Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Staying profitable can be difficult in a constantly shifting industry and the rental market is no exception. Major shifts have kept landlords on their toes throughout 2019, but it still appears to remain a landlord’s market as we move into 2020.

In the last decade, rental vacancy rates have steadily decreased, leaving landlords well-positioned to enhance their bottom line with a plethora of prospective tenants to choose from. As home prices have outpaced wage growth and debt amongst younger populations has increased, Americans continue to rent in droves.

In order to entice today’s renters, landlords are tasked with remaining up-to-date with industry trends. Failing to stay on top of the latest industry shifts can result in higher rates of tenant turnover, leading to loss of rental income and costly vacancy.

To position yourself for success in the New Year, it’s important to analyze the shifts currently occurring within the rental industry.

Below, we look at trends in various sectors of the market, including:

- Homeownership rates

- Demand for apartments

- Demand for single-family homes

- Increased interested in exurban rentals (suburbs)

- Renter income shifts

Let’s dive into these trends and explore landlord takeaways from the past year that could help guide your rental business decisions in 2020.

Millennials still haven’t caught up to homeownership rates of prior generations

Millennials make up a large portion of the rental population and it appears it will remain that way in the coming years.

While homeownership rates are increasing amongst Millennials, this subset still falls behind homeownership rates of previous generations, including their Baby Boomer and Gen X predecessors. The Pew Research Center defines Millennials as those born between 1981 and 1997, making them 23 to 39 in 2020.

