Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Today's Renters, and Many Others, Are Watching Their Bank Accounts Decline in Value. With Businesses Forced to Stay Closed, Employers Cutting Hours and Pay, and a Realization That There's No Known End to Quarantine Life, People Are More Concerned Than Ever That They Might Not Be Able to Make Rent Next Month.

Landlords Are Equally Concerned. Obviously, They Want to Continue Receiving Rental Income on Time (or Even at All). But If Renters Stop Paying, and If Landlord's Non-Rental Income (Job) Ceases, Then a Property Owner Could Face the Risk of Defaulting on One or More Mortgages.

This Feeling of Uncertainty, Combined With the Reality of So Many People Out of Work or Making Less Money, Sends a Ripple Across the Renter Market. For Tenants Who Are Impacted by the Slowing Economy, They Hope Landlords Can Offer a Grace Period. Landlords Who Are Impacted Hope for Forgiveness From the Banks.

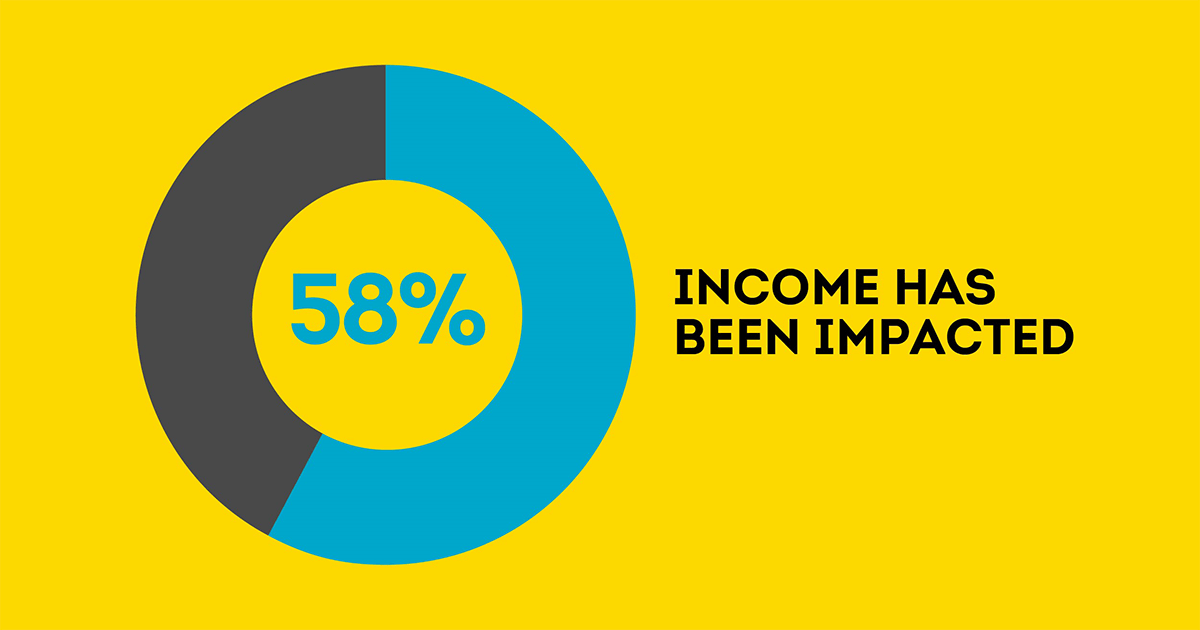

1. Majority of People Are Now Making Less Money

According to a Recent TransUnion Survey, 58% of Consumers Reported That Their Finances Have Been Negatively Affected by the Strict Quarantine Measures. From Loss of Jobs to Orders Drying Up to Reduction in Hours Worked, the Amount of Income That People Earn Will Likely Continue to Drop for the Time Being. With the Exception of Baby Boomers, Nearly 2/3 of Every Generation Indicate Their Household Income Has Been Affected.

