Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

The right real estate investment in the right market can prove to be profitable. However, not all rental markets are the same – certain markets are experiencing healthier and steadier growth than others. We’ll take a look at some of these markets and the drivers behind their growth.

Why Rental Property Investments Remain Popular

Investing in rental property remains an attractive option for people looking for a consistent source of passive income. In fact, a recent SmartMove survey showed 6 in 10 landlords say it is more profitable and attractive to be a landlord now than it was five years ago. The attractive rental market is in part due to the decline in homeownership as millennials wait longer to purchase homes. Landlords are benefiting from this trend and finding it less difficult or about the same to find qualified renters for their units compared to a year ago and that more tenants are staying in their units longer.

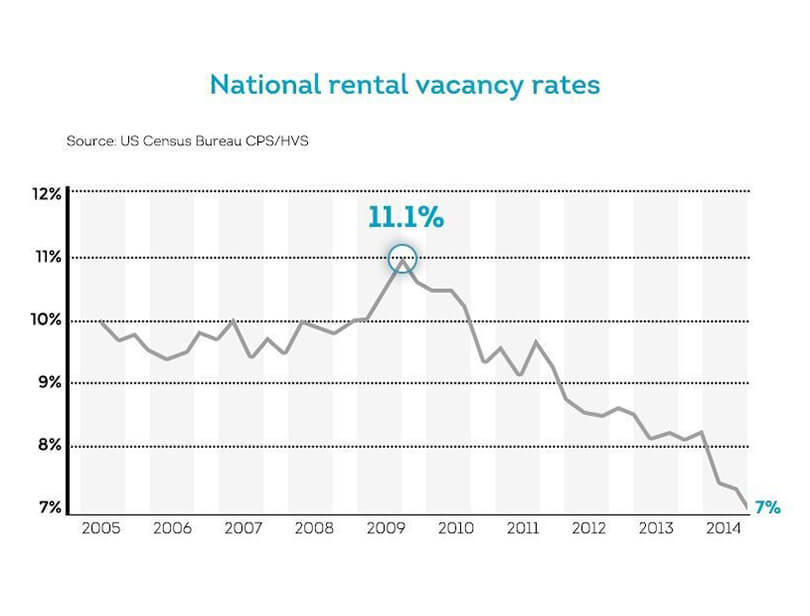

While homeownership has been declining, rental vacancy rates have declined as well. Back in 2009, the vacancy rate hovered around 11.1 percent. Since then, national rental vacancy declined, spelling out good news for rental property owners who don’t want their unit to sit on the market for very long.

rental property vacancy rates 2005-2014

Rising Rents

In combination with decreasing vacancy rates, landlords in general have seen rents rise. SmartMove’s 2017 user survey showed that 57% of landlords have increased their rental prices in the past year. Additionally, the national average increase in the rental rates for a three-bedroom home came in at 4.8 percent year over year.

As with any investment, the real estate industry offers its fair share of risk. Real estate can be subject to global economic changes and local economic slowdowns, as well. With that said, there are several promising trends in this year’s real estate market, and monitoring these trending areas can prove wise for the real estate investor.

