Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

Understanding fair market rent is essential to a successful rental business. Setting the right rent price can mean the difference between vacancies and attracting good tenants so you can rent your property quickly. So, it’s well worth it to gauge the market rent in your area.

Read on to find out what exactly market rent is, why it’s essential to determine it, and which factors influence most. We’ll also provide you with tips for determining the market rent for your neighborhood and provide you with some tools that will make the process easier.

What is Market Rent?

Bigger Pockets defines market rent as how much rent your property can command at a given time. The amount is determined by how much renters are able and willing to pay in your area, and the best indicator is what other landlords are charging their tenants for similar properties.

The U.S. Department of Housing and Urban Development (HUD) estimates fair market rents annually. Since they look at rents across the country, it’s a good place to start your research, but you’ll want to get a more localized view to see if rates in your area are the same or differ from HUD’s fair market rent estimations. Below, we’ll look at how market rate can vary even within a metropolis, and we’ll provide some tips on how to estimate the market rent in your specific neighborhood.

Why is it important for landlords to determine market rent?

For landlords who already own property, determining market rent will help you decide if you should increase your prices. Raising the rent too high (above market rent) can mean extended vacancies, leaving you to cover the mortgage on an empty apartment for several months. So it’s best to do your research in advance.

Determining market rent can also help you avoid charging too little for rent. Your own expenses (including property taxes and employee salaries) rise each year, and you need to charge enough rent to maintain a positive cash flow. Raising the rent may be the right way to do that, and it’s something you’ll want to consider at each lease renewal.

