Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Evicting a tenant is a landlord’s worst nightmare. It can be a stressful process rife with legal proceedings, work with contractors for repairs and maintenance, and the threat of potential lost income. It’s a last resort, and can be extremely expensive – often costing thousands of dollars and taking weeks to complete. Find out more about the costs to evict.

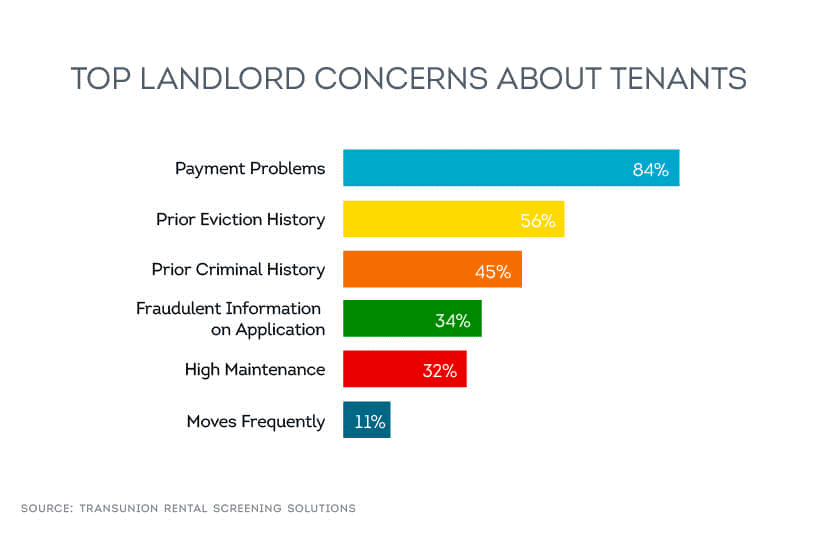

For any landlord, evicting a tenant is typically only done as a last resort. There are a few reasons a landlord may want to evict a tenant, including breaking the terms of lease, or damaging rental property, but the primary reason is because the tenant fails to pay rent. In fact, according to TransUnion research, 84%* of landlords say payment problems are their number one concern about new tenants.

Often, evictions will require notice to the tenant, filing a court action against the tenant, and seeing the eviction through a lengthy eviction process that may require a hearing. These expenses add up, especially when you consider the additional costs of potential lost income, repair costs, and more.

If that all sounds like a lot of money and effort, you would be correct. The eviction process is both expensive and time-consuming, but the fear of going through this process can yourself can be mitigated when you thoroughly screen tenants with SmartMove before they move into the property.

The Process of Evicting a Tenant

Before answering what it costs to evict someone, it’s helpful to understand how the eviction process works. After signing a lease agreement, a problem arises. Perhaps rent is not paid, the lease is violated, or your tenant breaks the law.

Ideally, you and your tenant would try to resolve this problem before an eviction notice is sent. Once the notice is sent, you’re required to wait a certain amount of time, depending on your location, for the tenant to resolve the problem. This waiting period differs vastly between states.

If the problem goes unresolved, and this waiting time lapses, a complaint in court is filed. After a court date is sent, your tenant will receive a summons. They have the choice to respond to this summons with an answer or resolution, or they can wait for the hearing. In court, the two of you will each describe your version of the story and wait for a judge’s decision.

Then, one of two outcomes can occur: you win or the tenant wins. If the tenant wins, they get to stay on your property, and, you may be required to pay for their court fees and attorney fees.

If you win and the tenant is forced to leave, the judge will issue a Court Order, also known as a Warrant of Eviction or Writ of Restitution. Once issued, your tenant can choose to leave the property voluntarily, or a law enforcement officer may be required to remove them and their belongings. Based on the lease agreement and local laws, your tenant may be responsible for paying your court filing fees, attorney fees, unpaid rent, and/or damages and penalties.

The Cost Break Down

The expenses don’t stop there, however. Often, they include other related expenses that you may not have factored in, such as maintenance fees, any lost rent, court costs, and other legal fees.

