Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Many landlords understand the value in screening potential tenants, but determining the strength of a potential tenant’s credit is only part of the equation. One of the best ways to assess an applicant is through a check of their credit, criminal and eviction history, which can help you make a more informed decision about who to accept or reject as a tenant.

But when reviewing an applicant’s reports, which information should really concern you? Each landlord has their own idea of what constitutes a deal-breaker when it comes to an applicant’s history, but there are certain items that require special consideration. Below are seven tenant screening warning signs you should pay extra attention to when reviewing an applicant’s reports.

1. Evictions

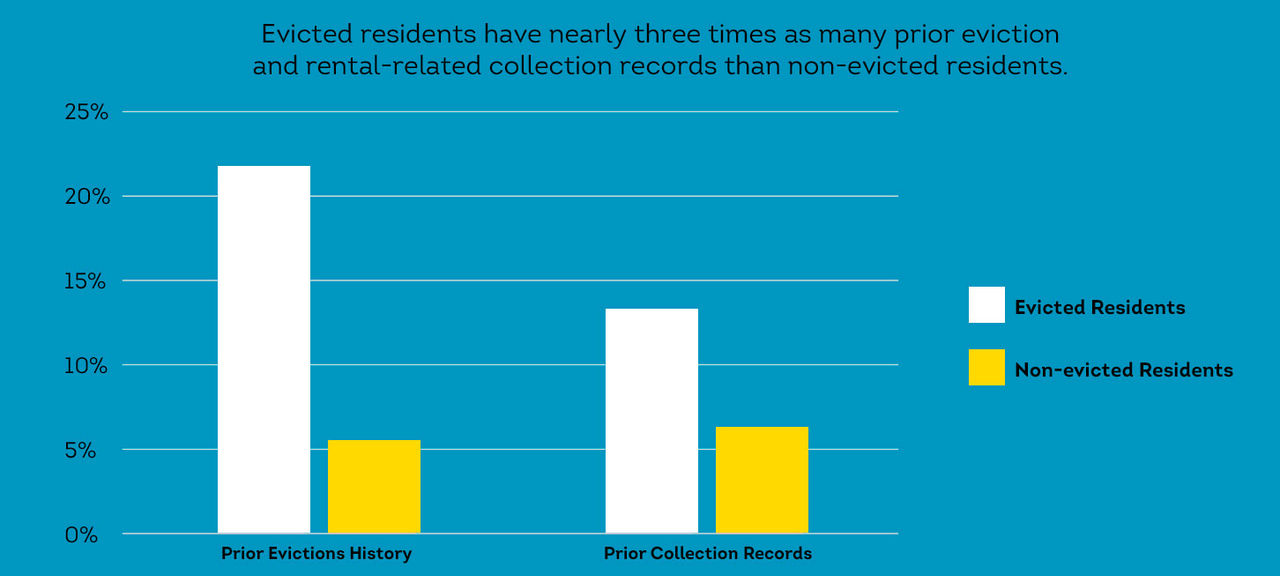

What may not be obvious for landlords to check, and what is likely an incredibly important indicator of landing a good tenant, is to check an applicant's eviction history. An eviction report is an essential part of any tenant screening process. Why? TransUnion research demonstrates that evicted residents have nearly three times as many prior eviction and rental-related collection records than non-evicted residents.

Landlords sometimes mistakenly assume evictions show up on a credit report, but that’s only true in the case of monetary judgments resulting from an eviction. An in-depth eviction report searches the prospective tenant in databases of court records, returning prior evictions. (An eviction report is important because it may detail an applicant’s prior eviction history outside of your state.)

Eviction reports typically include information on:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for small claims

It’s certainly helpful to know if the applicant has a history of difficulties with prior landlords. Having this kind of information can be incredibly valuable in helping you to find a tenant who will pay on-time and protect your rental income.