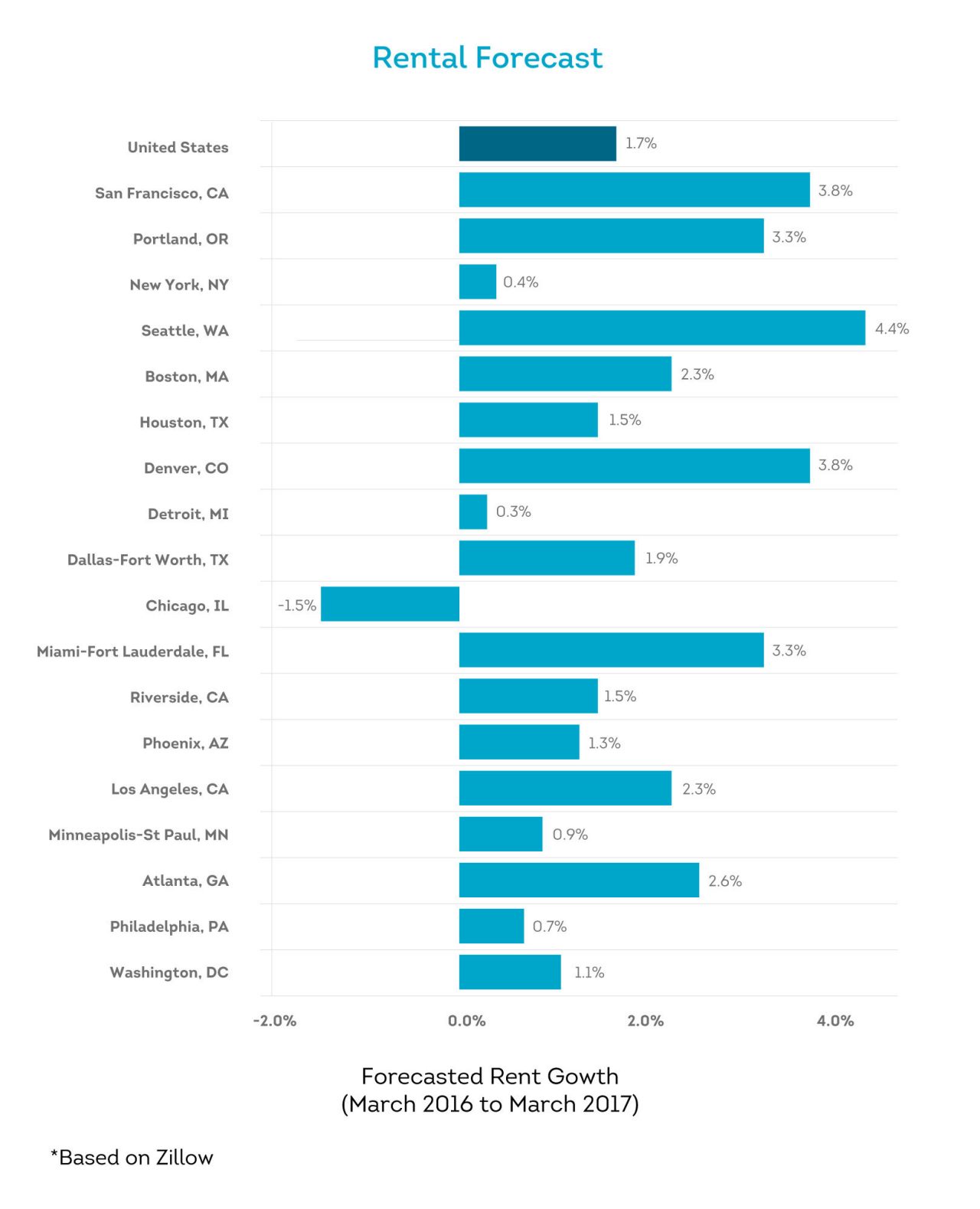

It’s also important to have an idea of how rent prices are predicted to change. For example, Zillow’s rental forecast indicated that landlords who raised rent in Seattle would be in good company.

Raising your rent doesn’t have to be a source of anxiety; there are ways to increase rent without dealing with a tenant confrontation.

If you’re looking to make a new rental property investment, having an idea of market rent can enable you to decide if you’ll earn a reliable income from the property. The rent prices of comparable properties will give you a good idea of how much you will be able to charge your own tenants.

This will help you calculate your cash flow, to help you determine if you will get a good return on your investment. It will also help you make a long-term projection, so you have a better idea how long it might take you to pay back your upfront costs.

What factors influence market rent?

