Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

A credit score is a good indicator of a tenant’s ability to pay their bills in a timely manner. Therefore, it makes sense that a credit report is one of the most important criteria that landlords consider when reviewing new applicants.

However, a low credit score doesn’t automatically have to disqualify a potential renter.

Independent landlords have the option to be flexible with their acceptance policies, and this kind of adaptability can give you an advantage.

There are steps landlords can take to get the story behind the score and to help ensure they end up with a reliable renter in their unit. Checking an applicant’s income, employment background, and eviction history will give you a more well-rounded view of who they are, their ability to pay rent, and suggests whether renting to them is a risky move or not.

1.Get the story behind the credit score

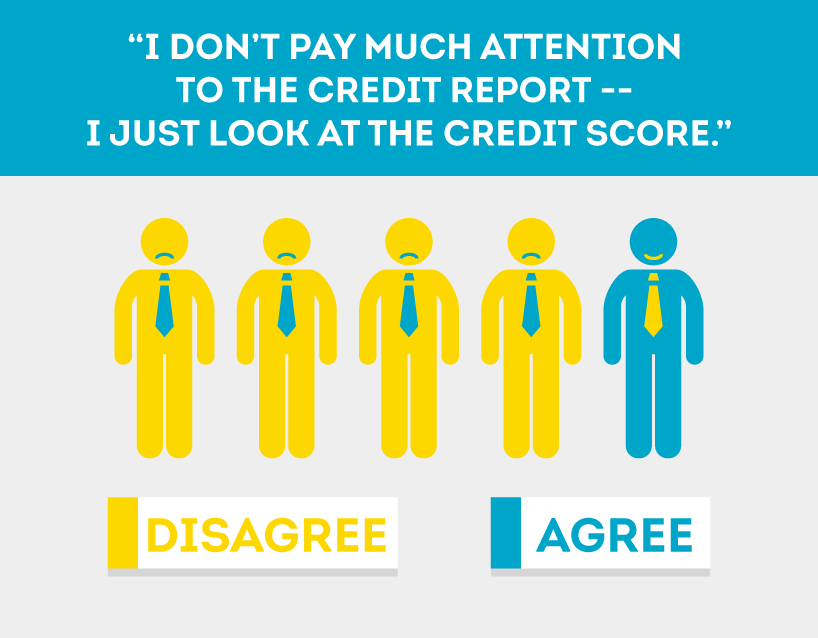

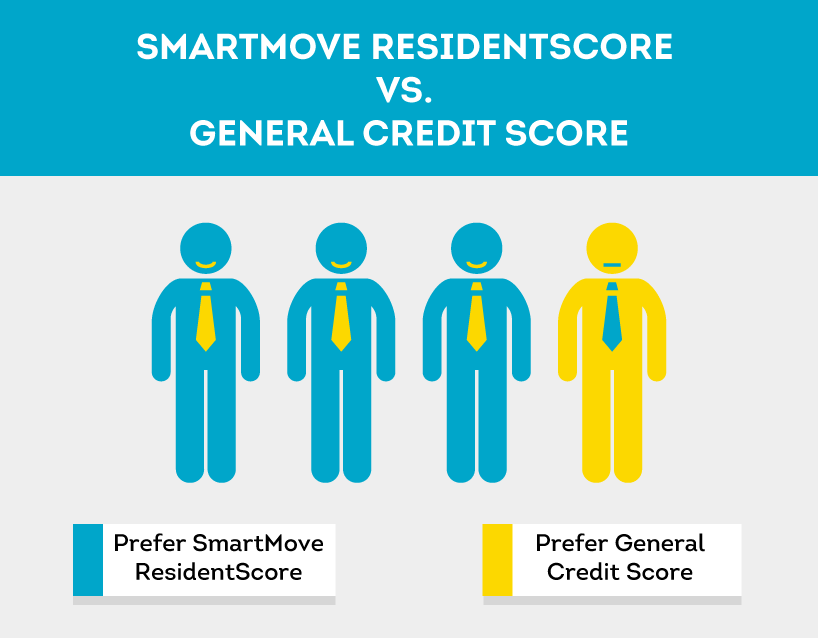

According to a 2016 SmartMove user survey, four out of five landlords disagreed with the statement “I don’t pay much attention to the credit report I just look at the credit score.”

