals.

If you decide to allow pets in your rental unit, you might accept that there could be minor scratches or animal hair left behind. This is one reason you might collect pet rent.

However, according to Specialized Property Management Memphis, extreme pet damage is typically not considered normal wear and tear. Pet damage could include things like scratches, urine stains, shredded curtains, or chewed doorways. You may need to deduct the cost of these damages from the tenant’s security deposit.

Typically, yes, nail holes are covered under expected wear and tear––but not always. According to the blog Your Landlord Resource, a reasonable amount of nail holes is generally considered normal wear and tear. After all, if a tenant lives somewhere for a while, it’s likely they may want to hang pictures or art to make the place feel like home.

However, if the holes are excessive or very large, then it might start to wander into “damage” territory. In this case, you may be able to deduct charges from the security deposit.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.