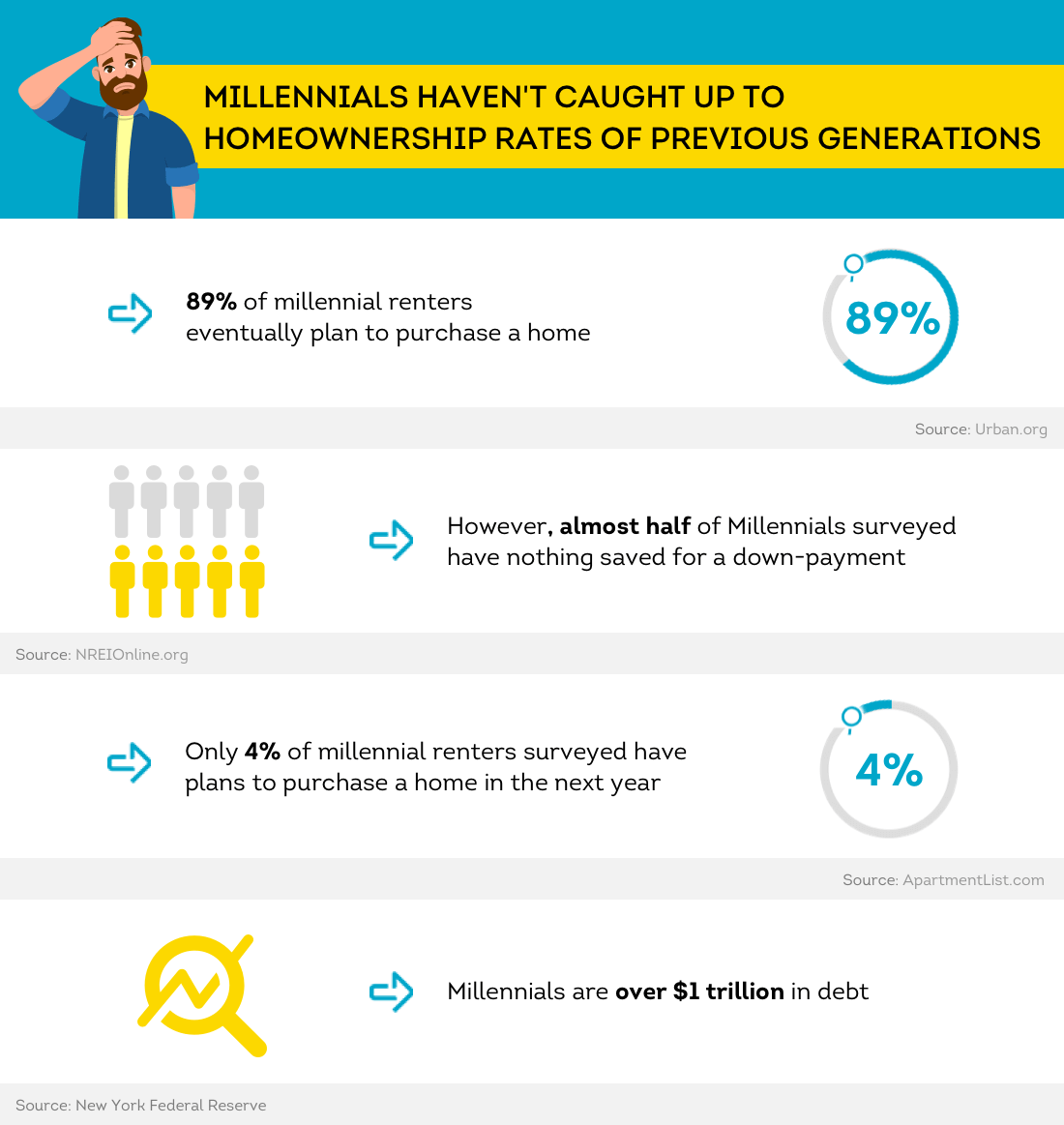

That’s not to say Millennials intend to rent forever. According to recent research from Apartment List, up to 89% of millennial renters eventually plan to purchase a home—key word being eventually.

While Millennials intend to buy homes in the future, lack of savings may prevent that for now. Almost half of those surveyed have nothing saved for a down-payment. According to The Atlantic, the net worth of the average Millennial household is 40% lower than it was for Gen X households in 2001 and 20% lower than for Baby Boomers’ households at the end of the 1980s.

The New York Federal Reserve found that Millennials are over $1 trillion in debt, largely due to student loans, leaving many in this generation unable to save enough to invest in real estate.

Only 4% of millennial renters surveyed have immediate plans to purchase a home in the next year, indicating this population will still be looking towards renting their living space for the foreseeable future.

Even those Millennials with down payment in hand will face other hurdles in a tough buyer’s market. Mortgage rates are rising, and Freddie Mac predicts 30-year, fixed rate mortgages will move up to 4.5% in 2020.

With a potential recession on the horizon, some Millennials are hoping to take advantage of reduced home prices. However, The Atlantic predicts that any type of downturn that increases unemployment and negatively impacts wages will make it hard for Millennials to build wealth in the near future, which may impact their ability to invest in the housing market.

Bottom line: The majority of Millennials will continue to rent their living spaces.

Landlord Takeaway