Knowing how to read a credit report can help you identify the reason behind the low score and whether these are items to be worried about. A lower credit score doesn't always mean they’ll be an unreliable tenant.

Some items may be more of a cause for concern than others. For example, medical debt might be due to circumstances outside the person’s control. This may be seen as less risky to a landlord than overdue credit card payments. Similarly, a bankruptcy may lower an applicant’s credit score, but if the bankruptcy has been fully discharged, the person might be in a much better position financially.

2. Verify proof of income

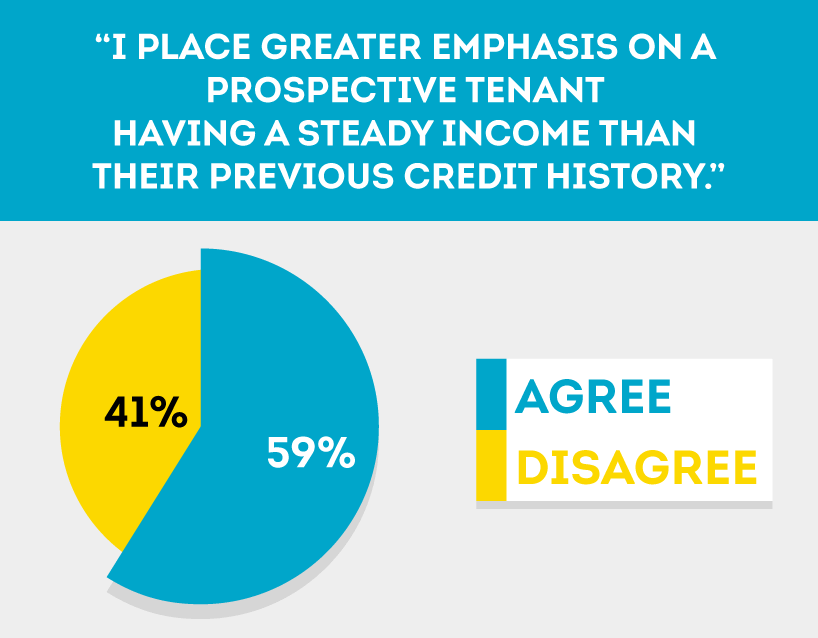

The same SmartMove user survey shows that 59% of landlords strongly and somewhat agree that they place greater emphasis on a prospective tenant having a steady income than their previous credit history.

Verify proof of income by asking to see current pay stubs to ensure that their monthly salary is high enough, with the industry standard being three times the monthly rent. You will also want to have a verbal conversation with their employer to find out how long they’ve been employed.

Since a tenant with bad credit history is an added risk, you need to be aware of any major warning signs while you’re reviewing their application. However, even with a lower credit score, someone with stable employment history and the means to make monthly payments may turn out to be more reliable than a renter with a good score but poor employment history and unstable income.

