Summary:

Accidental––and potentially intentional – damage occurs all the time in rental situations. As an independent landlord, you need to know how much renters insurance to require, to protect yourself and your property. To help determine renters insurance policy amounts, it's important for the tenant to know the value of the property and typical coverage limits. Most renters should have insurance that covers at least $20,000 in damages, but it could go even higher in some cases.

Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Disclaimer:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

It’s an unpleasant truth, but things like break-ins, fires, floods, and destructive visitors happen all the time in rentals. And, when the worst rains down on you and your tenants, it's helpful to have a protective umbrella––specifically, renters insurance.

A tenant’s belongings are their own responsibility. Unfortunately, some tenants incorrectly assume a landlord’s policy will cover their own personal property losses in the event of something like a fire. The last thing you want is for tenants to discover the hard way that this is not the case.

A 2022 study by home security company SafeHome shows that only 55% of renters carry renters insurance, and of those, the vast majority (75%) were required to carry insurance by their landlord.

This means that if you don’t require renters to have insurance, chances are slim renters will get it on their own. Then, if there is a catastrophic event, your renters could lose everything––and have no way to recoup the damages.

Thankfully, renters insurance can soften the blow by covering the cost of some or all of their personal property, depending on their coverage limit, and the nature of the loss. Requiring proof of rental insurance should be a must before signing a lease, just like vetting rental applicants with thorough tenant screening through a service like SmartMove®.

That said, it can be confusing to know exactly how much renters insurance tenants should have. This guide covers how to figure out how much renters insurance tenants should carry and how to calculate how much their possessions may be worth.

Why require renters insurance

Like with any insurance, the hope is your renters never have to make a claim. However, if disaster does strike, you don’t want your tenant looking to you to recoup their losses.

There are many excellent reasons to require renter’s insurance when you rent out property. Some of these include:

It’s good practice: Typically, landlord insurance doesn’t cover tenant property losses. Replacing an entire apartment’s worth of stuff out of pocket could be a major financial setback––no matter who pays.

Potentially help reduce personal liabilty: For example, if a tenant or visitor is injured on the property, having renter’s insurance may lower you or your tenant’s personal liability. This may be especially important if you are renting to college students.

Potentially help with renter relocation if displaced: One benefit of many renters insurance plans is providing support for temporary living costs, for example, if the apartment is destroyed in a fire and is unlivable.

Protection in event of property damage: If your tenant’s property is damaged, renters insurance often provides a way for tenants to cover their losses.

Potentially mitigates pet risks: There are many pros and cons to allowing pets in your rental. If something bad happens—such as property damage or even a dog bite––your tenant’s renters insurance may cover it.

Pro Tip:

In addition to renters insurance, you may want to consider adding pet fees, rent, or deposits if you allow tenants to have animals in the rental.

What is renters insurance and what does it cover

For people who lease or rent properties, renters insurance protects tenants and their possessions, similar to how homeowners insurance protects people who own their own place.

According to Investopedia, most renters insurance covers:

- Personal possessions

- Living expenses (in the case that an apartment becomes uninhabitable), and

- Liability/medical insurance that typically covers $100,000 to $300,000 of damages, in case someone gets injured on the property

In some situations it can also cover destruction of the landlord’s property due to tenant negligence. This may give landlords additional protection and potentially lowers the likelihood of their own premiums increasing due to multiple claims.

If you allow tenants to keep pets on your property, renters insurance may also cover liability for dog-bite injuries and pet-related damage.

Renters Insurance Details You Should Know

The Average Cost of Renters Insurance

According to NerdWallet, the average cost of renters insurance is $12/month in 2024, but can fluctuate to almost twice that. The cost of renter’s insurance can vary based on several factors, such as:

- Cost of living in a specific region

- If the area has higher crime rates

- How prone the area is to natural disasters, like hurricanes or wildfires

In fact, in some disaster-prone areas, instances like flood or storm damage are not covered by renters insurance. If your unit is in a severe weather-prone area, your tenants may want to look into purchasing an additional rider or a dedicated policy to help cover likely weather-related occurrences.

Who Sets Up, Manages, and Pays for Renters Insurance

It’s 100% the tenant’s responsibility to get set up and manage renters insurance. Required proof of renters insurance is one of many common lease terms. Typically, landlords require proof of a rental policy before officially signing an agreement or allowing move in.