According to the Brookings Institution, Millennials will account for more than 1 in 3 adult Americans by 2020. Because Millennials make up such a large segment of the rental market, landlords need to be thinking about how to appeal to them—retaining high-quality renters requires more than handing over the keys and waiting for a check.

Understand what entices Millennial renters, then cater your property offering to suit those needs. Through strategic property upgrades and effective marketing, you can pull in and retain this renter population.

- Cater to their desires:To keep Millennial renters interested, it’s important to consider what drives them.

- Pet-friendly rentals: Millennials are the largest segment of pet owners, and 80% of Millennials and Gen Z report owning a dog. If you want to appeal to Millennials, you need to appeal to Fido, as well. Consider revising your rental pet policy and allow pets if you want to attract more applicants.

- Eco-conscious properties: According to AMLI, Millennials care that their apartments offer sustainable features, and 61 percent of those surveyed said they would be willing to pay more to live in a sustainable community. Think about ways you could incorporate eco-conscious amenities or features into your rental property, whether it’s energy-efficient windows or graywater recycling systems.

These are just two simple ways landlords could better attract Millennial renters. By offering the modern amenities that tenants want, you can help your property stand out from the crowd.

2. Marketing to Millennials: You should also consider revamping your marketing efforts to attract better applicants. Is your rental listing enticing to the Millennial renter?

