Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

When I first bought rental properties, I did all the management myself. I advertised the homes, picked the tenants, took phone calls and handled the problems that came with tenants. I managed my rentals until I had 7 and then switched over to using a property manager. While I managed my rentals, I made a lot of mistakes and learned a lot about how to pick tenants. Many times not taking my time choosing tenants did not hurt me, but on a couple occasions it cost me a lot of money. Here are some of the mistakes I have made choosing tenants and mistakes I see other landlords make as well.

Can you get away with mistakes when choosing a tenant?

I invest in single family rental properties for a number of reasons. My experience has shown:

- Easier to get a great deal on, because there are more of them

- Sometimes appreciate more, because the value is not based on income

- Easier to manage, because tenants stay longer and take better care of the property

- Generate more rent per door, which equates to less management for same income

- Usually have less maintenance and vacancies

I have been fairly lucky when renting my properties and I think some of that is because I invest in single family homes. Many tenants treat a single family home as their own, where tenants in apartments might think of it as a temporary place to live. I have had very few bad tenants and even fewer who caused any damage or had to be evicted. Recently I can attribute my success to an awesome property manager who screens tenants very well. In the few cases where tenants have caused me major headaches, it was almost always my fault. I did not screen the tenants well, I did not charge late fees, I ignored huge red flags, because I thought my gut was telling me this would be a good renter.

If you or your property manager is making mistakes when choosing tenants or being lazy, you may get away with it for a while. Many tenants may work out okay even with poor screening, but one bad tenant can wreak havoc on your properties and wallet. Just because you have squeaked by up to this point with poor screening, does not mean you can continue without consequences.

What are the top mistakes I have made or have seen made when choosing tenants?

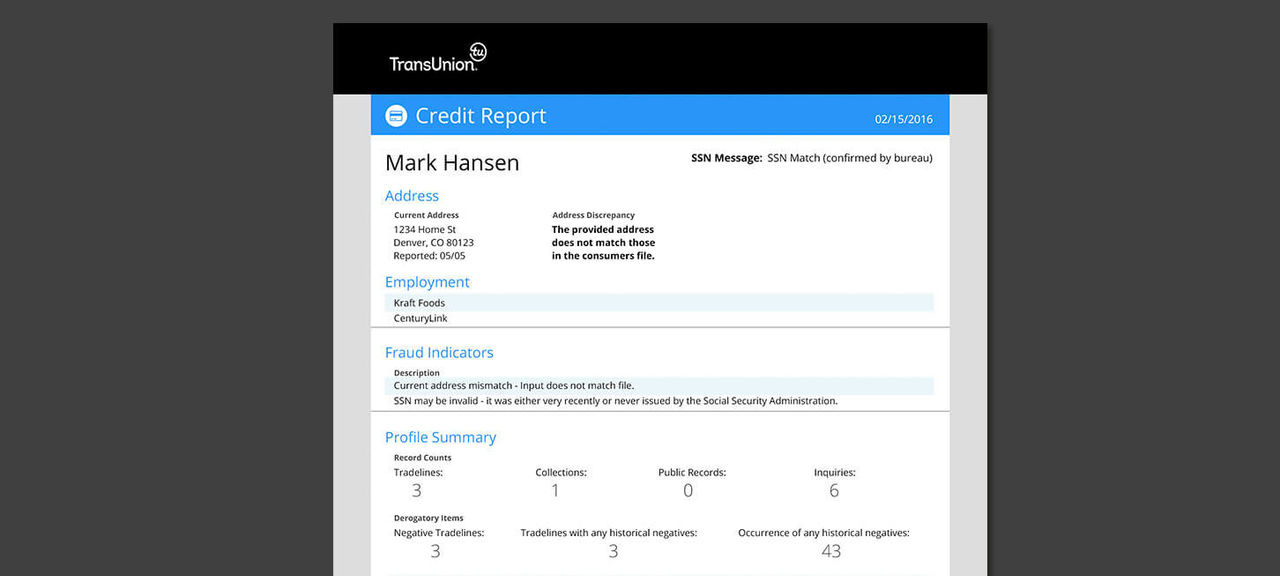

- Not checking credit: I used to avoid checking credit because I was lazy and I did not want to handle someone’s social security number. Almost every problem I had with tenants, came from people with bad credit. In some cases bad credit was something that could not be avoided or was caused by a one-time event.

- Not charging late fees: I felt bad charging late fees in the past. I did not want my tenants to not like me and they always had a really convincing story why they were late! In the end, the more they say I would not charge late fees, the more they would pay rent late. They would get in a hole that was impossible to get out of and it cost me money in lost rent.

- Not checking on houses: I have been pretty good about checking my rentals frequently. In fact, we have a clause in our lease that says we can come into the property every quarter to check smoke alarms, CO detectors and furnace filters. I have found it valuable to actively maintain the properties and maintain ongoing contact with my renters at the properties they rent.

- Not charging application fees where permitted: I did not charge application fees in the beginning. I did not run credit, so I felt bad charging the tenants a fee. The problem was every potential tenant would apply, because it cost them nothing. I would check references and spend time vetting the tenant, but they may not have even been serious about renting. Now that we charge application fees when we can and we have more serious tenants and waste much less time.

- Choosing tenants who do not have enough income: Many times tenants assume they will be able to afford a place without really thinking about it. A good rule of thumb I have found useful is the rent should be not more than 1/3 of their income. Whenever I have broken this rule, it has come back to bite me.

- Not getting full payment before move in: I have let tenants move in before they paid a full month’s rent and deposit. If the tenant cannot afford to pay the deposit and rent, they will not be able to afford the property.

Conclusion

Choosing tenants is a key to any successful rental property business. The better job you do of screening and choosing tenants, the more successful you will be. I had many more issues when I was managing properties myself, because I was lazy screening tenants and too soft on them when there was a problem. Not charging late fees, ignoring warning signs, or stretching your criteria, does not help you or the tenants.

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.