Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

With its monthly rental income and possibility of property value appreciation, the allure of owning rental property may have you considering becoming a landlord. On the other hand, you’re probably aware of concerns like non-payment of rent, destructive tenants, and major property repairs. So if you’re a beginner rental property investor, you probably have a lot of questions about the best way to get into the game and reduce your risk.

Here are seven stress-free ways to find and rent your first rental property:

1. Do Your Research

By taking courses, reading investment books, or speaking with local real estate agents, you can make more informed decisions as a potential property owner. It's helpful to read up on how to assess the value of properties, choose the right location, and understand market conditions. We'll go over some strategies for success in this article, but the more you know, the more confidence you'll have when making decisions about your first rental property investment.

It's also important to research potential rental property locations, which can often impact your quality of tenant, and therefore your revenue. There are certain characteristics that renters look for in a rental property, so you'll want to keep those things in mind while looking to buy.

Keep in mind that renters often look for properties close to their employer, so you want to understand who the major employers are and their proximity to properties you are considering. Look for factors that are important to tenants, such as safety, parking, and walkability. Keep in mind that school quality is an important predictor of neighborhood quality, which is important for all tenants, even those who don't have school-age children yet.

2. Calculate Your Cash Flow Before Making a Purchase

In order to ensure that being a landlord is going to be profitable for you, you'll need to factor in all of your expenses up front. You don't want to purchase a property only to find out later that the going rent in the neighborhood is lower than your monthly property expenses. The mortgage is going to be your largest obligation, but there are taxes, upkeep, and other cost considerations to keep in mind. Try to obtain precise information about the current figures for the property, so you can make a detailed assessment. Once you have an accurate projection of your cash flow, only buy if the numbers show you'll be able to make a consistent income on the property.

When shopping for rental property, keep the following costs in mind:

- Mortgage

- Taxes

- Maintenance

- Utility bills

- HOA

- Insurance

The above list will help you calculate ongoing expenses, but don't forget about the upfront costs. It may take you some time to find good tenants, and there may be initial repairs and maintenance. Therefore, prepare to have a negative cash flow at first. You want to make sure you have the resources to recoup your costs. In addition to calculating your cash flow, it's also a good idea to make a long-term projection, so you know how long it will take you to pay back your upfront costs.

3. Financing Your Property

Another way to reduce stress when buying your rental property is to choose a financing option that is right for you. By knowing your financing options ahead of time, you'll be better prepared when the right property comes along.

While current interest rates are low, it can be harder to come by financing these days. Do your research to determine whether your property can even be financed – many kinds of properties such as time-shares, some manufactured homes, and boarding homes might not be eligible for a loan. You'll want to also keep in mind that there will be closing costs, including taxes and escrow, to consider.

Whichever route you plan to take, you'll want to talk to your lenders early and get a better understanding of their requirements. This way, you won't miss your opportunity when the perfect property becomes available.

4. Buy at the Right Price

Once you have made your cash flow projections and researched lending requirements, you'll know how much you can afford and can scope out properties in your price range. Here are a few stress-free ways to find a rental property at the right price in the right area.

- Find a real estate agent who is experienced in working with property investors.

A real estate agent can be a great asset when it comes to knowing where to get the best value for your money and the best neighborhoods to purchase a rental property. Talk to a few agents before selecting one to be sure they have past experience working with property investors.

- Aim to pay 10 to 20 percent below market value.

By paying below market value, you're more likely to see a higher return on your investment down the line. You'll need to do your research beforehand to spot neighborhoods and properties that are good investment opportunities.

- Compare contractor quotes for repairs and upgrades.

Properties that are below market value might need repairs and upgrades to get the property into rentable shape. You should try to gather three written estimates from credible contractors to find out how much these renovations will cost.

5. Set the right rent price

Setting the right rental price will reduce the stress of worrying that your property may not be profitable. The right rental price must match all monthly expenses including mortgage and insurance, as well as taking into account your own cash flow.

Setting the right rental price will reduce the stress of worrying that your property may not be profitable.

Begin your research by looking at the comparable properties within the area, to give you a good idea of how much you will be able to charge your own tenants. Do some research on this before buying a property so that you can make sure you can get a good return on your investment.

Check the market rate for rent in the area you're considering by:

- Checking with property managers who handle similar properties

- Asking real estate agents

- Reviewing rental advertisements

- Using online rent price tools

In addition to researching local rental rates, you'll want to watch out for areas with vacancy rates that are significantly higher than the national average (7.4%).

A high vacancy rate could mean that you'll have trouble attracting tenants, which means long periods where your property is not producing any income.

6. Consider Hiring a Property Manager

From tenant screening to property maintenance, there can be a great deal of hands-on involvement in making your rental property a successful venture. If you don't have that kind of time or energy, you may find it's worth the added expense to hire a property manager to handle the daily details of managing a rental.

Most property managers can market your rental, source and screen tenants, collect rent, and handle maintenance.

7. Thoroughly screen your tenants

One of the most important ways to reduce your stress as a landlord is to attract reliable, rent-paying tenants. Signing a new tenant for the period of a lease (generally 12 months) is a big commitment and it can either be an easy, stress-free experience, or a decision that you regret. You don’t want to constantly worry that the rent payment is going to be late.

One of the most important ways to reduce your stress as a landlord is to attract reliable, rent-paying tenants.

So how can you be sure that a rental applicant will be a good tenant? Conducting a thorough tenant screening on each applicant is the most important thing you can do to reduce your stress and help ensure you're getting a reliable tenant in your property. Tenant screening gives you more insight into your applicant's background and helps you determine if they meet your rental criteria. In addition to online tenant screening, be sure to check employment and previous landlord references.

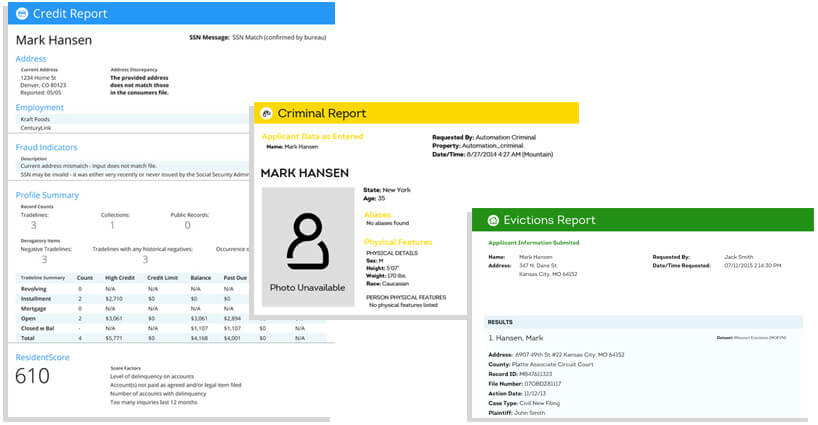

Credit, criminal, and eviction reports help you get a clearer picture of your applicant's background and their likelihood of paying on time. Additionally, when you use SmartMove tenant screening, you receive a credit-based ResidentScore that predicts evictions 8% more often than a typical credit score in the bottom score ranges where risk is greatest.

Conclusion

Investing in a rental property can seem overwhelming at first. However, if you do your research and planning ahead of time, you may find that owning a rental property is an excellent source of passive income. By following some simple steps prior to buying and renting an investment property, you can have a stress-free experience and get the most out of your new investment.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.