TransUnion SmartMove data found that total eviction-related expenses for property managers averages $3,500 and can take as long as 3-4 weeks for the eviction process to run its course.**

Let’s Break it Down to See What These Costs Entail:

Legal Fees: Due to the complicated nature of eviction cases, as well as the mountain of paperwork they often create, it is advised that you hire an attorney for eviction proceedings. Attorneys will typically charge hundred dollars an hour or more, and those hours can add up quickly.

How much does it cost to evict someone in legal fees?

Real estate or eviction attorneys can charge either a flat fee or by the hour, so what it costs to evict someone depends both on their experience and complexity of the case. The low-end average cost of eviction in legal fees is $500.

Court Costs: The cost to file a claim in court varies, but every state charges filing fees. Once filed, evicted can be, and often are, contested by the tenant. Disputed evictions represented by council can make an otherwise simple eviction more complex. Discovery, motions, and jury trial demands can all increase legal costs and drag out the process, meaning more spent in legal fees, plus any additional cost in further lost rent and wasted time.

How much does it cost to evict someone in court costs?

The cost of eviction in terms of court expenses will vary depending on which state your case takes place in, but the national average is $50. Keep in mind that this figure does not include any additional charges you may incur from a sheriff’s office to serve notice, so be sure to research this eviction cost as well.

Lost Rent: There’s a reason why lost rent is one of landlord’s biggest fears: along with legal fees, this lost rental income is one of the most expensive costs incurred during aneviction. During any legal proceedings for an eviction case, rent continues to accrue, and regardless of the court-ordered outcome, there may be unpaid rental debt owed to you. But, in the event there is property damage, the time spent dealing with contractors and making necessary repairs will likely prolong the amount of time your property is left vacant and thus not bringing in income. Not to mention the usual, added costs of turning over the unit – preparing it for rent, advertising, showing the property, and so on.

How much does it cost to evict someone in terms of lost rent?

Based on, and assuming an average 2-3 month eviction process, evictions typically cost $2,540 due to vacancy—which is no small number for budding landlords.

Property Turnover Costs: Of course, it’s not just lost rent that contributes to the total cost of eviction. In addition to a direct hit to your monthly income, you’ll also face cumbersome turnover costs. This means that payments towards your mortgage and HOA dues—which were once covered by the tenant’s rent payment—now fall on your shoulders. Additionally, to re-rent the unit, you’ll likely incur advertising costs and property management fees, in addition to maintenance services.

How much does it cost to evict someone in terms of property turnover?

There are many factors, but including your pro-ratedmonthly mortgage payment, Home Owner’s Association membership dues, and how you choose to advertise the listing are a few of the big contributors. On average, property turnover costs may amount to $1,750.

Property Damages: Even if the tenant was respectful to your property, and was evicted with no damage done, there may still be cleaning fees if you use an outside service to clean the property before re-renting. Remember that a tenant that is being evicted (and therefore unable to collect their rent deposit) is likely to have little motivation to clean the property before they vacate the premises. Depending on state laws, a tenant’s personal possessions may need to be removed and/or stored. In the case of abandoned property, you may need to spend even more money to safely and properly dispose of electronics, large items, and hazardous materials.

How much does it cost to evict someone in property damages?

If you’re lucky, you won’t have any property damage at all, but one eviction cost you can count on is the changing of locks. Be prepared to spend roughly $150 on a locksmith. Beyond this, it can be really hard to pin down exact amounts, considering the amount of variables. How disrespectful was the tenant How extensive was the damage How expensive were the items Were they insured All of these are factors to be considered when calculating the cost to evict in property damage alone.

Financial Damages: Even if you do win a financial judgment against the tenant, the American Collectors Association reports only a 17% success rate on the average debt collection (2010 Benchmarking Survey). After all, if a tenant is evicted because of their inability to pay rent, it is not very realistic to expect that you will be able to recoup your losses from them in a timely fashion, even after a court judgment.

