Disclosure and Disclaimer

This post only contains educational information. No financial, tax or legal advice.

This information is for educational purposes only and we do not guarantee the accuracy or completeness of this information. This website may contain links to third party websites. We are not responsible for their content or data collection. Trademarks used in this material are property of their respective owners and no affiliation or endorsement is implied. Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions. This information does not constitute financial, tax or legal advice and you should consult your own professional adviser regarding your situation.

Collecting rent can be a pain and a source of stress for many landlords. In a 2014 SmartMove user survey, landlords ranked payment problems as their top concern. Before placing tenants in any property, you should establish an effective rent collection system. So how do you make sure you get paid on time?

Whether you're old-school or tech-savvy, there are plenty of ways to collect your monthly payments. Once you establish a system, make sure each tenant fully understands your expectations to make the payment process go as smoothly as possible. Remember, there isn't just one "right" method—the best way to collect rent can vary by landlord preferences and property circumstances.

Please note that this material is not legal advice. You should not rely upon this material and you should check with your legal counsel about obligations under applicable law, including methods to collect rent. All uses of marks and service names in this material is for commentary and no endorsement or affiliate is implied, with the marks and names remaining the property of their respective owners.

1. Use an oniine payment portal

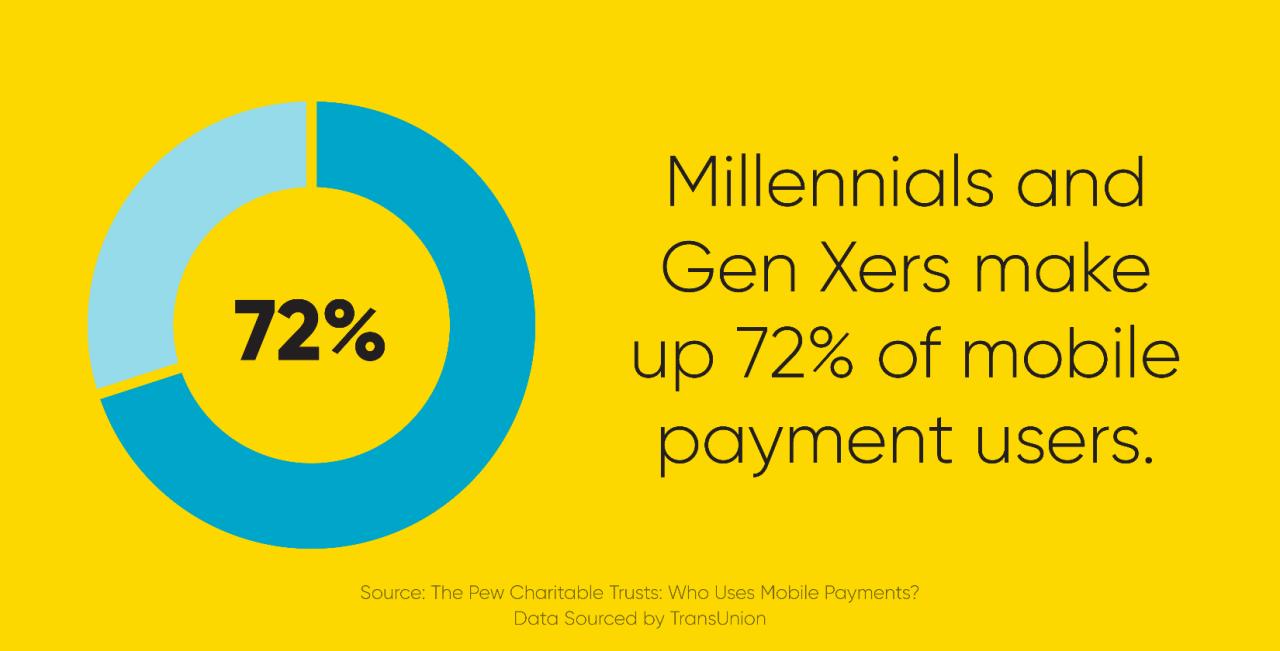

Many landlords take advantage of online payment portals, and tenants appreciate the convenience—especially younger generations. According to a study by The Pew Charitable Trusts, Millennials and Gen Xers make up 72% of mobile payment users.

Not only is online rent collection convenient for everyone involved, but also it may increase the likelihood that you’re paid on time. Each pay period, the tenant will electronically remit payment, and you’ll be on your way.

