Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

A Decade Has Passed Since the Great Recession First Gripped World Markets, Largely Driven by the Housing Market. Millions of Homes Went Into Foreclosure. The Financial Crisis Helped Drive Up the Number of Households That Are Renting to 50-Year Highs. In Turn, the Rental Vacancy Rate Decreased, Dropping Seven Years in a Row, and Rents Increased Significantly While the Housing Market Slowly Recovered.

However, the Days When Landlords Could Demand High Premiums on Rent and Choose to Be Selective on Picking Tenants May Be Over with the Economy in Recovery and Low Unemployment. Many Experts Believe the Slide in Homeownership May Finally Be at an End. There Are a Number of Factors in Play, Including a Rise in Real Income, the High Cost of Renting Versus Home Ownership, and a Construction Boom Finally Catching Up with Demand. However, Record-High Housing Prices, Rising Interest Rates and Other Factors May Offset Some of the Shift from Renting to Homeownership.

Below We Take a Brief Analysis of Six Market Trends That Landlords Should Note Moving Forward into 2018.

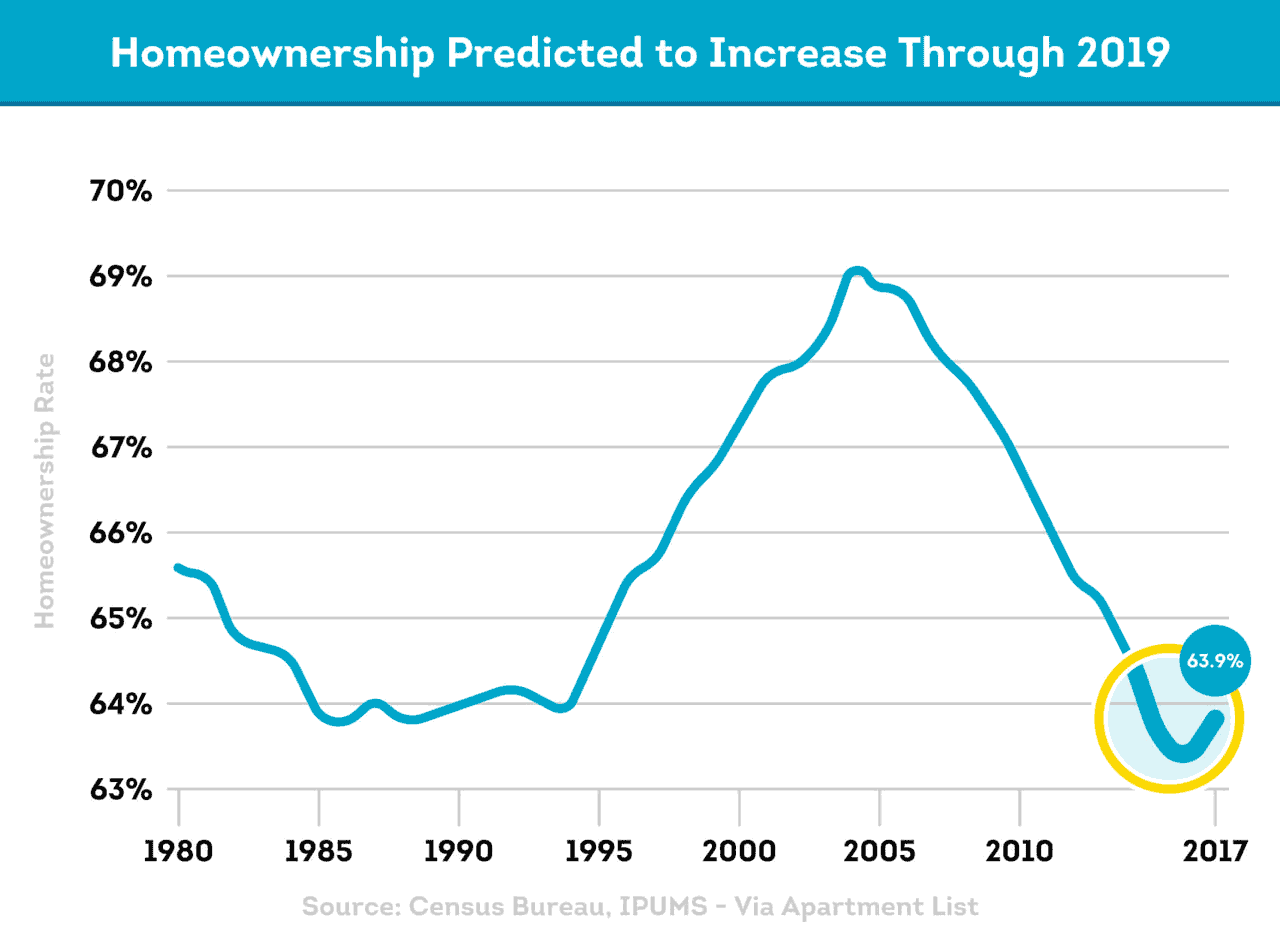

1. Homeownership Will Likely Continue to Increase Through 2019

Homeownership Dropped from a High of 69.2 Percent in 2004 to 62.9 Percent in the Second Quarter of 2016, According to Apartment List. However, in the Third Quarter of 2017, the Rate Had Ticked Up a Whole Percentage Point to 63.9 Percent. Experts Expect Home Sales Will Continue to Increase Over the Next Couple of Years, Especially as New Inventory Becomes Available and the Rise of Home Prices Decelerates.

