As an independent landlord, the last thing you want to deal with is a tenant that neglects to pay rent on time or at all. Considering that the average cost of eviction is $3,500, and can reach up to $10,000—this can be a devastating business blow that landlords should try to avoid at all costs. In addition to a very expensive eviction fee, you’re now left with a vacant rental unit that you will most likely have to pay for out of your own pocket along with other financial responsibilities. It’s no secret that a nonpaying tenant can be very detrimental to the success of your rental business and bottom-line.

With this in mind, screening your prospective tenants with a complete background check is incredibly important. After all, it’s your money and your property that’s on the line.

Credit checks are a key component of tenant screening, as the results of a credit check can help a landlord spot plenty of credit red flags, including:

- If your tenant has a history of paying bills on time

- If your tenant has a significant amount of debt

- If your tenant is likely to pay rent each month

Continue reading to learn why landlords need to conduct a credit check, tips for how to do a credit check, and guidance on what to look for in a credit check.

Why do I need to run a credit check on prospective tenants?

A credit check is just one part of an applicant’s background, but this basic screening may give you a foundational understanding of their financial health. Note: It is strongly recommended that you consider reaching out to legal counsel that is familiar with both credit reports and tenancy laws.

According to a SmartMove® survey, 84% of landlords cited payment problems as their top concern. A credit check is a prudent method of inquiry that may reveal what to reasonably expect from your renter in terms of their financial behavior.

Credit reports can provide you with insight into a tenant’s debt history and any significant credit mistakes that will help you determine if they’re likely to pay rent each month or can afford to live in your rental property. This is an important aspect of predicting whether or not a rental applicant will be a responsible tenant.

What do Landlords Typically Look for in a Credit Check?

As you review an applicant’s credit report, it’s important that you know what to look for in order to spot tenant warning signs immediately. As you assess the results of a credit check, landlords should watch for:

- Low credit score

- Late payments

- Payment gaps

- Significant debt load

- Derogatory marks

- Delinquent accounts in rental history

1. Low credit score

Landlords may initially believe that a low credit score immediately rules out an applicant, but that’s not necessarily the case. What credit score does the average landlord look for? According to TransUnion, there is not a definitive “good” credit score and many factors determine creditworthiness.

A credit score doesn’t necessarily provide a holistic view of the applicant’s financial state or behavior. In a SmartMove survey, 4 out of 5 landlords responded that reviewing a full credit report is important to understanding the applicant’s credit history and to getting the story behind the score.

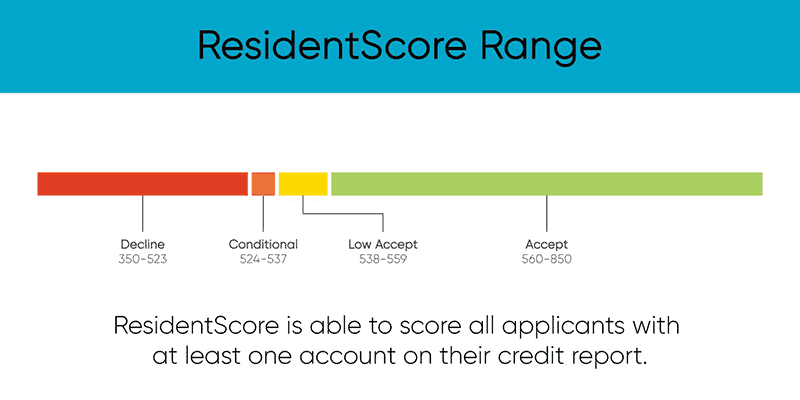

That’s why SmartMove’s ResidentScore® feature is a valuable tool you can leverage during the screening process. A generic credit score is usually used to evaluate loan performance; ResidentScore is tailored to the unique needs of landlords, taking into account almost 1,000 different credit variables that may point to certain rental outcomes, which has been found to help predict evictions 15% more often than the typical credit score.

ResidentScore also scores more applicants who may not have much credit history to evaluate. While traditional credit checks are typically more limited, ResidentScore can be used to score all applicants with at least one account on their credit report. This is an especially useful feature because it can help you if you’re trying to screen Millennial or Gen Z renters who are less likely to have a robust credit history.

Unlike a typical credit score, ResidentScore was built specifically to identify the likelihood of a potential tenant being evicted, which means:

- Landlords are able to pick a better tenant because ResidentScore can determine risk better than generic scores.

- Landlords may increase their chance of avoiding eviction because ResidentScore has been found to predict the likelihood of eviction at a rate of 15% better than other scores.

- Landlords can feel more confident and widen their applicant pool because ResidentScore can score more applicants with thin credit files.