A great rental listing does two things:

- grabs attention from searching renters

- screens out those who aren’t a good fit for your property

Be sure to highlight amenities that the competition may not offer and focus on local conveniences that could also tip the scales in your favor. You should also consider where you’re posting your listing in order to reach this younger population.

Around 90% of Millennials look for housing online, and 3 out of 4 do so using their mobile phones. Make sure you’re posting your listing in the right places, including online forums such as Craigslist, Hotpads.com, and Apartments.com.

There is Continued Demand for Apartments

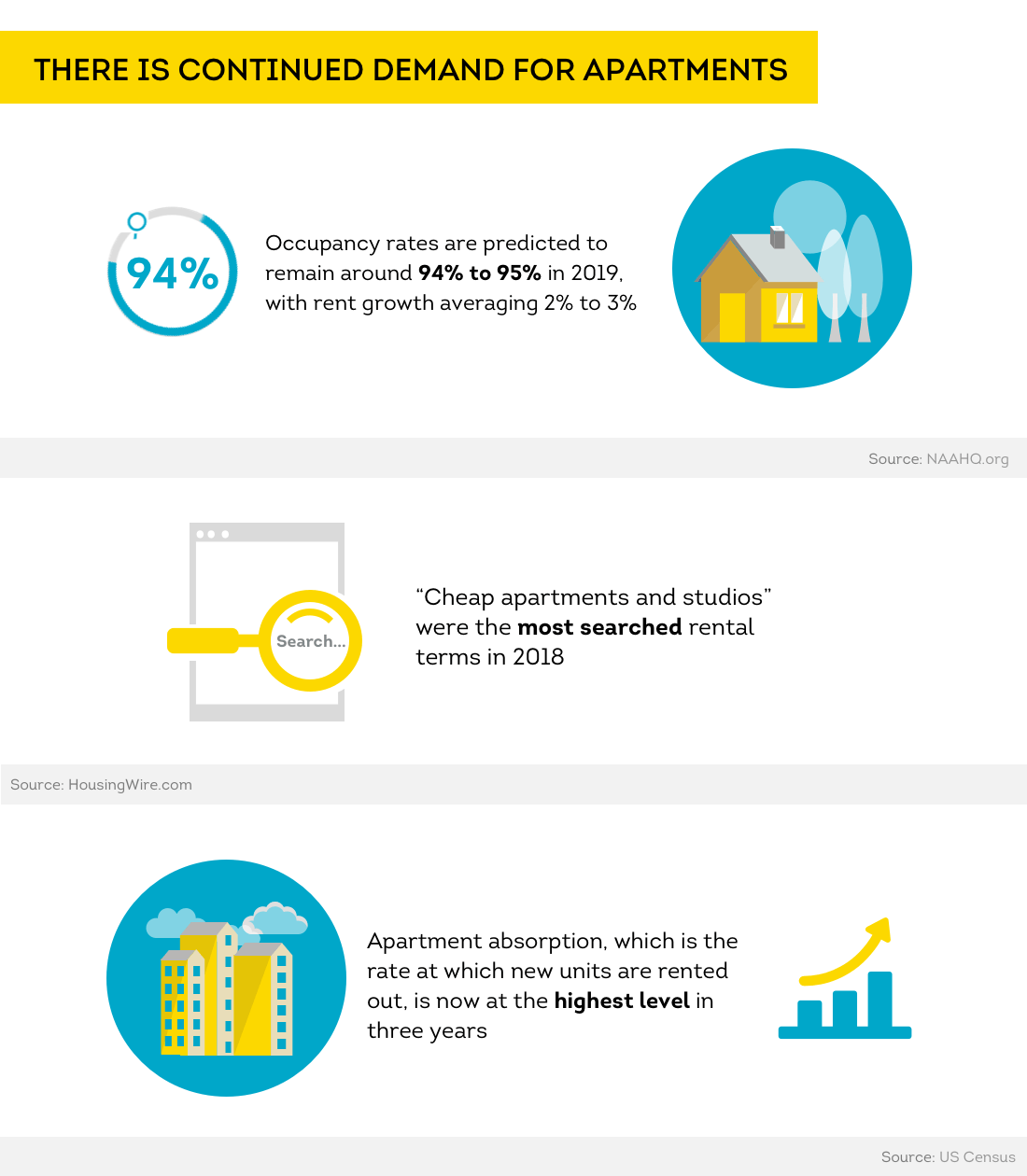

Landlords who own apartment rental properties are poised to profit well into the New Year. The National Apartment Association (NAA) predicts occupancy rates will continue to be around 94% to 95% through the remainder of 2019, with rent growth averaging 2% to 3%.

The desire for affordable apartment units is clear, as “cheap apartments and studios” were the most searched rental terms in 2018. Apartment absorption, which is the rate at which new units are rented out, is now at its highest level in three years.

However, the supply of new apartment units is also increasing. Developers were on track to deliver around 337,000 apartment units by the end of this year, a 17,000 increase from 320,000 in 2018. With many new units available, competition could heat up in 2020 for independent landlords who own apartment rental units.

Landlord takeaway: If you own a multi-unit apartment complex or single apartment unit, you stand to make money in the current rental market. However, with supply increasing, landlords must stay competitive.

Make sure you determine fair market rent and know what you should charge for rent in your area. Price too high and you could lose renters to cheaper, comparable properties in the area; price too low and you’ll lose out on rental income. Or, worse, you may end up with a less than desirable tenant.