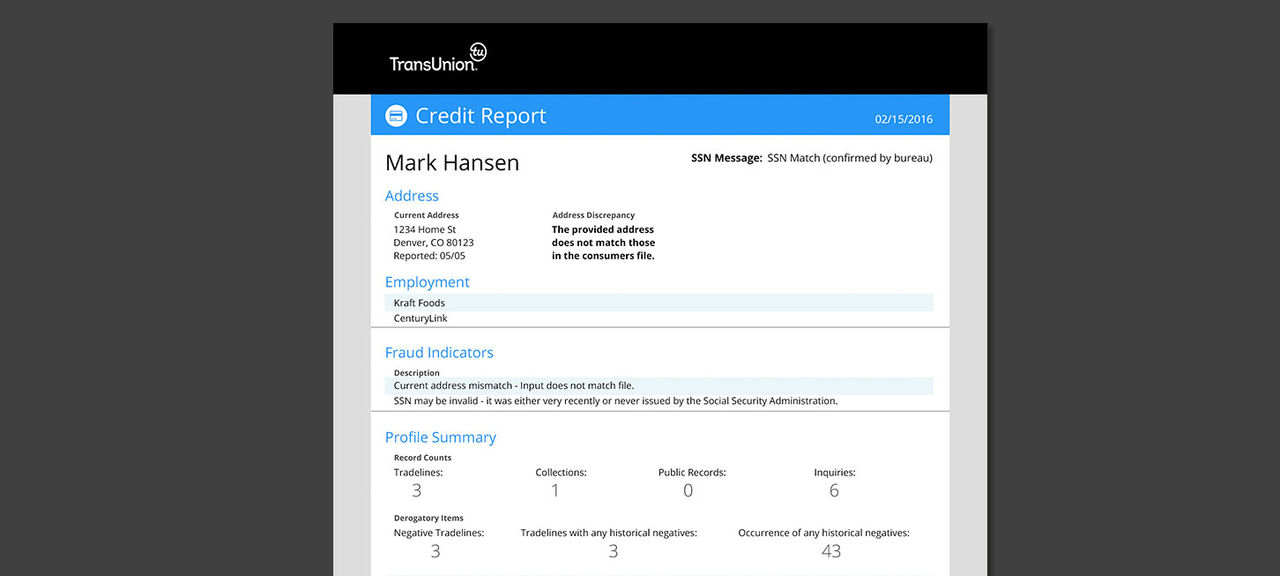

2. Payment History

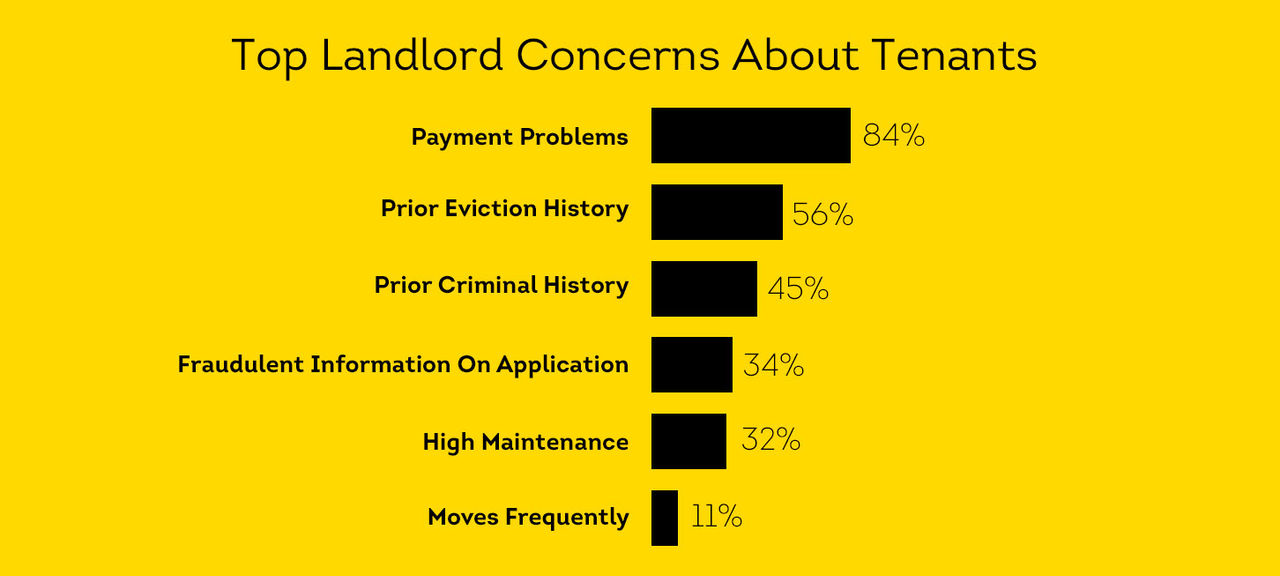

In a TransUnion survey, 84% of landlords reported payment problems as their #1 concern about new tenants.*

You don’t want to find yourself being late on a mortgage payment because your tenant is late on their rent. With a credit report, you gain insights into an applicant’s history of on-time payments. You also get a view of their accounts and payment track records – a useful indicator of the person’s reliability to pay his or her rent on time.

A history of consistently late payments is a big warning sign for any landlord.

3. Criminal Convictions

While a past record of one or more criminal convictions should not automatically disqualify a person in the landlord’s eyes, this is information worth considering. After all, a tenant with certain criminal records may represent a safety risk to your property or other tenants – which could possibly result in damage to your apartment or cause distress to others.

Make sure the criminal report includes a thorough search of FBI's Most Wanted and the Sex Offender Public Registries.

4. Financial Stability

A credit report also offers rich insights into an applicant’s financial stability, with answers to key questions like:

- Do they have a large amount of debt?

- Is there a history of late or missed payments?

- Have they recently applied for a large amount of new credit?

Some landlords find that not all types of debt are the same, and evaluate debt differently based on the source. By taking the entire credit report into account, you’ll get a more complete picture of the applicant’s level of risk.

5. Resident Score®

In addition to reviewing your applicant’s full credit report, referencing their ResidentScore can give important insight into the level of reliability and risk they may bring. SmartMove’s ResidentScore was built specifically for the rental industry and can help predict the likelihood of a bad rental outcome such as an eviction, 3+ late payments and/or not sufficient funds. In fact, ResidentScore predicts evictions 8%* more often in comparison to a typical credit score in the bottom score ranges where risk is greatest.