However, It’s Unclear if Homeownership Levels Will Ever Return to the 2004 Highs. One Reason Is That the Housing Crisis Generated Renewed Appreciation for the Advantages of Renting, According to the Joint Center for Housing Studies of Harvard University. In the Joint Center’s 2017 America’s Rental Housing Report, the Authors Write Further, “Indeed, Even as the Homeownership Rate Stabilizes, Renters Are Still Likely to Account for Slightly More Than a Third of Household Growth. … [T]he Number of Renter Households Will Increase by Nearly 500,000 Annually Over the Ten Years from 2015 to 2025—a Still Robust Pace by Historical Standards.”

The Increase in Housing Supply May Also Present an Opportunity for Landlords to Acquire Single-Family Rental Properties, Especially if Housing Prices Stabilize Before Interest Rates Increase. Single-Family Rentals Increased by Only 74,000 Units Between 2015 and 2016, According to the Joint Center.

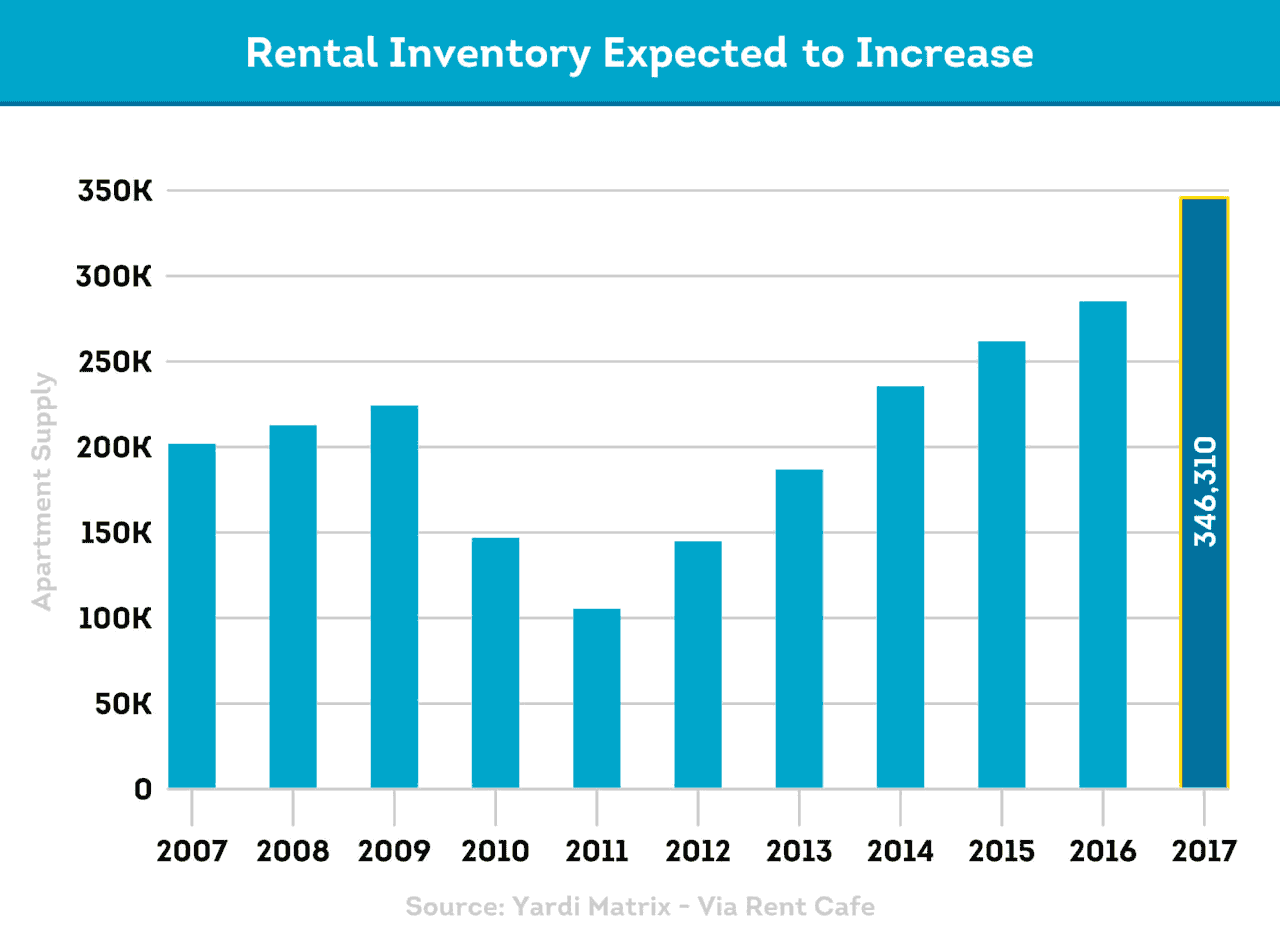

2. Rental Inventory Is Expected to Increase

Apartment Completions Were Expected to Top 345,000 in 2017, a 21 Percent Increase Compared to 2016. However, Much of This New Housing Is Targeted to Higher-Income Households and Located Primarily in High-Rise Buildings in Downtown Neighborhoods, According to the Joint Center.