3. Evaluate rental history

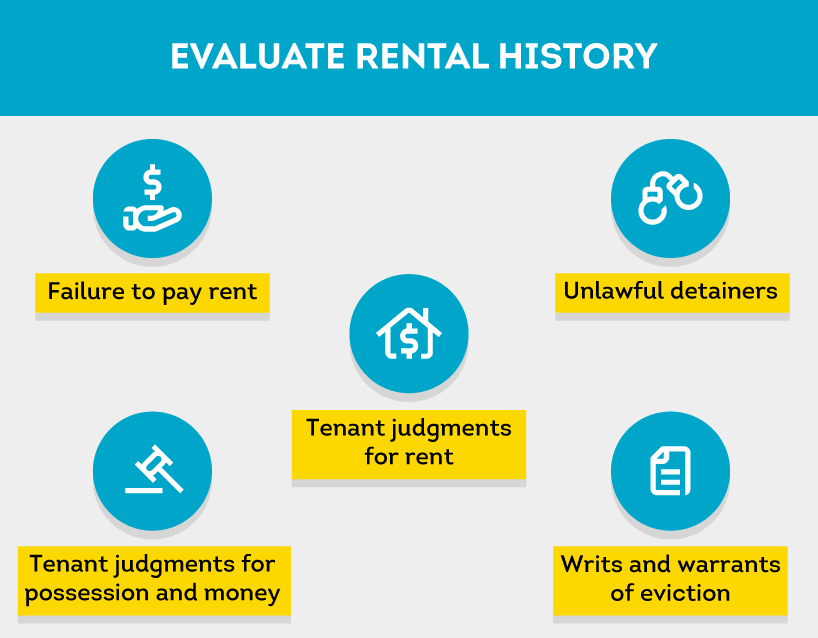

TransUnion research shows that past evictions are predictive of future evictions. Don’t just rely on a credit report to find out whether or not an applicant has an eviction on their record. You’ll want an eviction report that gives more detailed information such as:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for small claims

Even if someone has poor credit, a clean eviction report could be a positive sign. In this case, you can move on to checking prior landlord references to confirm the applicant’s payment track-record.

Current landlords may have the motivation to give an unduly positive reference in order to get the tenant to move out, so it’s a good idea to ask your applicant to provide proof of rent payments for the last year. That way you can see for yourself whether or not they have a recent history of paying their rent on time. While you’re checking receipts, you may also want to ask the applicant for recent bank account statements to see if they have money saved up in their savings, or if they live paycheck-to-paycheck. Obviously, a tenant with cash in reserves is better equipped to handle any unforeseen financial obligations, and still keep up with their rent.

If they have a steady income and history of paying their rent on time, the applicant may still be a good fit for your rental despite their credit score. In order to mitigate your concerns, you can ask for a co-signer as an added layer of protection or consider having them place a higher deposit.

4. Let SmartMove’s ResidentScore help you make a decision

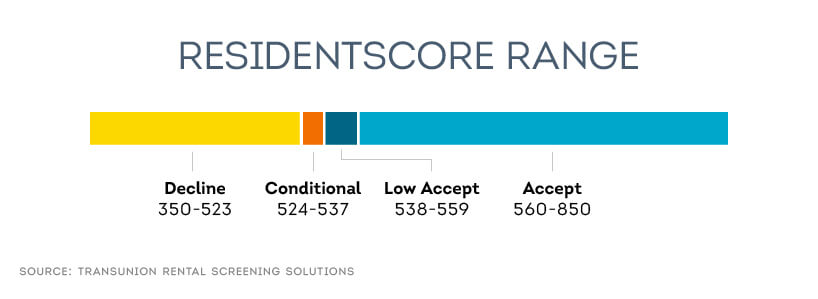

SmartMove’s ResidentScore was built specifically to predict the likelihood of a negative rental outcome during a lease. In fact, ResidentScore predicts evictions 8%** more often in comparison to a typical credit score in the bottom 20% score range where risk is greatest.

When you use SmartMove’s Resident Score, you can see where your tenant lies on the score band.

Why trust ResidentScore with your leasing decision? ResidentScore’s algorithm was designed specifically for rental screening. While a typical credit score is designed to predict likelihood of repayment on a loan or other credit obligation, ResidentScore is designed to predict the outcome of a lease. The elements that make up ResidentScore (payment history, utilization, credit history, etc.) are all weighted according to how closely they tie into predicting a negative lease outcome.

By using ResidentScore in combination with a full SmartMove tenant screening package, including eviction history and a criminal background report, you can better determine whether or not an applicant with bad credit history could still be a good choice for your property.

In Conclusion

When evaluating an applicant with a lower credit score, it’s important to take into consideration other factors in the applicant’s background. By understanding the reason behind the low score as well as the applicant’s current income and past rental history, you’ll be able to develop a more complete picture of the applicant’s overall suitability as a tenant for your property. With a little extra research, you may find that an applicant with a relatively low score ends up being an ideal tenant for you.

Sources

*2014 SmartMove user survey

**Based on 2015 TransUnion data

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.