The Outlook for Single-Family Homes is Bright

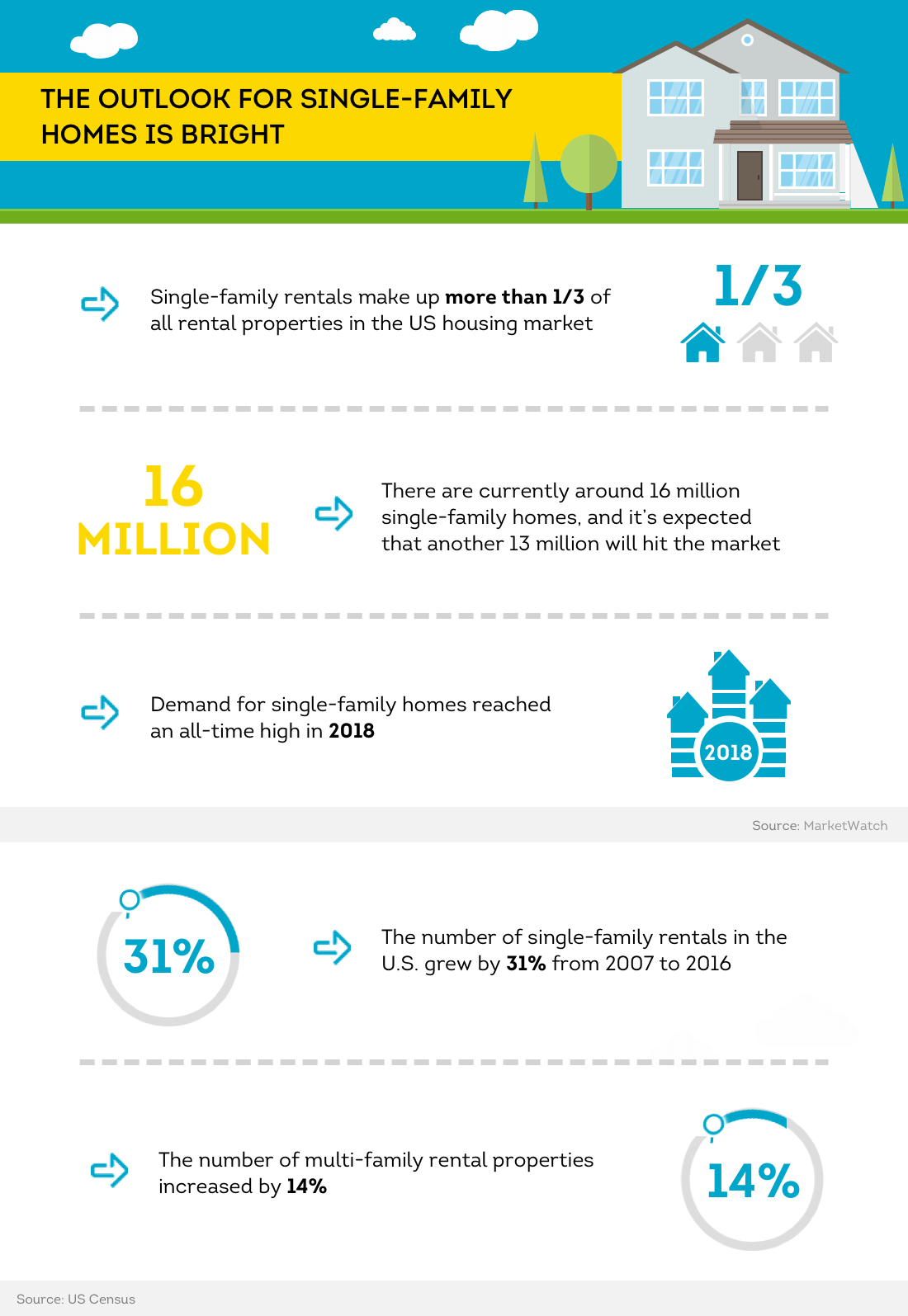

Demand for single-family homes reached an all-time high in 2018, and this is forecasted to continue in years to come. Landlords interested in investing in new properties may want to set their sights on these structures.

The number of single-family rentals in the U.S. grew by 31% from 2007 to 2016, while multi-family rental properties grew only 14%. Currently, single-family rentals make up more than one-third of all rental properties in the US housing market and it’s forecasted that another 13 million homes will hit the market by the year 2030. From an investment perspective, single-family rentals may be a good bet. While overall the stock market performs better than the real estate market, the latter experiences fewer lows and highs.

The average real estate appreciation rate is forecasted to remain at +3.7% through June 2020, however, Veros Real Estate Solutions has provided a list of 5 cities that may offer high real estate appreciation:

- Odessa, Texas — +9.7%

- Coeur D'Alene, Idaho — +9.5%

- Idaho Falls, Idaho — +9.4%

- Boise City-Nampa, Idaho — +9.1%

- Midland, Texas — +8.0%

Landlord takeaway: It’s apparent that renters are increasingly interested in single-family rentals. If you’re looking to invest in new rental property, this segment could be profitable. Consider investing in areas forecasted to appreciate in coming years.

Forbes provided a list of potential investment areas for investors looking to capitalize on single-family rentals. Their top 5 included:

- Las Vegas, Nevada

- Orlando, Florida

- Atlanta, Georgia

- Charlotte, North Carolina

- Phoenix, Arizona

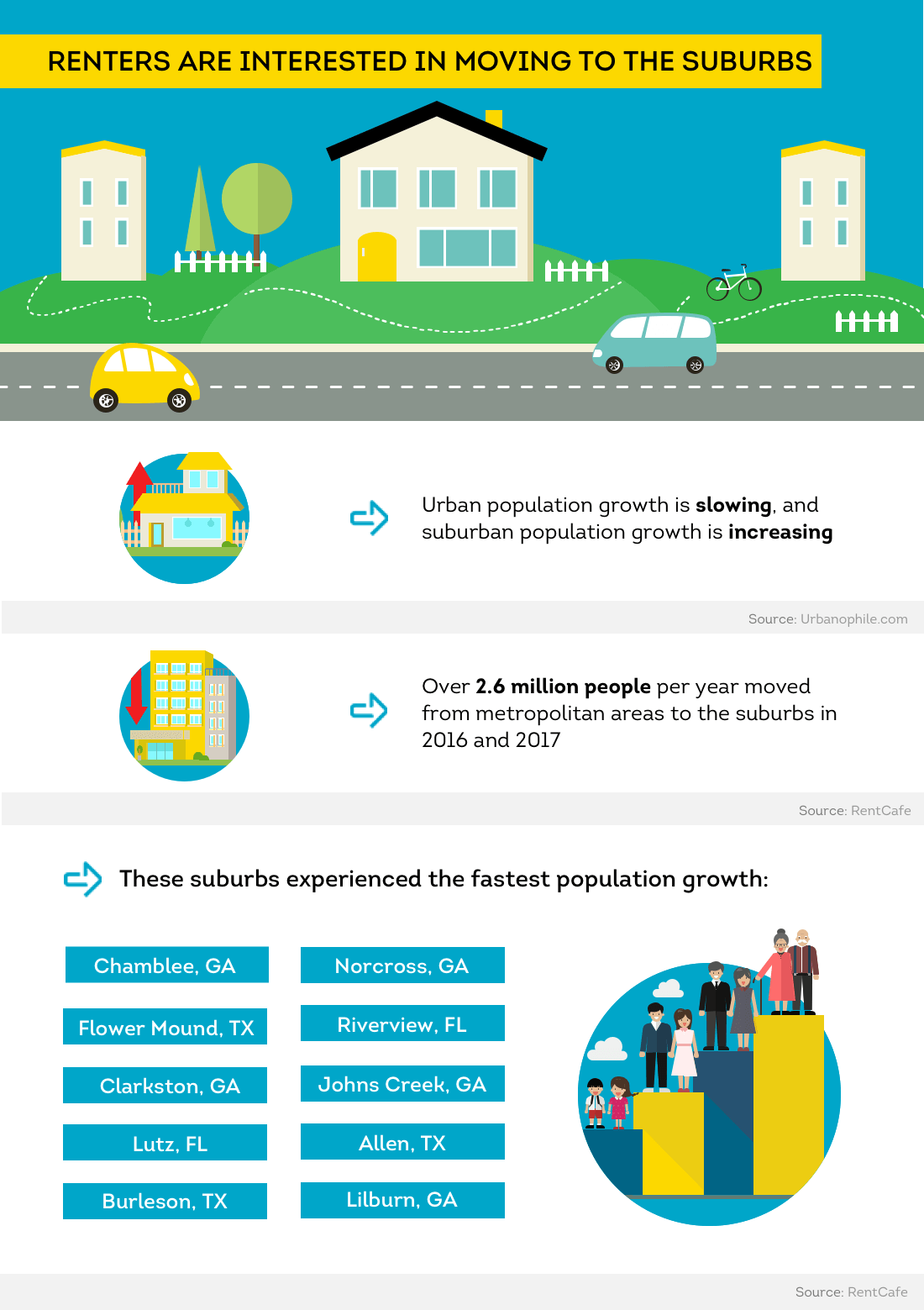

Renters are Interested in Moving to the Suburbs;

Urban population growth is slowing, and exurban population growth is increasing. The U.S. Census Bureau reports that over 2.6 million people a year moved from cities within metropolitan areas to the suburbs in both 2016 and 2017.

A variety of factors may convince today’s renter to leave set their sights on out-of-city living.

- Shifting needs: Millennials are moving into their 30s and starting to create families of their own. Suburban areas generally offer better school districts than urban areas, which may entice Millennial parents to make the exurban switch.

- Cost: Renting in urban areas can also be cost prohibitive. Because rent tends to be more affordable in smaller towns, this subset of the population may prefer to head to areas that aren’t as costly as metropolitan areas.

- Space desires: Tenants can outgrow their smaller apartment units, and may want to expand to areas with more space. Due to affordability and the prevalence of single-family homes in suburban areas, Millennials may find they can get more bang for their buck.

According to RentCafe, the following suburbs experienced the fastest growth:

- Chamblee, GA

- Norcross, GA

- Flower Mound, TX

- Riverview, FL

- Clarkston, GA

- Johns Creek, GA

- Lutz, FL

- Allen, TX

- Burleson, TX

- Lilburn, GA

Landlord takeaway: Keeping tabs on the shifting habits of renters can help guide investment decisions. Buying an investment property in a suburban housing market may be profitable in terms of rental income, due to:

- Economic growth

- Increasing rental demand

- High occupancy rates

In addition, the real estate market may prove kind to ready and waiting real estate investors. Sales of single-family homes through 2019 confirm housing markets are weakening across the country. If a recession does hit in the New Year, landlords may be able to take advantage of better real estate prices in a down market.

