Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

An eviction may seem like a clear-cut solution to a tenant skipping out on rent, but evictions are costly and time-consuming. TransUnion survey data shows that when you add up court costs, revenue and operating expenses, evictions average $3,500 per unit and three to four weeks for an eviction process to run its course. While large property management companies may have the resources to absorb the cost of an eviction, this is not the case for many independent landlords.

What can you do to help prevent an expensive eviction? Checking a prospective tenant’s rental history and conducting a screening of potential tenants can help you avoid renting to tenants with a history of evictions.

What You Can Learn From Eviction History

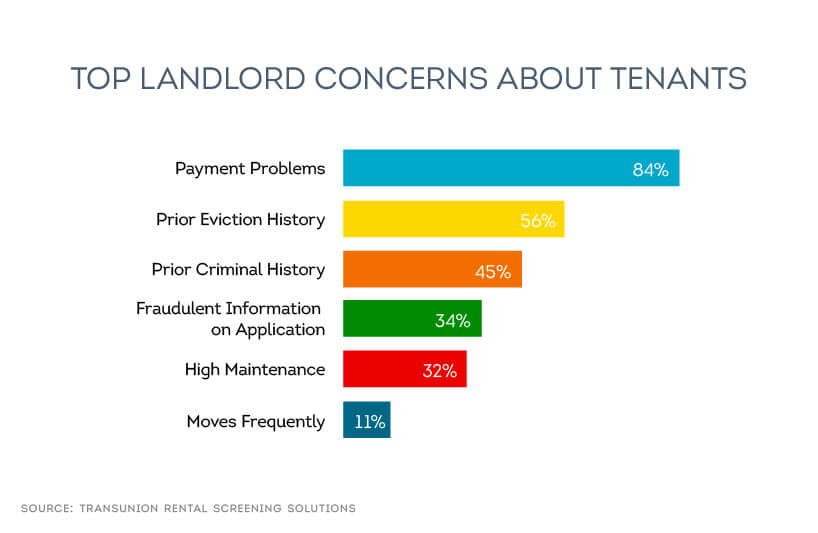

According to a 2014 SmartMove user survey,the top two concerns of landlords are payment problems and eviction history. This is no surprise given that a landlord’s rental income hinges on tenants paying their rent on time.

Eviction history should be a major concern to landlords, since

TransUnion analysis of prior evictions shows that they are highly predictive of future evictions.

