Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

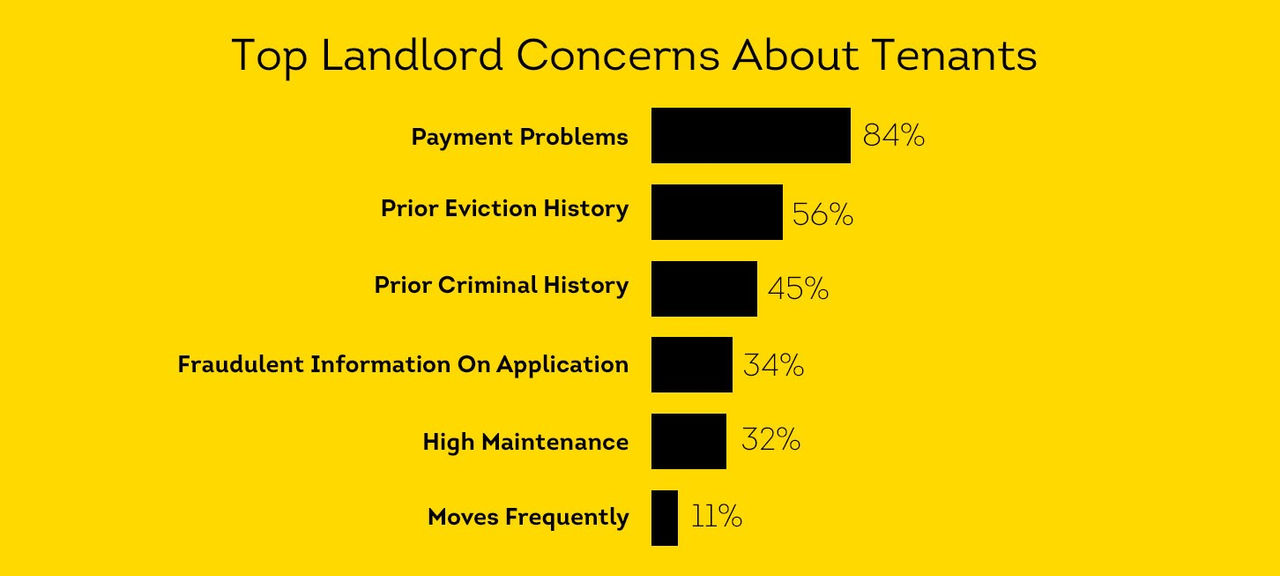

The number-one concern among independent landlords in the U.S. is non-payment of rent, according to a recent survey conducted by TransUnion Rental Screening Solutions. Payment Problems were ranked as the top concern by 84 percent of landlords surveyed for the study. This was followed by concern over renter’s prior eviction history (56 percent) and prior criminal history (45 percent).

“Non-payment is seen as the biggest risk factor for landlords when selecting a potential tenant,” notes Mike Doherty, senior vice president of TransUnion rental screening solutions group. “Obviously, the lack of rental payment creates problems for independent landlords, who must take corrective actions to offset the potential damage to their investments.”

One of the best ways to lessen the risk of non-payment is to conduct a credit check on tenants. A credit check gives insight to an applicant’s financial history and whether they have a track record of financial responsibility.

“Knowing an applicant’s credit score by obtaining a report from a tenant screening company, such as SmartMove, can reduce the landlord’s risk of renting to someone with a poor financial record,” Doherty says.

Going one step further, a full credit report offers even greater insight into the details of an applicant’s credit history, including any history of bankruptcy, accounts sent to collections, tax liens, and late payments. Armed with this information, landlords are better prepared to make informed leasing decisions.

Obtaining a credit report through a tenant screening service such as SmartMove also addresses landlords’ second and third concerns of concern of criminal history and bad credit. SmartMove screening reports detail the applicant’s credit score, as well as criminal history, helping landlords ensure they are fully informed on the applicant’s background.

In addition to running a credit check, landlords can take other steps to avoid the risk of non-payment:

Ask for employer or past landlord references. A tenant in good standing with his or her employer and prior landlord should be willing to provide references attesting to prompt payment in the past.

Request a larger deposit. A larger security deposit offers greater security because it can cover the landlord’s losses in case of damages or lost income.

Set up recurring auto-payments with a tenant. Automatic rent payments are designed to deduct the rent amount from the tenant’s account on a specific day each month. An auto-pay service offers the convenience of direct deposit, and also provides more assurance of getting paid on-time each month if payments are set up to recur.

“Non-payment will likely remain a key concern for landlords in 2014,” Doherty notes. “But taking pre-emptive action can reduce this threat and lead the way to a satisfactory landlord-tenant relationship.”

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.