2. Late payments

As a landlord, you want tenants who will pay rent on time, all the time. If a tenant has a history of making timely payments, then there’s a greater likelihood they’ll pay rent on time when living in your property.

You don’t want to rent to someone who might renege on their obligations to pay any bill on time, rent or otherwise. If your applicant has repeatedly failed to pay credit card, loan, or utility bills by their due date, then what’s to say they won’t do the same when it comes to their rent responsibilities?

Ultimately, a credit report gives landlords a holistic view of their prospective tenant’s financial history and can help you determine if you’re going to run into nonpayment issues down the line.

3. Payment gaps

Credit reports typically show anywhere from 7 to 10 years of an applicant’s credit history. Landlords should look for any gaps in payments to loans, credit cards, and other financial obligations. Consistency is a crucial part of financial responsibility, as you want a tenant will consistently pay rent each month.

4. Significant debt load

When reviewing a tenant’s credit report, landlords should look for significant amounts of debt. A tenant’s debts may affect their ability to pay rent each month.

Keep in mind that many Americans are dealing with a great deal of debt across the board, regardless of generation. So be sure to consider what kind of debt your tenant has and if it is considered responsible or irresponsible debts. For example, student loan debt may be considered responsible while Macy’s credit card debt may be considered irresponsible.

If a prospective applicant carries excessive debt, then it may render them unable to handle rent along with all of their other financial obligations.

It’s also important that you examine your tenant’s income and assess their rent-to-income ratio when considering debt load. Landlords typically look to see that a prospective tenant makes at least three times the income compared to rent.

5. Derogatory marks

Derogatory marks may indicate that your prospective new tenant is not financially responsible. Derogatory marks could include:

- Credit card charge-offs

- Accounts in collection

- Car repossessions

- Bankruptcies

If your applicant has many collection accounts and judgments, then it may indicate that they’re not financially responsible and unlikely to abide by your lease terms as they relate to rental payments.

6. Delinquent accounts in rental history

Landlords can generally also use credit checks to help assess an applicant’s rental history. If your prospective tenant’s previous landlord has reported their payment history to a credit bureau, then this will show up on their credit report. If your applicant owes an outstanding debt to their previous landlord, then it may be a red flag and indicate that they could fail to pay rent when living in your property.

You should consider asking prospective tenants to submit a rental history report in addition to running a credit check. Always consider reaching out to legal counsel familiar with credit checks and tenancy laws. The rental history report will generally list the addresses and landlord information of previous residences, allowing you to then choose to run landlord reference checks and gain insight into your applicant’s past rental behavior.

How do landlords check credit?

Now that you have information about red flags to keep an eye on, it’s important to consider how you’ll run your credit check. Give some careful thought to reaching out to legal counsel familiar with credit checks and tenancy laws, but generally, there are multiple ways to check credit that include the following:

1. Ask a potential renter to give you a copy of their credit report

Some would-be tenants may show up to rental showings with their own credit reports. However, this report could be fabricated and contain inaccurate information. Even if the report is real, it may be sourced from years prior, meaning you’re looking at outdated data that doesn’t reflect your renter’s current financial health.

2. Pull a credit report yourself

Another way to check an applicant’s credit is to pull the report from a credit agency yourself. Familiarize yourself with credit report-related laws and consider reaching out to legal counsel with any questions. In most cases, this is generally only a viable choice for landlords who have multiple units to rent, and requires a lot more time and effort to complete.

Pulling traditional tenant credit reports usually requires landlords to follow a lengthy process, which may include a landlord identity check, a background check into your business, and a property inspection.

This method may prove to be too burdensome for independent landlords, who typically have fewer renters.

3. Screen tenants online with SmartMove

When it comes to making leasing decisions, you may find it less than ideal to rely on a renter-provided credit report nor jump through the hoops required for using a credit reporting agency. That’s where SmartMove tenant screening comes in.

As a landlord, it’s incredibly important to properly and thoroughly screen your tenants. While it may be fairly easy to find out a prospect’s credit score, it’s crucial to go much more in-depth into a renter’s financial background to get an idea of the risk of renting to him or her.

Landlords require trustworthy information in order to make an informed decision. Up to 94% of landlords surveyed would recommend SmartMove to others, as it provides detailed reports you can use to spot tenant warning signs.

Using SmartMove is simple, convenient, and fast. Sign up for a free account, provide your applicant’s email address and we’ll handle the rest. We’ll acquire their permission then run the report with their authorization and approval. Once your tenant has consented to the screening, you’ll receive reliable, FCRA-approved reports in minutes.

With SmartMove, you gain access to all of the information below, plus more.

- ResidentScore: Proprietary to SmartMove, ResidentScore weighs an applicant’s rental performance and has been found to predict the likelihood of eviction 15% better than a typical credit score.