Meanwhile, the Supply of Moderate- and Especially Low-Cost Units Has Increased Only Modestly, the Joint Center Reported: The Share of New Units Renting for at Least $1,100 Jumped from 37 Percent in 2001 to 65 Percent in 2016, But the Share Renting for Under $850 Shrank from Just Over Two-Fifths to Under One-Fifth. The Lack of More Affordable Rentals Means That One in Four Renters Are Severely Cost-Burdened, Spending 50 Percent or More of Their Income on Housing. Nearly Half of Renters Are Cost-Burdened, Spending at Least 30 Percent of Income on Housing.

This Underserved Market May Present an Opportunity for the Landlord Willing to Take on the Unique Challenges of Working with This Population. In Fact, Freddie Mac Recently Announced It Would Re-Enter the Low-Income Housing Tax Credit (LIHTC) Market That Provides Tax Credits to Private Property Owners Willing to Invest in Affordable Housing.

3. More Renters May Double Up

Nationally, 30 Percent of Working-Age Adults—Aged 23 to 65—Live in Doubled-Up Households, Up from a Low of 21 Percent in 2005, According to Zillow.com. A Doubled-Up Household Is Defined as One in Which at Least Two Working-Age, Unmarried or Un-Partnered Adults Live Together. Not Surprisingly, Zillow Reports That Most Doubled-Up Households Are Driven by Financial Concerns: Adults Living with Roommates or Family Members Earn 67 Cents for Every Dollar Made by Adults Who Live on Their Own (or with a Partner).

Landlords Should Be Aware of the Potential Challenges Faced by Doubled-Up Tenants. This Makes Ensuring That Applicants Can Afford to Meet Their Financial Obligations Before They Move in All That More Important. Each Adult Planning to Live in the Unit Should Undergo Background, Credit and Eviction Checks Using SmartMove’s Tenant Screening Services.

4. Renter Credit Scores May Improve

This Is an Important Consideration Because Low Credit Scores, Especially Following the Great Recession, Kept Many People from Qualifying for Home Loans.

More Renter Credit Scores May Be on the Rebound as Foreclosures Begin to Fall Off Credit Reports. Foreclosures Hit Record Highs in 2009 and 2010 and Began to Fall in 2011. Mortgage Default Can Remain on a Person’s Credit Report for Seven Years, So the Credit Reports of Those Who Lost Their Homes at the Height of the Great Recession Are No Longer Haunted by a Mortgage Default.

A Credit Score, While an Important Data Point in Evaluating a Prospective Tenant, Isn’t the Only Measure a Landlord Should Consider When Screening an Applicant. SmartMove Offers a ResidentScore® as Part of Its Tenant Credit Check. The ResidentScore Is a Proprietary Formula Is a Proprietary Formula That Generates a Credit Score Based on an Applicant’s Credit History.

5. Millennials Will Likely Remain the Largest Group of Renters

Millennial Households Should Continue to Dominate the Rental Market, According to Renters Warehouse. Millennials Headed 18.4 Million of the Estimated 45.9 Million Households That Rented Their Home in 2016. As Competition to Fill Vacancies Potentially Heats Up in 2018, Renters Warehouse Recommends Offering More Perks to This Tech-Savvy Generation, Such as High-Speed WiFi and Online Services for Rent Payment. Other Tech Upgrades in Units Might Include USB Ports and Smart Home Appliances.

6. Welcoming Fido Into Your Rental

People Love Their Pets. According to the American Pet Products Association’s 2017-2018 National Pet Owners Survey, 68 Percent of U.S. Households Own a Pet. That Means If Your Current Policy Forbids Pets, You’re Leaving Out More Than Two-Thirds of Possible Applicants. Landlords Can Make Their Rentals More Attractive If They Allow Animals Onto the Property.

Obviously, Any Policy Should Be Tailored to the Risk That the Landlord Is Willing to Take. There Are Pro’s and Con’s to Allowing Pets in Rental Properties. The Landlord Would Be Well Served to Ask for a Non-Refundable Pet Deposit That Would Cover Potential Damages Such as Replacing the Carpet.

Conclusion

Landlords May Be Reading Headlines Proclaiming That Rental Markets Are Cooling Off, but the Sky Is Far From Falling. While Rents May Not Experience the Robust Growth of Recent Years, There Is No Reason to Believe That the Bottom Will Drop Out. On the Contrary, While Homeownership May Be Slowly on the Rise, Experts Predict the Number of Renter Households Is Likely to Continue to Increase at a Healthy Clip, Driving Up the Need for Additional Supply.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.