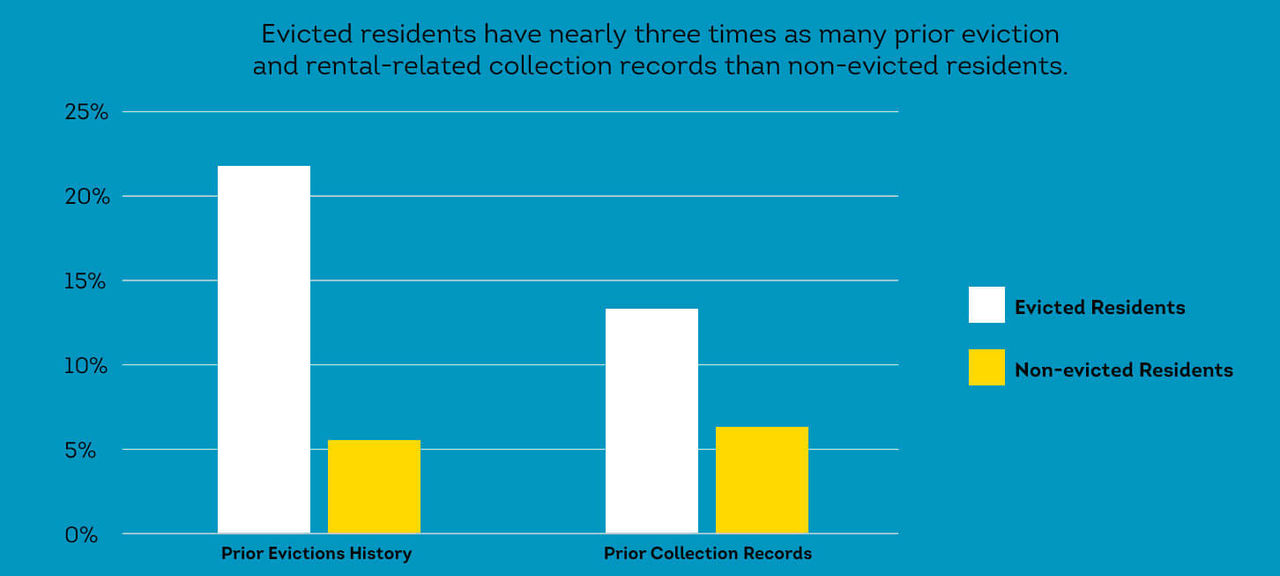

Evicted residents have nearly three times as many prior evictions and rental-related collection records as non-evicted residents.

TransUnion’s analysis examined the records of individuals from nearly 200 properties, comparing those who were evicted to those who were not evicted.

Their findings included:

- In the “not evicted” group, 5.5% of residents had prior evictions on their records.

- For residents who were ultimately evicted, the number rose to 21.7% of residents with a prior eviction.

- Evicted residents have twice as many prior rental related collection records as non-evicted residents.

Evicted residents have substantially higher prior rental collection records as non-evicted residents

According to NOLO, the formal eviction process is governed by your state’s landlord-tenant laws. In general, the process may involve giving proper written notice to the tenant, filing action with your local court system, and attending the hearing. If you succeed, further steps may be needed to be taken to collect past-due rent. If you think it sounds like a lot of time and effort, you would be correct.

How to Check If a Tenant Has Been Evicted

There are two important steps to finding out whether a tenant has been evicted from a prior residence:

1. Contact references

Checking references is a good way to verify an applicant’s behavior with past landlords, as well as their track record of paying rent on time. Make sure to ask the right questions, such as whether there were any circumstances that the applicant paid their rent late and if there were any complaints or other issues.

2. Conduct online tenant screening

With SmartMove online tenant screening, you can obtain a tenant credit report, tenant criminal background check and eviction check in a matter of minutes. Armed with this information, you’ll have a better sense for whether or not your applicant is likely to be evicted.

How You Can Help Prevent Evictions

The most important way to prevent evictions is to property screen tenants. It’s crucial for a landlord to conduct an in-depth screening which includes credit, criminal and eviction history. A credit report will help you to gauge how financially responsible your applicant is and their track record of making on-time payments. A criminal report will give you information on your applicant’s background and whether they have a lengthy relevant criminal history that could put the neighborhood at risk. And finally, an eviction report will tell you whether your applicant has a history or prior evictions, which indicates they’re more likely to be evicted again.

It’s also important to check references, which might indicate whether or not an applicant has a history of paying rent on time. Ask for current paystubs to ensure they make sufficient income to cover the rent.

The more accurate your view of an applicant’s rental history and financial situation, the more able you are to make an informed leasing decision.

How TransUnion Can Help

SmartMove’s eviction records check leverages TransUnion’s vast information databases. TransUnion’s eviction database contains millions of records that include:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for small claims

With comprehensive search results, you can make better leasing decisions that help lower your eviction risk. SmartMove also provides a proprietary ResidentScore, which is built specifically to predict bad rental outcomes and predicts evictions 8% better than a general credit score in the bottom ranges where risk is greatest.

Conclusion

Thoroughly screening your tenants, and making it a consistent part of your rental process, can help you avoid having to evict a tenant later on. According to a recent Zillow report, tenants (especially millennials and baby boomers) are staying in rental units longer as the purchase of housing is being postponed or avoided altogether.

In this landlord’s market, you can afford to be choosy and take extra precautions such as thoroughly researching your tenants to protect your rental investment. Since learning about prior evictions may prevent future evictions, it’s worth researching your tenant’s rental history.

There may still be an occasion where even the most careful landlord has to evict a tenant. However, advance tenant screening is a worthwhile bet against finding yourself in a complicated and costly situation.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.