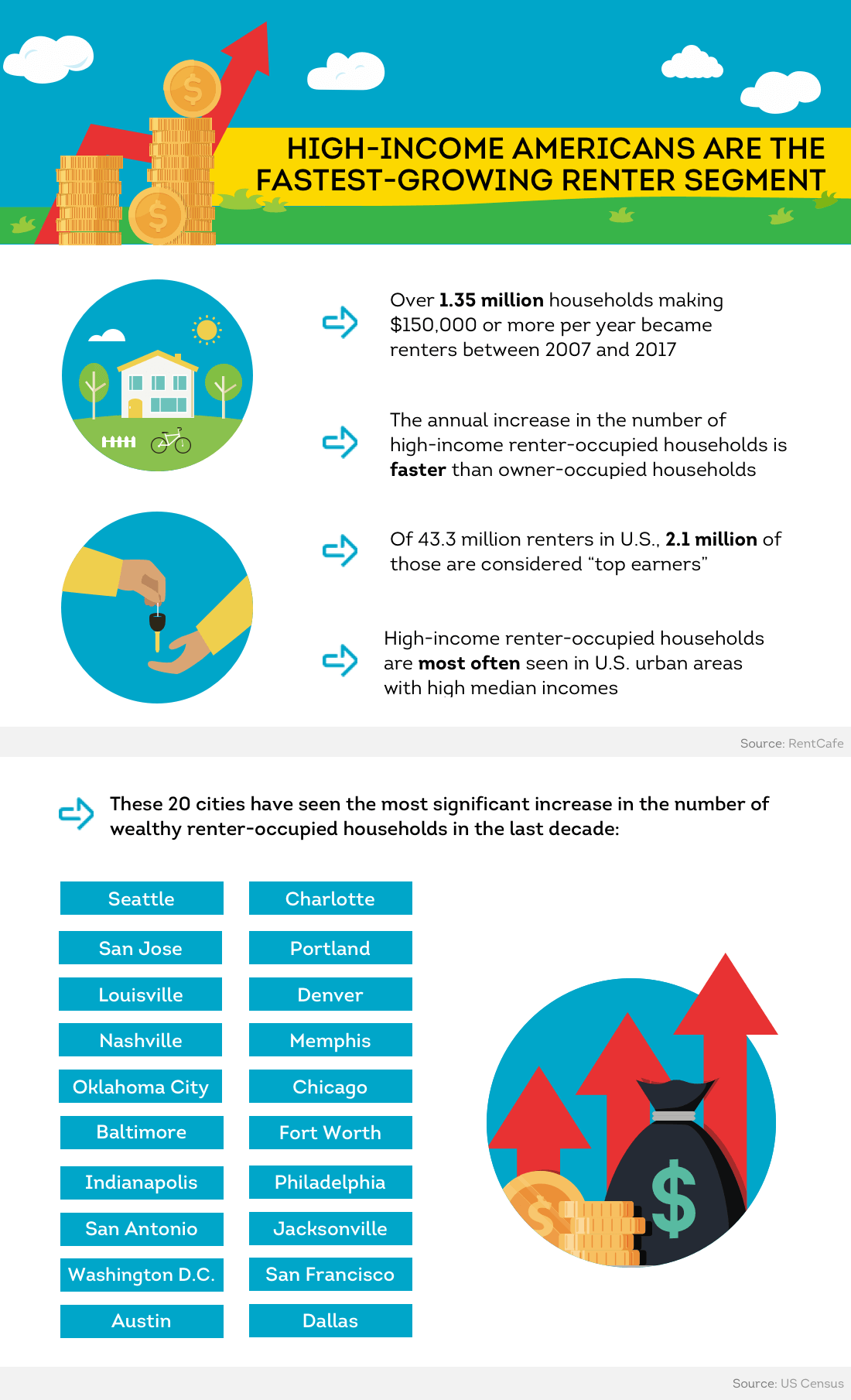

High-Income Americans are the Fastest-Growing Renter Segment

A new type of renter has invaded the rental market; according to RentCafe, 1.35 million households making $150,000+ per year became renters just in a 10-year span, from 2007 to 2017.