- Criminal report: SmartMove uses advanced filters and industry best practices to search millions of criminal records from state, national, and Most Wanted databases.

- Credit report: In-depth payment history information provides a closer look at your applicant’s ability to pay the rent, their debt levels, and other financial marks.

- Eviction report: According to SmartMove research, it takes up to 4 weeks to evict a tenant and can cost an average of $3,500. With a SmartMove eviction report, you can learn if your prospective tenant has been evicted in the past so you can avoid these costs down the road.

- Income Insights: Verify that your applicant is making the income they reported and reduce the likelihood of facing renter payment problems.

In addition to comprehensive and reliable screening reports, you won’t have to wait around before you can make a confident decision regarding whether to approve or deny a certain tenant. SmartMove screening only takes a few minutes compared to traditional background checks which can take days or weeks. During those weeks of waiting you lose valuable time looking for other tenants causing you to lose out on rental income during a vacancy. With SmartMove, there are no rental on-site inspections required either so you never have to worry about jumping through hoops to get the answers you need.

And finally, everything with SmartMove is completely online. Simply set up a free account, provide SmartMove with the applicant's email address, and then get the reports delivered. With pay-as-you-go pricing, you only pay for the screenings SmartMove conducts rather than paying a costly subscription fee that may be unnecessary if you only have a couple of properties or just a single one.

To learn more tips about how to run a credit check and read a credit report, check out our post “Guide for Landlords: How to Do a Credit Check on a Prospective Tenant.”

What if my prospective tenant doesn’t have any credit?

An applicant without a credit history doesn’t have to be automatically ruled out of your applicant pool, as they may not be a bad choice. A credit check is a basic but essential part of your screening process as a landlord, so you should do your due diligence. In the absence of credit history, you’ll need to dig more heavily into an applicant’s financial background to verify tenant identity, income, employment, and rental history. For example, you might want to ensure that the potential tenant can pay and afford the rent by asking for recent pay stubs, W2s, and a letter from his or her current employer. It’s also a good idea to contact former landlords and employers directly to ensure that your new tenant has a history of paying rent on time.

Pro-tip: In the absence of credit history, you might also consider requiring a larger security deposit or advanced payment of rent. However, you’ll need to outline these criteria in your initial screening requirements and indicate this within the terms of your rental agreement.

If an applicant doesn’t have credit, then you may also choose to offer a co-signing option (although you are not required by law to do so).

Cosigners are legally required to pay the rent if the applicant fails to do so, but it could depend on your jurisdiction and the terms of the agreement. They will sign the lease agreement with the applicant so they have a financial and legal obligation to you, the landlord. Depending on your specific state, you might be able to seek payment from both the renter and cosigner for nonpayment of rent or may go directly to the cosigner to receive your legally-entitled payment.

If your tenant proves to be consistent and regularly makes timely rent payments, then you may agree to take the cosigner off the lease at some point in the future.

Final Notes

Credit checks are an integral component of tenant screening that may allow you to better assess the risk of a person who will be living on your property. It’s important to look for an applicant who is capable of paying the rent on time and someone who you trust to take care of the unit in a responsible manner.

Make sure you thoroughly vet applicants to help reduce the risk of nonpayment, because if you don’t, you may risk paying out-of-pocket for business expenses. Renting to a bad tenant could also risk damage to your property through reckless behavior or neglect. Or, you could even rent to a tenant who ends up abandoning the property and leaving you to foot the bill.

It’s a better idea to use SmartMove’s screening process so you can receive the information you need to make an informed, objective decision. Here’s a summary of why SmartMove is better than solely relying on a credit check:

- Thorough background check: Credit histories, criminal histories, and eviction reports are mined so you can be confident in your tenant choice.

- FCRA compliant: Each screening report is compliant with local and federal laws from start to finish.

- Quick and easy: Results are sent to you in minutes.

- Online convenience: Skip the paperwork and rely on screening entirely online.

- No subscription: You will only need to pay for the screenings you need.

- You pay… or not: You can choose to pay the screening fee or pass the cost to the renter.

- Leasing recommendation†: Based on the data provided, SmartMove will recommend you to accept or decline an applicant.

- Soft credit pull: SmartMove’s screening doesn’t count as a hard inquiry into an applicant’s credit which means it won’t unnecessarily bring down their credit score.

With a smart screening process, you can have more peace of mind that you’re getting the right fit for your rental. A responsible tenant not only provides you with regular income, but you’ll enjoy the stability of a renter without a troubling financial history. SmartMove can help you make the most of your rental by filtering out risky applicants and providing information on your prospective tenants in a user-friendly, FCRA-compliant manner.

Create an account for free and start screening applicants today!

Know your applicant.

Additional Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.