Cataloging Items and Determining Value

It’s up to your tenant to work with their insurer to create a list of covered items and determine their value. Typically, renters are asked to provide proof of items, such as photos and receipts, by uploading digital photos to a cloud-based server and keeping records in a fireproof box. When it comes time to file a claim, a tenant will need to present appropriate documentation to the insurance company.

Replacement Value Policy vs. Cash Value Policy

According to the Insurance Information Institute, there are two options when it comes to purchasing renters insurance:

- Replacement Value Policy: this type of policy reimburses the policyholder for the actual cost of repurchase. It’s essential to save receipts with a Replacement Value Policy.

- Cash Value Policy: This type of policy reimburses an item’s current value. Cash value policies tend to be cheaper, but they don’t cover the current costs tenants incur when replacing goods.

Pro Tip:

Unexpected property damage can be a big hit to landlords, whether it’s from a natural disaster or a tenant. Discover what screening questions to ask new tenants to help reduce your risk after the lease starts.

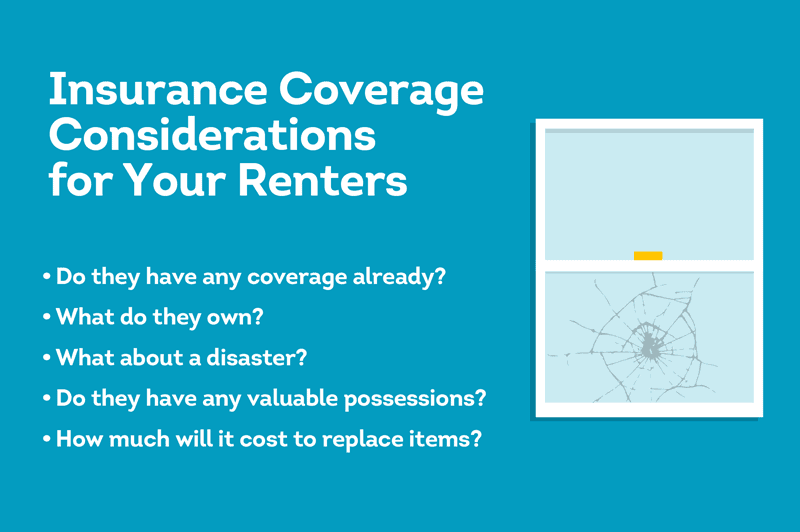

How much renters insurance should a tenant get

If you require tenants to have renters insurance, you should request a minimum coverage amount. To decide that, it will be helpful to know more about coverage amounts.

Know What Rental Insurance Covers

According to the Investopedia article mentioned above, most renters insurance policies cover personal items, living expenses, and liability insurance (typically from $100,000 to $300,000 in damages).

The same article also states that the average renter's belongings are worth roughly $20,000. As you create your policy, you may want to consider requiring renters to carry insurance that covers at least this much.

What Rental Insurance Doesn’t Cover

On the other hand, there are many things that standard renters insurance does not typically cover. According to Plymouth Rock Assurance, standard renters insurance policies don’t usually cover things like:

- Some natural disasters like floods, earthquakes, and sinkholes

- Pest damage, like bed bugs, termites, or mice

- Mold damage

- Damage caused by the tenant

- Items over the max limit (many policies max out for single items at a certain value)

- Items belonging to friends, roommates, or visitors not on the insurance plan

- Vehicles (but it may cover items stored inside the vehicle)

If you live in an area prone to natural disasters, your tenant has particularly valuable items (like musical instruments, jewelry, or an expensive collection), or may be impacted on other items on the list, they may want to get special supplementary insurance to help make sure their possessions are covered.

Determining How Much Insurance Coverage may be Needed

According to NerdWallet, most renters underestimate how much stuff they have and only think about big-ticket items such as computers. This can then lead them to be under-insured and not recoup their full losses if the worst happens.