Applicants with a low ResidentScore warrant special consideration since they could be a greater risk of eviction or late payments. Note where your applicant falls on the ResidentScore range for a better understanding of the risk.

6. Bankruptcies

Landlords obviously prefer a tenant who can be relied on to make timely payments and meet any other financial obligations. Prior bankruptcies may show that the applicant has had recent financial stresses or difficulties.

However, landlords should evaluate prior bankruptcies on an individual basis. If the bankruptcy has been fully discharged, you may choose to focus on the applicant’s most recent credit history, their current level of income stability, and any outstanding debt. It’s possible the applicant is in a much better financial situation than before the bankruptcy and can be a highly reliable and good-paying tenant for you.

7. Apartment-Related Collections

A history of unpaid rents is another issue for landlords to consider. A comprehensive tenant screening report can include records of collection agencies hired to collect on a renter’s debt.

Some landlords may find a history of rental-related collections indicative of an applicant’s future behavior.

Conclusion

There’s always an element of risk in deciding to accept a new applicant for your rental property. But by being armed with your applicant’s eviction, criminal, and credit history you can make a much more informed decision about who to accept or reject and more accurately evaluate the risk. It’s also possible to use credit information to negotiate additional rental requirements, such as a larger deposit or getting a co-signer on the lease. By commissioning a full-scale tenant screening report, you can reduce your risk and make better-informed leasing decisions.

Ready to start screening your tenants? Get an in-depth look at your applicant’s credit, criminal, and eviction history with SmartMove screening today.

*Based on 2014 TransUnion survey data.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.