Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Troublesome tenants can cause issues with neighboring renters, and expensive evictions if they do not pay their rent. Tenant horror stories are everywhere, yet these situations could often have been avoided if the landlord had thoroughly screened rental applicants upfront. Many landlords think they can go by their gut instinct, however, good or bad feelings about a prospective tenant often are not predictive of how they will behave. For a small landlord who is looking for a way to make sustainable and reliable passive income stream, it’s crucial to develop a thorough tenant screening process that includes credit report, criminal background check, and eviction history.

It’s easy to understand why a landlord would be tempted to skip tenant screening. As a landlord, you don’t want a rental to remain vacant for long periods of time. After all, you’re losing money every day on a vacant property. While you might be tempted to rent the property quickly, sacrificing tenant quality may cause costly, time-consuming problems down the road. Using a fast and easy tenant screening service can help you screen applicants quickly while also helping you to reduce future headaches.

By not thoroughly screening your applicants, you’re putting your rental income, your property, and the neighborhood at risk. Below are the top five reasons to conduct credit criminal and eviction checks on your applicants.

1. Know your applicant’s current financial situation

Receiving a full credit report is important for the majority of landlords. In a recent SmartMove survey, 79% of landlords strongly and somewhat disagreed with the statement, “I don’t pay much attention to the credit report – I just look at the credit score.”

It’s easy to understand why most landlords want the story behind the credit score. Certain items on a credit report may be warning signs that the applicant will not pay their rent on time, while other items may be less concerning. For example, some landlords are more willing to overlook medical or student loan debt rather than credit card debt.

A full credit report will help you to get a better idea of your applicant’s current financial situation. Do they have a large amount of outstanding debt? Have they recently applied for more credit? Have they recently had a credit card charged off? This type of information can be helpful in giving you a fuller picture of an applicant’s financial situation.

You’ll also be able to see if your applicant lacks any significant credit history. This is not unusual for younger renters who may not have credit yet, or who have recently gotten their first credit card or loan and haven’t had enough time to build credit history. In this case, you could better protect yourself in a variety of ways. One of which is requiring a co-signer on the lease, or in other words, a person designated to make the rental payments if the applicant is unable to pay.

When you have a more complete picture of an applicant’s financial situation, you’re in a better position to make an informed leasing decision.

2. Know how likely your applicant is to pay on-time

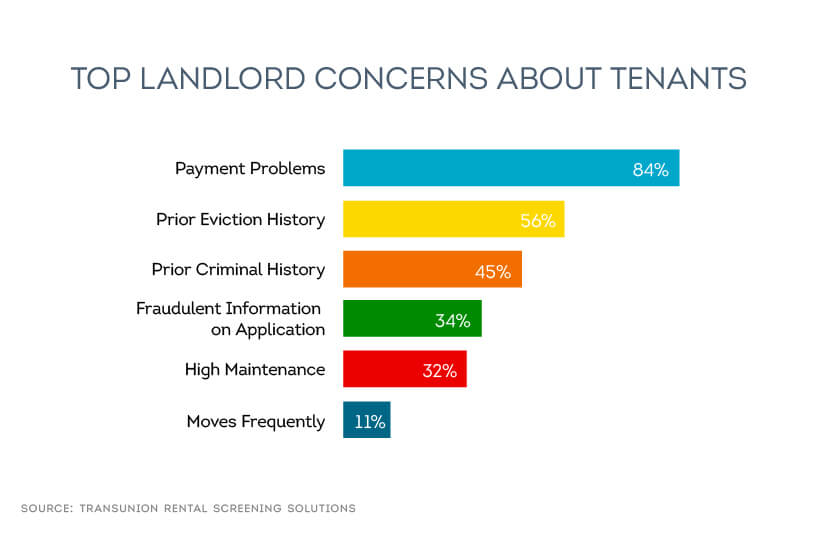

In a TransUnion survey, 84%* of landlords said payment problems were one of their top concerns about new tenants.

A full credit report will help you determine how likely your applicant is to make payments on time. You’ll be able to see their open and closed accounts, as well as their payment history. You’ll also be able to see whether there are any tenant-related collections on their reports. This appears when a collection agency has been hired to help collect on unpaid rent. A judgment can be equally concerning for a landlord. A judgment appears when a landlord successfully sues an applicant for unpaid rent or damages and represents a financial obligation that the applicant must pay. A history of chronic late payments could indicate that your applicant might have trouble making rent payments on time.

It’s also important to check previous landlord and employment references. Reference checks can help you confirm your applicant’s track record of making on-time rent payments and maintaining stable employment. Additionally, you should ask to see a pay stub as confirmation that their stated income is accurate.