There are many different online platforms landlords can use to collect rent, but they vary in price. While some portals require a small monthly fee to use their services, others are free for landlords. Before immediately opting for the free software, take a look at other features these online rent portals have to offer.

Several programs also give you the ability to send direct messages to tenants, upload important documents, respond to maintenance requests, and gain statistical insights into all your properties. These additional elements may be worth paying for as they provide digital documentation.

However, if online rent payment services are your primary collection method, then it's important to allow tenants to pay through other means. Not all tenants will have access to online resources, so make sure not to add any unnecessary hurdles between you and your monthly payments.

2. Use payment apps

Payment applications are also a worthy method of rent collection to consider. Apps such as PayPal, Venmo, or Chase QuickPay are gaining popularity in the rent collection market. These apps are free to use. Once you sign up, you can easily transfer payments from one user to another.

However, it can take a few days to transfer the sum to your bank account, which can be a challenge if you require strict payment dates. Plus, some landlords aren’t comfortable using that kind of technology when larger amounts of money are involved.

3. Setup direct deposit

You might consider setting up an auto withdrawal from your tenant’s checking account. With direct deposit, you can feel more confident about receiving each month’s rent collection. Additionally, you won’t have to worry about managing an online portal.

But of course there are a few drawbacks to consider. Banks typically charge a fee for direct deposit services. And, some tenants might not like the idea of you having direct access to their bank accounts.

4. Establish a drop-off location

Landlords who prefer to physically handle their rent payments can set up a drop-off location for tenants. It’s probably best to allow your tenants multiple ways to pay. Check, cashier’s check, or money order are good options. Be sure to request that they seal it in an envelope before placing it in the drop-off box.

5. Pick up payments in person

While this method may be old-fashioned, some landlords still prefer to pick up rent payments in person. The benefit of getting your monthly payments put right into your hand may outweigh the inconvenience to travel to your rental unit. Plus, by visiting the property to pick up the check, it can build in a forcing mechanism to keep regular tabs on your unit to ensure there aren’t any maintenance issues that need attention.

6. Collect rent my mail

Collecting rent by mail is a tried-and-true method. This option provides you with added convenience—you don't have to visit each rental unit every month.

However, there are some disadvantages when collecting rent by mail. It's easier to encounter payment problems should you receive payments several days after the official collection date. While an envelope may be postmarked on the correct day, you won't have the money in your hands for a few more days.

Determining the Best Rent Collection Option for You

With all these options in mind, it's important to consider your own personal preferences when rent is due. What works for one landlord may not work for others.

It really comes down to your personal preference. If your rental properties are at quite a distance or out of state, then picking up payments yourself is likely not an option. If your tenant isn't tech-savvy, then you might need to opt for an offline option. But most ways that people pay are migrating online, and those kinds of payment methods could be an easy and effective way to collect your rent.

What to Do After Collecting Rent

After setting up a successful rent collection system, there are a few tasks still to complete:

Organize Your Records: Whether you keep track of rent collection history by hand or digitally, remain diligent with updating your records. This will serve as crucial evidence if landlord-tenant legal disputes ever arise.

Charge Late Fees: If any of your tenants fail to pay rent, make sure to contact them about the missed payment, and enforce any late fees that are part of your rental agreement. Pro tip: Make sure that your late fee policy is outlined clearly in your lease.

Conclusion

Ensuring your tenants pay their rent on time is a priority. You can improve your chances of getting a good paying renter by looking at your rental applicant's credit history and income level. With SmartMove®, you can screen renters online and gain insight into their financial and rental history quickly.

SmartMove uses our proprietary credit scoring model called ResidentScore®. It is designed specifically for tenant screening and comes with every tenant screening package. Below are the benefits of ResidentScore as compared to a standard credit score:

- Identifies 15% more evictions and 19% more skips than other typical credit scores

- Scores more applicants who have thin files (can score all applicants with at least one account on their credit report)

- Built specifically to identify the likelihood of eviction

SmartMove also gives landlords another unique report called Income Insights. It allows you to analyze tenant income within minutes and get a better sense if the applicant can afford the rent. It compares the applicant's self-reported income against their credit behavior and may recommend further income verification. You'll better know which applicants require additional income verification and which ones you can skip.

With SmartMove, you can get critical insights in minutes and make a more informed leasing decision and improve your odds of getting a great tenant.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.