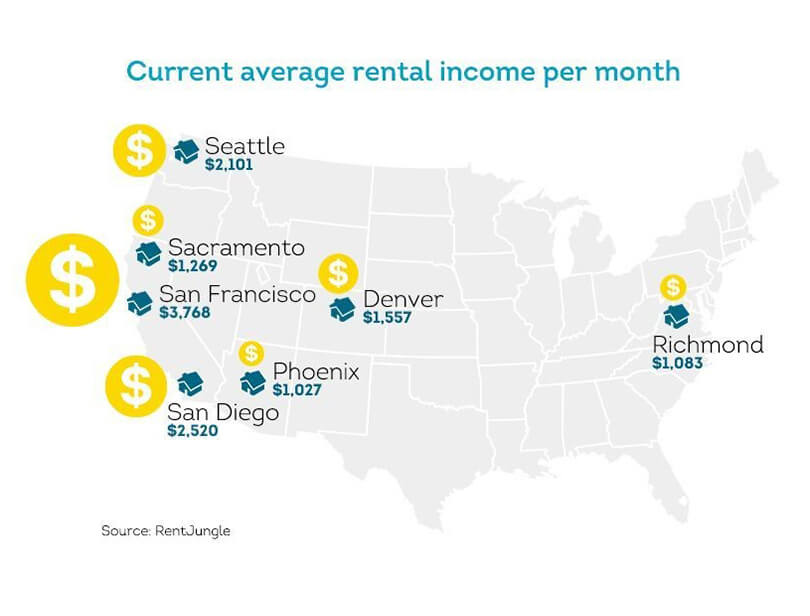

The following cities have experienced growing rental markets, and we’ve taken a look at potential rental income in these locations.

Sacramento, California

Silicon Valley and the greater Bay Area are saturated with tech industries, which has led to an influx of young professionals. These employees need housing, and arrival of new tenants have driven up rent and housing prices. Thanks to rising costs, many are flocking to nearby Sacramento to find more affordable housing. Median home value appreciation remains steady at 5.1 percent, and research estimates the median home price is around $420,000.

Sacramento rental property trends

San Diego, California

San Diego remains an expensive and competitive market for tenants. However, in 2016, there was a rise in single family home construction, which means there are more new housing starts available and potentially more inventory.

San Diego rental property trends

Richmond, Virginia

Richmond experienced a growing housing market in 2016, largely in thanks to its diverse economy. Income in the city has steadily increased and unemployment rates have remained at a steady low of 4.4 percent. The housing market growth is expected to slow and stabilize throughout 2017. Should higher numbers of buyers pursue fewer housing opportunities, home prices and rental rates may rise.

Richmond rental property trends

Seattle

Seattle is saturated with tech companies. As these companies grow, an influx of professionals continue to move into the city. These professionals tend to earn higher salaries on average, which allows them to buy property and afford higher rental rates in more affluent areas. The city is expected to draw in more young professionals. Home values for most neighborhoods in the city are expected to rise, and the overall economy is projected to continually strengthen throughout 2017.

Denver

Denver continues to experience steady growth in real estate; home values appreciated by 10 percent over the past year. The market has shown signs of leveling off, but with continued employment growth, there are burgeoning expansions of up and coming neighborhoods. As the city continues to expand and public transportation systems are refined, outer areas may see continued growth.

San Francisco

In San Francisco, demand exceeds supply and inventory is tight; in October 2016, active single-family home listings in San Francisco experienced a 21.7 percent decrease, leaving housing inventory at a total of 387 units—investors are buying property up quickly. According to a report from SFRealtors, the median sales price of homes in San Francisco increased by 34 percent, averaging $1,216,500. This data shows it can be difficult to locate the right unit or home at the right price, so it’s important to work quickly, as properties don’t remain on the market for long in the foggy city. Investors that can afford to snag real estate in San Francisco may see significant long-term profits.

Phoenix

Experts have predicted Phoenix home prices will climb by 5.9 percent in the next year, and sales are expected to increase by 7.2 percent, leading Realtor.com to proclaim this Arizona city as the number one U.S. housing market for 2017. The city continues to enjoy steady job growth, which increases housing demand, and a short supply of foreclosures leaves Phoenix in one of the healthiest real estate positions in the country. However, interest rates are on the rise in Arizona, and home prices may continue to increase in coming years.

Note: In order to understand the opportunity related to these trending markets, we’ve gathered data on the most current rental rates based on findings from RentJungle. These numbers provide a glimpse at the approximate rental income a property owner might expect in a given area.

Rent across the United States can vary in price substantially

Conclusion

These cities are trending to be top real estate markets this year. With rising populations, growing economies, and burgeoning housing inventory, real estate investors are keeping an eye on these cities as we delve further into 2017.

If you’ve made the decision to invest in rental property, be sure to set yourself up for success by thoroughly conducting tenant screening on your applicants. TransUnion SmartMove provides credit, criminal and eviction reports to help landlords find out what they don’t know about their rental applicants and protect their rental income.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.