3. Protect your property and the neighborhood

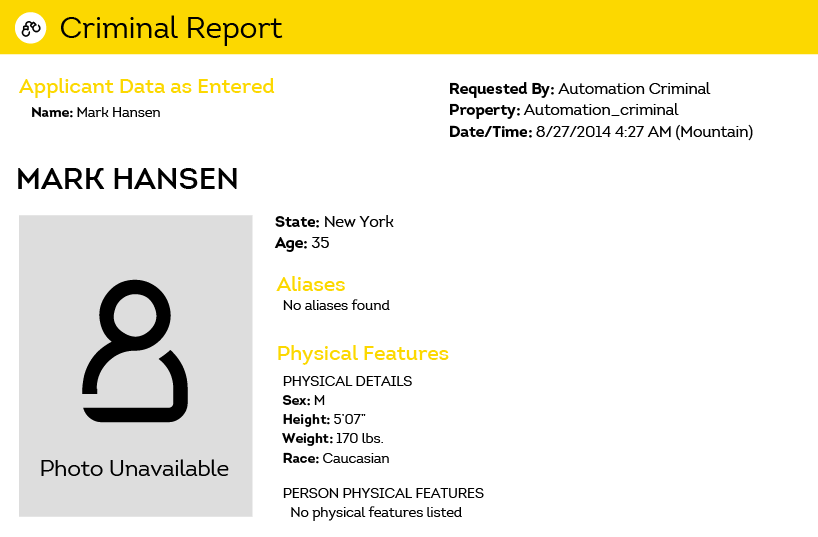

Your full tenant screening should also include a criminal background check.

In 2015, approximately one in five applicants screened by SmartMove had a criminal hit on their record.

Considering that criminal convictions are not all that uncommon, it’s important to review your rental applicant’s criminal history before making a decision. Not all criminal hits are deal breakers. An applicant may have a minor traffic violation on their record or a criminal conviction from several years ago that you’re willing to overlook. Review criminal records on a case-by-case basis to avoid renting to an applicant who could put your property or the neighborhood at risk.

Most landlords recognize the importance of reviewing criminal records. In a 2016 SmartMove survey, 60% of respondents strongly or somewhat agreed that criminal history is more important than credit history. Landlords want peace of mind that their tenant is a person they can trust with their property and in the neighborhood. You don’t want to put other residents at risk by not checking your applicant’s criminal history.

Landlords who perform background checks through SmartMove receive a criminal report pulled from millions of records. Landlords benefit from instant access to records from federal agencies.

Additionally, TransUnion can find more records that potentially match an applicant by supplementing the applicant’s own information with data from TransUnion’s databases (such as a middle name, previous address, or date of birth) to enrich record searches. In other words, SmartMove’s background checks provide reports with more accurate results and fewer false positive matches.

4. Help avoid future evictions

Evicting a tenant is a lengthy, costly process no landlord wants to go through. TransUnion estimates it costs an average of $2500-$3500 to evict a tenant and typically takes three to four weeks, however, it can stretch even longer. Knowing your rental applicant’s past eviction history can help avoid future evictions. TransUnion research shows that past evictions are predictive of future evictions.

Checking your applicant’s eviction report is one of the best ways to avoid a future eviction.

Many landlords think they can skip an eviction report since evictions show up on the credit report. However, evictions only show on the credit report in the case of some monetary judgments. You’ll want an eviction report that gives more detailed information including:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for small claims

5. Get peace of mind

You want a trustworthy tenant that pays their rent on time, is responsible, and respectful of your property. By implementing a consistent tenant screening process that includes credit, criminal record, and eviction reports, you will have a much greater chance of finding reliable tenants. Once you have a complete picture of their background, you’ll be able to make a better informed decision about the applicant’s reliability.

A reputable tenant screening service saves you time, energy, and money. Spending a little time and effort on screening tenants now could help you avoid costly evictions later. It’s hard to put a price on an easy, stress-free tenant that pays on time and takes care of the property. Finding reliable, long-term tenants is one of the most important aspects of owning property. With SmartMove’s quick and reliable tenant screening service, you’ll be able to make faster and more informed decisions.

While a tenant screening is a great measure of an applicant’s financial and rental history, it is important to verify employment and references. You should have an actual conversation with their employer and personal references. Ask to see a current pay stub as proof of current income. A consistent process that involves online tenant screening and reference checks will greatly increase your chances of finding excellent tenants.

Want to learn more? Check out how to screen a tenant infographic which is full of great facts and tips.

Sources

*2014 SmartMove user survey

2016 TransUnion SmartMove Customer Survey

https://www.zillow.com/rental-manager/resources/articles/finding-the-perfect-tenant/

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.