The year-over-year increase in the number of high-income renter-occupied households ($150,000 or more) is faster than owner-occupied households. That means renters with cash to spend are flooding the rental market, and landlords should be prepared to take advantage of this lucrative opportunity.

Of 43.3 million renters in U.S., 2.1 million of those are considered “top earners”. Where are these money makers living? High-income renter-occupied households are most often observed in U.S. urban areas boasting high median incomes.

RentCafe notes the American Community Survey from the U.S. Census Bureau, which highlighted 20 cities that have seen the largest increase in wealthy renter-occupied homes in the last decade:

- Seattle

- Charlotte

- Baltimore

- Fort Worth

- San Jose

- Portland

- Indianapolis

- Philadelphia

- Louisville

- Denver

- San Antonio

- Jacksonville

- Nashville

- Memphis

- Washington D.C.

- San Francisco

- Oklahoma City

- Chicago

- Austin

- Dallas

Landlord takeaway: Determine how to attract high-income applicants to your rental property in order to maximize rental income and give your property a leg up on the competition.

According to research from NMHC, these are the top 5 home amenities desired by renters:

- High-Speed Internet: Offering high-speed internet could help you pull in high-income renters looking for enhanced connectivity.

- Dishwasher: If your unit doesn’t already offer a dishwasher, consider installing one, as 86% of renters indicate they won’t rent a property without this appliance.

- Soundproof Walls: If you own a multi-unit property, noisy neighbors can become a challenge. Consider soundproofing walls to help mitigate risk of noise disputes.

- Air Conditioning: This is especially important if your rental property is in an area that sees high temperatures. Almost 92% of respondents surveyed would not lease a property without air conditioning.

- In-Unit Washer and Dryer: Tenants desire convenience - taking laundry to the local laundromat doesn’t align with that desire. Consider installing an in-unit washer/dryer setup in your rental property.

With the right features and amenities, you may be able to attract more quality applicants and may be able to charge higher rental rates, However, while high-income renters are more commonplace, it’s still crucial to analyze an applicant’s income to ensure that their self-reported income is similar.

Pro-tip: To help ensure that your applicant can afford the rent before signing the lease. landlords can use Income Insights, an income estimation tool unique to TransUnion SmartMove®. Income Insights will use information from the applicant credit report to determine whether further income verification is necessary.

Final Notes

With the aforementioned rental trends in mind, it appears that landlords are well-positioned to stay profitable in 2020. Here’s a quick recap of the trends you should keep in mind in the New Year:

- While homeownership is still on the rise, Millennials and their younger counterparts still rent at high rates.

- Demand for apartments has remained steady, but with new apartment construction landlords may face more competition.

- Rental demand for single-family homes is on the rise, and this type of real estate investment may be lucrative for independent landlords.

- Renters continue to move in droves to the suburbs, offering new investment opportunities for landlords in these areas.

- High-income renters have saturated the rental market, allowing landlords the opportunity to charge higher rental rates.

Keeping tabs on the above trends could help you tap into the right investment properties, cater to high-quality tenants, and increase your bottom line.

Whatever your investment choices are, tenant screening remains paramount. According to a SmartMove survey*, 94% of SmartMove users recommend SmartMove to increase their chances of finding the right tenants for their rental property.

With SmartMove, you can gain access to an applicant’s credit checks, criminal history, and eviction reports, along with ResidentScore and Income Insights.

Create an account for free using your email address and start receiving compliant screening reports within minutes. As SmartMove is accessible online, you can make a more confident leasing decision no matter where you are.

*2016 SmartMove Survey

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.