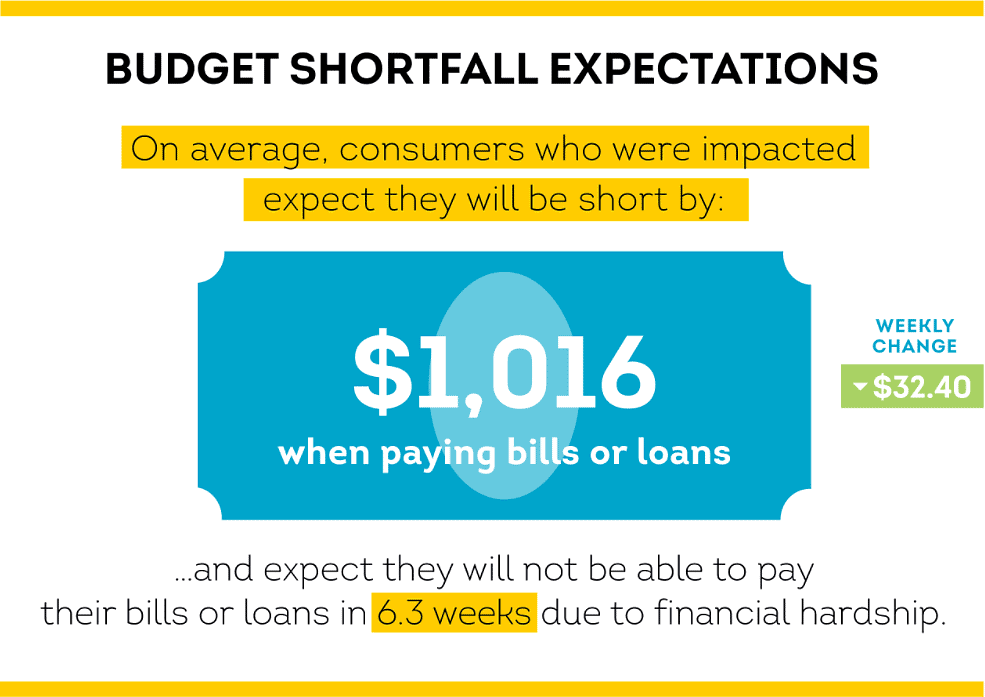

2. Income Earned Won't Cover Loans and Utilities

According to a Recent TransUnion Survey, People Experiencing Negative Financial Impact from Business Closures and Other Quarantine Affects Report That They Will Not Have Enough Money to Pay Their Bills. From Auto Loans to Small Business Borrowing to Rent Payments Due, Financial Hardships Created by the Loss or Reduction of Paying Work Means Many Americans Will Come Up Short by $1,016 Over the Next Month.

3. Bills May Be at Least Six Weeks Overdue

It's Appears Rather Inevitable That Consumers Will Be in Arrears. With Such a Sudden, Steep Decline in the Earning Potential of So Many American Workers, Many Will Be Forced to Put Off Paying Bills That Are Due Right Now. Whether It Is Electricity, Natural Gas, Water, or Specific Entertainment Expenses Such as Netflix® and Cable, Adults Who Were Surveyed Report That It Is Going to Be Over a Month Until They Can Pay Their Current Bills—an Average of 6.3 Weeks to Be Exact.

Imagine Your Tenants Are a Family of Four and Both Adults Are Chefs—One Was Laid Off Weeks Ago, and the Other Had Her Hours Slashed 80%. While Their Income Is Drying Up Due to Quarantine Regulations, the Majority of Their Expenses Continue. As Their Landlord, There May Be Some Tough Decisions on the Horizon if Your Tenants Find Themselves Unable to Pay Rent on the Usual Date.

Note: It's Important That Landlords Familiarize Themselves with Housing Regulations and State Specific Laws – Especially the Most Recent Ones. While Evicting Your Tenant Due to Nonpayment May Have Been a Justifiable Option Months Ago, the Current State of the Environment May Have Changed. Be Sure to Contact Legal Counsel for Further Guidance.

4. Millennials May Be the Hardest Hit Generation

Traditionally Defined as People Born Between 1981 and 1996, Millennials Are No Longer as Young as Most People Think When They Use the Term. This Generation Has Felt the Unfortunate Double-Whammy of Entering the Job Market During 2008's Recession, and Now, in Their Prime Earning Years, Are Seeing a Quarantine-Induced Recession Cause Their Income to Dry Up Before Their Very Eyes.

With So Many Millennials Employed (79% According the Bureau of Labor Statistics), They Represent a Huge Swath of People Who Have Been Financially Hurt by the Pandemic. Combined with the Fact That Many Millennials Rent, Landlords Could Start to See How Things May Get Worse in the Near Term.

5. 40% of People Are Working Less than Before*

Current Headlines Seem to Trumpet Bad Unemployment Figures. But One Often Overlooked Fact Is That While Millions of US Workers Still Have Their Jobs, They May Be Working Fewer Hours Each Week. This Not Only Includes Lower-Paid Hourly Workers—One of the Demographics Hardest Hit by Quarantine Shutdowns—But Also High-Paying, White-Collar Employees.

Tens of Millions of Americans Have Applied for Unemployment Benefits.

6. 20% of the Small Business Workforce Is Now Unemployed*

In the United States, There Are 30.7 Million Small Business Operating at Any Given Moment. With So Much Media Focus on Big Name, Fortune 500 Behemoths, It's Easy to Forget the Staggering Amount of Economic Impact Small Businesses Have in America. Now, Many Weeks In to an Almost National-Level Quarantine, a Recent Survey from TransUnion Reveals 1 in 5 Small Business Workers Are No Longer Employed.

