Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

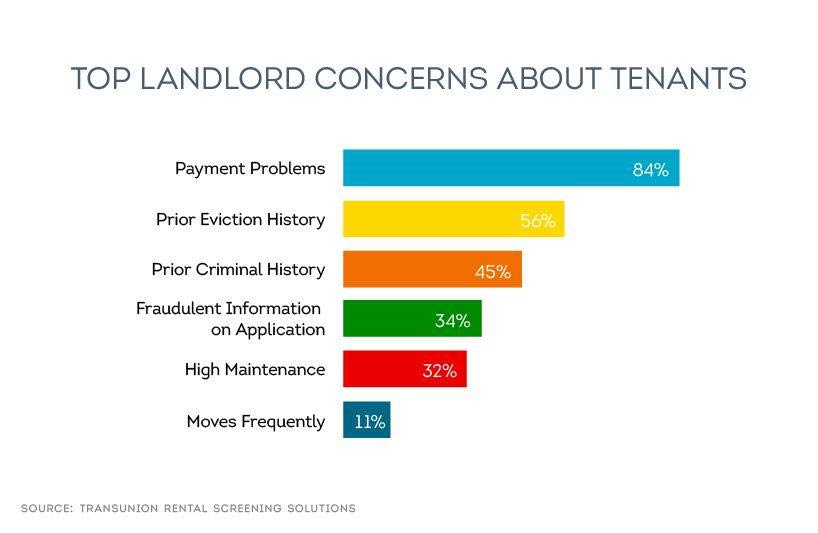

According to a 2014 SmartMove user survey, payment problems are one of landlords’ top concerns about new tenants. Payment problems can be more than a simple nuisance; as they can put you and your rental income at risk.

Chasing down rent payments with phone calls, late notices, and repeated requests can undermine the relationship between a landlord and tenant, making addressing other issues (such as necessary repairs) that much more difficult. In the worst case scenario, tenant turnover and evictions are both expensive and time consuming. Ultimately, payment problems are a headache that no landlord wants to deal with.

A thorough and consistent screening process is one of your best bets to finding a great tenant who will likely pay their rent on time, but a few preventative measures will encourage tenants to stay on track. Here are a few effective ways to reduce payment problems.

A thorough and consistent screening process is one of your best bets to finding a great tenant who always pays their rent on time

How to reduce payment problems in 6 steps

1. Protect yourself with good communication

Straightforward communication about rent, due dates, and possible consequences for late rent can help to reduce any misunderstandings down the road. Be sure to review the lease in person with the applicant so that the key terms are reinforced.

2. Charge late fees

Late fees and payment policies can help to motivate tenants to make rent payment a priority. You’ll want to check your local housing laws to determine how much you can charge to ensure you remain compliant with any federal or state specific laws.

3.Keep detailed payment records

Consider asking that rent payments be made online or by check instead of cash. Since there is no paper trail with cash payments, it’s easier to fall into a disagreement about whether or not the rent has been paid. Online payments and checks can be easier to trace and keep a record of.

If you do accept cash payments, be sure to write payment receipts so both you and the tenant have a record.

4. Send reminders

Send a rent reminder 10 days before rent is due (if you use an online rent payment system, check to see if they send it for you). You can send these invoices through USPS mail with return envelopes included or send them via email. The benefit to using email or text reminders is that tenants will see it even if they are out of town, which can be important during the summer months or holidays.

5. Make payments easy

Ask your tenant about making online rent payments through an online rent payment service. It’s convenient for both you and the tenant, plus there’s always an electronic record of payments sent and received. You can consider offering a slight discount on the monthly rent for tenants who sign up for automatic withdrawal.

One caveat here is that you want to make sure that online payments aren’t the only option for tenants to pay rent. You’ll want to be mindful of the fact that in some cases certain tenants may not have access to a credit card or computer.

6. Report rent payments

Reporting rent payments to consumer reporting agencies can be a strong incentive for renters to make their payments on time. There are several online payment services that offer the option for tenants to opt-in to reporting their rent payments. Knowing that a late payment could potentially impact their credit history could make the difference between paying their rent on time and putting it off a few days. It also is a great way for renters who have little to no credit to build their credit history.

7. Be consistent

Enforcing your policies in a consistent and professional manner will discourage tenants from taking advantage of your kindness. The last thing you want is for a small pardon to become a pattern of undesired behavior, or for a tenant to feel slighted because you addressed a situation with their neighbor differently.

Conclusion

One of the best ways to prevent payment problems is to get the right tenant into your rental from the start. A full credit report with a ResidentScore can help show you their credit history and behavior, so you can see if they can afford the rent. SmartMove is the only tenant screening service that provides landlords with a ResidentScore, which is designed specifically for the rental industry. Resident Score identifies 15% more evictions and 19% more skips than other typical credit scores, which can help you to avoid potential eviction in the future.

With SmartMove, you can also utilize an Income Insights reports, which helps landlords to verify the tenant’s income. Income Insights can help landlords skip this time-consuming step altogether. Landlords receive a clear, easy to read Income Insights report in just a few minutes, telling them whether conducting additional income verification is recommended for an applicant. If the Income Insights estimate shows the applicant’s income is close to, or higher than the amount they self-reported to SmartMove, the landlord can feel more confident in skipping additional income verification.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.