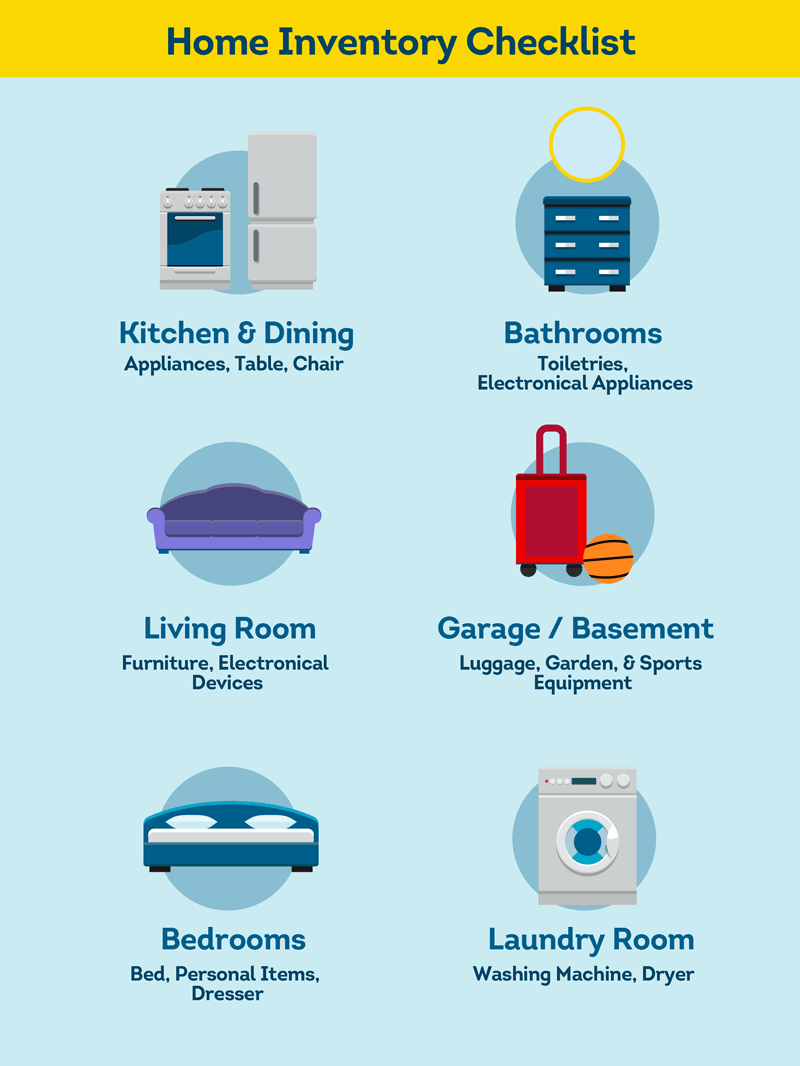

However, even a collection of 100 DVDs worth only $5 each has a value of $500. This is why most guidance recommends renters take inventory of possessions to help determine real value.

How Renters Can Create a Home Inventory

Before shopping around for renters insurance, tenants should review their residence and make an itemized list of all their belongings. Bankrate provides helpful, step-by-step instructions for creating a home inventory, including:

- Start small, such as with a closet or small room, then work through possessions little by little. Likewise, you can also start with your most recent purchases, if that’s easier.

- Stay organized. Include basic details for each item. Be consistent and include the same information for all items. Include serial numbers of items, where available.

- Take good photos. Take wide angle shots of each room, then zoom in for close-ups on individual items. Don’t forget about clothing, which averages from $3,000 to $5,000, and items such as sports equipment that may be in storage.

- Store receipts somewhere safe. Keep them organized and updated, as needed.

- Stay up to date. Update your records with new purchases or when you get rid of items on the list.

It can be a lengthy process, but it only needs to be done every few years (unless there are major purchases).

Once you have your inventory, it’s time to research replacement values. Renters tend to underestimate appreciation, and the cost of buying something new could be significantly more than the fair market value of the same item in used condition.

Help Protect Your Property with SmartMove

Renting out property isn’t always a picnic. Between missing payments, late night repairs, evictions, and accidental––or potentially intentional––property damage, independent landlords are constantly on the edge of disaster. While renters insurance helps tenants protect their possessions, -fast, affordable tenant screening with SmartMove may help protect your property business.

Discover if your rental applicant truly has the means to cover insurance along with rent. Tenant credit checks help you learn more about a potential tenant’s financial track record and see if there’s anything you need to be aware of.

Income Insights, exclusive to SmartMove, helps reveal if the renter’s income matches what they claim on the rental application. What’s more, included in every screening package, ResidentScore helps predict evictions 15% better than a traditional credit score alone.

A criminal background report zips through millions of federal and state-level crime records searching for a potential match to your applicant. Meanwhile, a previous eviction check sees if there are any eviction-related proceedings that may be attached to your renter’s information.

With fast reports on-demand, your tenants can even apply and be screened on the same day. All reports are backed by TransUnion, a major credit agency with four decades of data expertise, so you can feel more confident about result accuracy.

Don’t let destructive renters rain on your parade––or your livelihood. Help protect yourself with fast, affordable screening through SmartMove.

SmartMove,

Great Reports. Great Convenience. Great Tenants

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.