With Such a Large (and Growing) Amount of People Looking for Work, Their Ability to Pay for Necessities May Be Reduced.

Pro Tip: It May Be Worthwhile to Reach Out to Your Tenants Now to Get an Understanding of Their Situation. If Your Renter's Income Is Impaired, Then Look for Solutions Could Work for All Parties.

Possible Solutions for Landlords

While the Following May Not Work for All Landlords, There May Be Outside-the-Box Ideas Worth Considering for How to Deal with Keeping Your Rental Revenue Flowing During Such a Unique Time:

Work Out a Payment Plan with Your Tenant: Even Accepting Partial Payments for a Period of Time Can Be Better Than No Payments at All. Consider Working with Your Renter on a Payment Plan That Allows Them to Pay Partial Rent in the Short-Term.

Pause Rent Payments: If You're Able to Absorb the Loss of Income, Then You Can Be a Tenant's Hero and Push Rent Payment Until After Quarantine Has Lifted.

Ask Your Lender to Suspend Mortgage Payments: You May Be Able to Keep Your Home, Avoid Late Fees and Address Negative Reporting to the Credit Bureaus.

Allow Your Tenant to Break the Lease: Consider Releasing Your Renter from the Current Lease. You Could End Up Finding a More Qualified Tenant.

Screen Prospective Tenants to Help Lower Non-Payment Risks

There Is a Great Deal of Uncertainty in Today's World. But Landlords Can Get Peace of Mind Knowing That Compliant Tenant Screening Is Still Readily Available for Them at Any Given Time.

While Landlords Hope That Renters Will Cut Non-Essential Expenses Like Cable, Starbucks® Coffee and Premium Spotify® Subscriptions Before Skipping Rent Payments, There Is No Telling What Will Happen.

Undoubtedly, Economic Disruptions Due to the Pandemic May Be Causing a Larger-Than-Normal Number of Tenants to Stop Paying Rent (Amongst Many Other Bills). If You're Preparing to Rent Out Your Property Now, Be Sure to Lower Your Risk of Non-Payment by Verifying Your Renter's Creditworthiness and Ability to Afford the Rent in the First Place.

SmartMove tenant screening Can Help Lower Your Risk of Leasing to Non-Paying Renters—Pandemic or Not. By Enabling You Near-Instant Access to an Applicant's Credit Check, Criminal Background and Eviction History Reports, Reliable Information from TransUnion Can Help Guide You Toward Greater Decisions When Choosing Great Tenants. SmartMove Tenant Screening Offers Two Important Features That Can Help Landlords Appraise Renters in This Environment: Income Insights and ResidentScore.

An Income Insights Report from TransUnion Is Designed to Help Further Lower Non-Payment Risk. This Report Examines an Applicant's Self-Reported Income by Using Information from Their Credit Report to Include Aspects Such As: How Much Money They Spend, How Much They Pay Towards Balances, and Types of Balances They Carry Among Other Factors.

With the Help of This SmartMove Feature, You Will Know Which Applicants Require Additional Income Verification Before Signing the Lease.

- Save Time and Effort by Avoiding Manual Income Checks

- Lower Risk of Renter Non-Payment Issues

- Determine If Financial Behavior Reflects Self-Reported Income

- Estimate Both Job and Non-Related Sources of Income

SmartMove Landlords Will Also Receive a ResidentScore®, Which Is a Credit Scoring Model That Is Specific to the Rental Industry. Powered by a Sophisticated TransUnion Analysis of More Than 500,000 Actual Resident Records, ResidentScore Will Help You Score Potential Tenants with More Precision Than a Traditional Credit Score.

Why Is ResidentScore Better? Below Are Advantages It Has over Typical Credit Scores:

- Predicts Eviction Risk 15% Better

- Identifies 19% More Skipped Payments

- Scores More Applicants Who Have Limited Information (Also Known As “Thin Files”)

By Utilizing a Credit Report and ResidentScore, You'll Be Well-Equipped to Better Identify Your Risks of a Painful, Expensive Eviction, Which Can Cost As Much As $10,000.

Protect the Financial Health of Your Property Investment by Screening Remotely with SmartMove. Sign-Up for Free Today (Terms and Conditions Apply).

*April 2020 TransUnion Survey of 3,019 US Adults

If you, like many others, are concerned about your ability to pay your bills and loans in the coming weeks, TransUnion has created a COVID-19 support center, which can help you learn how to manage your credit during this uncertain time:

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.