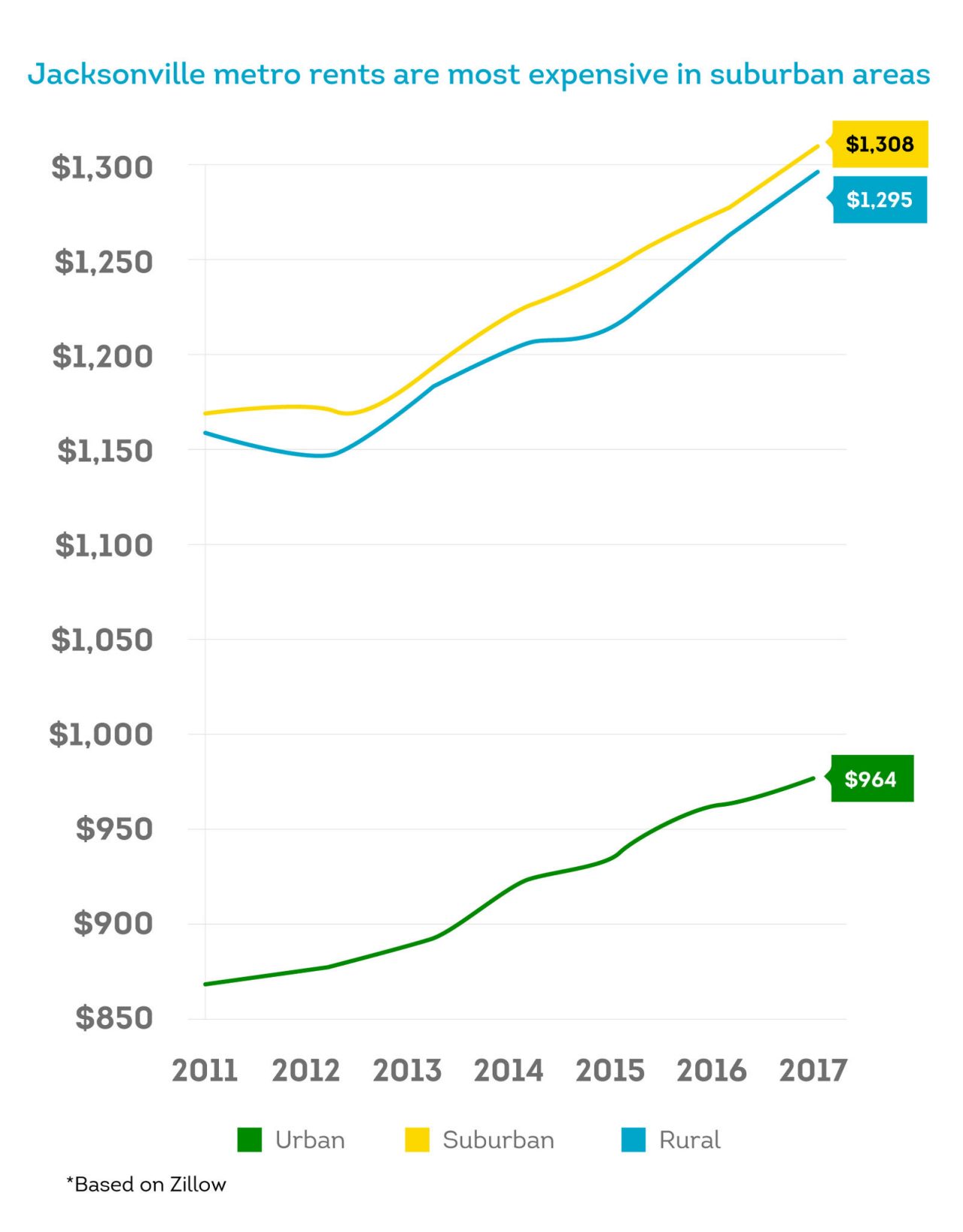

It’s important to keep in mind that market rent in your city might vary widely from the national averages, and rent can vary significantly even in the same metropolis. Take Jacksonville for example. According to Zillow, rent prices in suburban areas are significantly higher than those in urban areas.

- Location: If your apartment is in a desirable area, you can charge a higher rent than a property in a less desirable location.

- Amenities: Upgrades, open floor plans and outdoor spaces can all differentiate your property from a similar one in the same neighborhood and allow you to ask for more rent.

- Space: More square footage than other properties in the surrounding neighborhoods can equate to higher rent price.

- Bedrooms and Bathrooms: The more bedrooms and bathrooms your property has than the others in your area, the more likely it is that you can charge a higher rent.

How do you calculate fair market rent?

You’ll want to be aware of the market rate in your neighborhood so you can set an appropriate rent price. SmartAsset points out that considering the rent of similar properties in your area can help you avoid charging rent that’s too high, which can make it difficult to find quality tenants.

Bigger Pockets offers some suggestions on how to check the market rate for rent in your neighborhood:

- checking with property managers who handle similar properties

- talking to members of your local landlords association

- asking real estate agents

- looking at rental advertisements on classified advertisement sites

- checking your local newspaper (either print or online)

In order to determine the average rent price in your area, you’ll want to find out the rent for at least three properties that are comparable to yours. The number of bedrooms and square footage should be the same, and if possible, you should try to find out the rent price of units with similar amenities.

Fair Market Rent Calculators and Tools

Calling numbers listed on “for rent” signs may be an effective way to determine fair market rates. However, as a busy landlord, you may prefer to use technology to your benefit instead. This list of free online tools will help you calculate your cash flow and determine how much rent to charge, without patrolling the neighborhood.

- Rentometer - This site has been featured in U.S. News Report and The Wall Street Journal. You simply input your address, rent, and number of bedrooms to find out average and median rent prices in your area. It also gives you the percentage of apartments falling within a certain price range.

- Zillow - Zillow is one of the premier sources for real estate news and trends, and they can pull rates from hundreds of rental listings on their site. You can fine-tune your pricing by entering square footage and the number of bedrooms and bathrooms. Zillow’s Rent Zestimate® plugs information like amenities, comparable property prices and the last sale price into a special formula, giving you high and low rent estimates for your property.

Landlords may also like Zillow’s Rental Index, which indicates the median rental rate in certain areas. Select your city to get a gauge of what other landlords around you are charging for rent.

- City-Data - This site attracts 14 million users a month and has been featured on CNN and USA Today’s Hot sites. Pulling data from government and private sources to create detailed profiles of each city, it provides information on area income levels, home values, median gross rents. All of which can help you get a better handle on market conditions in your city.

- InvestFourMore - Calculating cash flows incorrectly or setting rent prices too low could mean that you’re struggling to make a profit or break even each month. Invest Four More’s founder, Mark Ferguson, is a licensed agent and successful investor offering free resources on his site.

The calculator helps you figure out your cash flow, based on expenses like mortgage payments, maintenance, and even vacancies. If you have a new property or have been lax about tracking certain expenses, this calculator offers tables with suggested values for your property.

Conclusion

Determining the fair market rent for your property may not only mean less chance of vacancy and longer tenures, but might increase the number of applicants vying to rent your property. The more applicants you have, the greater your chance of finding good tenants. Tenant screening services by SmartMove helps you ensure you have a renter in your property that will pay their rent and be a reliable tenant.

TransUnion SmartMove is the landlord’s solution for great reports, great convenience, and great tenants. Landlords receive a credit report formatted exclusively for rental screening, a criminal report drawing from hundreds of millions of national criminal records, a national eviction report, a ResidentScore, and a custom leasing recommendation. Renters get the peace of mind that only TransUnion, and not their landlord, will have access to their sensitive personal information.

Setting the right rent price and thoroughly screening your tenants are two of the best ways to ensure the highest possible profit as a landlord.

Sources:

https://www.zillow.com/research/december-2016-market-report-14098/

Gudell, S. (n.d.). A Rental Revolution: How Rents are Changing Across the US [PDF]. Zillow.

Know your applicant.

Additional Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.