The Total Cost of Eviction

In total,TransUnion data found that total eviction-related expenses for property managers averages $3,500, and can take as long as 3-4 weeks for the eviction process to run its course.**

There are also non-monetary costs to take into consideration, such as the strain and stress of an ongoing legal battle. Time is money, and the more time you waste on an eviction, the less time you have to spend on other potential business endeavors, or away from work with friends and family.

Prevent Evictions Before They Happen

When you consider that you can take steps to help avoid these costly evictions in the first place, it’s easy to see that the potential expenses from a bad tenant are too high. You can decrease the likelihood of an eviction with strong rental policies and preventative measures. Having a lease that specifically outlines late fees and payment policies will motivate tenants to make rent a priority. The best prevention, however, is through careful tenant screening. Screening your tenants will help you reduce your risk of delinquent and destructive tenants, helping you to free up time to run your rental empire.

As Benjamin Franklin said, “An ounce of prevention is worth a pound of cure.” Thoroughly screening your tenants, and making it a consistent part of your rental process, can help you avoid having to evict a tenant later on.

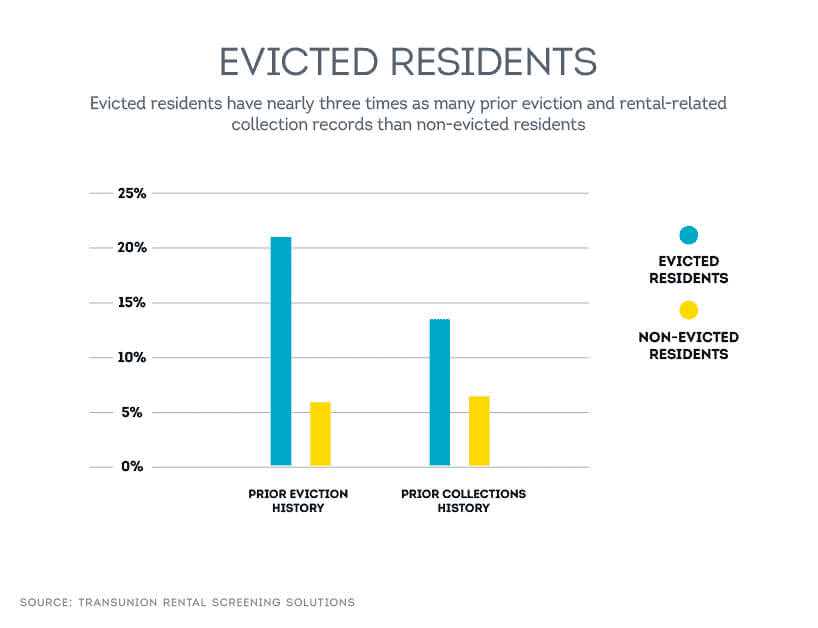

Whether you use SmartMove tenant screening or another screening service, it’s important to order an eviction report as part of your tenant screening package. TransUnion’s analysis of nearly 200 properties found that evicted residents have nearly three times as many prior eviction and rental-related collection records as non-evicted residents.

Tenant Screening: A Cost/Benefit Analysis

So let’s do the math on the cost/benefit of running an eviction report: if average eviction costs $3,500, and the SmartMove tenant screening package with an eviction report costs $40 or upgrade for a full screening for $44 you can screen nearly 100 tenants for the same price of evicting one.

Fifty-six percent of landlords say that prior eviction history is one of their top concerns about new tenants, so it would make sense that running an eviction report would be a step to provide you with the peace of mind you need to move forward with your next lease agreement.

When you think of the thousands of dollars you could avoid having to spend on an eviction, a tenant screening service is a prudent investment. With SmartMove, you can even pass on the cost to the applicant to have them pay for the screening. And if you do choose to pay it on your own, with SmartMove’s pay as you go structure, you’ll never have to pay for more than what you need. No subscription service; simply pay for an eviction report on each applicant as necessary.

There may still be an occasion where even the most careful landlord has to evict a tenant. However, advanced tenant screening is your best bet against finding yourself in a complicated and costly situation.

SmartMove,

Great Reports. Great Convenience. Great Tenants.

*2014 SmartMove user survey

**2013 TransUnion survey data

Know your applicant.

Additional Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.